As technology advances, so do the tactics of fraudsters. Liveness detection algorithms are designed to discern the live from the fake identities. But all liveness detection methods are not created equal.

In this blog, we delve into the depths of liveness check methods, compare them in detail, and share HyperVerge benchmarks for liveness checks.

Let’s begin!

What is a Liveness Check?

Liveness check refers to the process of verifying the authenticity of a biometric sample. This is typically in the context of facial recognition, ensuring that the presented data is from a live human being who is present during verification rather than a synthetic identity.

Liveness detection involves the use of advanced algorithms to detect the dynamic qualities of the biometric data, such as facial expressions or pulse in the case of fingerprint scans. This is essential for enhancing the security of biometric authentication systems, as it guards against potential threats like spoofing or the use of non-viable samples.

Read more: A complete guide to facial recognition

Why is Liveness Detection Needed?

Face recognition is being increasingly adopted by the industry as a safe, secure, hassle-free method of onboarding, authenticating, and verifying customers. Customers gain access to services by authenticating their faces. Modern face recognition can classify whether two faces belong to the same person with very high accuracy.

However, these systems are susceptible to various spoofing attacks. Spoofing is a technique used by fraudsters where they mimic the face of the victim using instruments like high-quality displays, printed photos, printed masks with one or more layers, and a host of other techniques.

These techniques are becoming increasingly common due to easy access to tools such as photo editors, high-quality displays, and printers. Any face-based biometric authentication system must protect itself from fraudsters by using a robust liveness detection system.

For a face-authentication system without liveness detection, a photograph or any display works just the same as the actual person!

How Does Liveness Detection Work?

Liveness detection systems are classified into two categories based on the input needed from the end-user:

Active Liveness Detection

Active liveness check requires the user to perform an action or a gesture to verify whether the user is physically present for the identity verification process. In the market, one can find active detection systems that

- ask the user to speak out the text displayed on the screen

- ask the user to hold a piece of paper where they write down some verification text

- ask the user to perform gestures such as moving their head up and down, left and right, blinking, etc.

Passive Liveness Detection

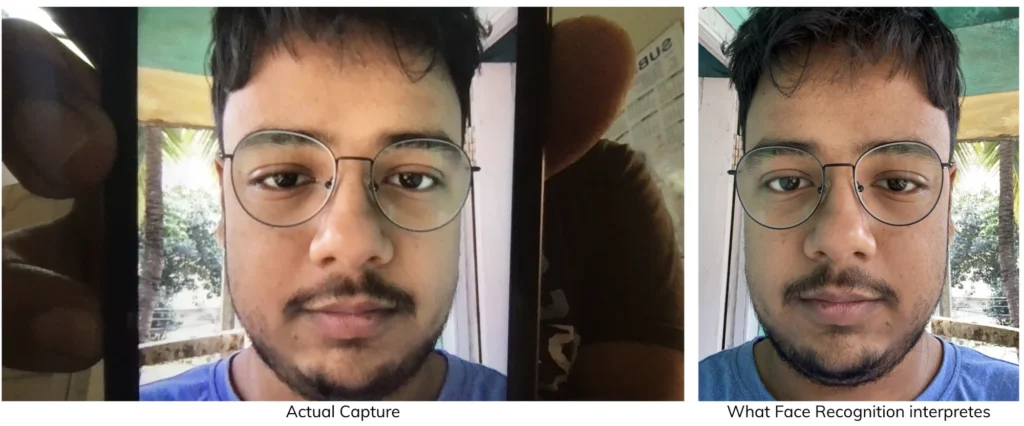

This is an advanced technique that detects whether a user is physically present without requiring any explicit action or gesture. Passive detection systems typically use a fixed-length video capture of the user, which is then analyzed for properties such as light, skin texture, micro-motions, and other characteristics to determine if a live person is present in the capture.

Single Image Passive Liveness Detection

A more advanced technique requires the capture of a single image, which is analyzed for an array of complex characteristics to determine if a live person is present.

Single image passive liveness detection is gaining traction among regulators and service providers alike, as it makes user authentication and onboarding very simple while ensuring that services are protected against any spoofing attempts. In the table below, we’ve compared the liveness detection techniques on all attributes.

| Attribute | Single image passive liveness | Video based passive liveness | Active liveness |

| End user effort | Zero effort as the image captured for face recognition is used to detect liveness. ⭐⭐⭐⭐⭐ | Minimal effort as the user has to hold the camera for a period of time while the video is captured. ⭐⭐⭐ | High effort as the user has to respond to challenges in order to prove their live presence. ⭐ |

| Drop-off rates | <1% drop-off is observed, as it’s a simple selfie capture. ⭐⭐⭐⭐⭐ | 3 to 10% drop-off has been observed in typical industry solutions, as users have to hold the camera still for 5-15 seconds. ⭐⭐ | As high as 50% drop-off rates have been reported by companies using active liveness. lack of comprehension and cognitive load on users lead to high abandonment. ❌ |

| User journey time | No latency is added to user journey as same selfie captured for face recognition is used. ⭐⭐⭐⭐⭐ | ~30 seconds of latency is added, including time to capture the video, and backend processing of the video. ⭐⭐⭐ | Highly subjective dependent on the gesture/action used. Typically in the range of of 20 seconds to 1 minute. ⭐⭐ |

| Network Requirements | A single image has to be transferred over the network for evaluation. Images as small as 100kB suffice. ⭐⭐⭐⭐⭐ | Video transmission consumes a lot of bandwidth depending on the length of the video. We have observed an average of 2MB data streams. ⭐⭐ | Highly subjective basis the evaluation technique. Typically, videos of the gesture are transferred, with sizes around 2-3 MB. ⭐⭐ |

| Integration Effort | Requires the integration of a single API to check liveness. ⭐⭐⭐⭐⭐ | Requires a frontend to capture video separately, and stream processing to transmit videos. ⭐⭐ | In most cases, it requires a frontend for explaining the challenge to the users, capturing the challenge video, and stream processing to transmit the video. ⭐ |

Single image passive liveness, by virtue of having no additional end-user effort, has the lowest drop-off rates, adds no latency to the user journey, and works well in poor network conditions, as well, with minimal developer effort in implementation.

Liveness Check in Customer Onboarding

Companies involved in providing financial services such as lending, insurance, investments, wealth management, payments, and others must ensure they perform proper KYC of users before allowing access to services. In addition to it being a compliance requirement, proper identity checks ensure that the company is protected from fraudsters and scammers getting access to its services.

However, subjecting customers to additional verification steps adds friction to the onboarding process and leads to high drop-off rates.

The ideal onboarding workflow verifies the user’s identity and liveness with high confidence while adding little to no friction in the onboarding process.

An ideal passive liveness solution for customer onboarding should have most, if not all of the following characteristics.

Single Capture for Face Liveness Detection

For checking a person’s identity, the user is asked to capture a selfie of themselves to match against their identity card. HyperVerge’s single image liveness check uses this same selfie for liveness detection.

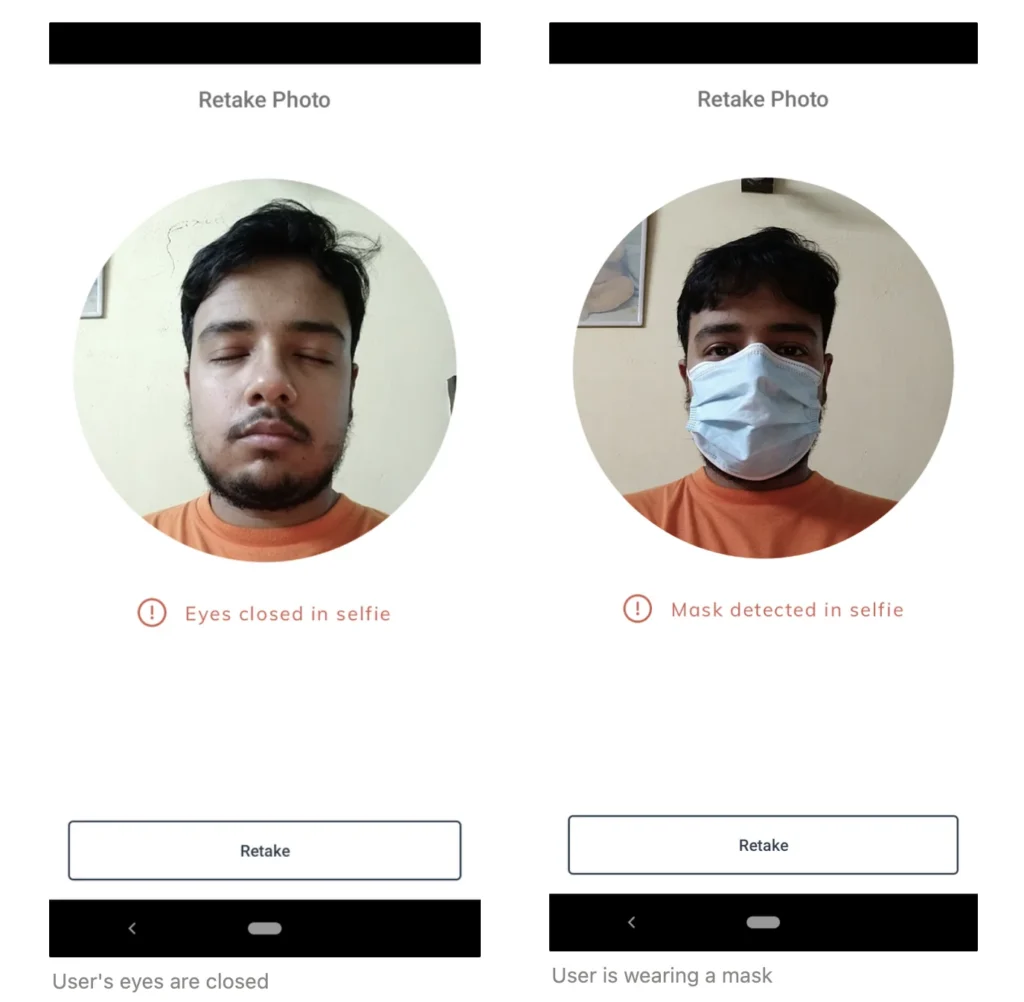

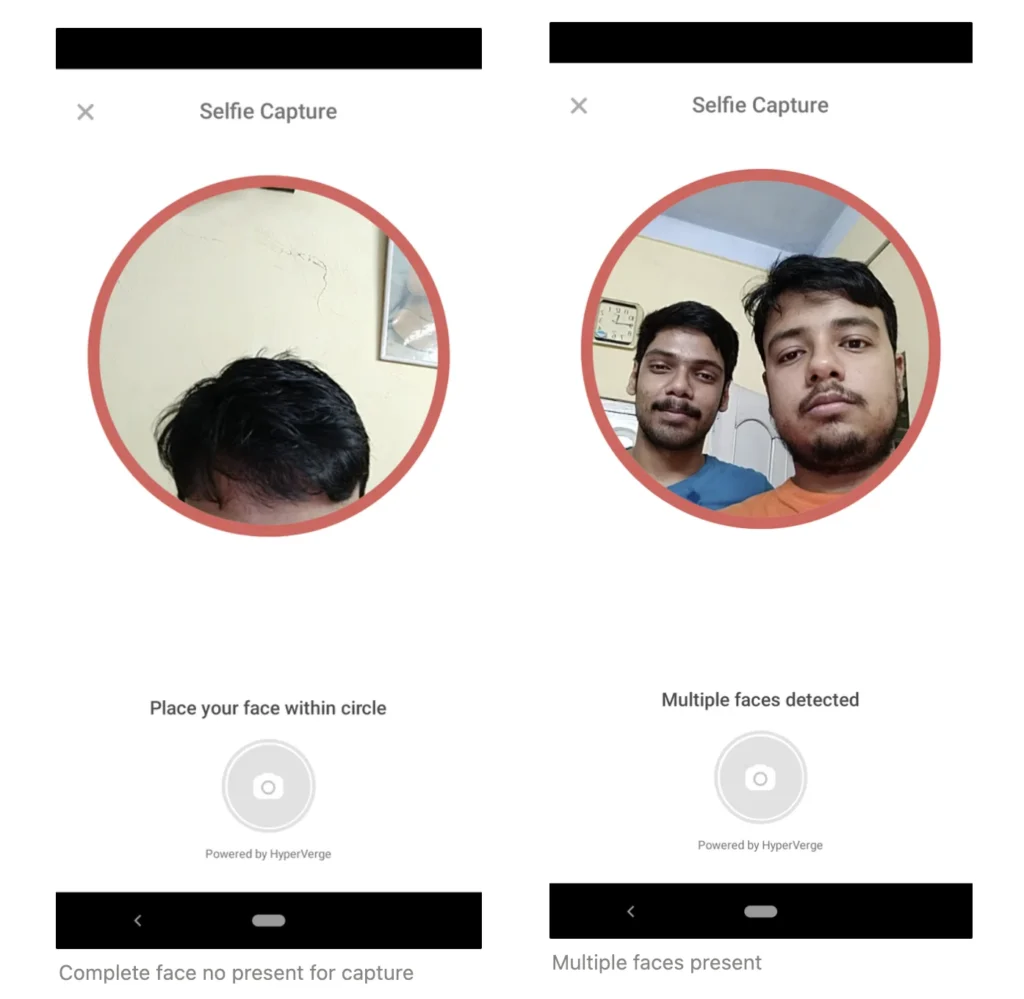

Immediate Feedback and Retries

In case a user captures a non-compliant selfie due to any reason, the workflow should provide immediate feedback to the user, and ask for a re-capture. Proper and immediate feedback ensures the least number of retries for the user, and that onboarding does not require manual verification of images leading to a high turn-around time for completing onboarding.

HyperVerge’s single image comes with an array of compliance checks that ensure that immediate and contextual feedback is given and the user can capture a correct image in the next attempt.

Liveness Check Benchmarks

Active liveness systems traditionally have performed at very high accuracy levels due to a fraudster having to pass difficult challenges. For instance, a fraudster with a digital photograph of the victim would find it very difficult to pass a challenge where the user is required to blink.

Any passive liveness system that replaces an active liveness system must provide on-par performance with traditional active liveness.

Passive liveness systems, while providing numerous benefits, must not compromise on performance and be capable of stopping all typical spoof attacks.

Additionally, passive liveness systems should have the lowest possible false-positive rates, to ensure genuine customers do not face any friction in the onboarding process.

HyperVerge’s single image passive liveness system has been rigorously tested on industry-standard benchmarks and has provided ~99.8% accurate predictions in live environments.

| Liveness Detection Benchmark | Accuracy (%) |

| Live detected as live (True Positive Rate) | 99.2 |

| Live detected as non-live (False Rejection Rate) | 0.8 |

| Non-live detected as live (False Acceptance Rate) | 0.2 |

| Non-live detected as non-live (True Negative Rate) | 99.8 |

Additionally, our liveness detection systems are reinforced for popular techniques used by fraudsters such as digital photographs, printed images, printed masks, etc to ensure maximum protection.

We firmly believe single image liveness is the best way forward for organizations looking to scale their business. The system provides

- very low drop-off rates

- serviceability in areas with low network coverage

- low manual operations costs

- very minimal turnaround time

All this comes at no compromise in protection against identity theft and fraud!

HyperVerge has enabled large organizations to safely authenticate and/or onboard millions of users over the past decade with minimal onboarding effort and turnaround time while ensuring protection against any fraudulent activity.

Large customers in telecom (Reliance Jio, Vodafone, etc), lending (Aditya Birla Capital, L&T Financial, EarlySalary, etc), securities (ICICI Securities, Angel Broking, Groww, etc), payments (Razorpay), e-commerce (Swiggy), and other industries trust HyperVerge’s onboarding solutions to safely onboard their users.

Check out our liveness detection solution and to speak to one of our solution experts, reach out to us at contact@hyperverge.co or contact us here.