As digital transformation reshapes lending practices, Loan Origination Systems (LOS) have become crucial for improving efficiency, accuracy, and customer satisfaction in loan processing.

LOS technology helps financial institutions generate loan documentation that adheres to regulatory and internal standards, with options to be installed locally or accessed via the cloud.

Every day, banks across the US use loan origination software to minimize risk and streamline lending operations. With the global LOS market projected to hit $17.5 billion by 2033, its role in the financial sector is clearly expanding.

Two major players in this space are Lentra and HyperVerge. Lentra specializes in financial data analysis and offers robust tools for lenders to automate and optimize their processes. HyperVerge, on the other hand, is known for its AI-powered investment tools and innovative solutions that enhance decision-making for financial institutions.

In this article, we’ll compare Lentra and HyperVerge in detail to help you determine which LOS platform best suits your needs.

What is Lentra?

Lentra is a next-generation Loan Origination System (LOS) that aims to transform how financial institutions handle loan processing. By combining advanced technology with a deep understanding of lending operations, Lentra aims to streamline and enhance the loan lifecycle.

Some of the key features and functionalities of Lentra include:

- Omni-channel Application Processing: Lentra supports multiple channels for loan applications, including web, mobile, and in-branch, ensuring a seamless experience for applicants.

- AI-Powered Credit Scoring: The platform utilizes artificial intelligence to assess borrower creditworthiness more accurately and efficiently than traditional methods.

- Automated Document Processing: Lentra automates the collection, verification, and processing of loan documents, reducing manual effort and errors.

- Compliance Management: All loan processing complies with regulatory requirements, helping institutions manage compliance risks effectively.

- Real-Time Analytics and Reporting: The platform provides real-time analytics and reporting tools, giving lenders valuable insights into loan performance and operational efficiency.

- Advanced Fraud Detection: It incorporates advanced fraud detection mechanisms to safeguard against fraudulent activities and protect both lenders and borrowers.

Lentra is tailored for banks, credit unions, and other financial institutions seeking to modernize and optimize their loan origination processes.

What is HyperVerge?

HyperVerge is an innovative Loan Origination System (LOS) that leverages advanced technology to enhance decision-making and streamline lending operations. Known for its focus on artificial intelligence and data-driven insights, HyperVerge aims to transform the way financial institutions manage and process loans.

HyperVerge is known for several features, including:

- Cloud-based and mobile-friendly: This platform offers universal access through a cloud architecture, allowing loan origination management from “anywhere, at any time.”

- AI-Powered Document Verification: HyperVerge uses artificial intelligence to verify and process loan documents quickly and accurately, minimizing manual effort and errors.

- Automated KYC/AML Compliance: The platform automates Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, ensuring compliance with regulatory standards while speeding up the onboarding process.

- Smart Risk Assessment: HyperVerge employs AI to analyze risk factors and assess borrower profiles, helping lenders make more informed and accurate credit decisions.

- Seamless Integration: The system integrates with existing banking infrastructure and third-party services, allowing for a smooth transition and enhanced operational efficiency.

- Customizable Decision Engine: HyperVerge features a flexible decision engine that can be tailored to meet specific underwriting criteria and business rules.

- Real-Time Fraud Detection: The platform includes advanced fraud detection mechanisms that utilize machine learning to identify and prevent fraudulent activities.

- Comprehensive Analytics Dashboard: HyperVerge offers a detailed analytics dashboard that provides real-time insights into loan performance, operational metrics, and overall business health.

- Omni-Channel Access: The system supports various channels for loan applications, including web and mobile, ensuring a convenient and consistent experience for users.

- Scalable and Adaptable: Designed to scale with business growth, HyperVerge offers adaptable solutions that can handle increasing volumes and evolving needs.

HyperVerge is ideal for banks, insurance companies, financial institutions, logistics, and small businesses seeking to enhance their loan origination processes through AI and automation. It is particularly suited for organizations looking to improve efficiency, compliance, and decision-making capabilities.

Whether for large banks with high application volumes or smaller firms facing challenges with online identity verification, HyperVerge provides versatile solutions to meet diverse lending needs.

How Do We Evaluate the Two Products?

To thoroughly assess Lentra and HyperVerge, we have conducted a detailed analysis of their features, pricing, pros, and cons. This includes evaluating core functionalities, cost-effectiveness, and each platform’s strengths and weaknesses.

We have also reviewed user feedback on G2 and Capterra, which provide comprehensive insights into real-world experiences and satisfaction levels. Additionally, we’ve considered Reddit reviews for supplementary perspectives.

This multi-faceted approach will help you determine which LOS—Lentra or HyperVerge—best fits your needs and offers the most value for your organization.

To begin with, we’ll take a look at their features.

Overview of the Lentra vs HyperVerge

Here’s an overview comparison between HyperVerge and Lentra:

| Feature | HyperVerge | Lentra |

| Core Functionality | AI-powered automation for KYC, onboarding, and loan origination, focused on reducing manual errors and speeding up the process. | Comprehensive LOS with modules for risk assessment, document verification, and approval. |

| Technology | Advanced AI and machine learning algorithms, particularly strong in facial recognition and document verification. | Leverages microservices architecture for flexibility and scalability with robust API integrations. |

| Use Cases | Ideal for banks, fintechs, and NBFCs needing fast, automated KYC and onboarding processes. | Suited for a wide range of lenders including banks, credit unions, and microfinance institutions. |

| Scalability | Highly scalable with a focus on quick deployment across multiple regions and verticals. | Designed to handle large volumes and complex workflows, with scalability as a core feature. |

| Integration Capabilities | Seamless integration with existing banking systems, offering end-to-end solutions from onboarding to disbursal. | Offers extensive integration options but is often used in conjunction with Lentra’s broader lending ecosystem. |

| Customer Support & Training | Provides dedicated support with an emphasis on quick issue resolution and minimal downtime. | Known for its comprehensive support and training, ensuring clients can fully leverage the system’s capabilities. |

| Market Differentiator | Excels in identity verification and rapid customer onboarding, significantly reducing fraud risk. | Strong in comprehensive loan lifecycle management, from application through to post-disbursement. |

Key Comparisons

Now that we have a fair understanding of the features both tools provide, let’s take a broader look at them to help you choose the right tool.

Features

When comparing HyperVerge and Lentra, both platforms offer robust features, but they cater to different needs.

HyperVerge excels in AI-powered automation and facial recognition technology, making it a strong choice for financial institutions looking for advanced verification and onboarding solutions. Its emphasis on deep learning algorithms allows for real-time decision-making and high accuracy in data analysis. HyperVerge One, our end-to-end platform, enhances this further with comprehensive LOS features driven by AI aimed at increasing application acceptance rates.

On the other hand, Lentra offers a comprehensive Loan Origination System (LOS) with strong features in credit underwriting, risk assessment, and customer onboarding. Lentra’s platform is designed to streamline the lending process with end-to-end solutions that integrate seamlessly with existing systems.

While both platforms offer strong offerings, the choice depends on whether the user prioritizes AI-driven automation (HyperVerge) or a full-featured LOS tailored for lending institutions (Lentra).

Pricing

HyperVerge typically offers a modular pricing approach, where clients pay based on the specific AI modules they use, which can be cost-effective for businesses that only need certain functionalities.

HyperVerge provides the following pricing plans:

- Start Plan (for startups): Includes a free one-month trial and offers seamless integration within four hours.

- Grow Plan (for midsize companies): This plan builds on the Start Plan with additional features like custom workflows and enhanced document processing management.

- Enterprise Plan (for large organizations): This plan expands on the Grow Plan with collaborative tools, a custom pricing structure, and dedicated support.

Lentra typically employs a subscription-based pricing model, where clients pay for a suite of services under a single umbrella. In terms of value for money, Lentra might offer a more all-encompassing solution, whereas HyperVerge offers precise, scalable pricing that could be more attractive for smaller entities or those focusing on specific features.

Target Audience

HyperVerge is ideal for financial institutions that need cutting-edge AI and machine learning solutions for tasks such as KYC verification, fraud detection, electronic identity verification, and document processing. Its focus on high-tech automation makes it perfect for organizations seeking specialized, advanced solutions.

Lentra, in contrast, caters to banks and financial institutions needing a comprehensive LOS to manage the entire lending lifecycle. Its all-in-one platform is best suited for larger institutions with complex and varied lending needs.

Security

HyperVerge places a strong emphasis on security, utilizing advanced encryption and secure cloud-based infrastructures to safeguard sensitive data. Its AI models are meticulously designed with privacy at their core, ensuring that customer information is handled with the highest level of protection.

While Lentra also prioritizes security, employing encryption protocols and adhering to standards like GDPR and PCI DSS, HyperVerge stands out with its proactive approach. It integrates security throughout its AI-driven processes, ensuring that data remains secure from initial handling through to final processing.

User Experience

HyperVerge is known for its intuitive user interface, which simplifies complex AI processes, making it accessible even to non-tech-savvy users. Its customer support is responsive, and plenty of resources are available to help users maximize the platform’s potential.

Lentra focuses on providing a seamless user experience through its LOS. The platform is designed to be user-friendly for banking professionals, with a dashboard that offers easy access to all loan origination features.

Integrations

HyperVerge excels in integration capabilities, offering seamless connectivity with existing financial systems and third-party applications. This flexibility allows organizations to effortlessly deploy their AI solutions across various platforms, enhancing adaptability and operational efficiency.

While Lentra also provides robust integration features with core banking systems and financial services software, HyperVerge’s superior integration flexibility shines bright. Its ability to easily connect with a wide range of systems ensures a smoother, more versatile deployment of AI-driven solutions.

Pros and Cons

HyperVerge Pros

HyperVerge offers a comprehensive, cloud-based loan origination system that covers the entire loan lifecycle, from application intake to closing. Here are some of its benefits:

- Automates various stages of the loan process, enhancing efficiency and reducing manual efforts.

- Focuses on delivering a seamless and user-friendly experience for borrowers, making the process smoother and more intuitive.

- Incorporates sophisticated fraud detection mechanisms to ensure secure and reliable loan transactions.

- Simplifies digital lending processes, minimizing technical challenges and improving overall system accessibility.

- Helps organizations save money by streamlining operations and reducing the need for extensive manual processing.

- Accelerates the loan approval process, allowing for quicker decision-making and faster service delivery.

HyperVerge Cons

User satisfaction says it all – with HyperVerge, you might be so impressed by the efficiency that you forget to look for any downsides.

(However, if you do spot any, we welcome your feedback to help us continually enhance our service.)

Lentra Pros

Lentra is a cloud-based LOS that offers a complete suite of services covering the entire lending lifecycle, from origination to servicing and collections. Users like the platform for these reasons:

- Provides highly customizable features to meet the specific needs of different financial institutions and their unique lending processes.

- Integrates well with core banking systems and other financial software, facilitating smooth data flow and operational efficiency.

- It is designed with an intuitive interface that enhances user experience and simplifies the loan management process for both lenders and borrowers.

Lentra Cons

While Lentra provides many advantages, it’s worth noting that the platform also has a few challenges.

- Some users report that the initial setup and configuration can be complex, potentially requiring a significant time investment.

- The platform’s comprehensive nature may come with higher costs, which could be a concern for smaller institutions or those with limited budgets.

- While it integrates with many systems, users might experience challenges with certain legacy systems or non-standard software.

Hear it Directly From the Users

Lentra

“The Lentra team has scaled the business in a highly capital-efficient manner and is well positioned to benefit from the tailwinds of digitization across markets.”

- Vamsi Duvvuri, Founder and Managing Partner of Dharana Capital

“We started our partnership with Lentra with consumer durable loans. Their product enabled us by giving us seamless API connections to all products of every credit bureau in the market. It helped us in creating bureau strategies, balancing business benefits and bureau usage costs, thereby increasing our efficiency. This partnership has led to seamless customer journeys and high satisfaction levels among our partners and customers.”

- HDFC Bank

However, some mention a steep learning curve and complexity in setup as areas for improvement. Others point out that the initial implementation can be time-consuming and costly.

HyperVerge

Choose HyperVerge for the Smoothest Loan Management Cycles

When comparing loan management platforms, HyperVerge stands out with its AI-powered automation and facial recognition technology, ideal for financial institutions seeking advanced verification and onboarding solutions.

HyperVerge One takes this a step further with its no-code, cloud-native platform designed to provide scalable agility, making it suitable for lenders of any size. It emphasizes user-friendly navigation and robust security while offering a comprehensive suite of features to streamline the loan origination process.

This includes built-in modules for identity verification, validating key financial details, and advanced underwriting capabilities, all aimed at enhancing efficiency and increasing application acceptance rates. This seamless integration of cutting-edge technology ensures that HyperVerge One is a powerful tool for managing loan cycles smoothly and effectively.

Modular Flexibility

- The design philosophy of HyperVerge is centered around modular flexibility.

- Its architecture ensures easy integration, allowing seamless onboarding with your current systems.

- The platform also provides extensive configuration options, giving you the ability to customize it according to your specific lending needs and risk profile.

Advanced AI Engine

- At the heart of HyperVerge lies an advanced AI engine.

- This engine leverages cutting-edge machine learning algorithms to automate crucial steps in the loan origination process.

- Tasks like identity verification methods and document authentication, which are often manual and time-consuming, are automated through HyperVerge’s KYC (Know Your Customer) technology.

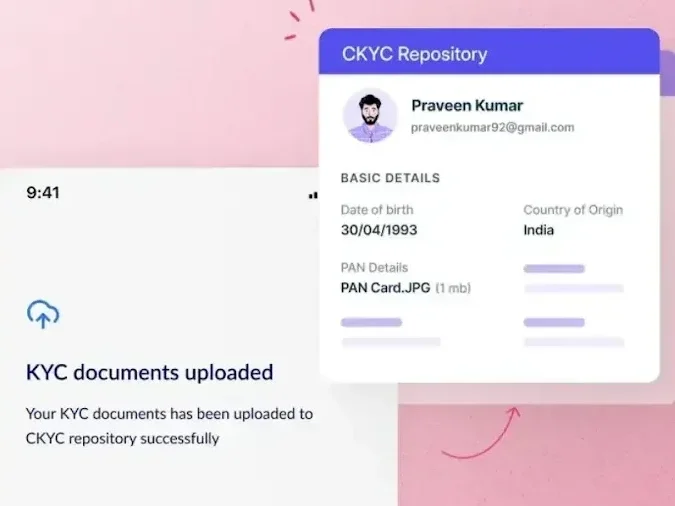

CKYC Repository

- This feature uses sophisticated optical character recognition (OCR) and facial recognition to extract and verify borrower data from government-issued IDs.

- This process ensures compliance with regulations and boosts operational efficiency, making it one of the top five identity verification solutions in the market.

End-to-End Journeys

- HyperVerge excels in offering end-to-end journeys (5x onboarding), ensuring that every stage of the loan origination process is covered.

- The platform’s seamless workflow contributes to fewer drop-off rates, as users are guided smoothly through each step.

- Additionally, HyperVerge’s efficient processing and thorough verification methods lead to higher approval rates (99%), making it a preferred choice for lenders looking to optimize their loan origination systems.

Supercharge Your Loan Origination with HyperVerge

In today’s digital era, automation is disrupting loan origination by streamlining operations, cutting costs, reducing risks, and enhancing the customer experience.

HyperVerge ONE offers a comprehensive solution that automates the entire loan process, featuring tools designed to boost approval rates and support modern lenders.

Explore HyperVerge ONE today to unlock new possibilities for your lending business.

Mastering the loan origination process is crucial for success, and by leveraging automation and embracing innovation, lenders can ensure a smooth, efficient, and customer-focused experience. Sign up now to begin your journey with automation!

FAQs

1. What does Lentra do?

Lentra provides a comprehensive loan origination system that streamlines the entire lending lifecycle, from application to disbursement, with customizable features and seamless integration.

2. What is loan origination software?

Loan origination software automates and manages the entire loan process, including application intake, processing, underwriting, and approval, enhancing efficiency and accuracy.

3. What does a mortgage automator do?

A mortgage automator streamlines and automates various aspects of the mortgage process, such as application processing, document management, and approval workflows, to improve efficiency and reduce manual effort.

4. What is a loan management system?

A loan management system oversees the complete lifecycle of loans, including origination, servicing, and collections, providing tools for tracking, managing, and analyzing loan performance and borrower interactions.