One of the best ways to streamline operations in the lending business is by investing in a single solution that can take care of the entire process.

Two strong contenders in this area are Karza and HyperVerge. Karza, recently acquired by Perfios, is a cutting-edge identity verification, fraud analytics, and risk assessment solution. Its clientele mostly consists of banking and fintech companies, but it caters to various industries like gaming, legal, payments, and insurance.

HyperVerge is an identity verification and customer onboarding software that uses AI models to present a seamless experience to your new customers and reduce drop-offs. It is internationally recognized for its high level of compliance and is trusted by enterprise companies like Jio, Vodafone, and L&T Finance.

What is Karza?

In Karza’s words, it is a one-stop solution for financial companies to manage their lending journey from start to end. It stays true to its name by offering its features under three pillars Verify, Scan, and Monitor which cover the entire lending journey.

Here is the list of features you should look at to skim through its core capabilities:

Document verification: Karza uses OCR technology to extract details from government-issued ID cards like PAN cards, Aadhar cards and passports. It also verifies whether the documents have been altered or fraudulent.

API access: Karza offers robust API functionalities to verify bank accounts, GSTIN, and employment details. It uses penny drop functionality to credit a customer’s bank account with a small amount and verify its existence. Similarly, it uses different data points from government databases to confirm GSTIN and employment information.

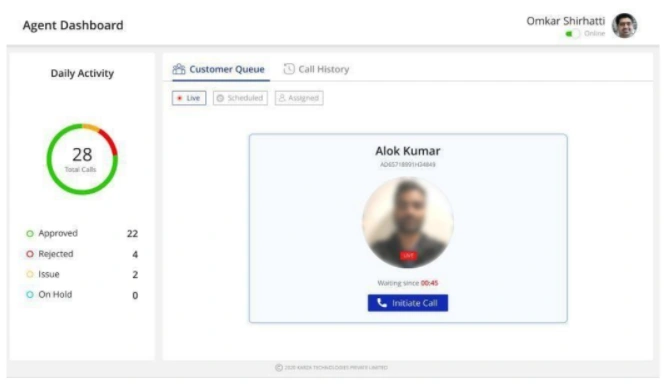

Video KYC: With Video KYC, Karza empowers your agents to perform audio-visual checks remotely and verify customer identities. The interactions are completely encrypted and the video KYC system attaches geotagging to track the customer’s geographical location.

Data analytics: The big data and machine learning engine within Karza provides useful insights into customer profiles. It performs risk scoring based on deep data analysis and tracks the financial health of clients to highlight potential defaults.

What is HyperVerge?

HyperVerge is one of the best solutions to automate the identity verification process and the lending journey from start to end. Its advanced algorithm identifies real customers, reports suspicious accounts, and trains itself continuously to identify advanced frauds. Apart from customer identification and fraud detection, HyperVerge extracts information from customer IDs, creates scorecards, and customizes logic for underwriting. HyperVerge is a trusted partner for industry stalwarts because of its advanced features, user-friendly interface, and well-built API infrastructure that can adapt to all kinds of systems.

Here are the core features of HyperVerge that you must know about:

Loan pre-approval process: HyperVerge streamlines the application process by assessing the applicant’s creditworthiness and prompting your team if the person is the right fit for the loan.

Processing and underwriting: After a loan application is filled, HyperVerge analyzes it for accuracy and errors further reducing the manual work for your staff. It also assesses the credit history and income stability to help your team make informed decisions.

Liveness testing: HyperVerge’s passive liveness technology is ISO 30107-1/ 30107-3 level 2 certified, making it a rare identity verification solution with such a coveted certification. Passive liveness confirms a customer’s identity with a single image or video and prevents advanced spoofing attacks.

Customized workflow: The no-code workflow of HyperVerge gives product managers the superpower to design the onboarding workflow using a simple drag-and-drop builder. The implementation is much quicker and it’s convenient to test different options using the built-in A/B testing functionality.

Scalable architecture: The plug-and-play API architecture gives you access to 100+ APIs including digital KYC stack, video validation, address and geolocation, and more. This allows your existing system to communicate seamlessly with HyperVerge and every department can work in harmony without bottlenecks.

Data analytics: HyperVerge’s analytical abilities give you microscopic visibility of customer behaviour in each module. It tells you how much time they spend in each step or what is causing them to drop off. This speeds up your team to take action quickly and try out new ideas.

How did we evaluate the two products?

We followed a three-step formula to give you a detailed evaluation of both:

- Neck-to-neck comparison of features, pricing, user experience, and more

- Pros and Cons of each tool

- Reviews from software comparison websites like G2 and Capterra

Overview of the Karza vs HyperVerge

| Features | Karza | HyperVerge |

| Identity verification | ✔ | ✔ |

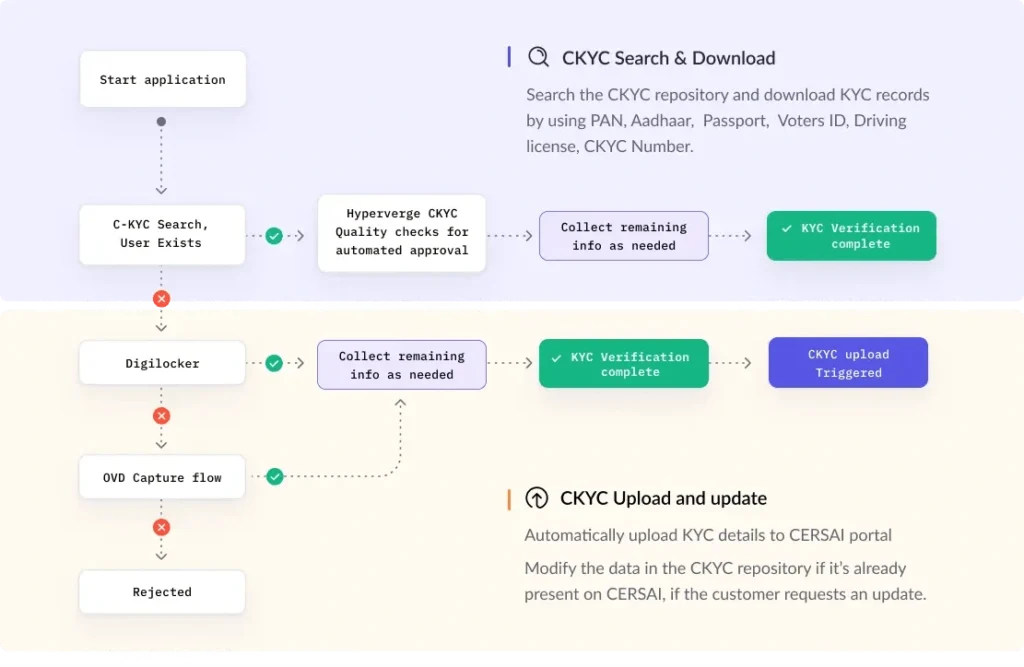

| Automated KYC solutions | ✔ | ✔ |

| Passive liveness detection | ✘ | ✔ |

| Loan origination management | ✔ | ✔ |

| Integration capabilities | ✔ | ✔ |

| Tier-based pricing | ✘ | ✔ |

| Fraud detection system | ✔ | ✔ |

| Deep image analysis | ✘ | ✔ |

Key comparisons

The following six areas are the most crucial for you to pay attention to. It will help you decide which solution is the best for your business and team:

Features

Karza and HyperVerge both perform a solid job in streamlining your lending journey. But, look closely at their features and you will discover each specializes in a different area.

Karza’s suite of features is more tuned towards KYC, fraud detection, and financial compliance. Its expertise lies in validating the authenticity of a wide range of IDs like PAN cards, Aadhar, and Voter IDs. Moreover, the API engine allows integration with different systems to verify GSTIN and confirm the customer’s bank account making it a worthy asset for banking and insurance companies.

HyperVerge is more focused on providing AI-driven identity and finance verification solutions. It has unparalleled excellence in liveness detection technology and facial recognition. HyperVerge works without interruptions in areas with low bandwidth making it a great choice for companies having low internet access. When speaking about the features, HyperVerge One deserves a special mention. It’s an end-to-end solution for financial companies to design their lending journey and reduce drop-offs. It’s a complete package — customer identification, fraud detection, workflow builder, analytics dashboard, and integrations all presented under the same hood.

Pricing

Karza doesn’t offer a straightforward pricing plan. You need to contact their sales team and they will build a customized pricing package for you based on your requirements. This is a great choice if you have a flexible budget, but with a limited budget, it might put your finance team under pressure.

HyperVerge’s pricing plan is more transparent. It has a three-tiered pricing plan – Start, Grow, and Enterprise. The Start plan is for startups and offers a 30-day free trial for small companies to take a test ride of the product and decide if it fits their requirements. The Grow plan is more comprehensive offering a mix of identity verification and anti-money laundering features. The Enterprise plan has customized pricing and you get a dedicated support team to answer your questions promptly. HyperVerge’s pricing makes more sense to companies with a planned budget and prefers tools with a clear pricing structure.

Target audience

Karza is ideal for banks, financial institutions or insurance companies looking for a robust KYC and KYB solution. It will empower them to onboard authentic customers while cutting down manual work.

HyperVerge is the best choice for financial companies and the marketplace industry looking for AI-driven solutions for identity verification and loan origination.

Security

There are no clear reports on the security standards employed by the Karza team to protect customer data. However, the entire platform is built on AWS infrastructure which is well-known for its high-level security standards. Besides, all the interactions recorded using Karza are encrypted and within RBI’s guidelines.

HyperVerge is compliant with global regulations like GDPR and CCPA to manage customer data securely. It is also among the top of the NIST FRVT 1:1 testing and adheres to the AICPA-SOC2 guidelines to keep customer data safe while storing and processing.

User experience

Karza promises to streamline the KYC and document verification processes of companies, however, its interface could be complex for smaller companies.

HyperVerge has carved a name for itself due to its user-friendly interface. The no-code workflow builder also makes it convenient for the user to customize the product without depending on too many technical solutions.

Integrations

The API infrastructure of Karza allows companies to run KYC and document verification, credit and compliance checks in their existing systems. This boosts the flexibility to run operations smoothly without exerting too much pressure on the current set-up.

In addition to the AI-driven solutions, HyperVerge makes it even more convenient for companies by offering API integrations with 100+ third-party vendors under 12 categories.

Pros and Cons

After the detailed comparison, here’s a quick rundown of the pros and cons of each tool:

Karza Pros

- The wide range of KYC verification capabilities and identity checks makes onboarding much faster for companies

- The risk assessment ability is on par with the best solutions in the industry and protects companies from financial fraud

- Video KYC with geotagging is a strategic feature for organizations looking to double down on remote customer onboarding

Karza Cons

- The lack of pricing transparency could put off smaller companies and compel them to look elsewhere

- The technical dependency is high which could lead to delays and disruptions

- While Karza offers a well-developed API integration suite, there is a lack of clarity on its scalability

HyperVerge Pros

- Best in the industry AI solution for identity verification and fraud detection

- Transparent pricing with a free trial makes it a great choice for startups

- No-code workflow builder is a superpower for companies looking to build customized solutions at scale without relying on extensive technical skills

- A tall list of API integrations means easy collaboration and a seamless information flow

HyperVerge Cons

- Learning advanced features of HyperVerge might need some additional training especially if the team is inexperienced in working with identity verification solutions

Hear it directly from the users

Let’s take a look at a few reviews for both solutions:

What are users saying about Karza?

What are users saying about HyperVerge?

Choose HyperVerge for the smoothest verification journeys

HyperVerge is a comprehensive solution catering to every need of a financial business. It aces in AI solutions and is globally recognized for meeting the highest level of compliance standards. But if you’re still in doubt, here are the solid four reasons why you should keep HyperVerge at the top of your priority list:

End-to-end journeys: From customer identity verification to underwriting and final disbursement, HyperVerge stays with you at every stage of the lending journey. The single-platform onboarding experience delights your users and makes it convenient for your employees to track and plan activities in the future. The L&T Finance team chose HyperVerge as their identity verification solution and achieved an impressive turnaround time of 30 seconds and 45 seconds for two-wheelers and micro-loans, respectively.

Fewer drop-off rates: HyperVerge puts the verification process on auto-mode and achieves an impressive rating of 98% completion rate and a 50% reduction in drop-offs. The process is streamlined and requires no manual intervention. Your customers do not face hurdles, and with such a smooth onboarding experience, they are likely to stay for the long term.

Single image liveness check: With a single image sample, HyperVerge analyzes and confirms the customer’s identity. It compares the photograph of a person with the photo on their ID card to find out if it’s the same person. The single image liveness check is one of the core features the Slice team relied upon to scale their platform to 5 million users in 5 years.

Deep image analysis: HyperVerge’s trump card lies in performing deep image analysis to go beyond the common techniques of image recognition. It easily detects deepfakes and other advanced fraudulent methods with high precision.

Compatibility: HyperVerge is a fitting example of a tool with the most advanced electronic identity verification features, yet it’s easy to use, scalable, and flexible. It’s compatible with 100k+ devices and supports 195+ countries. With 100+ integrations and the proficiency to work in 2G bandwidth, it’s a worthy investment for companies looking to grow aggressively without stressing out their technical team.

If that got your attention, check out the HyperVerge One landing page or book a demo with us right now.

FAQs

1. Is Karza a FinTech company?

Yes, Karza is a FinTech company specializing in offering KYC verification and fraud prevention solutions for banks and financial institutions

2. What do Karza Technologies do?

Karza Technologies offers comprehensive solutions for risk management and fraud prevention. It also helps to enhance diligence and decision-making process throughout the lending journey

3. Which identity verification solution works best for lenders?

Karza and HyperVerge both are solid identity verification solutions for lenders. The best depends on the preference for features. Karza is a great choice for KYC verification while HyperVerge is for lenders who prefer AI solutions to scale onboarding and reduce drop-offs.