With the rise in identity-related fraud, the demand for identity verification solutions is at an all-time high. According to a report by IMARC Group, the identity verification market is expected to reach USD 8.9 billion by 2033. The need for such solutions can be felt equally across all sectors, like banking, e-commerce, and telecommunications.

Businesses in these sectors are trying to secure digital transactions to mitigate fraud and win customer trust. However, you have a tough job if you’re in the market looking for the best identity verification platform. Jukshio and HyperVerge are top competitors in this space and have much in common. Both lean on AI-powered identity verification methods to support end-to-end Know Your Customer (KYC) verification. So, how do you choose the right identity verification solution for your business?

In this blog post, we will compare the two platforms based on features, security, user experience, and more so that you can determine which best suits your business.

What is Jukshio?

Jukshio uses artificial intelligence to provide advanced KYC solutions. It meets businesses’ digital security needs by enhancing the onboarding process while ensuring compliance with regulatory standards.

Jukshio’s facial recognition and liveness detection capabilities help businesses identify individuals based on their facial features. Jukshio also offers customisation abilities, so it’s easy to integrate it with their existing processes. It fully adheres to the RBI guidelines, making it a popular choice for banks and NBFCs as a finance verification tool.

Key features and functionalities

Here are some of the key features of Jukshio to give you a deeper understanding of its capabilities:

AI-powered video KYC: Jukshio allows you to perform video KYC, which can reduce the in-person KYC ID verification process. This is useful for remote customer onboarding while complying with regulatory standards.

Real-time face liveness detection: Jukshio also uses advanced algorithms to detect facial movements in video calls. This feature stops bad actors from using pre-recorded videos or masks to gain unauthorised access.

Document validation: The built-in AI technology also verifies the authenticity of government-issued documents.

Face matching and deduplication: Once an individual shares their ID, the AI algorithm uses its sophisticated face-matching abilities to compare the customer’s live video feed with the ID.

Customisable workflows: Jukshio can be easily customised based on your workflows and needs. You can integrate it into your processes without hassles and offer a seamless experience to your customers. For example, a bank can integrate Jukshio into its mobile app to automate the onboarding workflow. Customers only have to upload a picture of their identity cards and a selfie to verify their identity.

Adverse media screening: While onboarding new entities, Jukshio helps to verify their identity by performing adverse media screening. It checks for any adverse news coverage about the business and notifies you if it comes across anything.

Target audience and use cases

Juskhio is an ideal platform for industries that depend on identity verification in their daily processes. It’s a good fit for financial institutions, telecommunications and retail companies, and government agencies.

What is HyperVerge?

HyperVerge is a leading cloud-based provider of identity verification solutions. It uses AI and ML technologies to streamline your business’s entire KYC and customer onboarding process. Its flexibility and customisation abilities make it a great fit for various sectors.

You can effortlessly integrate its offerings, such as liveness detection, document verification, and facial recognition, into your current processes. By leveraging these features, businesses can reduce fraud, comply with regulatory requirements, and improve the user experience.

It has a proven track record of verifying over 750 million identities in 195+ countries.

Key features and functionalities

HyperVerge encompasses a wide range of features. We have picked the best of the lot to give you a quick overview:

AI-powered biometric authentication: HyperVerge uses advanced facial recognition technology to accurately verify a person’s digital identity in less than 3 seconds. It serves two primary purposes: the customer onboarding experience remains unaffected, and your business stays safe from threats like identity fraud.

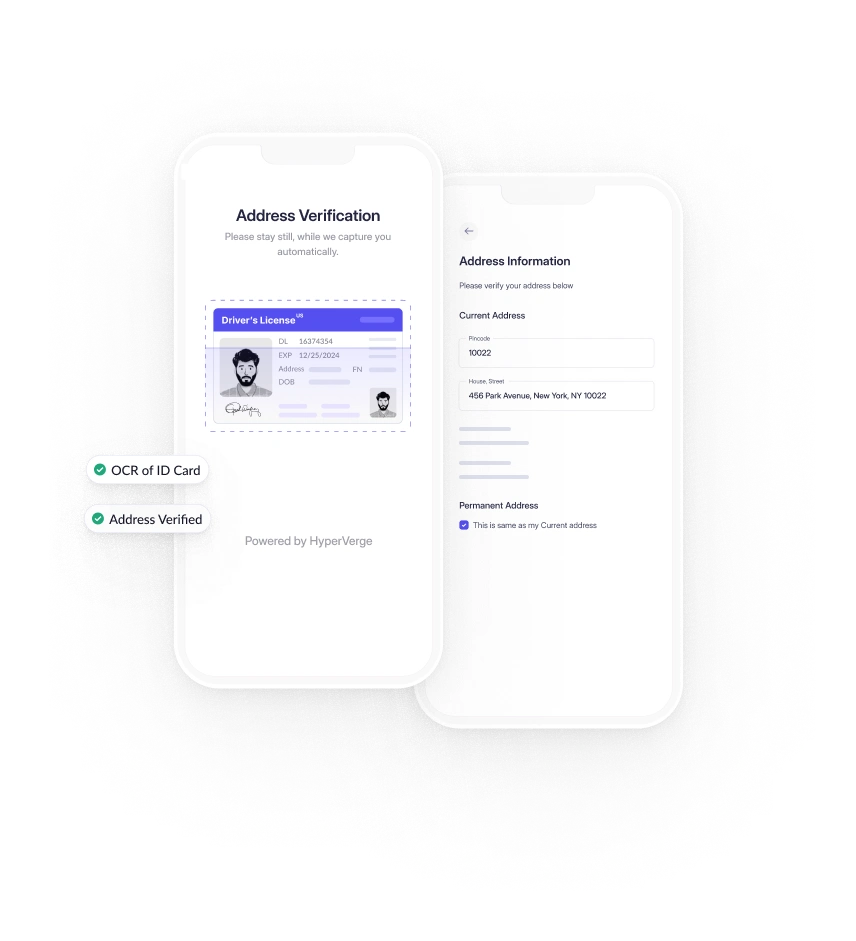

Document verification: HyperVerge uses Optical Character Recognition (OCR) to extract and validate information from ID cards. HyperVerge extracts relevant data with a 99% precision rate for documents across 190+ countries.

Real-time AML screening: If you are in the financial industry, anti-money laundering (AML) screening is an essential feature. HyperVerge monitors client activities against the global watchlist, raising the alarm early on if there is a potential threat.

Comprehensive risk profiling: HyperVerge helps you create risk profiles based on multiple data points, such as document verification results and behaviour patterns. This risk profile allows you to tailor the anti-money laundering (AML) measures. This means keeping strict measures for risky customers but not for less risky customers.

Customisable no-code workflow builder: One of the biggest advantages of using HyperVerge is you can customise its use based on your processes without any technical expertise. The no-code builder doesn’t add extra pressure on your development team and can be executed much faster.

Seamless integration: HyperVerge uses API architecture to integrate into your existing software suite effortlessly to build the customer journey end-to-end. Some of the most popular HyperVerge integrations are Passport OCR, Aadhar Card OCR, Face Match, and AML Screening.

Target audience and use cases

HyperVerge caters to multiple categories, including banks and NBFCs, insurance, education technology, gaming companies, and marketplaces. Our notable clients include Cred, Swiggy, TATA Capital, and ICICI.

How did we evaluate the two products?

We went beyond features and pricing analysis because Jukshio and HyperVerge are strong competitors in the KYC verification space. We analyzed websites like G2 and Capterra to understand what actual users have to say about them. We also checked Reddit to get unfiltered reviews and experiences.

Overview of the Jukshio vs HyperVerge

Here’s an overview of Jukshio vs. HyperVerge:

| Features | Jukshio | HyperVerge |

| AI-powered video KYC | ✔ | ✔ |

| Biometric authentication | Х | ✔ |

| Document verification with OCR | ✔ | ✔ |

| Customisable workflows | ✔ | ✔ |

| Real-time AML screening | Х | ✔ |

| No-code workflow builder | Х | ✔ |

| Fraud detection | ✔ | ✔ |

| API integration | ✔ | ✔ |

| Multi-language support | Х | ✔ |

Key comparisons

Jukshio and HyperVerge provide digital identity verification solutions, but their capabilities differ. We have compared them based on features, pricing, security, and more to give you a better idea.

Features

Both Jukshio and HyperVerge are identity verification platforms, but they differ in their approaches and feature sets.

| Feature | Jukshio | HyperVerge |

| AI-Powered Verification | Jukshio provides KYC verification, facial recognition, and ID Card OCR | HyperVerge uses AI-driven identity verification, which includes KYC checks, liveness detection, facial recognition, and forgery checks |

| Digital Signature Capabilities | Provides Aadhar-based e-signatures | Offers electronic signatures for added security and efficiency |

| Integrations | Quick integrations with APIs and SDKs | Integrates with web and mobile SDKs and covers 100+ onboarding APIs |

| Fraud Prevention | Focuses on digital signatures, document management, and face matching and deduplication | Uses advanced fraud prevention techniques like spoofing checks, face search, deep image analysis, and fraud pattern analysis |

| Support | Jukshio provides support to its customers by sharing detailed documents for developers | HyperVerge offers personalised customer support to understand the issues and resolve them with the quickest solution |

| Target Audience | Financial, Telecommunication, and Retail industries | Banks, insurance firms, telecommunications, crypto and gaming companies |

| Unique Strength | Customised identity verification solution suitable for large businesses | AI-driven, scalable platform with advanced passive liveness testing capabilities ideal for companies of all sizes |

Jukshio’s strength areas lie in real-time fraud monitoring and comprehensive risk assessment tools. It supports multi-document verification and automates the screening process.

HyperVerge, on the other hand, excels in leveraging AI to deliver scalable identity verification solutions. It specialises in passive liveness detection and offers a frictionless verification experience.

HyperVerge is an excellent choice for businesses that want a scalable identity and document verification solution with advanced AI capabilities.

Pricing

Jukshio’s pricing model is not openly published on their website. They offer customised pricing based on the client’s requirements.

HyperVerge offers three pricing plans: Start, Grow, and Enterprise.

Start: The Start plan has a 30-day free trial and best suits small companies.

Grow: The Grow plan is for medium-sized companies

Enterprise: The Enterprise plan is for larger companies that need a dedicated customer support team.

Target audience

Jukshio mainly fulfils the identity verification and KYC requirements of the financial, telecommunication, and retail industries.

HyperVerge’s features are well-tuned in multiple categories, including banks, NBFCs, and insurance companies. It also caters to the marketplace industry, gaming, and crypto companies.

Security

Jukshio strongly commits to protecting user privacy. It maintains transparency about how it collects and uses user data and outlines the user’s right to access, correct, or erase their data. Jukshio also has a Data Protection Officer (DPO) to oversee compliance with the GDPR norms.

HyperVerge complies with the GDPR and CCPA regulations to secure customer data. It also follows the AICPA-SOC2 regulations to store and process the data. HyperVerge also uses advanced security measures like:

- Forgery checks

- Known face checks

- Deep image analysis

- Liveness detection

- Fraud pattern analysis

User experience

Jukshio prioritises user experience by offering flexibility in building customizable workflows based on their requirements. It provides support by sharing resources like detailed documentation for developers to understand all parameters and tests.

HyperVerge delivers an excellent user experience through an intuitive interface and efficient identity verification process. Moreover, the clean dashboard and AI-driven features provide quick and accurate results. HyperVerge has dedicated customer support focusing on quick resolution and minimal downtime.

Integrations

Jukshio offers customisable APIs and low-code solutions to help companies integrate Jukshio into their existing tech stack. It also integrates with government databases like Aadhar and Digilocker to create a seamless identity ecosystem for various applications.

HyperVerge uses API architecture to embed identity verification solutions in your existing onboarding process. HyperVerge integrates with 100+ third-party vendors from 12 categories covering onboarding scenarios, KYC, and fraud detection.

One of HyperVerge’s most significant advantages is its ability to provide mobile and web SDKs that can be implemented in less than four hours.

Pros and cons

You may still be unsure which platform is best for KYC verification and real-time identity analysis. To help you make your decision, we have listed the pros and cons of Jukshio and HyperVerge.

Jukshio Pros

Scalable: Jukshio has onboarded 615 million+ customers to date. Its advanced encryption methods provide the highest level of security and confidentiality. With such a large database and advanced technology, it’s capable of handling a growing customer database without compromising on security or performance.

Advanced Machine Learning (ML) models: Jukshio has detected more than 3 million frauds, and its machine learning models are continuously updated to keep pace with new fraud types. The models are updated using AI and human expertise to identify fraud patterns.

Jukshio Cons

Steep learning curve: Getting used to Jukshio might take time if your employees are unfamiliar with identity verification solutions. You have to spend some time training them initially.

Overwhelming for smaller businesses: Jukshio might not be the best choice because the advanced features might be overwhelming for their identity verification needs.

HyperVerge Pros

Comprehensive KYC solution: HyperVerge automates different aspects of the verification process. The Aadhar Card OCR automatically extracts the details and fills out the information. It also verifies the user records on CKYCRR and performs video liveness testing to ensure a real person is sitting in front of the camera.

Detailed analytics: With HyperVerge’s detailed analytics, you spot the friction points accurately and see where exactly your customers are dropping off. Moreover, the stepwise analytics tells you which module is the most time-consuming for the users and the conversion rate for each module.

Liveness testing: Our passive liveness technology is ISO 30107-1/ 30107-3 level 2 certified with a 0% false acceptance rate (FAR) and maintains a 0% false rejection rate (FRR). Passive liveness verifies an individual’s identity based on a single image or video.

This helps to offer a better user experience as your customers don’t have to interact or follow any steps to verify their identity.

HyperVerge Cons

Might need training: HyperVerge offers a clean user interface; however, your in-house team might need additional training to get used to the product.

Hear it directly from the users

What do the current users of Jukshio and HyperVerge have to say about the platforms? Let’s discover the top platform.

What are the users saying about Jukshio?

What are the users saying about HyperVerge?

Choose HyperVerge for the smoothest verification journeys

HyperVerge offers advanced fraud detection and identity verification solutions for businesses to ramp up their security infrastructure. It functions at an impressive speed without compromising user-friendliness. If you’re still thinking if HyperVerge is worth giving a try, here are five reasons why you should:

End-to-end journeys

HyperVerge’s comprehensive KYC solution takes care of the entire onboarding journey. For identity verification, document checks, and fraud detection, HypreVerge performs seamlessly without manual intervention. The result is that every journey runs efficiently from start to end, no matter how complex.

Fewer drop-off rates

With a 95% auto-approval rate, you can expect significantly reduced user drop-off rates. HyperVerge provides a user-friendly experience and cuts the steps to the bare minimum so a new user doesn’t feel overwhelmed by the details and continues until the end.

Highly accurate AI models

HyperVerge’s AI models achieved an impressive 99% accuracy rate in document verification. To maintain this high accuracy, the AI models are constantly trained on diverse facial variations and ID formats. So, when you choose HyperVerge, you’re investing in a fast and reliable tool.

Single image liveness check

HyperVerge confirms a person’s identity based on a single selfie. There is no need for the person to perform gestures or record lengthy videos. It’s quick and convenient for the user, further reducing friction. The Slice team used this feature to scale their platform to 5 million users in 5 years.

Deep image analysis

HyperVerge uses an advanced algorithm to raise a red flag when it spots a deepfake or other spoofing technique. This technology boasts a success rate of 98.5%, making it one of the best platforms in the industry.

High compatibility

Despite its advanced electronic identity verification, HyperVerge is compatible to work with 100K+ devices. Moreover, it integrates with 100+ applications and can work smoothly in bandwidth as low as 2G.

If that got your attention, check out HyperVerge One.

FAQs

1. Is Jukshio a FinTech company?

Jukshio is an identity verification and KYC vendor, particularly for the financial sector.

2. What do Jukshio technologies do?

Jukshio provides comprehensive identity verification, document, and fraud detection solutions. It’s an AI-powered platform that empowers companies to automate customer onboarding while enhancing their security infrastructure.

3. Which identity verification solution works best for lenders?

HyperVerge One is an excellent identity verification solution for lenders. It’s quick, highly accurate, and offers comprehensive analytics capabilities. Lenders can simultaneously automate the customer onboarding process and minimise fraud risks.