Deepfakes, synthetic IDs, and stolen identities are slipping through weak verification systems. And if your fraud detection is slow or rigid, you’re giving fraudsters an open door.

Now, fraud prevention isn’t just about blocking bad actors, it’s about letting in the right users without unnecessary friction. That is exactly where many verification tools, including iDenfy, fall short. While iDenfy is built on solid fundamentals, its limited customization and lack of no-code automation make it a challenge for scaling and regulated companies.

Looking for iDenfy alternatives? Let’s explore 10 equally good or even better alternatives in this blog post.

Why consider alternatives to iDenfy?

iDenfy does offer a comprehensive suite of verification and fraud prevention solutions. And, while the tool has garnered favorable feedback, there are certain limitations in terms of advanced customizations and rule-based settings that may cause trouble or a bit of hassle for its users.

Here’s why you should be considering iDenfy alternatives:

1. Customization & API integrations

While you get APIs for various services, including identity verification, business verification, and AML screening, the integration process is a bit complex and sometimes slow. Users can benefit if they are provided more flexibility when choosing MFA methods.

A no-code workflow builder could have simplified this by allowing businesses to create and modify verification processes without heavy developer involvement.

2. Pricing & scalability

The pricing of iDenfy isn’t publicly available. It offers custom quotes depending on the solutions and verification required. However, the reviews on various platforms suggest its pricing is high for more verifications.

3. Compliance & regional availability

iDenfy complies with global security and privacy standards, including SOC 2, ISO 27001, GDPR, eIDAS, and ETSI. While these ensure strong data protection, businesses operating in India may still require solutions explicitly aligned with RBI, SEBI, and local KYC/AML regulations.

4. AI & fraud detection capabilities

iDenfy doesn’t support advanced techniques like behavioral biometrics or comprehensive device fingerprinting, which are employed by other providers to detect and prevent fraud.

5. User experience & onboarding

iDenfy’s interface is mostly easy to use. However, multiple users have reported complexity in managing user roles and permissions.

In terms of solution, its passive liveness detection is comparatively slower than competitors, resulting in a slow and prolonged onboarding process.

How do we evaluate the top iDenfy alternatives?

To find top iDenfy alternatives, we made a list of tools offering solutions for digital identity verification and compliance management and then evaluated these tools based on their pricing, AI capabilities, data security measures, and customer support.

Not only that, we dug through user reviews on G2 & Capterra and captured the essence from relevant Reddit threads to understand what the users loved and despised about the product.

Overview of the top 10 iDenfy alternatives

| Top alternatives | Free trial and demo | Standout features |

| Hyperverge | Yes | No-code workflow automation AI-based liveness and fraud checks |

| Sumsub | No | Unilink allows you to add a QR code to your website |

| Onfido | Yes | Onfido Studio to build and customize verification workflows |

| ComplyAdvantage | Yes | Free sanctions & PEPs check |

| ShuftiPro | Yes | Multilingual OCR |

| Trulioo | Yes | Automatic business verification |

| Persona | Yes | Selfie liveness checks and case management |

| Id.Me | NA | Consumer-centric authentication |

| Sanction Scanner | Yes | AML and PEP data |

| IDfy | Yes | Privy Suite complying DPDP Act |

A detailed list of the 10 best iDenfy alternatives

Let’s now discuss the top iDenfy alternatives in detail.

1. HyperVerge

via HyperVerge

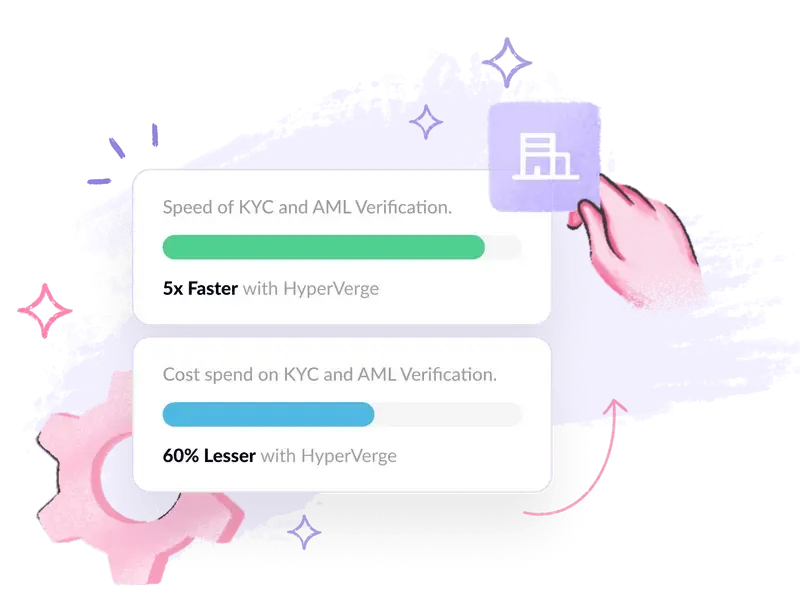

HyperVerge lets you onboard users across diverse devices and demographics while delivering the highest conversion rates in the industry. With over 1 billion identities verified, businesses using HyperVerge have seen a 40% increase in customer conversions.

The platform provides a comprehensive suite of KYC and AML solutions, enabling document verification, biometric authentication, and high-accuracy passive liveness detection.

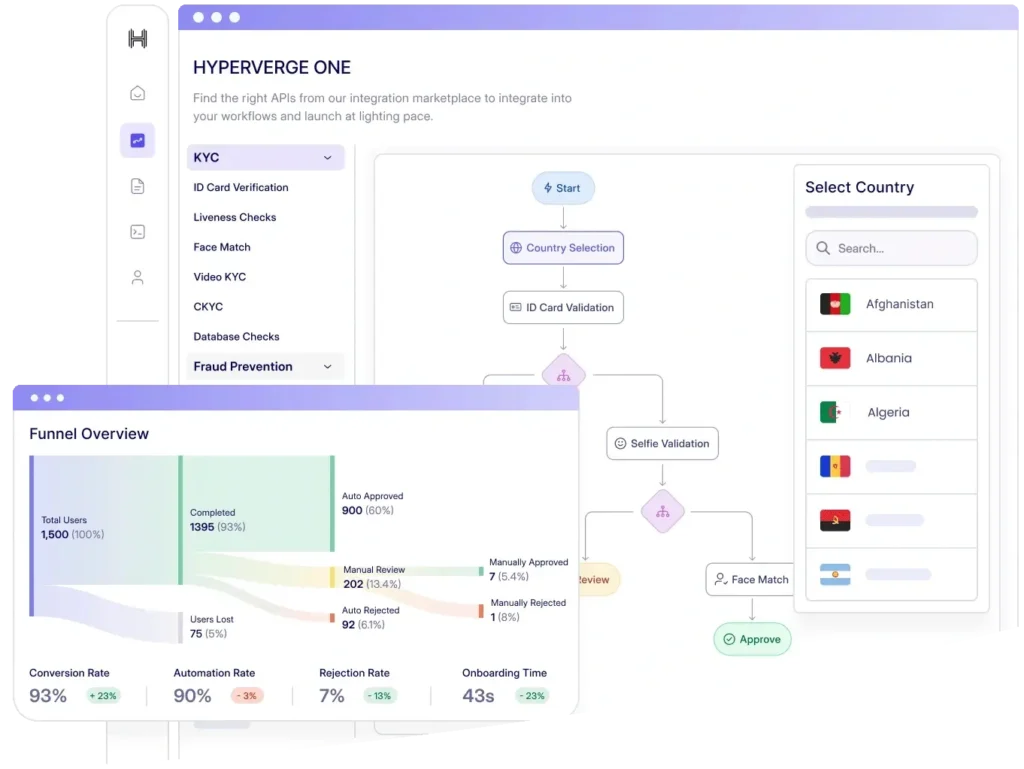

With HyperVerge ONE—AI-powered automation, you streamline your end-to-end financial product onboarding journey without compromising on security.

Here’s what it offers:

- Supports multiple identity verification formats

- Real-time fraud detection

- Deepfake prevention

- OCR-powered document verification

- Face deduplication

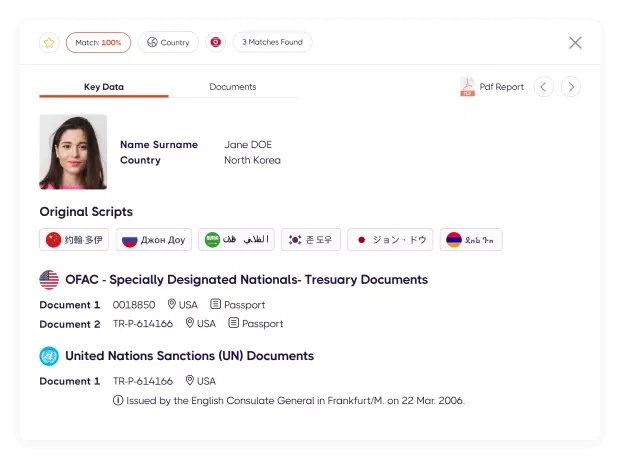

- AML checks (global watchlists, PEP screening, adverse media monitoring)

HyperVerge One has an auto-approval rate of 99%, ensuring smooth customer onboarding for every use case.

Key features:

- Analytics dashboard: Helps businesses identify friction points and optimize the onboarding journey with a funnel overview on drop-offs, retry rates, and conversion trends

- End-to-end journey automation: Streamlines end-to-end customer onboarding with comprehensive workflow automation

- Advanced fraud detection: Hyperverge supports multiple identity verification methods such as facial recognition, biometric authentication, single-image passive liveness detection, spoofing tests, and behavioral analysis

- Cross-platform verification: Works seamlessly across web, mobile SDKs, and APIs, ensuring easy integration into existing systems

- OCR data extraction: Extracts data from any document globally (supports 150+ languages), be it structured or unstructured, with over 90% accuracy

Best for:

Hyperverge is perfectly suited for Banks, NBFCs, insurance providers, gaming platforms, crypto businesses, logistics providers, and marketplaces—all those businesses that are heavily regulated and require stringent compliance with KYC and AML protocols.

HyperVerge pricing:

HyperVerge offers three pricing plans:

- Starter: This plan is best suited for startup companies. It offers a free trial, complete integration set-up, SDK, biometric analysis, and more

- Grow: Grow is an ideal choice for mid-size companies. Here, you get everything in the starter plan, plus a dedicated customer success manager, face liveness check, custom user roles, and more

- Enterprise: If you’re a large organization, this is the plan to opt for. You get a dedicated support team, custom collaborative innovation, and a custom pricing structure

What do HyperVerge users say?

2. Sumsub

via Sumsub

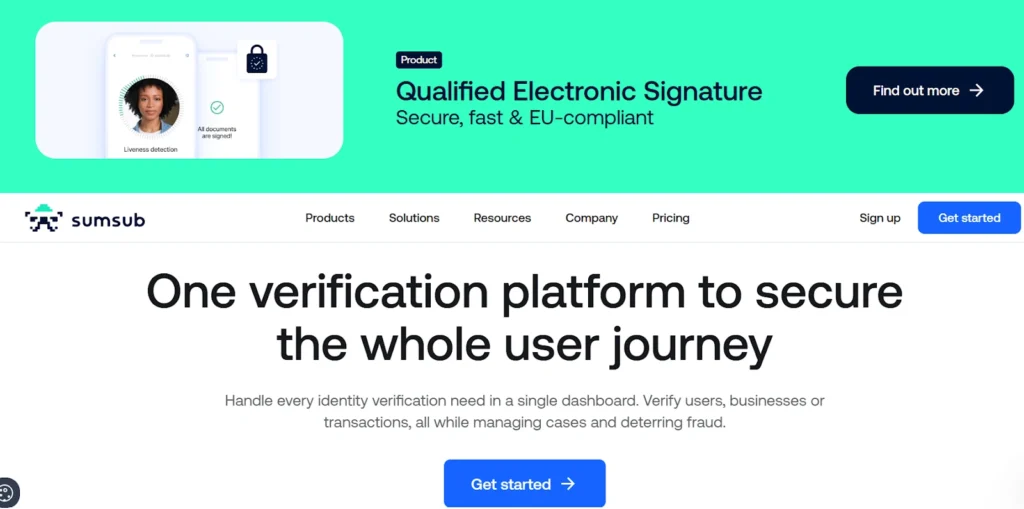

Sumsub is an all-in-one verification platform designed to secure the entire user journey—from identity verification to transaction monitoring and fraud prevention. Its customizable KYC/AML solutions help businesses onboard users quickly while staying compliant with global regulations.

Sumsub’s non-doc verification lets you verify identity using just an ID number and a selfie. You can combine this Non-Doc Verification with standard verification methods and build a workflow with strategic fallback options.

Key features:

- Hassle-free migration: Migrate your entire database without disturbing the verification processes with your current provider

- Unilink: Skip the integration process entirely by adding an identity verification link or QR code to your website

- AML screening: Screen users against 11,000 global watchlists to find high-risk individuals

- Deepfake detection: Confirm live presence in 2-4 seconds, with 99.95% deepfake detection on the first try

- Multilingual document verification: Supports a wide range of languages, including complex scripts like Cyrillic and Semitic

Best for:

Fintech, iGaming, trading, crypto, payment, transportation, and marketplace industries.

Sumsub pricing:

| Basic | Compliance | Enterprise |

| $1.35/ verification For non-regulated businesses | $1.85/ verification For regulated businesses | Custom For extensive verification and compliance solutions |

What do Sumsub users say?

3. Onfido (Now Entrust)

via Onfido

Onfido (now Entrust) offers a global identity verification platform that authenticates over 6,000 government-issued IDs using AI and biometric analysis. It supports ICAO-compliant eIDs, including ePassports and UK biometric residence permits, making it ideal for regulated sectors with strict KYC needs.

Entrust provides NFC chip reading, on-device biometric storage, and the ability to issue both physical and digital IDs through a secure issuance pipeline.

The tool allows risk-based adaptive authentication that adjusts the level of security based on contextual signals like device trust, IP reputation, and user behavior.

Key features

- Adaptive liveness detection: Dynamically adjusts liveness test difficulty based on real-time capture conditions (e.g., glare, facial angle, ambient lighting) to reduce false rejections while blocking spoofs

- Offline eID verification support: Supports verification in low-connectivity environments and border control regions.

- Multi-format ID issuance: Allows you to issue digital and physical ID cards for programs requiring portable identity credentials

- Qualified Electronic Signature (QES): Integrates QES into the verification process to provide legally binding electronic signatures

Best for:

Healthcare, education, government, enterprise, and financial services.

Onfido pricing:

Onfido offers custom pricing. However, you can try it for free before making your decision.

What do Onfido users say?

4. ComplyAdvantage

via ComplyAdvantage

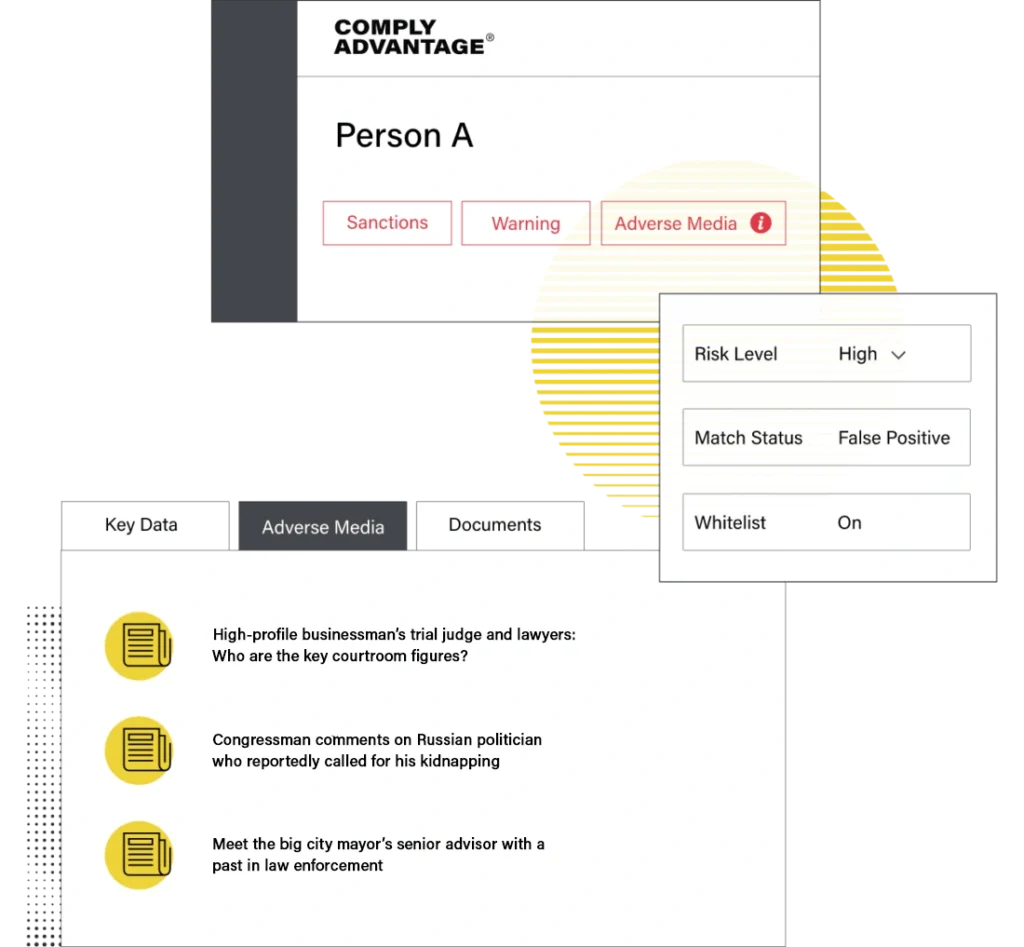

ComplyAdvantage is a SaaS-based risk and compliance platform that helps businesses detect financial crime and comply with global anti-money laundering (AML) regulations.

Trusted by over 1,600 organizations, including Al Jazeera, Allianz, and Santander, the platform delivers real-time risk insights using machine learning. With graph analysis and identity clustering, it uncovers hidden links between entities and flags suspicious behavior that traditional systems often miss.

The tool assigns real-time risk scores to customers and transactions, helping compliance teams prioritize investigations more effectively. Businesses can customize the verification experience to reflect their brand identity, ensuring consistency across user touchpoints.

Key features:

- Identify risks: Monitor hundreds of known typologies and trends within customer transactions to detect suspicious behavior

- Integrations and APIs: Industry-leading API integration along with plug-and-play cloud application services

- Advanced sanction watchlist: Scans 200+ million global news articles using natural language processing to flag reputational risks in real time

- Payment screening: Screen cross-border payments against up-to-date global sanctions intelligence

Best for:

Early-stage startups, banks, insurance, payments, and wealthtech investment firms.

ComplyAdvantage pricing:

ComplyAdvantage offers custom pricing depending on the verification and compliance requirements.

What do ComplyAdvantage users say?

5. Shufti Pro

via Shufti Pro

Shufti Pro is an AI-powered identity verification platform offering global KYC, KYB, and AML solutions. It streamlines customer onboarding with advanced biometric safeguards, including facial recognition with liveness detection.

Its multi-parameter risk engine uses machine learning and behavioral analytics to assess individuals and businesses against 1,700+ global watchlists. The platform also supports NFC-based verification, enabling fast, secure scanning of chip-enabled ID documents.

It maintains a detailed audit trail of user consent, helping businesses meet privacy and regulatory compliance requirements. For added flexibility, Shufti Pro provides a customizable, hosted verification page, allowing businesses to embed identity checks into their workflows without coding or managing backend systems.

Key features:

- Facial recognition: Offers 99% accuracy and facial authentication in less than 5 seconds

- Multilingual OCR technology: Fully automated, remote document verification solution to increase conversions by 80% (supports 3000+ document types)

- Comprehensive watchlist screening: Screens businesses against global sanctions lists, watchlists, and adverse media databases

- AI-powered risk assessment: Uses machine learning insights to analyze risks associated with individuals and businesses for fraud prevention

Best for:

Gaming, forex, social networks, fintech, crypto, and e-commerce & marketplaces

Shufti Pro pricing:

Shufti offers custom pricing for its users depending on their screening and verification requirements

What do Shufti Pro users say?

6. Trulioo

via Trulioo

Trulioo is a global identity and business verification platform that authenticates over 14,000 ID types using AI-driven document checks and advanced biometric verification.

The platform supports no-code workflow building, letting you design custom verification flows with fallback steps. With its single token API, you can deploy identity, business, and watchlist screening tools into your stack efficiently and securely.

Trulioo’s TruMatch Engine is its proprietary matching technology that boosts verification accuracy by applying smart algorithms to match user-provided data against hundreds of global data sources. It helps reduce false negatives and improves match rates, especially in hard-to-verify regions.

Key features:

- Optimizes operations: Spot identity verification workflow gaps with real-time metrics, detailed reports, and audits to help you spot identity verification workflow gaps

- Drag and drop builder: Customize identity verification to match risk profiles and minimize friction with a drag-and-drop workflow builder

- Automate business verification: Access a broad range of global and local sources, as well as data updated every 15 seconds, to verify more than 700 million business entities

- Identity Verification Analytics Dashboard: Provides granular-level insights, helping you track match rates, approval times, failure patterns, and regional performance to reduce friction

Best for:

Forex, payments, online trading, marketplaces, crypto, banking, remittance, and wealth management businesses

Trulioo pricing:

Trulioo’s pricing is not available on its website. Users can book a demo and request a custom quote from their team

What do Trulioo users say?

7. Persona

via Persona

Persona is a flexible identity platform built to help businesses manage their compliance and onboarding needs while adapting to changing risks and regulations. It consolidates all identity-related workflows and lets you create custom workflow templates tailored to different use cases and industries.

The platform offers AI-powered age assurance that estimates age from selfies without requiring documents. It also supports employee verification, automating identity checks across the entire employee lifecycle—from hiring to offboarding.

Persona detects passive signals like device behavior, network activity, and location patterns to flag suspicious users without adding friction.

Key features:

- No-code UI builder: Allows businesses to design branded flows for any point of the identity life cycle

- Passive signals: Collect behavioral, device, and network signals to catch bad actors without adding friction to the user experience

- Identity checks: Extract data from ID documents and verify the collected data against issuing sources and authoritative databases in less than 1.9 seconds

- Liveness checks: Guides users through poses to increase pass rates

Best for:

Digital health, public sector, fintech, marketplaces, crypto, and financial institutions.

Persona pricing:

Persona offers custom pricing to its users.

What do persona users say?

8. ID.me

via ID.me

ID.me is a U.S.-based digital identity platform that enables individuals to verify their identity online.

The platform provides identity verification services to over 146 million users across various sectors, including government, healthcare, and e-commerce. The platform is certified to meet NIST 800-63-3 IAL2/AAL2 standards, ensuring compliance with federal guidelines for identity proofing and authentication. ID.me’s services are utilized by 20 federal agencies, 45 state government agencies, and numerous private organizations to facilitate secure access to services and benefits.

Key features:

- Omnichannel identity verification: Provides multiple electronic identity verification methods, including self-service, video chat, and in-person options, to accommodate diverse user needs

- Digital wallet: Users can store and manage their verified credentials in a digital wallet, allowing for seamless access to services across ID.me’s network without repeated verifications

- Trusted referee service: For users unable to complete automated verification, ID.me provides a video chat option with trained agents to assist in the identity proofing process

- Multi-factor authentication (MFA): Enhances account security by requiring additional verification steps beyond just a password

- Privacy controls: Empowers users to manage and control the sharing of their personal information, ensuring transparency and trust

Best for:

Public sector, healthcare, retail and ecommerce, employment and background checks, automotive, travel and hospitality, financial services, fintech, and ticketing entertainment.

ID.me pricing:

ID.me is free for individual users. However, businesses seeking advanced features can request a custom quote.

What do ID.me users say?

9. Sanction Scanner

via Saction Scanner

Sanction Scanner delivers fully automated, turnkey risk solutions to help businesses of all sizes prevent financial crimes and ensure regulatory compliance. It pulls data from over 3,000 global sanctions, PEP, and watchlists across 220+ countries, with updates every 15 minutes to ensure real-time accuracy.

The platform performs scheduled daily checks based on each customer’s risk level and supports local list management, letting teams include internal blacklists and whitelists. It’s built-in AML database covers sanctions, PEPs, and adverse media without relying on third-party feeds.

Aligned with global standards like FATF, EU AMLD, and OFAC, Sanction Scanner is ideal for businesses operating across borders. Its API-first design, fraud detection tools, and customizable match settings make it a scalable choice for proactive risk mitigation.

Key features:

- AML data: Supports your AML compliance process with its global, comprehensive AML data

- Transaction screening: Automatically verifies the sender and receiver with APIs

- Fraud detection: Real-time monitoring and AI-driven insights to detect prominent threats

- Adverse media data: Strengthen AML Compliance with Global Comprehensive Adverse Media Data

- Custom match settings: Adjust match sensitivity thresholds and filtering rules based on business needs

Best for:

Banks and neobanks, payment, fintech, crypto, and insurance.

Sanction Scanner pricing:

Sanction Scanner offers custom pricing depending on your needs.

What do Sanction Scanner users say?

10. IDfy

via IDfy

IDfy helps you fight fraud at scale with the least possible friction. The tool’s plug-and-play solutions integrate with your existing systems and offer a suite of 140+ onboarding and risk APIs.

IDfy’s Video KYC helps financial institutions onboard customers remotely while staying compliant with RBI and SEBI norms, cutting verification costs by up to 90%. For added security, VIPV (Video In-Person Verification) enables live agent-supervised sessions. This is quite helpful in reducing identity fraud during high-risk onboarding.

Key features:

- Transaction intelligence: Captures data from over 400 points to help businesses make smart credit decisions

- Employee background checks: Verifies credentials, runs criminal record checks, and conducts comprehensive background verification to validate candidate history

- Privy suite: Comprehensive government solution that ensures PII data privacy compliance under the DPDP Act

- Facial recognition: Uses biometric verification to enhance identity security and reduce impersonation risks

- Criminal record checks: Searches through over 400 million court records and legal documents

- Bank statement analysis: Processes bank statements to extract financial insights, such as salary patterns and transaction behaviors, aiding in credit risk assessment

Best for:

E-commerce & payments, banking, communities, insurance, HR & recruitment, capital markets, gaming, and fintech organizations.

IDfy pricing:

IDfy pricing is available upon request.

What do IDfy users say?

That’s a round-up of top iDenfy alternatives that are feature-rich and have a favorable response from their users.

Build digital trust without the legal headaches.

Stay DPDPA-ready with HyperVerge Trust’s privacy-first infrastructure. Schedule a DemoRead Also: Top 5 Identity Verification Solutions and How to Choose One (2024)

How to choose the best iDenfy alternative for your business?

Now that you have a list of iDenfy alternatives, the next step is finding the one that best fits your business needs.

Here’s how you should be evaluating tools:

Functionality and features

Evaluate your verification and fraud detection needs and list down features essential for comprehensive KYC and AML checks in your business.

Here’s a quick table highlighting what you should be looking for in a tool.

| Features | What to look for? |

| Identity verification | Passive liveness detection that works in the background without user effort Multi-modal biometrics (face, fingerprint, voice) for better securityHigh-speed document verification with broad global document coverage |

| Fraud prevention | AI-driven fraud detection with real-time risk analysis Behavioral biometrics and device fingerprinting to detect suspicious patternsDeepfake and synthetic identity detection |

| Customization and integration | No-code workflow builder Seamless API integrations with existing tool stack Multi-device compatibility for web, mobile, and SDK support |

| Compliance and security | No-code workflow builder, Seamless API integrations with existing tool stack Multi-device compatibility for web, mobile, and SDK support |

Look for an end-to-end solution

Look for a service provider that offers end-to-end automated solutions for streamlining KYC and AML. Here’s what a tool should automate and optimize:

- Improve document verification speed with AI-powered OCR extraction

- Enhance fraud detection with behavioral analytics and real-time risk assessment

- Reduce user friction with seamless, background liveness detection

- Strengthen AML compliance with a deep watchlist and adverse media screening

- Simplify workflow automation with no-code tools and API integrations

- Ensure regulatory adherence with built-in compliance for global and regional standards

Ease of use and onboarding

Ideally, get a demo and see if the tool has an intuitive, easy-to-use interface. Check if the tool integrates smoothly with your existing workflows and how many steps it takes to onboard a user normally.

Scalability and flexibility

Choose a solution that allows you to customize workflows based on your use case and unique verification needs. It should let you set rules, automate decision-making, and adjust verification flows without heavy development effort.

Make sure that the tool supports high-volume processing without delays or an increase in false positives.

Customer support and reputation

Check real user reviews on platforms like G2, Capterra, and Trustpilot to see how well the tool performs in real-world scenarios. Look for feedback on response times, issue resolution, and onboarding assistance.

Research how the providers are adapting the solution to evolving fraud patterns and compliance regulations.

Test a tool vigorously on these key parameters before you finalize a service provider.

Read also: Top Challenges Of Online Identity Verification & How To Resolve Them

The future of identity verification with HyperVerge ONE

Looking for a one-stop solution to streamline your customer onboarding journeys? HyperVerge is the perfect choice. Why? Read below:

AI-powered KYC and fraud prevention

HyperVerge’s AI engine is built to handle the real world—diverse faces, multiple ID types, and tricky forgeries. With capabilities like face deduplication, passive liveness checks, deepfake detection, and biometric verification, it delivers up to 95% auto-approvals. Result? Faster onboarding, fewer false rejections, and strong protection against account takeovers, without any friction.

No-code workflow builder

Design your KYC flows without writing a single line of code. HyperVerge’s drag-and-drop builder lets teams create, test, and tweak workflows with ease. You can adapt flows to different user journeys, insert fraud checks at key points, and refine every step—no developers needed.

Enterprise-grade compliance & security

Stay audit-ready with full support for RBI and SEBI regulations, plus global standards like SOC 2, GDPR, ISO 27018, and NIST. HyperVerge takes data protection seriously, delivering enterprise-grade security and privacy without compromising on speed or accuracy.

From verifying identities to stopping fraud and ticking all the compliance boxes—HyperVerge handles it all. Book a demo today and transform your verification processes.

FAQS

1. What are the best iDenfy alternatives in India?

Some of the best iDenfy alternatives in India include:

- HyperVerge

- IDfy

- Sanction Scanner

- Sumsub

2. Which identity verification provider has the best fraud detection?

HyperVerge stands out in fraud detection with AI-driven real-time risk analysis, passive liveness, face deduplication, deepfake prevention, and behavioral biometrics. Its machine learning models, trained on billions of data points, minimize false positives and catch even the most sophisticated fraud attempts.

3. What is the most affordable alternative to iDenfy?

HyperVerge is one of the most affordable options for businesses that want to move away from iDenfy. It offers reliable identity checks and fraud protection at competitive prices.

4. How do I choose the right identity verification solution?

Choosing the right identity verification tool depends on your specific needs. Start by looking at the features each provider offers, such as face matching, document checks, or automation. Check how easy the platform is to use and whether it can grow with your business. Compare prices, read user reviews, and see what kind of support is available. These factors will help you find a tool that works best for your team and customers.