If you’re in the market looking for a Loan Origination System (LOS), then Finflux and HyperVerge are both excellent choices.

Finflux takes end-to-end care of the loan management process. From origination, disbursement, and workflow management to repayment scheduling, your operations run smoothly with little manual intervention. HyperVerge is an advanced tool that streamlines the entire loan origination process from user authentication to loan agreement signing. It uses AI and ML models for KYC verification and helps you configure scorecards for underwriting, loan offer selection, EMI auto-debit setup, and e-signing agreements.

This blog dives into the nuances of each product to give you a clearer picture of each tool’s capabilities so you can make an informed decision.

What is Finflux?

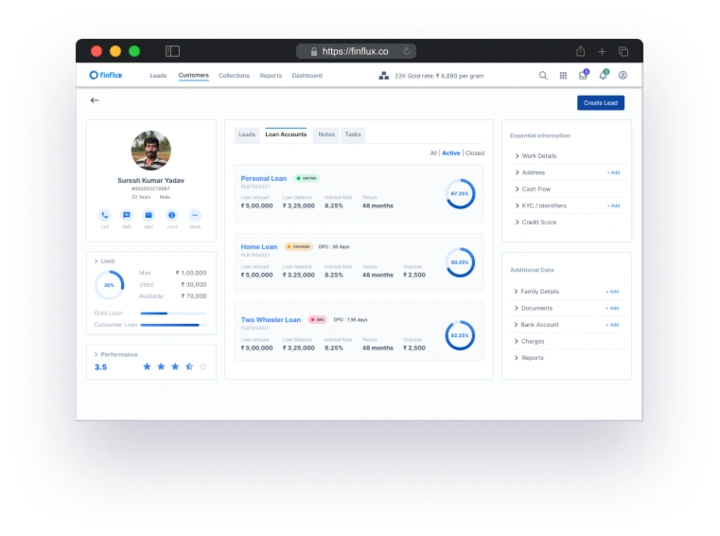

Finflux is a cloud-based platform that automates the entire loan origination process from start to end. It cuts down the process time and makes it smoother and more flexible. Result: your staff has more time to focus on strategic initiatives which means higher productivity and scalability.

Here’s an apt example of how Finflux automates the process. A customer applies for a home loan on your banking app. Once the application is received, the loan origination process begins. Your team runs the KYC compliance process, credit checks, and finally when everything looks proper, the application is accepted. Because this process is managed manually, it takes almost three weeks to complete.

Finflux automates the entire process by setting up your workflow. You have complete control over how you want to design the digital lending process and set your own underwriting rules. Once a user enters their loan details in the app, the Finflux workflow triggers. It automatically verifies the user’s KYC, calculates the credit history and loan eligibility, and then tells your credit team if they should approve the request.

What is HyperVerge?

HyperVerge caters to every stage of the loan origination process and ensures that the entire workflow runs smoothly. It takes care of user authentication by verifying the phone and email information of the customer and scanning their name in the fraudster list simultaneously.

Once the user data has been authenticated, HyperVerge uploads the personal information and document proofs. It then helps you create scorecards and customized logic for underwriting. Based on the decision, HyperVerge offers different loan offers and orchestrates different KYC modes based on your risk policy. Once all the above steps are completed, HyperVerge verifies the customer’s bank account, provides different modes for EMI payment, and creates a virtual loan agreement that the customer can e-sign to accept the terms and conditions.

How did we evaluate the two products?

Before we proceed, here’s a quick breakdown of how we have evaluated HyperVerge and Finflux:

- Head-on comparison of the features and pricing

- Overview of the pros and cons of each tool

- Reviews from real-life users published on reputable software review websites like G2 and Capterra

Overview of the Finflux vs HyperVerge

| Features | Finflux | HyperVerge |

| KYC and AML Compliance | ✔ | ✔ |

| API integration | ✔ | ✔ |

| AI-powered facial recognition | ✘ | ✔ |

| Biometric authentication | ✘ | ✔ |

| Quick customer verification | ✘ | ✔ |

| Compliance with regulatory norms | ✔ | ✔ |

| Free trial | ✘ | ✔ |

Key comparisons

In the previous parts of this blog, we gave you an overview of how each tool is useful for simplifying your loan origination process. In this section, let’s compare the different nuances of products by keeping them side-by-side.

Features of Finflux

Tailor-made products

One of the biggest draws of Finflux is its customization abilities. It provides financial institutions and non-banking financial companies the power to create tailor-made onboarding experiences using their architecture. For example, you can set dynamic pricing and flexible repayment options to create more personalized service for a special group of clients.

The built-in security system is designed according to global rules and regulations like BASIL III and RBI guidelines. This is an added advantage to ensure that your customized products are within the purview of the laws.

Business Rule Engine (BRE)

The Business Rule Engine (BRE), is a graphical interface that allows you to analyze scenarios using simulations. Say you want to offer a special loan product for customers with a 750+ credit score. Give Finflux access to your credit policy saved in your backend system and it will automatically tell you who is eligible for the new loan scheme.

The drag-and-drop builder inside BRE helps you to define your own rule. For example, you develop a rule to assign scores to a list of borrowers. A potential lender with a high credit score will get a high rank on the scorecard. The BRE will do the calculation on its own giving you the best group of borrowers making it easy to take action.

BRE also offers three options for simulations:

Backtesting: Using existing data to test the new BRE

A/B testing: Sending 100% of the applicants through the old and new BRE

Champion challenger: Send 50% of the applicants through the new BRE and 50% through the old

Automatic reconciliation with Samya

Samya is the reconciliation feature of Finflux that automates the entire reconciliation process for a lending platform or financial institution. It cuts down the time and effort your team has to put into performing a range of reconciliation processes.

Mobile compatibility

Finflux offers Oja, a mobile app for microfinance companies. With this app, companies can onboard customers and offer them customized products right from the mobile. Due to this the processing time is faster and documentation is minimal. This can be a game-changer for attracting micro and small businesses in search of loans to grow their business.

Features of HyperVerge

No-code workflow builder

The no-code builder by HyperVerge fills the gap in your tech stack for offering superior services to your customers. Don’t mistake it for a coding platform that will add more work to your developer’s plate. It’s a simple drag-and-drop builder that lets you create customized journeys for your customers which means quicker decision making and go-to-market strategy.

OCR software

The AI-powered OCR engine of HyperVerge allows quick data extraction from any document. It’s template and language agnostic, which means it can detect data in any language, shape, and form. This is a highly useful feature in the loan origination process when a user uploads their income documents or tax filing statements.

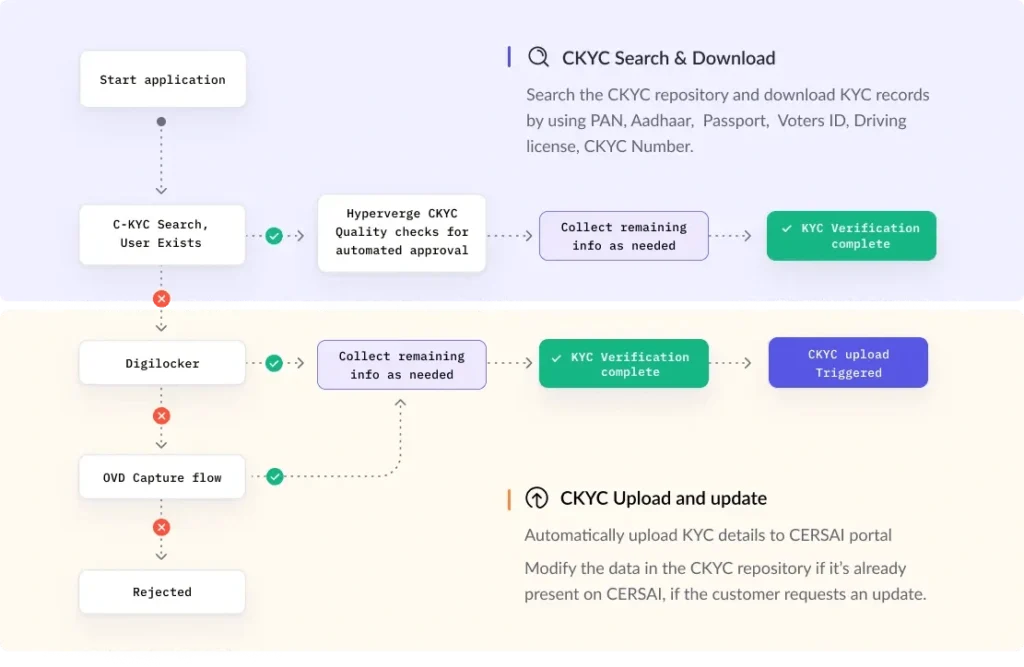

KYC Verification

HyperVerge also takes end-to-end care of the KYC verification process. It verifies the authenticity of documents using central database checks, screens the user profile against local databases, adverse media, and Politically Exposed Persons (PEP), and performs quality checks to prevent bad-quality images.

Real-time facial recognition

Identity fraud is on the rise and with deepfake videos, your security system could be breached even when you use a well-developed biometric system. HyperVerge’s AI facial recognition system identifies anomalies in the user’s face during active and passive liveness detection in only 3 seconds. But HyperVerge’s liveness check goes beyond videos. The single image passive liveness detection determines the identity of a person based only on their image, like a selfie. It uses advanced techniques to analyze facial characteristics without having the user do anything on their end.

Pricing

Finflux doesn’t offer pre-built pricing plans. It has a ‘pay as you go’ model which means the price is determined based on your requirements and modules you opt for. It does not have a free trial.

HyperVerge offers three pricing options: Starter, Grow, and Enterprise. The Starter plan is for Start-up companies, Grow is for mid-size organizations, and Enterprise is best suited for conglomerates. Each plan has a 30-day free trial and basic features like a dashboard, document data extraction, barcode scanning support, workflow orchestration, central database checks, and biometric analysis. In the Grow and Enterprise plan, HyperVerge offers extra checks like PEP, Adverse media checks, and email and phone risk on top of the basic features.

Target audience

Finflux offers lending solutions making it a perfect fit for banks, NBFCs, microlending firms, and credit unions. It will be an ideal partner for financial companies wanting to expand their digital lending options and launch microlending schemes.

The KYC and advanced anti-fraud features of HyperVerge make it a favourite amongst financial companies like banks and NBFCs. However, digital identification is a need of the hour for other industries too. Therefore, HyperVerge also caters to industries like EdTech, Gaming, Logistics, e-commerce, marketplaces, and Crypto.

Security

Finflux is built on a secured infrastructure and customer data is saved in the state-of-the-art AWS data centre. It also uses data encryption to add an extra layer of security over data at rest.

HyperVerge complies with global security standards like the General Data Protection Regulation (GDPR) and the California Consumer Protection Authority (CCPA). HyperVerge is also an ISO 27018-certified company and its passive liveness technology has ISO 30107-1/30107-3 Level 2 compliance certification. It also adheres to AICPA-SOC2 to keep client data safe when storing and processing them.

User experience

Finflux offers a user-friendly interface with options for users to customize the workflows and pick the most suitable modules according to their needs.

HyperVerge interface is simple, and if you’re using the tool for the first time, it’s easy to get started—one of the biggest USPs of the product.

Integrations

Finflux supports API integration to let you run complex workflows and streamline your financial process with third-party ERP systems and payment gateways.

HyperVerge API database supports integration with 100+ third-party vendors. These vendors are from 12 different categories ranging from face validation, bank account verification, and AML to digital signature.

Pros and Cons

The best way to summarize that breakdown is by highlighting the pros and cons of each tool:

Finflux Pros

- Powerful end-to-end loan origination and management features

- Fantastic tool for organizations looking to areas explore co-lending and microfinancing

- Flexible platform with great built-in features to create customizable workflows

Finflux Cons

- No free trial – with no standard pricing plans, it might be expensive, especially for smaller financial organizations

- The feature list is high and with so many options, the learning curve will be steeper most likely

HyperVerge Pros

- End-to-end lending solution, Advanced AI, Machine Learning and Automation features

- Best-in-class liveness detection technology for KYC verification

- Clear pricing plans with customization options–a great fit for organizations of all size

- Suitable to various industries like finance, e-commerce, and gaming

HyperVerge Cons

- Setting up a workflow for digital identification from scratch might take some time, especially if your team is not experienced in it

Hear it directly from the users

Real-life review of Finflux:

Real-life review of HyperVerge:

Choose HyperVerge for the smoothest loan management cycles

In financial industry, a smooth and quick onboarding process is a harbinger of a well-developed lending platform. Here’s how HyperVerge helps you build that process:

End-to-end journeys

HyperVerge’s AI-driven features automate the onboarding and verification process. This ensures a smooth transition from the loan application and approval to the final disbursement step.

Fewer drop-off rates

48% of banks have agreed to lose customers due to the slow KYC process. But when you use HyperVerge’s fast and accurate liveness testing, you retain such customers for the long term and stay secure simultaneously.

Reduced fraud risk

HyperVerge performs multiple checks for the background verification of customers and uses robust KYC techniques to reduce fraud and keep bad actors at bay.

Online identity verification is a key step in the loan origination process. HyperVerge One is the perfect online identification platform to launch user onboarding journeys, reduce customer drop-offs, and boost revenue.

FAQs

What does Finflux do?

Finflux is an advanced software that lets lending platforms like banks and financial institutions automate the end-to-end loan management process. It also gives them the power to launch customized products and generate more revenue

What is loan origination software?

Loan origination software manages and automates the initial loan process from application to approval. KYC and AML checks are the focus areas where its need is felt the most.

What does a mortgage automator do?

Mortgage automator is an advanced SaaS platform that assists financial organizations with loan origination, compliance, accounting, and reporting.

What is a loan management system?

Loan management system is a digital tool that helps you manage the entire loan process from application to disbursement