When it comes to digital lending, the infrastructure you use can make or break your business. As a result, selecting the right Loan Origination System (LOS) is vital to your continued success. In this article, we put two LOS platforms against each other. Finbox vs HyperVerge – which LOS is right for you?

Both platforms have different areas of focus, making them more or less useful depending on the sector in which you plan to use them.

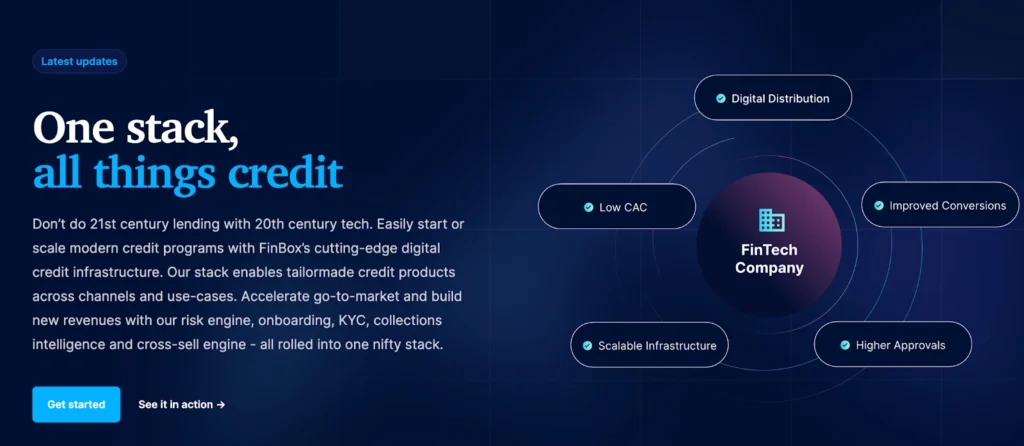

Finbox specializes in putting together Digital Credit Infrastructures, allowing users to build and scale their credit products efficiently.

Their Risk Intelligence Suite and API stack are most useful for micro, small, and medium enterprises (MSMEs), while their focus on embedded finance solutions allows platforms to integrate loan services and other financial services into their stack seamlessly.

HyperVerge, on the other hand, focuses on Computer Vision and AI solutions, empowering the process of data verification, document analysis, fraud detection, and regulatory compliance.

For the banking and insurance sectors in particular, HyperVerge’s focus on Real-Time Data Processing and mobile-friendly applications makes the process of onboarding much easier, especially when it comes to loan management.

Let’s take a detailed look at the different aspects of the two platforms.

What is Finbox?

Finbox is a fintech company specializing in digital lending and credit infrastructure. It focuses on giving enterprises the support they need to extend credit to underserved sectors like MSMEs.

They provide a comprehensive suite of products as well as end-to-end support to help companies launch and scale their credit offerings. Their main goal is to democratize access to loan and financial services, and as a result, their features and functionalities are designed to support that goal.

As an embedded finance platform, Finbox offers an API and an SDK that can be quickly integrated into most systems. Their platform allows for the integration of financial services into non-financial applications.

Their software also comes loaded with a Risk Intelligence Suite, an AI/ML-enabled tool that supports proper risk assessment and management.

It also helps judge creditworthiness, which is especially useful for people and businesses with limited credit history. Plus, their full-stack lending solutions also provide the infrastructure for underwriting, Know Your Customer (KYC), and customer servicing.

They focus on streamlining the user experience and making the loan process faster and more transparent.

They mainly serve financial institutions, fintech startups, e-commerce platforms, and enterprises looking to offer digital lending solutions.

What is HyperVerge?

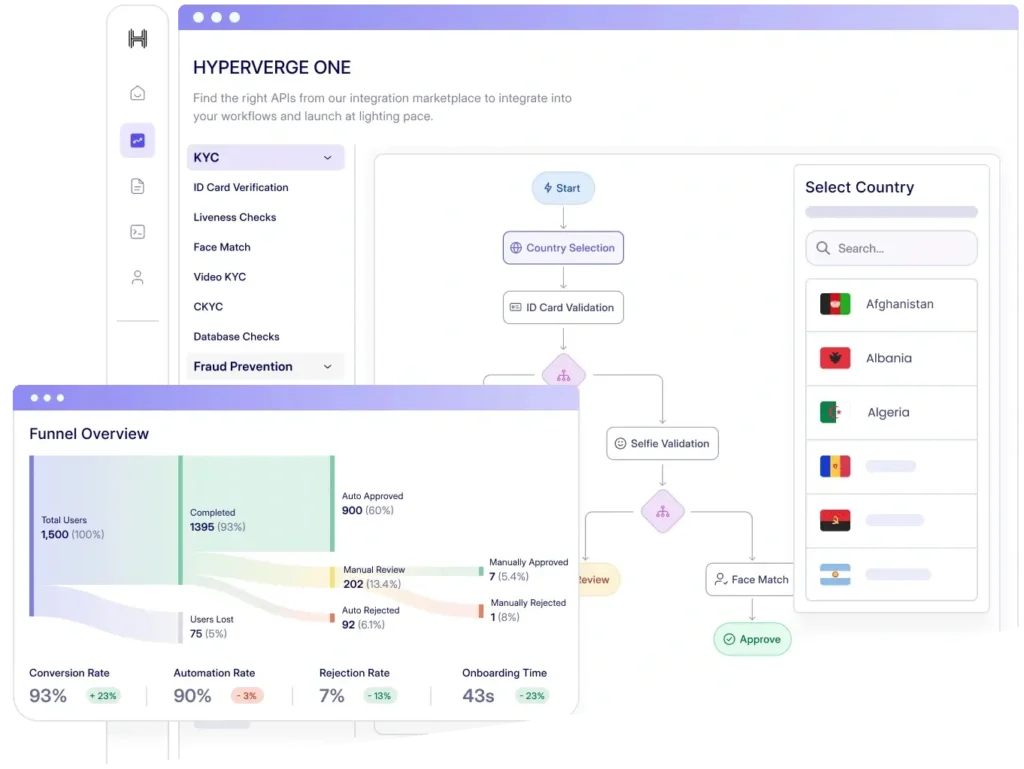

HyperVerge is a B2B SaaS company specializing in AI-enabled ID verification and onboarding solutions. The focus is on enhancing the onboarding process across multiple sectors, including fintech, crypto, gaming, banking, and insurance.

As an LOS platform, HyperVerge uses its image analysis technology to ease customer onboarding processes, prevent fraud, and provide authentication. It offers a comprehensive digital KYC solution, allowing businesses to verify customer identities quickly.

HyperVerge’s AI-enabled fraud detection systems use AI models to detect deepfakes, perform facial recognition tasks, and more.

The platform also provides detailed real-time analytics to detect drop-off points during onboarding processes, and supports over a hundred different integrations to customize the onboarding process as needed.

How we evaluate the two products

In this article, we will evaluate these two products across several different criteria, including features, pricing, and pros and cons. Customer reviews are also taken into account.

We will focus more on reviews from G2 or CapTerra, as they are from verified users, but reviews from Reddit are also taken into account, as they sometimes provide useful information on edge cases.

Overview of Finbox vs HyperVerge

Now, let us take a detailed look at Finbox and HyperVerge. There are several key points of comparison, each of which showcases the different strengths of both products.

Key Comparisons

Features

| Features | Finbox | HyperVerge |

| Customizable UI/UX | Yes | Yes |

| KYC Support | Yes | Yes |

| Real-time Fraud Detection | No | Yes |

| AI-powered ID Verification | No | Yes |

| Comprehensive Analytics | No | Yes |

Pricing

Finbox has not made their pricing models public.

HyperVerge offers three different plans. The Start plan, meant for startups, allows for a free trial in a sandbox environment over a one-month period, and allows users to view and manage verifications.

Their plan for mid-size companies is named Grow, and offers everything in Start, plus an end-to-end ID verification suite, central database checks, access to AML checks, and a custom workflow.

Their third plan, Enterprise, is meant for enterprise-level organizations. It includes everything from the first two tiers plus premium features.

Given the fact that over a hundred integrations are available for HyperVerge, the exact price of a plan fluctuates depending on client requirements and modules installed. This modular pricing allows clients to invest only in the modules they need, which allows them to reduce expenditures without giving up on important functions.

Target Audience

When it comes to target audiences, Finbox and HyperVerge have a fair amount of overlap. They both serve financial institutions and digital platforms. That said, they focus on different aspects of the lending process, with different specializations.

Finbox focuses on providing digital lending options to MSMEs, and works to help them address the unique challenges of working in this underserved sector. They also support banks and other financial institutions in enhancing their credit offerings, as well as digital platforms that want to integrate financial services into their systems.

HyperVerge focuses on identity verification for secure transactions, and mainly serves financial institutions and fintech companies. They also target different sectors, including gaming, crypto, insurance, and banking.

HyperVerge is heavily used by startups and midsize companies that require quick and efficient onboarding processes, as well as e-commerce sites that require secure authentication for regulatory compliance.

Security

The field of digital lending is heavily regulated, and any organizations involved need to stay compliant.

Finbox adheres to international standards for information management systems, and has several security protocols in place. The platform uses SSL encryption as well as application-level encryption to protect data.

HyperVerge is also fully compliant with industry-standard security practices, and maintains the confidentiality of customer information. They use robust encryption methods to protect data.

User Experience

A good user interface and user experience greatly improve efficiency, making it a necessity for platforms like Finbox and HyperVerge.

Finbox offers a highly customizable user interface that allows for quick and seamless integration. Their risk engine is fully automated, allowing them to maximize automatic approvals while flagging any cases that require manual review.

HyperVerge considers user experience to be quite important, with many features dedicated to improving it. The AI-powered onboarding process seeks to make it easy for users. On the client side, the highly customizable no-code workflow builder allows for near-perfect customization.

In terms of customer support, Finbox is easily contactable by using a form on their site, and they have extensive FAQs to provide information.

Along with extensive customer support, HyperVerge also offers a number of resources on their site. Their blogs contain extensive amounts of information covering a broad range of topics, while the glossary acts as an excellent primer for new clients.

Integrations

As a general rule for LOS platforms, the more integrations, the better. Finbox has stated that they provide seamless integration with a large network of lenders, and work with over 50 lenders to provide diverse credit solutions.

HyperVerge offers over 100 integrations, as the modular architecture of the platform and open APIs allow for greater flexibility. Both platforms are heavily compatible with other tools and systems, with HyperVerge having a slight edge.

Pros and Cons

Finbox Pros

- Large Lender Network – Finbox enables businesses to quickly and easily connect to its expansive lender network. By doing so, clients will not need to develop custom-built integrations for each of the lenders.

- eKYC Authentication Suite – Finbox has a strong user authentication suite, which includes Aadhar eKYC, face ID verification, PAN authentication, and more. Their comprehensive KYC support reduces approval time drastically.

- Security – Finbox is built to meet high standards of data privacy and security. The software is also ISO certified and compliant with changing regulations.

- Underwriting Suite – Finbox’s underwriting suite has been validated on a customer base of over 16 million people, greatly improving the rate of approvals.

Finbox Cons

- Too focused – Finbox is extremely focused on MSMEs in India, which limits it. Any form of international lending is not possible via this infrastructure.

- Lack of pricing information – As Finbox has not made its pricing structure public, it is difficult to judge if it fits in budgets.

- Lack of reviews – There are no publicly available reviews, making it difficult to get social proof of how useful Finbox is.

Hyperverge Pros

- AI-Powered ID Verification – HyperVerge uses advanced AI/ML systems for real-time ID verification. This method greatly increases onboarding speed, while also keeping data security high.

- Customizable workflow – Since HyperVerge handles a wide variety of clients across multiple sectors, the platform needs to be flexible enough to handle all kinds of workflows. As a result, the no-code customizable workflow was developed to be maximally adjustable and fit the needs of most clients.

- 100+ integrations – Given the broad client base, HyperVerge’s open API and integrations help enhance productivity and efficiency across many different sectors. Since the platform is built to be modular, integrations can be added as necessary without having to develop new software for each one.

- Fraud detection – HyperVerge’s robust fraud detection technology make the onboarding process much more secure, while also making sure that the entire process is compliant with data security regulations.

HyperVerge Cons

Here at HyperVerge, we are dedicated to improving our services in all spheres. If you run into problems with our platform, please let us know. We will do our best to rectify the issue and make sure it doesn’t recur.

Hear it directly from the users

What are users saying about Finbox

Note: There were no verified reviews available.

What are users saying about HyperVerge

Choose HyperVerge for the smoothest loan management cycles

Selecting an LOS platform can be one of the most impactful decisions any company can make, and so it is important to pick the right one. Compared to its competitors, HyperVerge outperforms in almost every category. With end-to-end support, lowered drop-off rates, higher approval rates, greater flexibility, more integrations, and incredible customization, HyperVerge is an excellent pick. If you want to know how HyperVerge can enhance your system, click here to book a demo.

FAQs

1. What does Finbox do?

Finbox is a fintech platform that provides digital lending support, specializing in MSMEs. It is used for loan origination, risk management, and embedded finance solutions.

2. What is loan origination software?

Loan Origination Software is a kind of software that financial institutions use to manage the entire loan process, from application to disbursement. It handles a variety of tasks including lead management, onboarding, verification, and more.

3. What does a mortgage automator do?

As the name suggests, a mortgage automator is a type of software that is used to manage the mortgage lending process. It supports the mortgage process by assisting with application processing, document management, and more, depending on its features.

4. What is a loan management system?

A loan management system is a software that lenders use to manage their loan portfolio. It often has features like loan tracking, reporting tools, payment processing, and compliance tools.

5. What are some alternatives to Finbox?

Some good alternatives to Finbox are HyperVerge and Lentra.