The identity verification industry is heating up, and it’s no surprise why. With fraud on the rise and digital security becoming a non-negotiable, companies are battling it out to claim the top spot. Did you know the identity verification market is expected to skyrocket from USD 13.19 billion in 2024 to USD 23.49 billion by 2029? That’s a compound annual growth rate (CAGR) of 12.64%!

So, the big question for businesses today isn’t whether to invest in identity verification but which solution to choose.

Two names that often come up in this conversation are Digio and HyperVerge. Each brings something unique to the table, but how do they stack up against each other? What’s going to help your business stay ahead? In this article, we take a deep dive into the Digio vs HyperVerge debate, breaking down their strengths, features, and everything in between—so you can confidently choose the platform that’s right for you.

What is Digio?

Digio, at the forefront of India’s paperless digital transformation, offers an innovative all-in-one platform for legal document signing, recurring payments (through e-NACH), and secure identity verification with Aadhaar-based eSign and eKYC. By simplifying complex client onboarding processes, Digio helps businesses cut costs, boost efficiency, and provide a smoother experience for their customers.

Digio’s numbers speak for themselves-

- 1500 business and 100 million+ individual customers

- 45 million+ digital signings per year

- 50 million+ documents automated

- 180 million+ debits processed

What’s more? Supported by notable investors like Groww and Rainmatter, Digio raised $11.5M in 2022 and has earned a spot among the world’s 100 most innovative RegTech companies.

Key features and functionalities

- DigiSign: Makes document signing effortless with Aadhaar-based eSign, USB digital certificates, and more ensuring all your agreements, approvals, and self-attested documents are handled securely and legally.

- DigiKYC: Streamlines customer verification with video KYC, selfie checks, and Digilocker integration. It also uses OCR (Optical Character Recognition) technology for ID parsing (reading barcode to translate and store data) and offers thorough background checks.

- DigiDocs: Helps businesses easily create, manage, and standardize document templates. From e-stamping to version control, it keeps all your documentation in one place. No more jumping from one database to another.

- DigiCollect: Simplifies recurring payments with clean NACH, UPI, and debit mandate integrations offering businesses an easy way to track and manage payments.

Target audience and use cases

Digio primarily caters to sectors like banking, fintech, insurance, real estate, and healthcare. Some of its clientele includes names like Hero Fincorp, Zerodha, Axis, Paytm, Navi, and AngelOne.

What is HyperVerge?

HyperVerge is revered as the industry leader in digital identity verification solutions and fraud prevention. Leveraging cutting-edge AI, it transforms the customer onboarding process with precision ID document verification, advanced biometric authentication, and liveness detection.

But that’s not all—With coverage in 195+ countries and over 750 million customers verified, the platform ensures smooth operations across diverse devices—even in areas with 2G bandwidth. Their AI-driven technology enables fast ID verification in under 3 seconds thereby–

- Helping businesses reduce customer drop-offs by almost 50% and

- Achieving 95% auto-approval rate

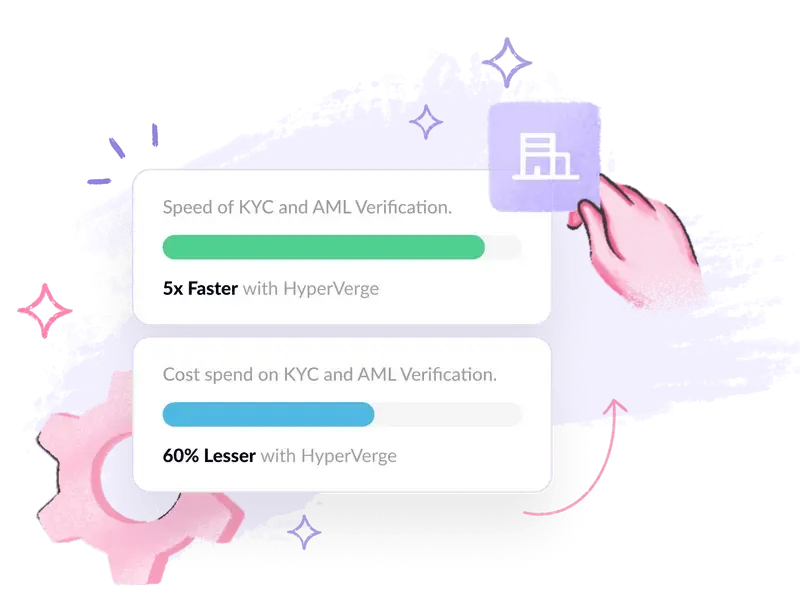

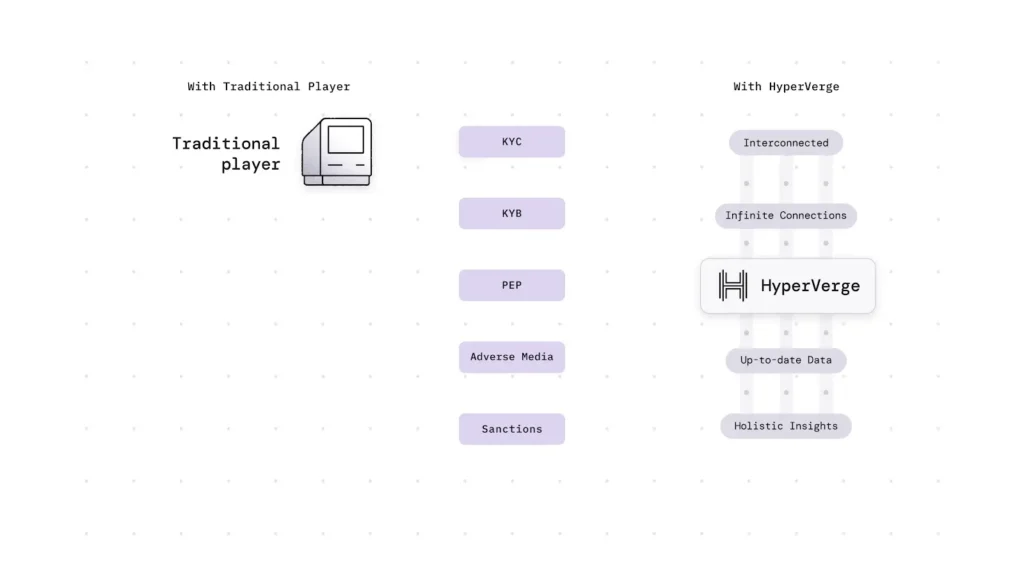

What sets HyperVerge apart is its advanced fraud prevention capabilities. The platform utilizes deep fake detection, forgery and spoofing checks, face matching, image analysis, and more to provide airtight security. It supports compliance with global KYC and AML regulations while reducing KYC costs considerably.

HyperVerge’s technology is also race, age, and gender agnostic, ensuring a seamless experience for all businesses, regardless of demographic differences.

Key features and functionalities

- AI-powered OCR: Extracts text from diverse ID documents such as passports, driving licenses, and social security cards with over 95% accuracy.

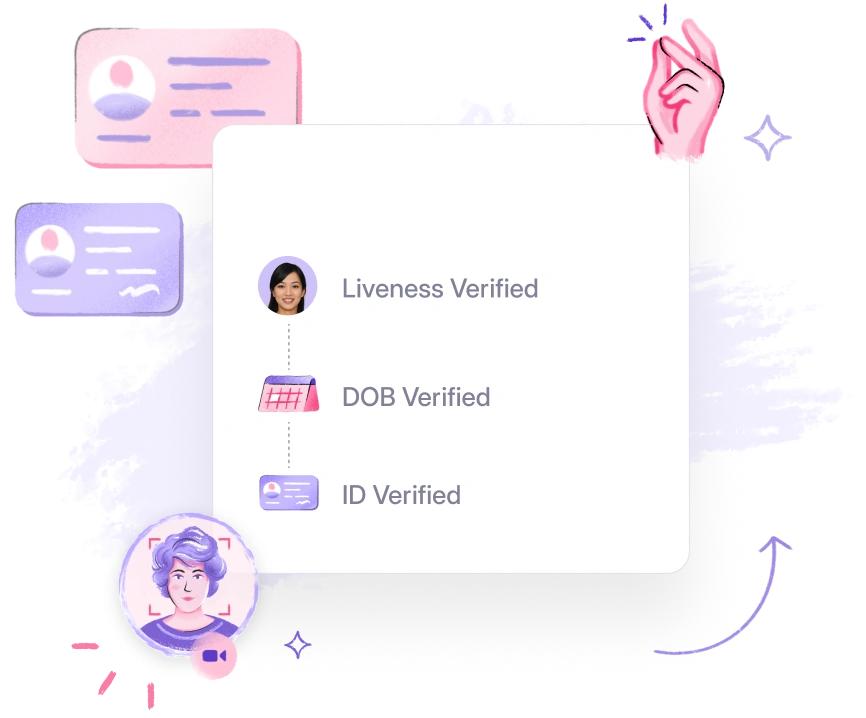

- Biometric authentication: Utilizes advanced face recognition and passive liveness detection to verify identity without user interaction.

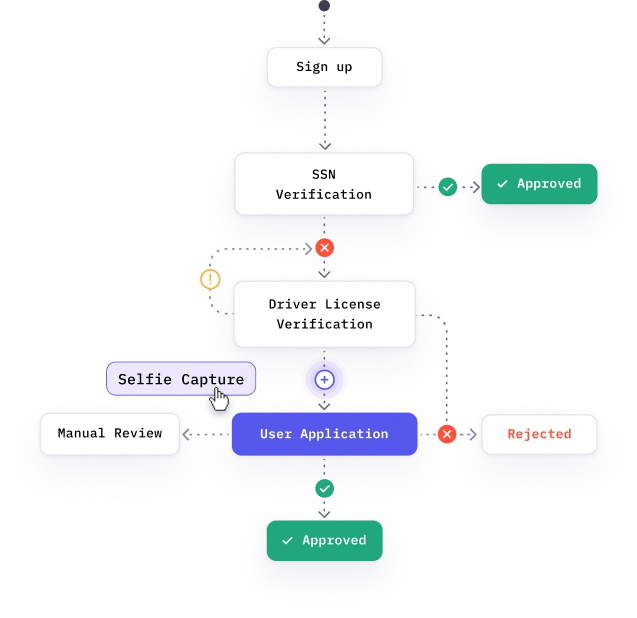

- No-code workflow builder: Allows businesses to create custom onboarding journeys without coding and is compatible with 100,000+ devices! Hassle no more.

- AML compliance: Features real-time monitoring, extensive global checks, and even Politically Exposed Person (PEP) screening to mitigate financial risk.

Target audience and use cases

HyperVerge caters to a diverse range of sectors, including fintech, banking, education, gaming, and eCommerce, and for date has verified more than a billion IDs. Some of its clients include notable names such as Jio, Groww, slice, Razorpay, Tata Capitals, IND money, MPL, Cred, Swiggy, and ICICI.

Looking to enhance your digital onboarding process with seamless identity verification?

Choose the solution that best fits your needs and start streamlining your KYC today! Schedule a DemoHow did we evaluate the two onboarding solutions?

When our team set out to do a Digio vs HyperVerge comparison, we didn’t just stop at the typical features and pricing analysis. We dove deeper, and looked at platforms like G2 and Capterra–they offer loads of detailed, user-driven reviews that can honestly be a goldmine for understanding how these tools perform in the real world.

And, of course, we turned to Reddit too! Have you ever been on one of those niche subreddits where professionals share their unfiltered, real-life experiences? It’s raw, it’s authentic, and sometimes it’s exactly what you need when typical reviews and testimonials feel too polished.

Now, we agree that Reddit reviews aren’t as structured, but they do sometimes offer a raw and authentic perspective that can help fill gaps left by more traditional platforms.

Overview of Digio vs HyperVerge

| Features | Digio | HyperVerge |

| Digital signing | ✔ | ✘ |

| Biometric authentication | ✘ | ✔ |

| Document automation | ✘ | ✔ |

| Recurring payment automation | ✔ | ✘ |

| AI-powered verification | ✘ | ✔ |

eKYC verification | ✔ | ✔ |

Facial recognition | ✘ | ✔ |

Liveness detection | ✘ | ✔ |

Multi-platform integration | ✔ | ✔ |

Key comparisons: Digio vs HyperVerge

When comparing Digio vs HyperVerge, you’ll note that both platforms offer identity verification solutions, but their capabilities differ in scope and specialization. Here’s a closer look at how these two stack up against each other in terms of key features, pricing, security, integration, and more.

Features

| Feature | Digio | HyperVerge |

| Digital signing | Offers Aadhaar-based eSignatures, USB-based digital signer certificates, and electronic signatures | Provides advanced electronic signatures enhanced by AI for added security and efficiency. |

| KYC verification | Includes video KYC, ID card OCR, and geolocation checks for thorough identity validation. | Features AI-driven identity verification along with Video KYC, Aadhaar e-KYC, KRA KYC, CKYC, Whatsapp KYC |

| Document management | Allows for custom document templates, version control, and integrated e-stamping to streamline workflows. | Offers intelligent OCR processing for effective document verification and management. |

| Payment solutions | Simplifies recurring payments with automated collection via NACH and UPI. | Is customizable for each industry and unique needs. |

| Integration capabilities | Quick integration through simple APIs and SDKs for web, mobile, and other systems. | Compatible with 100,000+ devices and integrates with web & mobile SDKs in less than four hours. |

| Compliance | Ensures adherence to SEBI, RBI, IRDAI, and PMLA regulations plus bank-grade security with 2-factor authentication | Complies with global KYC and AML regulations. |

Pricing

Digio offers customized pricing, based on the unique needs of your business, and also the operating industry.

HyperVerge, on the other hand, provides a broad spectrum of three plans:

- Start plan: For startups with a free one-month trial.

- Grow plan: For mid-sized companies with additional features and custom workflows.

- Enterprise plan: For large organizations with a tailored pricing structure.

In terms of value for money, we believe HyperVerge’s pricing aligns with its advanced AI-driven capabilities, which might be more suited to enterprises needing high-end verification.

Target audience

Digio is primarily geared toward businesses in sectors such as lending and banking, finance, healthcare, and real estate. Its user-friendly tools make it ideal for small to medium enterprises looking to simplify their onboarding processes.

HyperVerge, with its emphasis on AI and fraud prevention, is better suited for industries requiring stringent security measures, such as fintech, gaming, and eCommerce. Businesses that prioritize advanced identity verification and fraud detection will find HyperVerge’s offerings particularly beneficial.

Security

Digio employs Aadhaar-based eKYC and eSign, ensuring secure digital signatures and document management. Their systems are designed to protect sensitive information during the onboarding and signing processes.

HyperVerge leverages AI and deep learning for advanced security measures, including:

- Spoofing checks

- Known face search

- Forgery checks

- Face matching

- Deep image analysis

- Liveness detection

- Fraud pattern analysis

User experience

Digio is built around a user-friendly interface that prioritizes simplicity, especially for first-time users in regulated industries. Its commitment to local compliance means the user interface is designed to be region-specific.

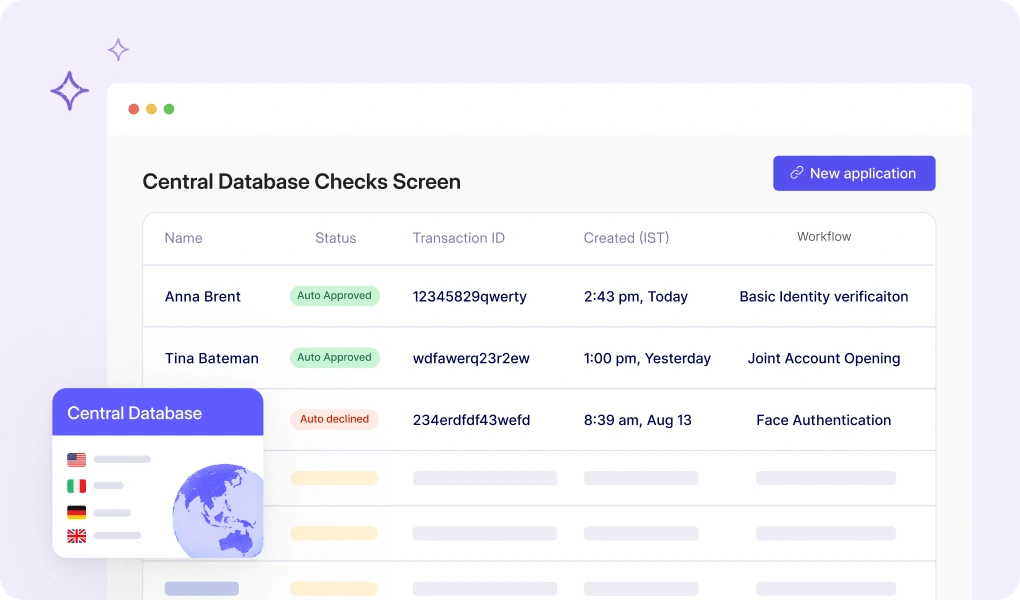

HyperVerge, by contrast, focuses on speed and automation in its UX. Its AI-powered system allows for real-time identity verification, reducing the time users spend in onboarding workflows. The platform’s strong visual design and clean dashboards make it easy for admins to monitor verification processes and troubleshoot potential issues.

Integrations

Digio is known for its ease of integration, especially within the Indian ecosystem. It integrates seamlessly with Aadhaar-based services, government databases, and eSign platforms, making onboarding quick, and frictionless.

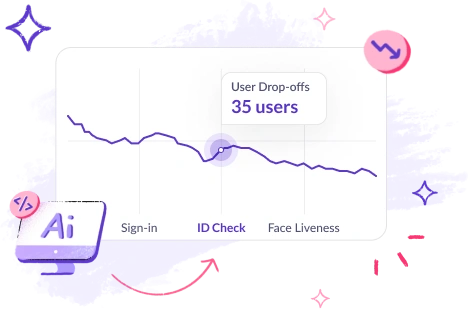

HyperVerge, on the other hand, offers an extensive array of web and mobile SDK integrations, and over 100+ onboarding APIs covering all onboarding scenarios, from KYC to fraud detection. HyperVerge also provides step-wise analytics with detailed funnel insights that companies can use to identify and address bottlenecks in their verification processes and have more conversions.

Discover the fusion of security and simplicity

with HyperVerge’s pioneering digital solutions. Schedule a DemoPros and cons: Digio vs HyperVerge

Choosing the right platform for your business will ultimately depend on your specific needs, industry, and the level of security you require. Before you make a choice, here’s a quick overview of their pros and cons.

Digio pros

- Broad range of services: Need a single platform for Aadhaar-based eSignatures, KYC verification, document management, and automated payment collections. Digio’s got it all covered. What’s more? Immediate onboarding and quick go-live.

- Cost-effective: Digio’s custom pricing is a win for businesses on a budget—especially startups or SMBs looking for digital signing without breaking the bank.

Digio cons

- Limited AI and advanced identity solutions: Digio is not recognized as a leader in AI-driven identity verification technologies. Unlike HyperVerge, it lacks sophisticated features such as deep fake and fraud detection and advanced biometric authentication, which today are essential to comprehensive identity verification.

- Limited applicability in high-threat industries: Digio does not offer critical security features like spoofing checks, deep image analysis, liveness detection, etc. This limitation can make it less suitable for industries where heightened security and fraud prevention are paramount.

HyperVerge pros

- High efficiency: HyperVerge boasts a 98% completion rate and 99% auto-approval, minimizing manual reviews. Plus, with a 50% reduction in drop-offs, it better streamlines onboarding and keeps users engaged.

- AI-powered advanced fraud prevention: HyperVerge utilizes advanced technology for identity verification, including deep image analysis, liveness detection, and fraud pattern analysis, significantly enhancing security. Plus, the platform’s AI capabilities, such as accurate OCR and biometric authentication, allow for efficient and reliable identity verification across a wide range of documents.

- Global reach: HyperVerge’s solutions are designed to comply with international KYC and AML regulations, making them suitable for businesses operating in multiple regions.

HyperVerge cons

- High price: Smaller businesses might find HyperVerge a bit on the pricier side. Is the advanced security worth it? Depends on your needs.

- Niche focussed: HyperVerge is laser-focused on verification. If you’re looking for broader functionality like payment automation, you might miss what Digio offers.

Hear it directly from the users

- What are users saying about Digio

Capterra reviews–

Digio eSign boasts an overall rating of 4.8 out 5 stars on Capterra.

- What are users saying about HyperVerge

G2 reviews–

Capterra reviews–

HyperVerge enjoys an overall rating of 4.5 out 5 stars on Capterra.

Choose HyperVerge for the smoothest onboarding experience

As digital onboarding gets more complicated by the day, ensuring a seamless onboarding experience is crucial for retaining customers. That’s where HyperVerge ONE comes into play.

Specialized in creating comprehensive, end-to-end onboarding journeys, this platform has not only elevated user experience but also minimized drop-off rates by 50%. Yes, that’s right!

But, what sets HyperVerge ONE apart?–It’s the intuitive no-code workflow builder–which allows businesses to effortlessly design and launch customized onboarding experiences without needing extensive IT support. This agility means you can adapt your processes to meet evolving market demands quickly. Couple this with an advanced analytics dashboard, and you can gain deep insights into customer behavior, pinpointing friction areas that could hinder conversions.

Security is paramount, and HyperVerge delivers with features like AI-driven OCR for instant document verification and world-class biometric authentication through passive liveness detection.

Unlike competitors, HyperVerge ensures that onboarding is not just fast, but secure. Imagine onboarding users in less than 60 seconds while maintaining the highest standards of security and compliance. Dream isn’t it?

So, why compromise on your onboarding experience?

Choose HyperVerge ONE for a smooth, efficient, and compliant process that sets you apart from competitors.

Get started today!

FAQs

- What does Digio do?

Digio simplifies digital workflows by offering Aadhaar-based eSigning, e-KYC, and recurring payment solutions. It helps businesses digitize and streamline document signing, customer verification, and payment collections.

- What is an onboarding platform?

An onboarding platform manages and automates the process of integrating new customers and handling tasks like identity verification, document collection, and account setup to ensure a smooth and compliant transition.

- Which onboarding platform has the best customer support?

While the industry is bustling with a lot of options, HyperVerge stands out with its exceptional customer support, rapid response times, ensuring a smooth onboarding experience, and addressing any issues promptly and effectively.