How do terrorists fund their operations in a diverse, complex, and densely populated country like India? What measures are in place to stop money from being funnelled into activities that threaten national security?

The tragic events of 26/11 served as a stark reminder of how financial networks can fuel terrorism, making the need for effective Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations more critical than ever.

AML/CFT measures are essential to safeguard economic stability, minimize illicit ‘hot money’ inflows, and strengthen governance systems. These frameworks are designed with one large objective—breaking the financial backbone of terrorism.

In, this guide, we provide a comprehensive look at India’s approach to combating terrorist financing and how businesses can navigate these complex regulations.

Understanding CFT regulations

CFT regulations are designed to tackle threats such as money laundering (ML), terrorist financing (TF), and proliferation financing (PF), including the funding of weapons of mass destruction. Their goal is to preserve the stability and integrity of global financial systems.

Terrorists may use businesses, charities, or informal methods like hawala to hide and move money. They often rely on money laundering to make illegal funds seem legitimate, making them harder to trace. By cracking down on these financial channels, regulators work to disrupt terrorist networks.

Historical development

The fight against financial crimes began to take shape on a global scale in 1989 with the establishment of the Financial Action Task Force (FATF) by the G7 nations. This body was tasked with setting international standards to combat money laundering and terror financing.

Over the years, FATF’s key framework evolved, culminating in the 2012 FATF 40 Recommendations, which remain the gold standard for AML/CFT measures. The International Monetary Fund (IMF) too has played a pivotal role in shaping AML/CFT policies, offering technical assistance, conducting financial assessments, and integrating AML/CFT considerations into its lending programs.

Core objectives of AML/CFT regulations

AML/CFT regulations have well-defined objectives to combat the threats posed by financial crimes:

- Criminalization of financial crimes:

- Laws are enacted to criminalize money laundering, terror financing, and proliferation financing per international norms.

- Asset freezing and confiscation:

- Governments freeze terrorist assets and confiscate the proceeds of crimes to disrupt criminal networks.

- Establishment of financial intelligence units (FIUs):

- These units analyze and disseminate suspicious transaction reports to aid investigations.

- Compliance and oversight:

- Financial institutions conduct due diligence, report suspicious activities, and comply with regulations.

- International cooperation:

- A collaborative global approach to ensure effective prevention of cross-border financial crimes.

Protect your business from financial crimes

with HyperVerge’s advanced AML solutions! Schedule a DemoGlobal perspective on CFT regulations

FATF, as mentioned above, has been a key part of global efforts to combat money laundering and terror financing. With participation from 40 member countries, associate organizations, and numerous observers, this is how FATF coordinates a global response to financial crimes—

- Guidance and collaboration: Working closely with the IMF, World Bank, and UN, the FATF develops strategies to identify and mitigate financial crime risks

- Capacity building: Providing training for law enforcement, prosecutors, and regulators to detect and combat money laundering and terrorism financing effectively

- Core standards: The FATF’s essential standards mandate criminalizing money laundering, freezing terrorist assets, establishing financial intelligence units, and ensuring robust supervision of financial institutions

- Trend analysis: The FATF monitors evolving threats, including the use of virtual assets and emerging technologies

Since the 2012 revisions, the FATF standard has introduced key updates, including requiring national risk assessments, adding tax crimes as triggers for money laundering investigations, and focusing on politically exposed persons (PEPs).

The FATF is now focusing on Virtual Asset Service Providers (VASPs) and wire transfers. Proposed changes to Recommendations 15 and 16 aim to ensure technology neutrality and consistent application.

As of August 2024, several jurisdictions have introduced or are planning significant changes to enhance their AML/CFT frameworks.

Here are also some of the latest updates coming in on AML/CFT—

European Union

- A new AML/CFT regime was established in June 2024, comprising a centralized EU AML/CFT authority and a single rulebook, aiming for uniformity across member states.

United States

- New beneficial ownership registration requirements are in effect for corporate entities formed after January 1, 2024. Investment advisors face upcoming AML compliance obligations by 2026, signaling a shift towards uniformity across financial institutions.

Canada

- Midway through its 2023-2026 AML/CFT strategy, Canada has introduced draft regulations under the PCMLTFA, with FINTRAC issuing advisories on virtual currency risks.

United Kingdom

- Updates to the Money Laundering Regulations (MLRs) 2017 are underway, alongside FCA (Financial Crime Guide). The spotlight remains on Politically Exposed Persons (PEPs) and customer due diligence.

| Did you know? In March 2022, the UAE was added to FATF’s grey list for AML/CFT deficiencies but was recently removed after significantly improving its regulatory measures. |

CFT regulations in India

- Prevention of Money Laundering Act (PMLA)

The Prevention of Money Laundering Act (PMLA) of 2002, is India’s key legislation to fight money laundering. It mandates banks, financial institutions, and intermediaries to verify client identities, maintain records, and report to the FIU-IND. PMLA also empowers authorities to confiscate property linked to money laundering activities.

- IRDAI’s role in monitoring CFT compliance in the insurance sector

Empowered by the Prevention of Money Laundering Act (PMLA), IRDAI monitors the insurance sector’s adherence to AML/CFT regulations through both on-site and off-site processes.

Insurers are required to establish robust systems for customer due diligence, record keeping, and reporting, all under the supervision of their boards and audit committees. IRDAI’s oversight includes regular reviews and audits to ensure the effectiveness of these systems.

Additionally, the authority collaborates with national and international agencies, including the Department of Revenue and the Eurasian Group, to ensure the sector’s preparedness in combating financial crimes.

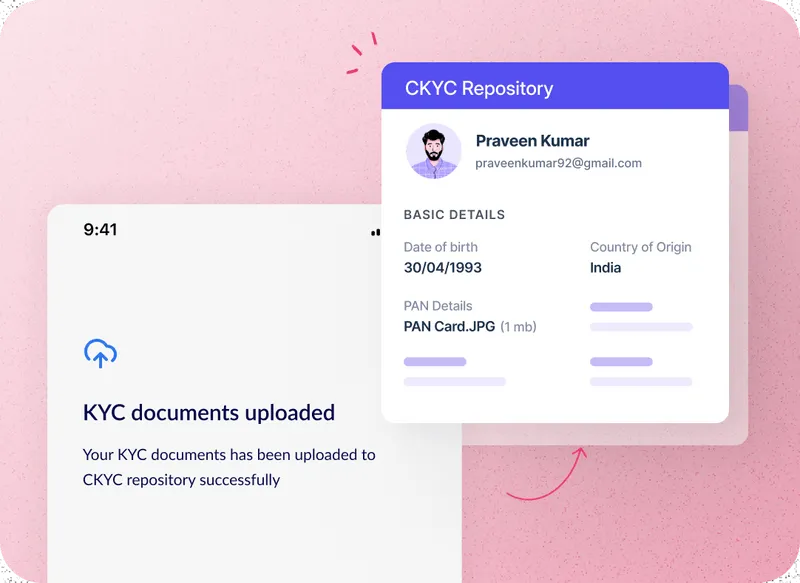

In its early form, KYC, born under the Prevention of Money Laundering Act, of 2002, required banks and other financial institutions to gather basic details such as the customer’s name, address, date of birth, and identification number. As the global financial landscape evolved, KYC procedures incorporated more sophisticated methods like Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD).

Today, in India, KYC plays a pivotal role in the prevention of fraud and money laundering, particularly as digital transactions have surged. India has also embraced digital KYC (eKYC), leveraging technology like biometric identification, AI, and mobile applications to streamline the verification process, making it quicker and more accurate.

Challenges in implementing CFT regulations

Combating terrorist financing through regulations may not just be enough.

Why? Read below–

- Difficulties in tracking cross-border transactions: The global nature of financial transactions complicates the monitoring of funds moving across borders, making it difficult to trace and intercept illicit financial flows. Divergent AML/CFT regulations across different jurisdictions create complexities for financial institutions in ensuring consistent compliance.

- Use of emerging technologies by terrorists: Terrorists increasingly exploit new technologies, such as cryptocurrencies and decentralized finance platforms, to conceal and transfer funds, posing challenges for traditional monitoring systems. Hamas, a militant group based in Palestine for instance, raised funds through cryptocurrencies like Bitcoin.

- Lack of resources and trained personnel: Many financial institutions and regulatory bodies lack sufficient resources and trained personnel to implement and enforce CFT measures, increasing compliance gaps.

- Data privacy and transparency: Confidentiality laws and data privacy concerns can hinder the sharing of critical financial information, impeding the detection and prevention of terrorist financing activities,

Role of technology in CFT compliance

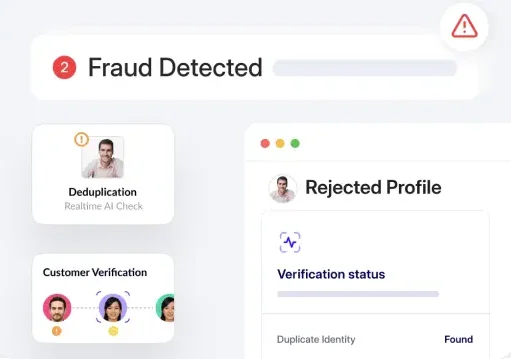

AI and machine learning algorithms can analyze vast amounts of data and are transforming the way financial institutions identify and prevent financial crimes. These technologies can detect hidden patterns in transactions that traditional methods often miss. For example, AI can identify ‘structured’ transactions, where large amounts of money are split into smaller sums to avoid detection.

AI also ‘models’ expected customer behavior, flagging deviations that could indicate fraud. And in addition to real-time monitoring, AI can enhance customer due diligence (CDD) and Know Your Customer (KYC) processes through automated identity verification and continuous transaction monitoring of customer transactions.

AI-powered digital tools also can improve the efficiency of suspicious activity reporting (SAR), reduce false positives in sanctions screening, and generate valuable insights through data visualization.

Future of CFT regulations in India

The future of CFT regulations in India looks set for significant advancements. AML regulations will likely expand to cover a wider range of entities, including service providers to companies and trusts.

Plus integration of AI, machine learning, and blockchain technology will enhance security and transparency. Cybersecurity and cross-border collaboration will also play key roles in addressing online financial crimes.

As India strengthens its CFT efforts, HyperVerge’s AI-powered identity verification solutions are crucial for the security and brokerage sector.

The platform’s solutions such as video KYC and deepfake detection, ensure smooth and compliant onboarding and protect against financial crimes. Plus, with real-time monitoring and AML features, HyperVerge helps institutions meet regulatory requirements seamlessly.

To explore how HyperVerge is safeguarding the financial ecosystem, visit HyperVerge’s Security & Brokerage page.

FAQs

1. What are CFT regulations under KYC/AML regulations?

In easier terms, CFT regulations (part of AML and KYC regulations) aim to prevent funds from reaching terrorist organizations. They involve monitoring and restricting financial transactions linked to terrorism.

2. How does India enforce CFT regulations?

India enforces CFT regulations through several key bodies— The Reserve Bank of India (RBI), the Enforcement Directorate (investigates money laundering offenses), the Financial Intelligence Unit (FIU), SEBI, and IRDAI.

3. What is the difference between AML and CFT?

AML focuses on detecting and preventing money laundering activities, while CFT specifically targets financial support for terrorism.

4. What is FATF, and why is it important?

The Financial Action Task Force (FATF) is an international body that sets standards for AML and CFT regulations. FATF’s guidelines ensure global financial systems are protected from criminal activities like money laundering and terrorism financing.