Fraud is getting sneakier by the day, especially with criminals using AI to outsmart businesses. In fact, it is predicted that fraud losses in the U.S. could explode to a jaw-dropping $40 billion by 2027, up from $12.3 billion just a few years ago. Scary, right?

That’s why companies need to up their game with advanced identity verification systems to stay ahead of the curve. Enter Bureau ID–one of the big players in this space. With features like Optical Character Recognition (OCR) and passive liveness detection, it helps businesses stay secure. One standout feature is its money mule score, designed to spot and stop money-mulling activities before they hurt business.

But, is Bureau ID the best fit for your business? Let’s dive into the top Bureau ID competitors and alternatives to help you find the perfect match for your needs.

Why consider alternatives to Bureau ID?

Now, Bureau ID is solid–no doubt about it. But it might not be the one-size-fits-all solution. Here are a few reasons why you might want to explore other options:

- Do you really need all the fancy features? Some industries don’t need complex tools like money mule scoring.

- Budget constraints? Bureau ID’s pricing might not fit every budget, especially if you’re expecting a high return on investment.

- Is speed crucial? If you’re in a fast-moving industry and need quicker verification, Bureau ID’s pace might not cut it.

- Integration headaches? If it doesn’t blend well with your existing systems, your workflows could suffer. Now, who wants that?

Read more:

So, is it time to explore Bureau ID competitors? We’ve got you covered.

Don’t leave your business vulnerable.

Explore HyperVerge’s AI-powered identity verification solutions that adapt to your needs. Schedule a DemoHow we evaluate the top alternatives

Wondering how we found the top Bureau ID competitors and alternatives? It wasn’t just a quick Google search. We dug into user reviews on trusted platforms like G2, Capterra, and even Reddit (yes, Reddit!). These reviews come straight from people using these platforms daily, so you get real-world insights.

To get deeper insights, read out blog titled –’Top 5 Identity Verification Solutions and How to Choose One (2024)’

With that said, let’s take a quick glance at the top 10 Bureau ID alternatives.

Overview of the top 10 Bureau ID alternatives

| Top alternatives | Free trial availability | Standout features |

| A 30-day free trial is available | Deepfake & passive liveness detection | |

| Free trial available | Self-healing systems | |

| N/A | 360-degree assessment of counterparty risk through KScam | |

| N/A | 240+ APIs | |

| N/A | Multilingual support | |

| N/A | Aadhaar-based KYC | |

| Free trial available | 3D liveness detection technology | |

| N/A | Instant digital & e-signing | |

| N/A | Location coordinate extraction of identified entities for easy redaction | |

| Free trial available | GSTIN &UPI ID verification |

A detailed list of the 10 best Bureau ID alternatives for automated loan journeys

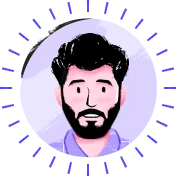

1. HyperVerge

- Basic info

HyperVerge is a top AI-powered platform that specializes in digital identity verification and fraud prevention. Trusted by major brands like Jio, Razorpay, ICICI, and Swiggy, it delivers secure and efficient user onboarding. With a global reach across 195+ countries and over 750 million verifications, HyperVerge ensures precise and compliant KYC solutions.

Businesses benefit from remarkable outcomes, including

- Over $3 million in savings

- A 98.5% accuracy rate,

- A 95% auto-approval rate, and

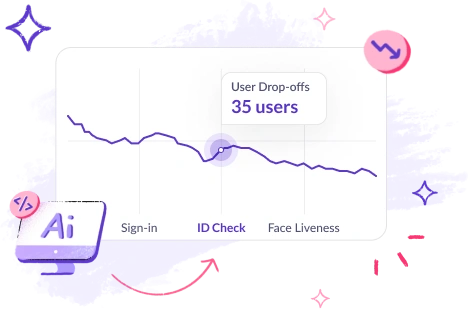

- A 50% reduction in customer drop-offs

One of HyperVerge’s standout capabilities is passive liveness detection, which employs advanced tech to verify that users are real and present, combatting spoofing attempts.

- Best for

HyperVerge is a great fit for industries like finance, e-commerce, gaming, and crypto. It uses AI-powered OCR, advanced KYC and passive liveness detection to confirm users without them needing to do anything extra. Deep fake detection stops advanced fraud, while the no-code workflow builder makes creating custom onboarding processes easy.

- HyperVerge pricing

HyperVerge offers three pricing plans:

- Start Plan: Ideal for startups, includes a free one-month trial.

- Grow Plan: Designed for mid-sized companies, with extra features and custom workflows.

- Enterprise Plan: Tailored for large organizations, featuring personalized pricing and support.

- What do HyperVerge users say?

G2 reviews–

Capterra reviews–

HyperVerge scores an overall rating of 4.5 out 5 stars on Capterra.

2. IDfy

- Basic info

IDfy is an advanced identity verification platform offering secure, AI/ML-driven solutions for KYC, KYB, and digital onboarding. Since 2011, it has processed over 70 million verifications for 600+ clients, including major names like HDFC, Axis Bank, Paytm, and Zomato. Known for its self-healing systems and real-time responses, IDfy ensures banking-grade security with features like encryption, audit trails, and compliance management.

In 2024, IDfy raised $27 million from investors like Elev8 and KB Investment to further strengthen its offerings.

- Best for

IDfy is a great fit for businesses that need to scale smoothly without worrying about downtime, especially in sectors like banking, e-commerce, telecom, and gaming. It offers near-instant responses for a better customer experience, with AI-driven APIs that handle tasks in seconds. With strong encryption and ID vaulting, your data stays secure. Plus, easy-to-read metrics help you quickly adjust customer journeys and improve results in real time.

- IDfy pricing

IDfy provides tailored pricing options designed to fit your specific business needs, so you only pay for the services that matter to you. Want more details? Click here to learn more.

3. Perfios Karza

- Basic info

Karza Technologies, a leading data and analytics provider, offers end-to-end solutions for fraud prevention, risk management, compliance, and automation. Catering to industries like banking, insurance, retail, and law, Karza’s AI and ML-powered solutions assist with onboarding, due diligence, and collections.

Acquired by Perfios Software Solutions in 2022, Karza has earned its reputation as India’s No.1 microservices company, with major clients like Google Pay, ICICI Bank, and Bajaj Finance.

- Best for

Karza is a great choice for businesses like banks, insurance companies, and eCommerce platforms that need reliable fraud prevention and compliance solutions. With tools like TotalKYC, Video KYC, KScan, KLookup, KBanking, KScan, KGST, KITR, and more, Karza helps automate manual tasks such as onboarding and data checks.

- Karza pricing

Karza offers a flexible pricing model if you’re interested in learning more, you can write to connect@karza.in for details.

4. Signzy

- Basic info

Signzy is a digital banking infrastructure provider that specializes in seamless, no-code onboarding solutions for financial institutions. Their award-winning GO platform integrates over 240 bespoke APIs, enabling businesses to quickly and accurately onboard customers through automated processes.

With a robust AI/ML-powered engine, Signzy has served over 99 million customers globally, including major financial institutions like ICICI and SBI, delivering 90% faster turnaround times and significantly reducing onboarding costs.

- Best for

With advanced features like real-time document verification, video KYC, fraud detection tools, and AML checks, Signzy is ideal for industries in banking, gaming, lending, and compliance sectors, helping them stay compliant with regulations like RBI’s KYC norms while ensuring a secure and user-friendly experience. Plus, their offerings suit large institutions that are aiming to lower customer drop-offs and mitigate fraud through solutions like video KYC and AML checks.

- Signzy pricing

Signzy’s pricing is customized per your unique requirements and business needs. To know more details, you can write to connect@teamsignzy.com.

5. Jukshio

- Basic info

Jukshio is an AI-based identity verification system that harnesses computer vision and cloud technology. The platform excels in facial recognition, fraud detection, optical character recognition (OCR), multi-factor authentication, and document classification. With an impressive capability to verify over 650 million identities and detect more than 3 million fraud cases, Jukshio operates across various sectors, including human resources, retail, e-commerce, telecommunications, travel, hospitality, and finance.

Notably, it enables KYC verification for 52% of eligible Indians, supports over 150 languages, and can complete identity checks in less than a second!

- Best for

Jukshio is perfect for businesses that want a complete KYC++ solution that prioritizes security while still providing a great customer experience. They block 9,000 spoof attempts daily and use their AI-driven Dfraud technology for quick and accurate fraud detection. With SafeCrypt-Enterprise Access, you can integrate facial recognition for added privacy protection. Plus, Jukshio helps you check for any negative press or brand risks.

- Jukshio pricing

Jukshio’s Starter Plan is $15 per user monthly or $180 yearly, with integrations, backups, file sharing, and security included. The Pro Plan costs $35 per user monthly or $420 yearly, offering all Starter features. Jukshio’s Enterprise Plan is $80 per user monthly or $960 yearly, with the same benefits as Starter and Pro.

6. Digitap

- Basic info

Digitap’s AI and machine learning solutions focus on efficient and compliant customer onboarding and automated risk management, boasting impressive success rates with its proprietary algorithms.

As a certified Technology Service Provider (TSP), Digitap utilizes the Account Aggregator framework to securely gather customer financial data through APIs. Its onboarding suite features Aadhaar-based KYC, paperless verification, and RBI-compliant video KYC, ensuring a smooth customer experience. Additionally, Digitap’s expense management tools help clients track income and spending in real-time, providing valuable insights into customer behavior.

- Best for

Digitap is great for businesses that are looking for an all-in-one risk management solution. Their automated system evaluates various channels like SMS, social media, and cash flow to provide a complete picture of risk. Digitap systems can also quickly verify government documents with impressive accuracy. Plus, their easy-to-integrate API solutions and scalable options make it simple to grow the customer base without any hassle.

- Digitap pricing

To know in detail about Digitap’s pricing, you can write to info@digitap.ai or sales@digitap.ai

7. Idenfy

- Basic info

iDenfy is an identity verification platform that helps businesses manage onboarding and combat fraud. By supporting compliance with important regulations like KYC, KYB, and AML, iDenfy ensures that organizations can meet legal requirements while safeguarding their operations. Operating in over 200 countries, the platform can quickly extract data from over 3,500 government-issued documents in just 0.02 seconds!

iDenfy combines advanced AI technology with human oversight to enable accurate identity checks and reduce the risk of fraud. Plus, its innovative 3D liveness detection technology helps identify fraudulent activities during verification. Businesses can also benefit from cost savings, as iDenfy allows them to pay only for successful verifications, cutting onboarding costs by up to 70%.

- Best for

iDenfy could be an excellent choice for fintech companies and cryptocurrency exchanges that require robust identity checks to prevent fraud. It’s also a great fit for online gambling and gaming platforms where the risk of fraud is higher.

- Idenfy pricing

iDenfy customizes its pricing based on a detailed assessment of your business requirements.

8. Digio

- Basic info

Established in April 2016, Digio offers services like legal digital signing (DigiSign), user identity verification (DigiKYC), and digital document management (DigiDocs). The platform also offers services like Aadhaar-based eSign through its DigiSign product, along with robust KYC solutions via DigiKYC, and is backed by major players like Groww and Nithin Kamath of Zerodha.

Digio has gained recognition as the leading eSign platform in India and is honored as one of the world’s 100 most innovative RegTech companies.

- Best for

Digio is an ideal solution for businesses in lending, insurance, and banking, looking to enhance their digital operations. It benefits financial institutions aiming to speed up customer onboarding by reducing the usual 5-7 day process to mere minutes while cutting service delivery costs by 60%. Companies in the fintech space can automate recurring payments with DigiCollect, ensuring smooth transaction management.

- Digio pricing

Digio’s pricing varies depending on your unique needs and requirements.

9. newgensoft

- Basic info

NewgenONE by newgensoft is an innovative low-code platform that transforms how organizations automate their operations. Designed for end-to-end automation, it connects various aspects of a business, including processes, content, communication, and AI, all within a single technology framework.

NewgenONE prioritizes information security with strong authentication and authorization across data, applications, and processes. The platform uses two-factor and multi-factor authentication to prevent unauthorized access. It also offers object-level access controls, ensuring that only the right people can view sensitive information.

What’s more, NewgenONE provides audit and reporting features to help track activities and maintain compliance.

- Best for

For those businesses that are looking for complete automation through tech, AI, and more in different departments of their business, all while ensuring proper compliance and verifications, newgensoft is a good choice.

- newgensoft pricing

newgensoft’s pricing for one year starts from $200,000. To know more, you can visit their official website.

10. Cashfree

- Basic info

Cashfree Payments is a platform designed for specific payment requirements of businesses, whether for collecting payments or facilitating quick payouts. Through its versatile platform, it enables businesses to collect online payments via websites or apps while ensuring efficiency with features like payment links, auto-collect, and easy splits.

One of the standout aspects of Cashfree Payments is its robust verification suite, allowing businesses to automate critical checks such as bank account, PAN, Aadhaar, and GSTIN verifications. This feature not only enhances customer onboarding but also ensures accurate beneficiary details before executing transactions, which is crucial for sectors like finance and insurance.

- Best for

Cashfree Payments is ideal for businesses that need a reliable solution for both collecting payments and verification. It is ideal for industries such as fintech, lending, banking, and more that require a large range of verification APIs to avoid fraud and onboard customers more efficiently.

- Cashfree pricing

CashFree Payments offers custom pricing for enterprises. You can fill out this form to get in touch with their sales team.

How to choose the best Bureau ID alternative for your business

Choosing the right identity verification platform can feel like a big decision, right? It’s not just about ticking off a list of features or comparing price tags. The real question is: does this solution actually fit your business and can it grow with you? Whether you’re scaling fast or navigating the complexities of compliance, the choice has to make sense for your unique needs.

If you’re on the lookout for top Bureau ID competitors and alternatives, here’s a breakdown of the key things to consider:

- Functionality and features

Before anything else, let’s talk about what the platform can actually do for you. How fast and accurate are its verifications? How well does it integrate with your existing systems? Does it have the AI smartness to keep up with your needs? These aren’t just fancy add-ons; they’re the backbone of the platform’s performance.

For instance, think about AI-powered solutions. Platforms like HyperVerge take things up a notch with AI-driven identity verification across industries like banking, telecom, and insurance. They handle high transaction volumes without breaking a sweat. Impressive, right?

- Look for an end-to-end solution

Ever felt the frustration of jumping between different tools just to get one task done? If yes, you’d understand why an end-to-end solution is a game-changer. Imagine handling everything–from document capture to final approval–all within one platform. Why add complexity when you can simplify the whole process for both your team and your customers?

Investing in an end-to-end system means fewer headaches, fewer delays, and more time spent focusing on what matters: growing your business.

- Ease of use and onboarding

Here’s a question to ask yourself: How easy is the platform to navigate? If it feels like you’re trying to learn rocket science, chances are your team won’t adopt it fully. And a complicated interface can lead to delays, errors, and frustration. No one wants that.

Look for a solution that prioritizes user-friendliness. HyperVerge, for example, is known for its simple, intuitive interface, plus it offers hands-on support and onboarding resources. Your team can hit the ground running without a ton of training. Win-Win.

- Scalability and flexibility

Here’s something that’s often overlooked: Is the platform built to grow with your business? What happens when your identity verification needs multiply–can the system handle it? For example, maybe you’re verifying a few hundred customers today, but what about when that number shoots up to thousands? If the platform isn’t scalable, you’re in for some serious downtime, bottlenecks, or worse–security issues.

Also, consider those seasonal spikes in customer activity. Think travel companies during the holidays or e-commerce stores during sales. A flexible system that can scale up (or down) based on demand is crucial. You don’t want your operations overwhelmed just when business is booming.

- Integration and compatibility

Chances are, you’re already using some sort of CRM or accounting software, right? Maybe even credit bureau databases. If the identity verification solution doesn’t integrate seamlessly with these tools, you’re asking for trouble.

Imagine an e-commerce company is unable to sync its verification data with the CRM. What happens? Incomplete customer records, slow response times, and–yep, you guessed it, high drop-off rates.

Not exactly the customer experience anyone is aiming for.

- Security and compliance

In a world where data breaches seem to be everywhere, you need to ensure that the Bureau ID competitor you choose not only protects sensitive customer information but also complies with all relevant regulations. Nobody wants to deal with fines or damaged reputations.

HyperVerge stands out here with its commitment to security and compliance. The platform has achieved ISO 30107-1/30107-3 Level 2 compliance for passive liveness detection, making it one of the few identity verification providers with this certification. Additionally, HyperVerge has completed the RIVTD Track 2 (Selfie-ID document match) assessment conducted by the US Department of Homeland Security, further showcasing its security credentials.

- Customer support and reputation

Last but definitely not least–how’s the customer support? Imagine your system crashes during peak hours. Do you have a reliable team to call? A lack of support can turn a small problem into a major crisis, costing you customers and revenue.

It’s not just about fixing issues when they arise–it’s about preventing them in the first place. So do your homework: read customer reviews, check industry ratings, and ensure you’re choosing a platform that’s known for stellar support.

Improve your identity verification journeys with AI

Are you looking for a way to make identity verification smoother and more secure?

HyperVerge One is here to help!

This innovative platform uses advanced AI tools to simplify the entire process. Imagine designing your onboarding experience without any coding headaches–all thanks to its intuitive no-code workflow builder and customizable user interface.

With HyperVerge, you can verify real users quickly and securely, thanks to features like single-image liveness detection and AI-powered forgery checks.

Plus, the face de-duplication and biometric feature ensures that no one sneaks in with multiple accounts, while deep image analysis catches even the sneakiest fraud attempts.

Ready to take the stress out of identity verification? Explore what HyperVerge can do for you today!

FAQs

1. What is Bureau ID?

BureauID is a fraud prevention and identity verification platform founded in 2020, headquartered in San Francisco, with global offices. It helps businesses manage compliance and detect fraud by analyzing data signals, having verified over 300 million identities. Key features include advanced link analysis, AI-driven liveness checks, and OCR technology.

2. What are the best alternatives in India to Bureau ID?

HyperVerge stands out as a top Bureau ID competitor in India, offering AI-driven identity verification with unmatched speed, accuracy, and flexibility, designed to meet your diverse business needs.

3. Why do you need an AI-powered identity verification solution?

AI-powered identity verification can help reduce manual onboarding by quickly verifying identities, reducing manual errors, and identifying fraud in real-time.