Banks, financial services, and insurance providers (BFSIs) experience a colossal number of transactions. According to a Capital One Shopping report, the US alone recorded 54.8 billion credit card transactions in 2022.

To manage these volumes, BFSIs need reliable transaction monitoring to ensure operational accuracy. Although monitoring, analyzing, and scrutinizing each transaction manually is impractical, transaction monitoring systems can perform these tasks automatically.

This guide presents a list of the 10 best transaction monitoring tools. Let’s begin by understanding what transaction monitoring software is.

What is transaction monitoring software?

A transaction monitoring system is a digital tool that monitors all transactions within your institution. These transactions are closely analyzed to detect suspicious activities and potential financial crimes.

Using a transaction monitoring solution helps prevent fraudulent individuals from misusing your financial services for money (transaction) laundering and terrorist financing. Screening transactions through software also ensures compliance with anti-money laundering regulations, a legal requirement in most countries.

We analyzed some of the best transaction monitoring systems on the market and curated a list of 10 excellent transaction monitoring tools. Let’s see how we evaluated each software.

How we analyzed and selected the top transaction monitoring software

At HyperVerge, we assessed over 30 transaction monitoring systems based on their features and functionalities. We also reviewed user feedback, ratings, and experiences on platforms like G2 and Capterra.

Our team evaluated each software for its usability, capabilities, and, most importantly, efficiency in the transaction monitoring process. This thorough analysis allowed us to craft a list of the top 10 transaction monitoring tools.

Overview of the 10 best transaction monitoring software for 2026

| Software | G2 Ratings & Reviews | Best For |

HyperVerge | 4.7 Stars (57 Reviews) | Small businessesMid-sized companiesEnterprises |

ComplyAdvantage | 4.4 Stars (14 Reviews) | Mid-sized companiesEnterprises |

SAS | 4.3 Stars (6 Reviews) | – |

Oracle | 4 Stars (124 Reviews) | Mid-sized companiesEnterprises |

SEON | 4.6 Stars (295 Reviews) | – |

Effectiv | 4.5 Stars (2 Reviews) | – |

Ondato | 4.7 Stars (53 Reviews) | Mid-sized companiesEnterprises |

Sumsub | 4.5 Stars (83 Reviews) | Mid-sized companiesEnterprises |

Pirani | 4.6 Stars (107 Reviews) | – |

iDenfy | 4.9 Stars (83 Reviews) | – |

| Get started with automatic transaction monitoring HyperVerge offers a comprehensive transaction management software solution to help you track all transactions automatically. Our transaction monitoring tool enables you to monitor, scrutinize, and assess each financial transaction. Book a free demo |

The above list provides a brief overview of some of the top AML transaction monitoring systems. In the next section, we will discuss each option in detail.

A detailed explanation of the 10 best transaction monitoring software

Selecting the right transaction monitoring tool involves evaluating the capabilities, features, pros, and cons of each software. We have compiled all this information to assist you in making an informed decision.

- HyperVerge

About HyperVerge

HyperVerge is an AI-powered customer onboarding platform that helps ensure smooth, safe, and moderated customer onboarding. Trusted by over 200 brands globally, including HomeCredit and HSBC, HyperVerge helps businesses comply with legal regulations while maintaining operational efficiency.

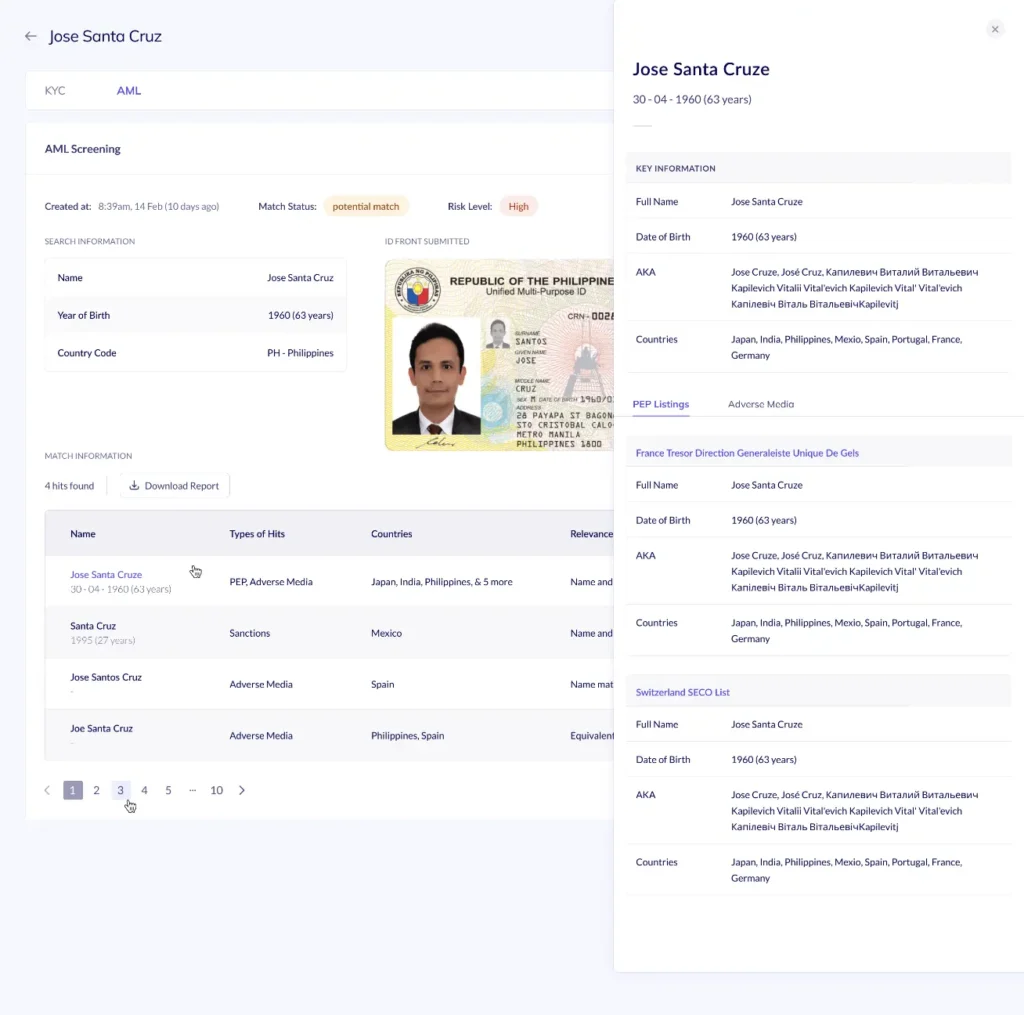

Built with a 95% accurate AI model, this AML software solution monitors real-time transactions, ensuring strict compliance with AML regulations. HyperVerge’s AML solution has advanced machine-learning capabilities that efficiently detect suspicious patterns and help measure financial crime risk in your business.

With 100+ global sanctions and watchlist checks, nearly 100% PEP checks, and thorough adverse media screening, HyperVerge is a reliable tool to identify and mitigate threats. This tool helps fulfill compliance requirements in 195+ countries- enabling seamless business expansion.

Tailored for financial institutions and entities, the HyperVerge AML system offers continuous screening to reduce false positives and ensure safe and compliant transactions.

HyperVerge pricing

HyperVerge offers three pricing plans for startups, midsize, and enterprise-level organizations. Based on your organization’s size and requirements, you can get a custom quotation and choose a transaction monitoring system.

| Start For start-up companies | Grow For mid-size companies | Enterprise For enterprise-level organizations |

| Free Trial | Custom Quotation | Custom Quotation |

Key features of HyperVerge’s transaction monitoring system

- Automatic transaction monitoring: Continuously monitor all financial transactions and detect suspicious activity.

- Custom filtering: Reduce false positives and negatives through smart filtering options based on country and DOB.

- Relevant name: Omit non-relevant transaction profiles for accurate AML screening.

- Automatic alerts: Generate alerts based on financial crime risks and risk prioritization.

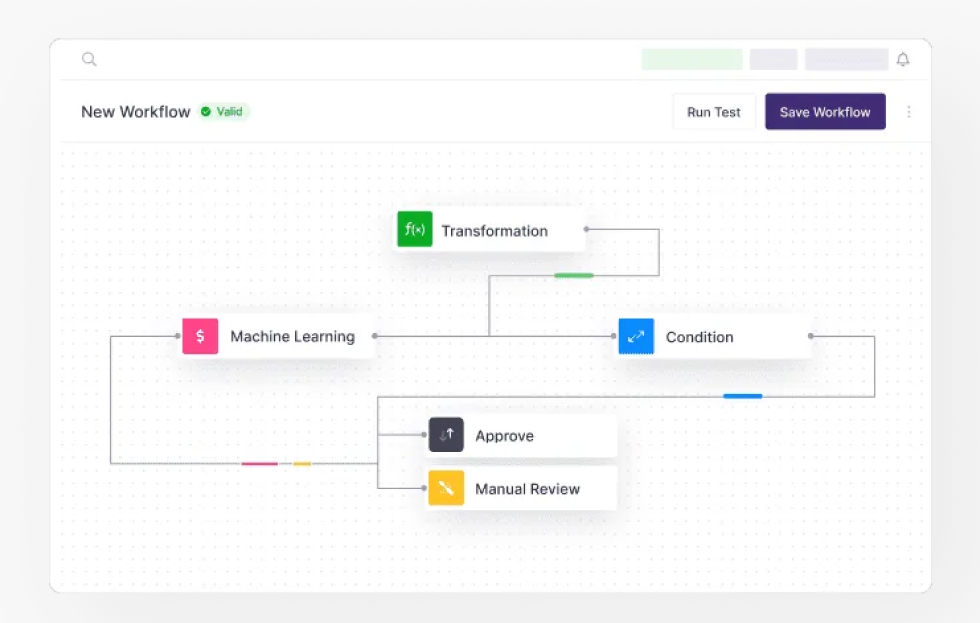

- Workflow builder: Build low-code workflows to manage steps in transaction monitoring and compliance actions.

Case study

Pros of using HyperVerge

- HyperVerge’s AML solution offers easy integration with external systems through SDKs, APIs, and webhooks to ensure seamless implementation in your financial institution’s systems.

- Customizable workflows help take transaction monitoring to the next level. They help create custom rules to dictate steps for fraud management.

- HyperVerge offers prompt implementation and onboarding support to help you efficiently implement transaction monitoring software in your business.

- HyperVerge’s AI works with 95% accuracy to ensure no suspicious transaction goes unmonitored.

Cons of using HyperVerge

- Some users report that HyperVerge could be priced more competitively to suit all business scales.

- The SDK customization options cover basic requirements. Further customizing the SDK requires putting in extra effort.

Key highlights of HyperVerge

| 10+Industry vertical compliance | 50%Cost saving on pricing options | 4-hourIntegration with low-code workflows | 24/7Real-time sanction screening |

| Get the smart transaction monitoring software HyperVerge’s AML software solution helps ensure end-to-end legal compliance by automatically tracking, evaluating, and analyzing transactions. We make transaction monitoring effortless for financial institutions. Book a free demo! |

- ComplyAdvantage

About ComplyAdvantage

If you want to combine transaction monitoring with AML compliance, ComplyAdvantage is a software to watch. ComplyAdvantage offers AI-driven fraud detection and risk management solutions to improve compliance efficiency.

ComplyAdvantage helps detect suspicious transactions from certain countries, currencies, or spending patterns. Its artificial intelligence identifies and stops financial crime risks before they become major business hazards.

ComplyAdvantage pricing

ComplyAdvantage offers two pricing models: a starter plan and a premium plan. The starter plan costs $99, excluding local taxes. The premium model comes with a custom quotation based on tailored requirements.

Key features

- Custom risk rules: Choose from a pre-defined rule library and tailor your transaction monitoring software to your unique scenarios.

- Test rules: Pre-test transaction monitoring rules in a sandbox environment for accuracy.

- Risk insights: Use risk score and exposure insights to plan mitigation and enhance AML compliance.

- Smart alerts: Set up smart alerts for risk exposure and prioritize risks based on threat.

Pros of using ComplyAdvantage

- ComplyAdvantage offers a dedicated account manager to handle client requirements. Users vouch for ComplyAdvantage’s prompt responses and support availability.

- The platform is easy to use and easily customized to fit your unique needs.

- The back-end algorithms are strong and can reduce false positives while monitoring transactions.

Cons of using ComplyAdvantage

- Some users report data errors in ComplyAdvantage’s screening, such as duplicate user profiles for the same individual, increasing manual work.

- SAS

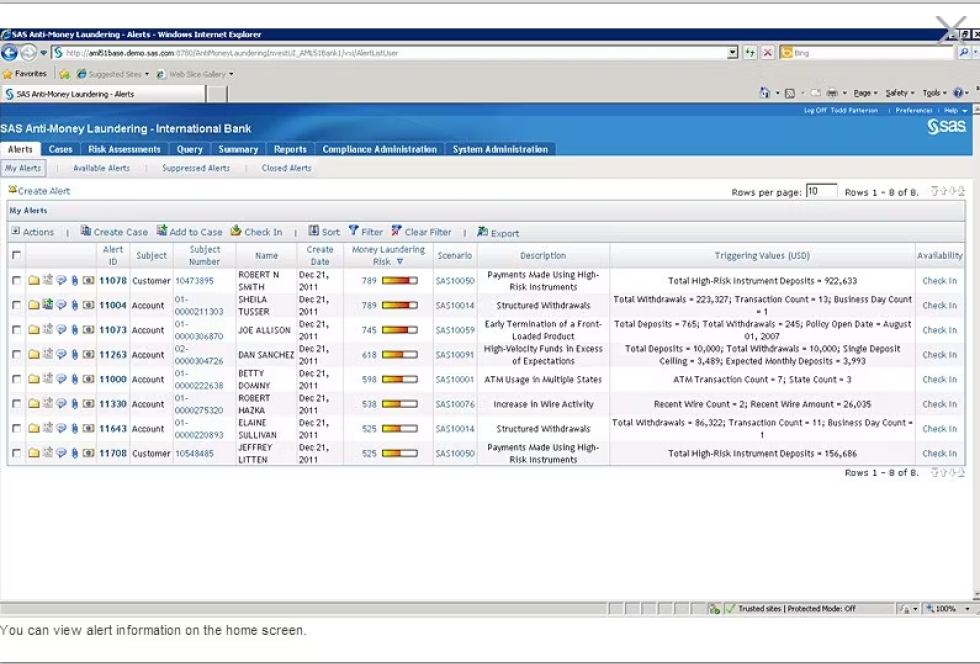

About SAS

SAS offers a robust anti-money laundering system to help fight money laundering, terrorist financing, and other financial crimes. This transaction monitoring tool is 90% accurate and has been proven to reduce false positives in transaction screening by up to 80%.

SAS provides a comprehensive transaction monitoring mechanism built using artificial intelligence, machine learning, and deep learning. This mechanism allows you to screen and assess transactions and identify business risks and hidden relations for a comprehensive risk overview.

SAS pricing

SAS offers custom quotations based on client requirements. You can consult the SAS team for a quote tailored to your transaction monitoring software requirements and scope.

Key features

- Suspicious activity monitoring: Combine industry-specific default rules with ML for anomaly detection.

- Alert management: Manage risks through holistic alerts. Auto-prioritize important alerts through AI.

- Data orchestration: Make transaction data analytic-ready through centralized data enrichment and transformation.

- Entity-centric investigations: Enable risk and compliance teams to get a holistic view of the entity’s network for a thorough investigation and detailed risk analysis.

Pros of using SAS

- SAS offers advanced analytics functionalities to help understand financial risks and plan risk mitigation strategies effectively.

- The software offers comprehensive functionalities for AML compliance, transaction monitoring, customer due diligence, and onboarding.

- SAS offers various customization options to tune the solution to your unique requirements.

Cons of using SAS

- Some users report that due to a high customer line-up, receiving customer support from SAS’s support team can be time-consuming.

- SAS AML has a high false positive rate for some customers. Rectifying these false positives requires additional manual effort and can hamper decision-making.

- Oracle

About Oracle

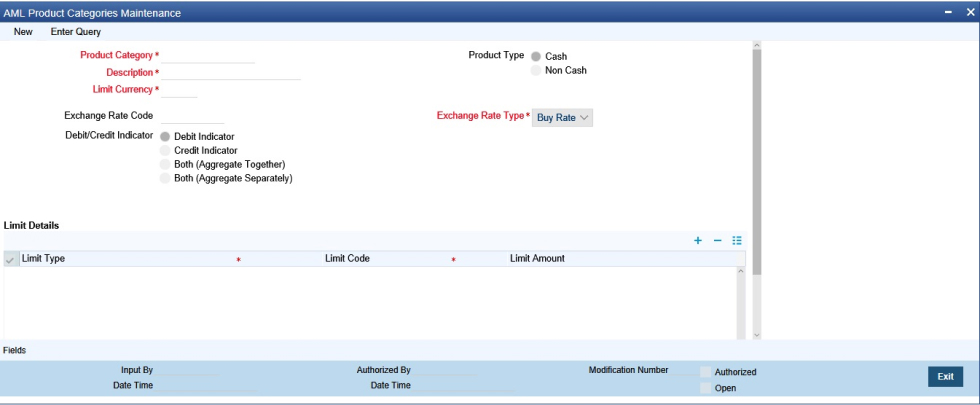

The trends and patterns in financial crime activities are always changing. Oracle offers a comprehensive solution that helps financial institutions keep up with the changing patterns and automate efficient transaction monitoring practices.

Oracle’s transaction monitoring software automates the consistent screening and scrutinization of all accounts, customers, correspondents, and third parties making transactions. Leverage Oracle’s robust mechanisms to maximize data usage for transaction monitoring and compliance management.

Oracle pricing

Oracle offers custom pricing options for its transaction monitoring tools. Contact their support team to get a quote based on your requirements.

Key features

- Event scoring: Reduce false positives through ML implementation and prioritize alerts.

- Transaction filtering: Monitor sanctions in real time and get information on detection, analysis, and resolution capabilities.

- Compliance agent: Use an AI-powered money launderer to test your transaction monitoring system’s efficiency and precision.

Pros of using Oracle

- Oracle excels in precisely monitoring and filtering out suspicious transactions.

- Oracle offers a complete suite that encompasses AML compliance, audit, and sanction screening for complete fraud prevention.

- The AML module offers a comprehensive scenario library. Financial institutions get to choose scenarios specific to their industry.

Cons of using Oracle

- Some users report that Oracle’s transaction monitoring software is expensive, making implementation feasible only for enterprise-level companies.

- There are cases where the ML technology in Oracle’s system fails to recognize data, increasing the chances of false positives and negatives.

- SEON

About SEON

SEON is a one-stop platform for avoiding unauthorized fund transfers, identifying suspicious transactions, and blocking fraudulent orders. This transaction monitoring solution helps control transactions while maintaining business efficiency.

Equipped with machine learning capabilities, SEON screens all transactions against easy-to-create rules. The rules can be tested in a sandbox environment for precision. SEON also offers comprehensive anti-money laundering software features to help maintain complete legal compliance.

SEON pricing

SEON offers three pricing models: the free version, the starter version, and the professional version. The starter version is priced at $599/month, while the professional version comes with a customized quotation.

Key features

- Custom rules: Create custom rules and test them in a sandbox environment. Set rule triggers based on risks.

- AML screening: Implement continuous fraud detection mechanisms for end-to-end compliance with AML regulations.

- Watchlist monitoring: Block high-risk customers from transferring funds through automatic watchlist monitoring.

Pros of using SEON

- Users particularly praise SEON’s customer support services. The support team makes implementation and adoption a smooth process.

- The custom rule functionality helps match alerts with the business’s own verification engine and offers remarkable observability.

- SEON offers a diverse set of configuration tools to help administrators tailor the software to their needs.

Cons of using SEON

- Some users report that the analytics dashboard does not allow them to pick multiple statistics simultaneously.

- Setting up SEON can be time-intensive. Small businesses may not have the resources to invest in implementation and setup.

- Effectiv

About Effectiv

Is AML compliance your primary objective? If so, Effectiv can be a great choice. This transaction monitoring software helps stay compliant with AML regulations by continuously monitoring transactions.

Effectiv’s transaction monitoring solution operates through a diverse array of data signals, such as user identity, transactions, behavior, and more. This platform leverages historical data to monitor suspicious transactions and avoid fraud. Effectiv also facilitates end-to-end automation in transaction screening, enhancing efficiency in the process.

Effectiv pricing

Effectiv offers customized quotations based on your unique needs. Contact the Effectiv team to schedule a platform demo and get a quotation.

Key features

- Real-time rules: Instantly identify suspicious behavior by implementing current rules for transactions in real-time.

- Network graph: Get a detailed map identifying the complex relationships between the entities and discover hidden patterns.

- Allow/Deny lists: Tailor lists to approve trusted entities to make transactions (approve list) and block out known fraudsters (deny list).

- Risk workflow testing: Evaluate the effectiveness of a fraud detection rule and determine the success rate and risks through testing.

Pros of using Effectiv

- Effectiv offers customizable workflows to suit the monitoring needs of different operational processes like onboarding, anti-fraud, logic check, and more.

- The system quickly analyzes data and helps businesses offer a smooth, compliant, and safe onboarding experience to their customers.

Cons of using Effectiv

- Some users report that additional user roles and permissions could expand platform usage.

- Effectiv does not offer the functionality to partition workflow access based on the user. Moreover, a single entity cannot be linked to multiple workflows.

- Ondato

About Ondato

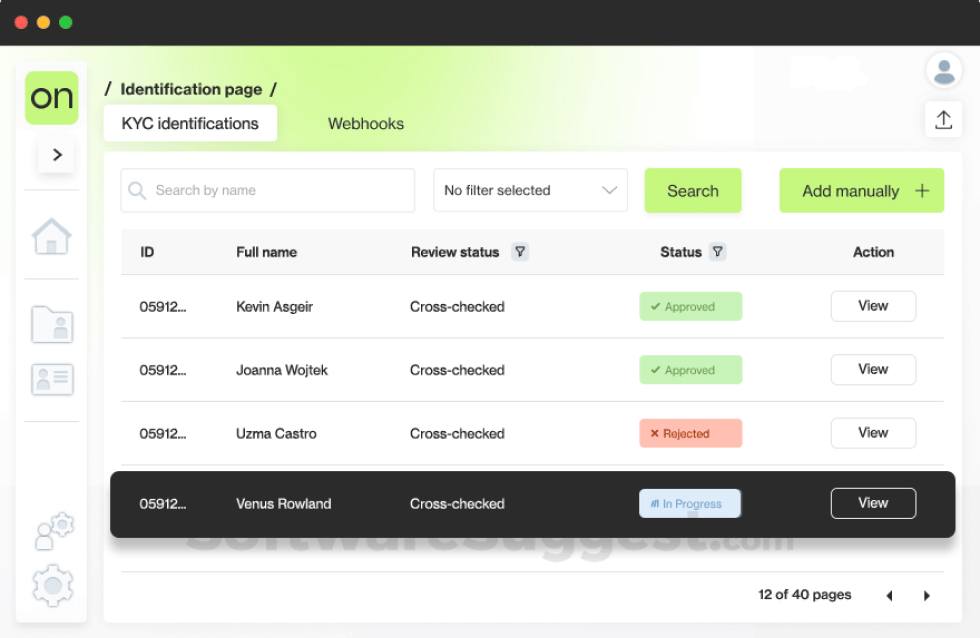

Ondato offers an end-to-end transaction monitoring software solution to track financial transactions. This KYT (Know Your Transactions) system ensures international compliance and AML adherence.

With Ondato, you can integrate KYC with transaction screening to ensure only authorized entities are availing of your services. Whether you need the complete fraud detection and prevention suite or want to block fraudsters, Ondato is an excellent choice.

Ondato pricing

Ondato offers three pricing models: growth plan, expansion plan, and enterprise plan. The pricing starts from $1 per verification plus a $280 monthly license fee. Ondato also offers custom quotations for enterprise plans.

Key features

- Real-time monitoring: Screen transactions in real time and detect fraud activities.

- Analysis and dashboard: Gain insights into transaction screening. Understand metrics like false positives and negatives to improve transaction monitoring accuracy.

- Alerts: Generate and prioritize alerts efficiently for smart risk management.

Pros of using Ondato

- Users particularly like the prompt customer support offered by the Ondato team. They are satisfied with the quick responses and helpful support options.

- The platform is easy to use and has an intuitive dashboard, making implementation quick and easy.

- Ondato offers a comprehensive suite of AML tools to help you monitor transactions and comply with AML regulations.

Cons of using Ondato

- Some users dislike Ondato’s auto-refresh functionality. They report it results in the loss of entered data.

- While useful, the risk score feature can be improved to be more flexible and adjustable to suit individual needs.

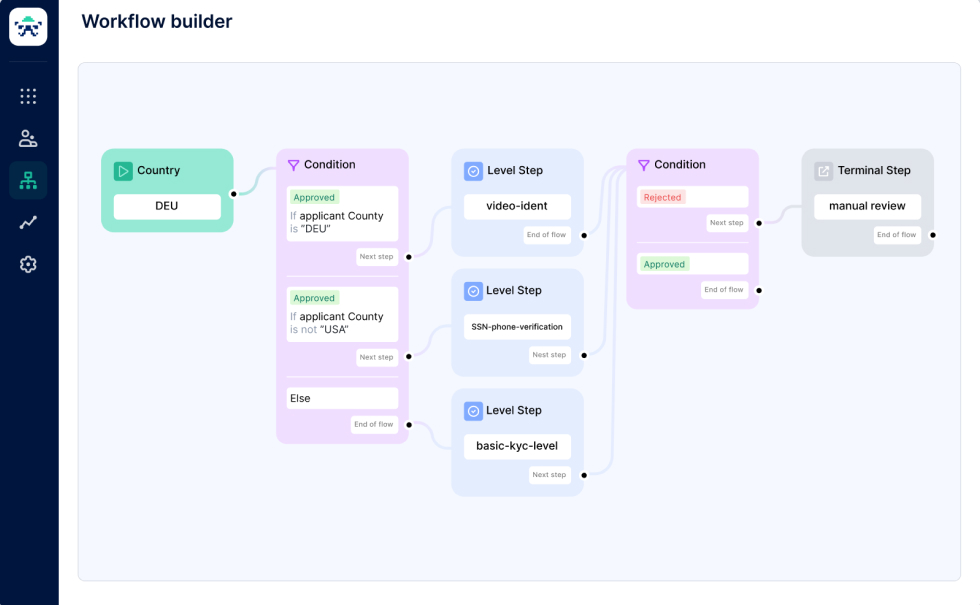

- Sumsub

About Sumsub

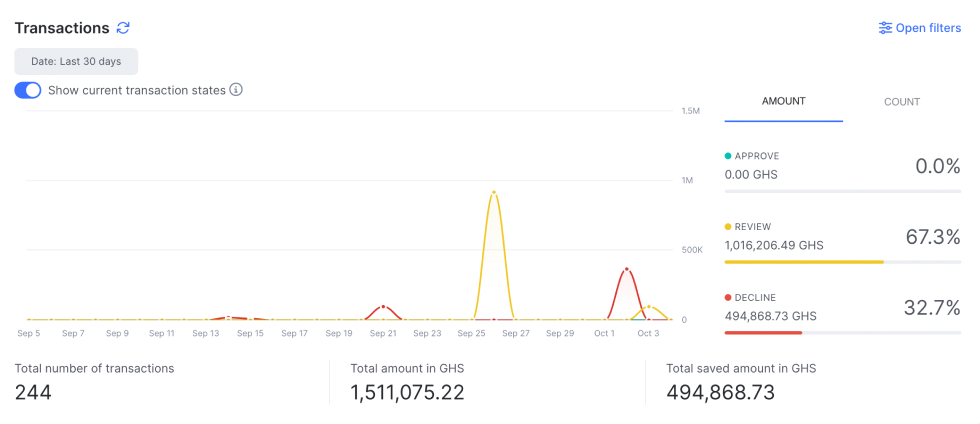

Do you want to get a complete picture of your transactions in one place and ensure flawless screening? If so, Subsub is a great transaction monitoring software for you. Sumsub helps avoid financial fraud and makes monitoring easy for FinTech, banking, gaming, and eCommerce industries.

With Sumsub, you can get up to 240% ROI on transaction monitoring. Built using artificial intelligence, this platform precisely detects suspicious patterns to ensure that no malicious transaction goes unmonitored.

Sumsub pricing

Sumsub offers three pricing plans: basic, compliance, and enterprise. The basic plan is priced at $1.35/verification with a $149 minimum monthly commitment. The compliance plan is priced at $1.85/verification with a $299 minimum monthly commitment. The enterprise plan comes with custom quotations.

Key features

- Rule system: Pick industry-specific default rules from Sumsub’s system. Use a no-code rule builder using historical data and test rules for accuracy.

- Pattern detection: Detect frauds of all types using smart pattern recognition capabilities powered with AI.

- Automated reporting: Get ready to file SAT/STR (Suspicious Activity Report/Suspicious Transaction Report) with AI-led automation.

Pros of using Sumsub

- The verification system is highly accurate and reliable, ensuring a quick verification process process.

- Sumsub’s customer support team is responsive and offers help to improve operational flows.

- The data analysis feature is highly customizable and helps businesses get tailored insights into their performance.

Cons of using Sumsub

- Some users report that configuring workflows within Sumsub is tricky and may require additional training.

- While Sumsub’s UI is user-friendly, it offers limited customizability that some businesses might require.

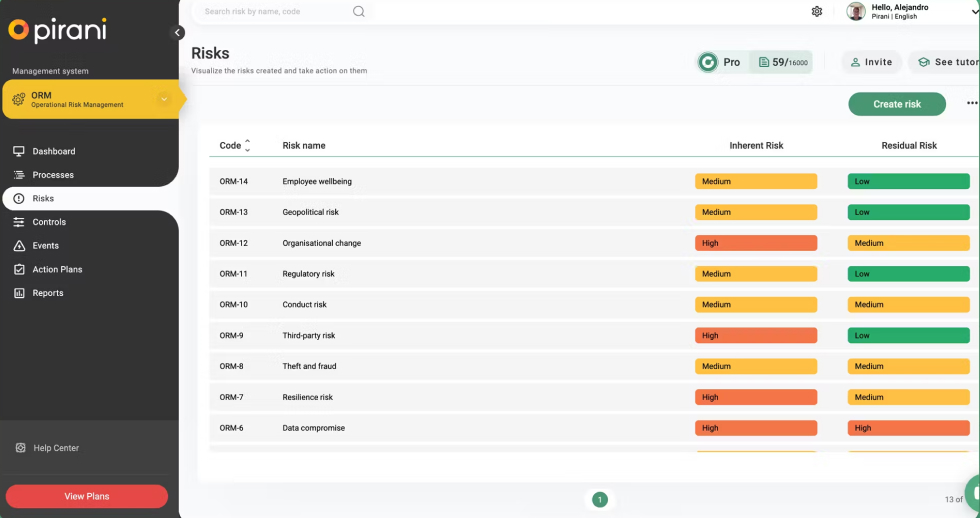

- Pirani

About Pirani

Pirani helps track financial transactions through ATMs, mobile apps, and virtual branches. This transaction monitoring software assists in managing all AML risks through end-to-end monitoring and AML checks.

With Pirani, you can easily track your client’s transactions and financial activities and detect unusual behavior. You can also set up alerts when Pirani detects financial fraud and money laundering activities, making it a one-stop solution for all transaction monitoring needs.

Pirani pricing

Pirani offers four pricing models: free version, starter plan, basic plan, and enterprise plan.

The prices start from $0 for the free version and go as high as $637 per month for the basic plan. Pirani offers custom quotations for the enterprise plan.

Key features

- Automatic case assignment: Smartly assign cases to the compliance team based on transaction type and risk monitoring.

- Advanced reporting: Generate reports based on alert type, economic activity, location, and frequency of alerts triggered.

- Alerts: Create an alert system based on profiling for more predictive transaction monitoring. Make fail-proof judgments to analyze unusual customer activity.

Pros of using Pirani

- Users particularly like Pirani’s UI as it helps them understand different stages of risk management within their organization.

- Pirani offers integration within different modules to help users get an all-in-one solution for risk monitoring and AML compliance.

- Users report that the support team offers quick and on-point solutions to their queries.

Cons of using Pirani

- Some users state that Pirani could have better pricing options based on the chosen modules and functionalities. This would help businesses align the solution’s scale with their needs.

- The alert configuration and reporting features of the tool can be improved for accuracy.

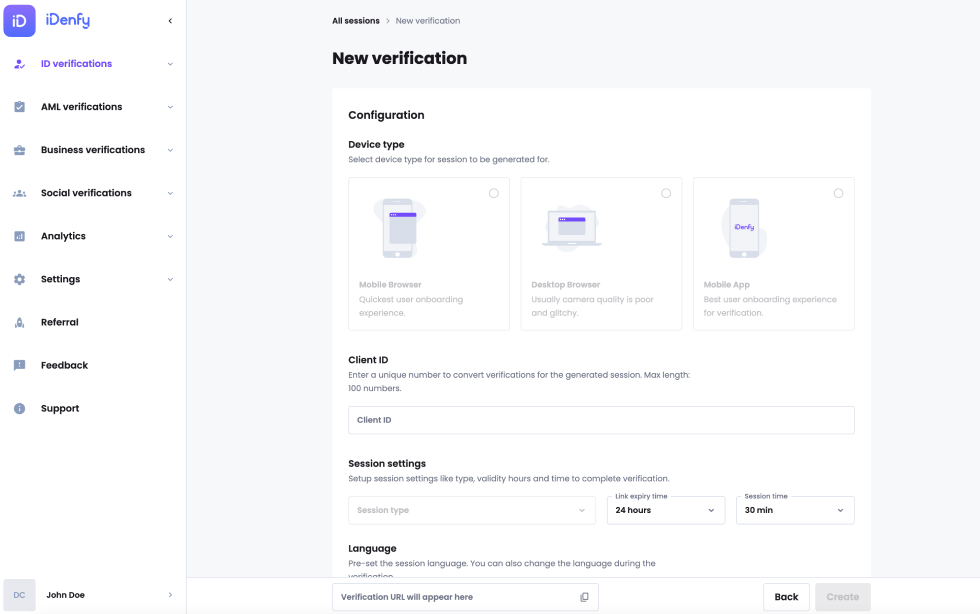

- iDenfy

About iDenfy

Screen your customers through multiple sanctions, politically exposed people, and watchlists, and ensure every transaction is monitored through iDenfy.

iDenfy offers a robust AML compliance solution to help organizations implement anti-money laundering practices. Get results in seconds through iDenfy- one of the top AML software solutions and AI-powered KYC systems.

iDenfy pricing

iDenfy offers custom quotations based on the required models and number of transactions you want to monitor. You can get a unique quote for your requirements from their team.

Key features

- Identity verification: Verify customer identities and block out known fraudsters on the global watchlist.

- Fraud scoring: Assess the risk of fraudulent activity through real-time scoring.

- AML monitoring: Implement continuous monitoring mechanisms to detect suspicious activities in real time and avoid AML violations.

- Proxy detection: Identify and block users using your financial services through proxy servers for end-to-end traceability.

Pros of using iDenfy

- An easy-to-use UI helps users seamlessly adopt iDenfy in their processes.

- iDenfy offers easy-to-connect APIs that you can integrate with your financial service platform.

- You can get customized solutions based on your activity type and company status.

Cons of using iDenfy

- Some users report a steep learning curve for iDenfy. They need time to become acquainted with the platform before using it.

- Comprehensive documentation of the platform can extend the implementation time.

These were the 10 best transaction monitoring tools available on the market. However, why should a business invest in a transaction monitoring tool? Let’s find out in the coming section.

What are the benefits of using transaction monitoring tools?

- Ensures AML compliance

Many jurisdictions, such as the USA, UK, Canada, and EU, enforce anti-money laundering laws. Financial institutions are required to make their services AML-compliant to avoid money laundering.

A transaction monitoring system helps safeguard your financial institution from possible AML violations. Monitoring every transaction assures AML compliance and helps avoid legal penalties resulting from AML violence.

- Reduces manual review efforts

Manual transaction monitoring can take hours or, in some cases, days. An analyst must evaluate each transaction against regulatory requirements to ensure nothing is left to chance.

Transaction monitoring software automates monitoring, assessing, and evaluating transactions made through your platform. These systems simultaneously assess thousands of transactions against pre-defined rules and without error, aiding efficiency and reducing the need for manual review.

- Automates fraud identification

Monitoring transactions helps prevent fraudsters from using your financial services for financial crimes. Identifying these fraudsters requires tracking patterns, understanding users, and defining the deep-rooted network of financial criminals.

A transaction screening system accomplishes this using smart algorithms, machine learning models, and artificial intelligence. Identifying high-risk activities and enhancing AML compliance becomes easy with software, as fraud identification is quick, accurate, and automated.

- Helps build customer trust

Customers prefer financial services from vendors that safeguard their platforms against fraudulent activities. If your platform is repeatedly reported for financial crimes, your brand’s market trust will likely decline.

Transaction monitoring systems help maintain a positive brand image and regain customer trust by continuously providing transaction screening data and helping improve security. Continuous transaction monitoring, watchlist-based blocking, insights from adverse media, and risk scoring enhance the safety of transaction platforms for trusted entities.

- Enables data tracking

Efficient transaction monitoring requires using historical transactional data to understand patterns, identify suspicious activities, and identify fraudsters. However, manual tracking limits data tracking and often leads to inefficient transaction monitoring.

Using software, on the other hand, makes data tracking quick, easy, and reliable. Transaction monitoring software vendors offer data-driven insights with global watchlists and PEP checks. Moreover, the software itself tracks transactional data and fine-tunes its transaction monitoring.

| You are one step away from streamlined transaction monitoringHyperVerge helps financial entities meet compliance requirements smartly through robust transaction monitoring automation solutions. We offer a complete suite of solutions for AML compliance and financial entity safety.Book a free demo! |

These were the benefits of investing in transaction monitoring tools. But, with so many options, how does a financial institution select the right tool? Keep reading to find out.

Tips on choosing the right transaction monitoring system

Each transaction monitoring system has unique features, capabilities, integration options, and ideal use cases. Here are criteria to consider while choosing a software vendor for your transaction monitoring system.

1. AI and ML integration helps not only monitor transactions automatically but also take action based on suspicious user activity. AI-based features are a must for efficient and precise transaction monitoring.

2. How much time will you spend on software implementation? This is an important factor for small businesses with limited implementation resources.

3. Optimal transaction visibility helps the transaction screening process gain insights and drive results. Reporting, analytics dashboards, and data tracking are essential to making transactional data visible and usable.

4. Risk assessment helps you understand your exposure to financial crimes and take steps to mitigate it. An integrated risk-scoring feature saves you from additional investment in risk management tools.

5. Startups and mid-scale enterprises deal with relatively fewer transactions in their initial kick-off period. Having the option to choose from a small-scale solution with selected modules and scaling later on helps growing organizations.

6. Custom rules are an important functionality of transaction monitoring systems. Having software that allows more customization options helps tailor the software to your unique transaction monitoring objectives.

These were a few aspects to look for while evaluating transaction monitoring systems. Now that you have all the information needed, you can choose a transaction monitoring software that fulfills your needs.

Looking for a reliable transaction monitoring automation system?

Selecting the right monitoring system is crucial for ensuring efficient transaction monitoring. HyperVerge offers reliable, scalable, and affordable transaction monitoring software to help you monitor transactions automatically.

Our transaction monitoring system leverages powerful AI integration to ensure AML compliance and reduce errors in transaction monitoring. We offer solutions for KYC (Know Your Customer), PEP check, adverse media categories check, and watchlist check for end-to-end monitoring.

The transaction monitoring system by HyperVerge is a part of the AML suite- an intelligent AI-driven software for automated compliance. HyperVerge AML solution offers continuous monitoring to keep your processes AML-compliant and business safe. Protect yourself from fines worth USD 8 billion through our smart AML compliance solutions.

Book a demo with our team today to learn more about our solutions.

Frequently asked questions

1. What is the need for monitoring transactions?

Monitoring your transactions based on customer behavior helps identify suspicious activities like money laundering, financial fraud, and terrorist financing. This practice helps identify and block fraudsters from your organization, thus maintaining your platform’s security.

2. Is transaction monitoring mandatory for AML compliance?

If AML laws are a legal mandate in your country, transaction monitoring is crucial for AML compliance. This is the case with the USA, the UK, Canada, and EU countries. Monitoring transactions helps ensure AML compliance by avoiding money laundering through your financial platform.

3. How does transaction monitoring software work?

Transaction monitoring systems function by automatically monitoring, analyzing, and evaluating all transactions that occur through your financial service platform. These software are often powered with artificial intelligence that helps asses the legitimacy of a user and assesses whether a transaction could be for money laundering activities.

4. Is transaction monitoring only for finance sector institutions?

No, transaction monitoring is not limited to financial sector entities. Crypto trading, stock trading, eCommerce, and gaming, among other sectors, also benefit from transaction monitoring. Businesses in these sectors often fall prey to illicit activities like money laundering, which can be prevented through transaction monitoring.

5. Are transaction monitoring systems secure?

Yes, transaction monitoring systems are highly secure in terms of data safety, and most of them comply with data security laws such as GDPR, DCIA, PDPA, and other legal requirements. You can stay assured that your transactional data is secure on these systems.

6. What should we look for in transaction monitoring software?

When choosing a transaction monitoring system, you should look for specific features and functionalities that solve your business challenges. Additionally, factors like scalability, ease of use, affordability, and integration options are a few other options to consider.

=============================================================================