September 23, 2022

September 23, 2022

Electronic Signatures: Uses, Benefits & How to Create

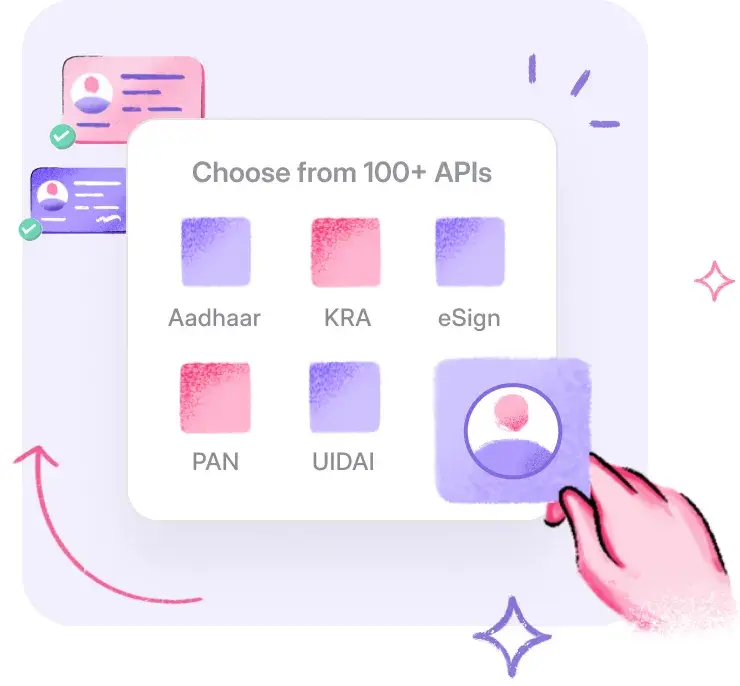

Electronic signatures (eSignatures) are a legal & secure way to get remote work done faster & easier. Click...