What is an Money Laundering Reporting Officer (MLRO)?

MLRO stands for Money Laundering Reporting Officer. An MLRO is a designated individual within a financial institution or other regulated entity who is responsible for overseeing the organization’s anti-money laundering (AML) and counter-terrorism financing (CTF) compliance efforts.

The primary role of an MLRO is to ensure that the organization is compliant with relevant laws and regulations related to detecting and preventing money laundering and terrorist financing activities.

Who can Become an MLRO?

It is critical to have a firm understanding of the applicable anti-money laundering rules and regulations in your country. The company’s anti-money laundering officer can then use this information to understand and apply it to your business.

Having a certain set of talents is essential for the position, although formal qualifications aren’t always necessary. A decent MLRO usually has the following features:

MLROs in the UK:

- In the UK, MLROs are responsible for overseeing and implementing anti money laundering (AML) and counter-terrorist financing (CTF) measures inside their organizations.

- MLROs are obligated to report suspicious activities to the proper authorities, such as the National Crime Agency (NCA), and to guarantee compliance with applicable laws and regulations, including the Money Laundering Regulations (MLR) 2017, Proceeds of Crime Act (POCA) 2002, and Terrorism Act 2000.

MLROs in the EU:

- MLROs are responsible for reporting suspicious transactions to the appropriate authorities, typically the Financial Intelligence Unit (FIU) in each member state, and to guarantee compliance with EU directives like the Fifth Anti-Money Laundering Directive (AMLD5) and national laws that implement these directives.

- A compliance officer should have the following attributes and capabilities:

- Compliance Expertise

- Ability to Manage Risks

- Critical Thinking Skills

- Instruction and Dissemination of Information

MLROs in the USA:

- MLROs must ensure adherence to laws and regulations, such as the Bank Secrecy Act (BSA) and regulations set forth by the Financial Crimes Enforcement Network (FinCEN).

- They are in charge of making sure that staff members are trained on AML/CTF regulations and best practices.

MLROs often come from backgrounds such as those of firm compliance officials, AML-savvy attorneys, or those who have worked in financial crime investigations.

Why do Businesses Need to Have an MLRO?

Banks, investment businesses, insurance companies, and real estate agents are among the regulated financial services sectors usually subject to the requirement. Money laundering is more likely to occur in these sectors due to the high number of financial transactions they process. It is one of the strategic decisions made by the organization’s senior management. Here are some reasons to appoint an MLRO:

- Compliance Issues: In addition to protecting you from the serious repercussions of failing to comply, an MLRO in senior management shows that you are serious about preventing money laundering.

- Heavy Fines: Relevant authorities might fine businesses significantly if they don’t follow money fraud rules and policies.

- Reputational Damage: Your company’s image could be irreparably damaged if it is linked to money laundering.

- Legal Consequences: In a severe situation, a person or business might be subject to civil and criminal action.

What are the Duties of an MLRO?

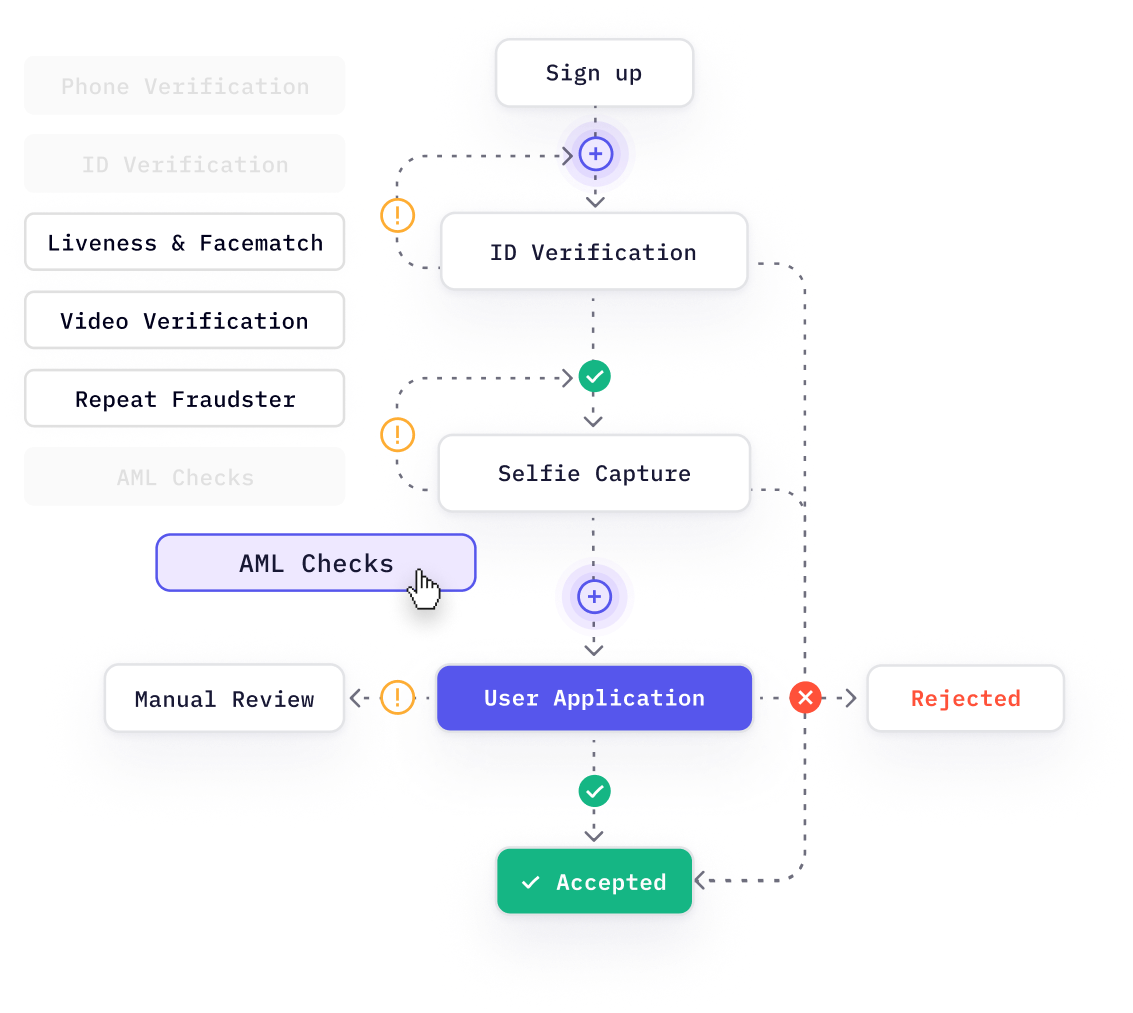

- Developing and Maintaining a Strong AML Program: This program specifies the measures the organization will take to forestall the unlawful practice of money laundering. The MLRO ensures the AML policies are updated and in line with current rules.

- Risk Management: MLRO’s responsibilities include risk mitigation by considering the database of clientele, goods sold, and the physical location of the businesses with the potential for money laundering. The compliance officer can strengthen business practices and AML processes to adjust appropriately.

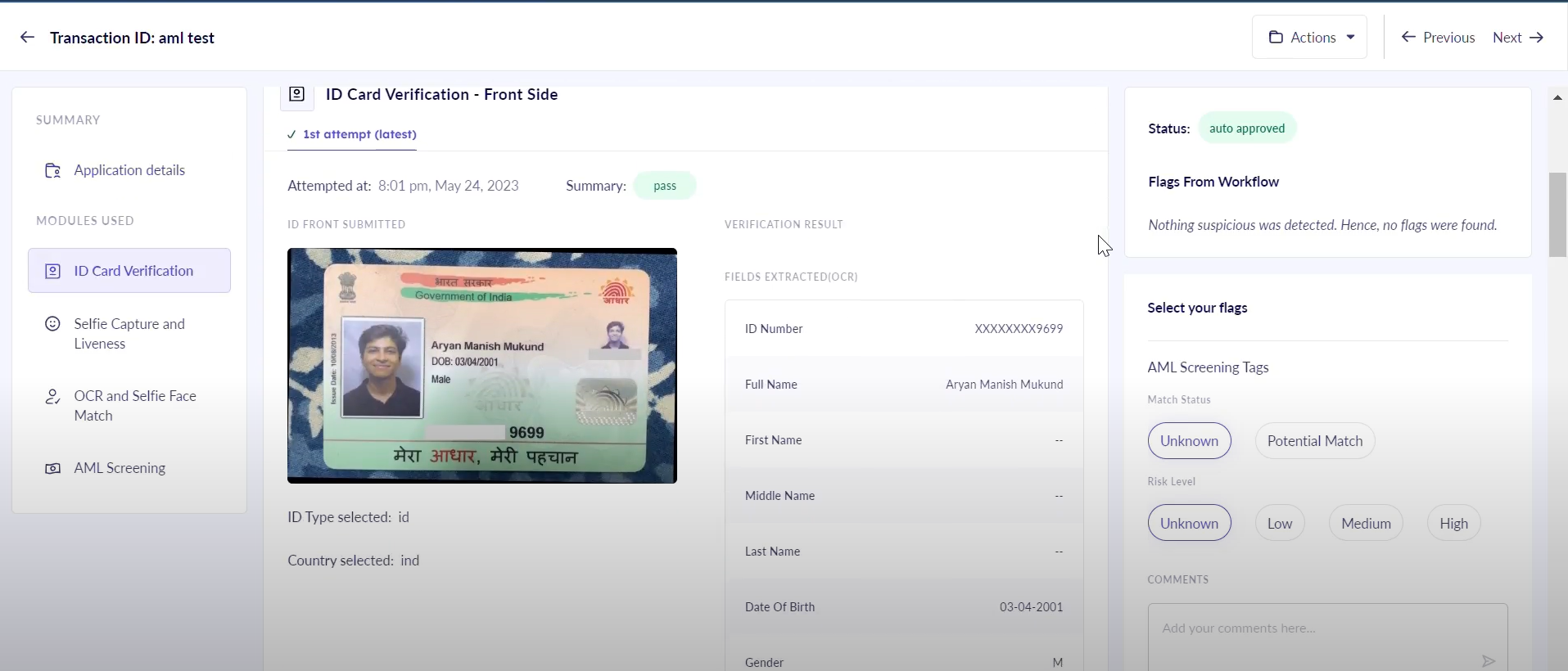

- Customer Due Diligence (CDD): Customer due diligence includes the verification of clients’ identities, professional relationships with other parties, and understanding of their wealth sources.

- Monitoring Transactions: The MLRO sets up a system to monitor all financial activities to detect potential signs of money laundering risk.

- Suspicious Activity Reporting (SAR): When the money laundering reporting officer (MLRO) notices anything out of the ordinary, it falls under the AML duties to report it to the senior management function, including the national crime agency, in a fast and accurate manner.

- Training and Awareness Programs: Staff training courses on adequately documented anti-money-laundering rules, business policy, and suspicious activity reports are important parts of the MLRO responsibilities, as are training and awareness initiatives.

- Maintaining Records: The individual appointed is responsible for ensuring proper AML checks and documentation of all AML policies, processes, and AML procedures, including risk assessment, CDD checks, and SARs.

Significant personal liability is associated with these tasks. If the company’s AML policies and regulations are inadequate, the MLRO can face civil and criminal action.

Read more:

- What is an AML program?

- What is a suspicious activity report?

Complying with the AML regulations

- Stay Under Compliance: Hiring a money laundering reporting officer (MLRO) is a preventative measure that can help you stay in compliance with the firm’s anti-money laundering regulations.

- Builds a Strong Compliance Culture: The MLRO must have a strong grasp of AML and act as an advocate for a compliance program by clarifying the roles and duties of all employees with respect to AML.

- Provides Sufficient Authority: It is imperative that the money laundering reporting officer (MLRO) has adequate permissions and sufficient seniority to examine firm documents, investigate questionable behavior, and raise issues without requesting permission beforehand. This guarantees that they are able to carry out their responsibilities and other duties to a high standard.

- Mitigates Risk of Regulatory Breaches: Compliance with regulations is far less likely in an AML program that is well-managed by an experienced MLRO.

- Protects from Serious Legal Consequences: Thanks to the MLRO’s proactive reporting of questionable conduct, the organization can avoid legal issues and reporting obligations regarding money laundering and terrorist financing.

- Maintains Positive Relationships with Authorities: Your dedication to cooperating with appropriate authorities may be shown in your robust anti-money-laundering program and the designation of an MLRO, which can help build confidence and ease the load of future regulatory inspections.

Because of the ever-present danger of financial crime, all businesses providing regulated financial services must have strong anti-money laundering programs. Assuring your firm’s compliance program aligns with AML requirements. It safeguards itself from the hazards of money laundering and terrorist financing; money laundering reporting officers play a crucial role as allies in this battle.

Selecting a competent and seasoned money laundering reporting officer (MLRO) will solidify your future success and show your dedication to building a compliance culture. A regulatory environment is no excuse to do nothing. Now is the time to begin protecting your company.

Consult an expert in anti-money laundering rules if you wish to clarify your AML compliance responsibilities.