What is Medical Identity Theft?

Medical identity theft occurs when someone steals other people’s personal details for medical gain. It involves theft of information like name, social security number, and insurance details from the victim.

The scammer uses these details to submit fraudulent claims and get prescription drugs, surgeries, and other medical aid without permission. It’s a financial fraud that specifically targets the healthcare world, endangering medical records and violating health insurance policies.

How does medical identity theft impact businesses?

Medical identity theft damages businesses as much as it impacts individuals. It hits explicitly businesses in healthcare and insurance hard. This fraud brings risks, affects operations and finances, and leads to legal and regulatory challenges for healthcare providers and insurance companies.

Risks associated with medical identity theft

- Businesses face direct financial losses from such claims. These money losses are significant because paying for services no one receives uses up a lot of resources.

- Investigating and fixing issues from medical identity theft raises administrative and operational costs, not to mention the potential legal troubles and federal law implications.

- In healthcare, trust is key. As soon as word gets out that patients’ medical information is not safe, the business loses its good reputation and potential customers.

Impact on healthcare institutions and insurance companies

Healthcare providers and health insurance companies feel the biggest effects of this identity theft.

- Medical providers face financial loss and the risk of mishandling patient medical records, which can be dangerous for patient safety and care quality.

- Insurance companies or providers might get more defrauded claims. This situation can raise premiums and hurt everyone.

Legal and regulatory implications

The legal and regulatory landscape surrounding medical identity theft is complicated. The fraud puts the companies in legal and regulatory violations at once.

- The Health Insurance Portability and Accountability Act (HIPAA) requires that organizations keep patient medical information safe. Therefore, medical ID theft is a direct violation of HIPAA. This leads to compliance violations, which have hefty penalties and can potentially bankrupt or shut down businesses.

- The Federal Trade Commission may also get involved due to Medicare fraud and misuse of medical documents.

- If businesses do not stop or properly report medical identity theft, they may have to pay hefty fines and face legal penalties.

- Once a business has faced such an incident, regulatory bodies may scrutinize it more closely. This situation means you must allocate more resources to ensure compliance and enhance reporting activities.

How does medical identity theft happen?

Medical identity theft happens in several ways. Here are the main ones:

- Data Breach: Sometimes, healthcare places get hacked, or miscreant individuals get access to the victim’s medical record, credit report, benefits statement, credit accounts, Medicare number, health plan documents, treatment details, hospital database, or any other critical file.

- Personal Document Thefts: Thieves might steal wallets, mail, or documents. These items often contain personal information, putting medical documents at risk.

- Phishing Scams: These are when victims receive fake emails or calls. They seem real and ask for personal info. The goal is to trick the victims into giving away their details, leading to medical ID theft.

- Threats From Within: Sometimes, people working inside healthcare or insurance companies take personal information for their own use or to sell it, risking patient medical records.

- Over-sharing on Social Media: Fraud awareness is slowly spreading. However, people still sometimes share too much online. One may post pictures of their documents or critical information. It is important to be responsible while sharing information online.

All these methods enable thieves to steal personal information, risking identity theft and misuse of medical records.

Signs of medical identity theft

Identifying signs is essential to stop further misuse of one’s identity in healthcare fraud. Here are some warning signs:

- Victims often receive unexpected bills for medical procedures they did not undergo. This is a fraud alert – someone else has accessed medical services under their name.

- If medical supplies or kits are delivered to someone’s home without their request. It indicates their information is being misused, hinting at medical ID theft.

- When debt collectors or collection agencies contact a person about unpaid medical debt that the person does not recognize, it is a red flag.

- So is finding unfamiliar medical debt collections on credit reports.

- If a health insurance company denies coverage because of a condition the policyholder does not have. Denied coverage suggests their medical identity has been compromised.

- Being informed by an insurance company that the benefit limit has been reached prematurely. It indicates that someone else might be using the insurance benefits, a direct sign of medical ID theft.

- Receiving a notification about a change of address that the policyholder did not initiate is another warning sign. It suggests someone is trying to divert medical information or bills.

Additional signs include:

- Receiving an Explanation of Benefits (EOB) for services not received points to medical identity theft.

- Discovering discrepancies in medical records or seeing unknown conditions or treatments is a sign that you need to check with your insurance provider about the benefits statements.

- Trouble getting prescriptions because records list unneeded medications also indicates theft and misuse of medical documents.

Strategies to prevent medical identity theft

Preventing identity theft in medical care requires a comprehensive approach to fraud detection and prevention strategies. Several best practices are available for organizations and individuals to protect personal and patient medical information from being accessed without authorization.

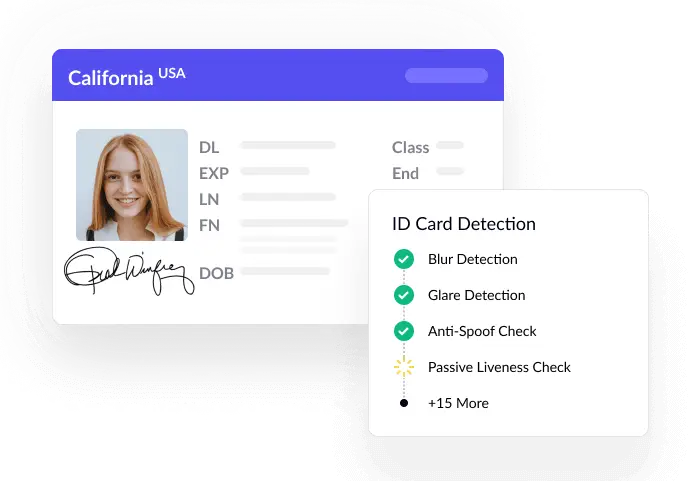

Perform document verification

Verifying documents is crucial. Processes like customer identity verification checks the authenticity of ID documents that patients provide. Ensuring the person who seeks medical records or files insurance claims is really who they say stops fraud from happening if the fraudster already has access to data. Hospitals, clinics, and insurance companies need to make document verification a standard practice to protect medical records from misuse.

Implement biometric verification

Using biometrics for verification relies on unique physical traits, like fingerprints or facial recognition. This security layer is tough for identity thieves to mimic, much more so than stealing personal details from documents or online, enhancing the protection of medical documents.

Report suspicious activity

You should report any unusual activities. Unusual billing, statements for services not received, or unexpected insurance notifications all count. Reporting these promptly to the right authorities or internal security can block thieves’ attempts. Both individuals and organizations (health care, insurance, and others), have a role in this.

Regularly conduct review audits

Auditing medical and billing records regularly is key to finding signs of fraud. Individuals should monitor their medical bills, insurance notices, and credit reports. Meanwhile, organizations need to check their records and systems often for any signs of unauthorized access or discrepancies.

Safeguard your business from identity fraud

Choosing to use digital identity verification is wise in combating medical identity theft. Such solutions are effective. They verify someone’s identity against official records before allowing access to medical services or insurance benefits, protecting medical records and combating fraud.

Here’s how they help:

- Accurate Identity Checks: These solutions match a person’s ID against official databases. Catching impostors attempting to access services under a stolen identity, protects you against medical ID theft.

- Biometric Verification: These solutions verify identity using unique personal features. With every individual having unique biometrics, this effectively blocks identity thieves.

- Real-time Verification: Performing identity verification instantly offers immediate security and a chance to catch the perpetrator at once.

- Audit Trails: Each verification event is logged, creating a detailed history. This aids in spotting and acting on suspicious patterns swiftly in health insurance benefits claims, drug purchases, and so on.

- Ease of Integration: You can integrate these solutions smoothly into current healthcare and insurance frameworks. They enhance existing security layers, forming a strong defense against identity theft, protecting medical records in the first place, and stopping this financial fraud.

If you are looking to enhance security measures against medical identity theft with identity verification technology, explore our identity verification solution. ̇Want to see it in action? Sign up for a walkthrough.