Money Laundering 101: How Does It Work?

Money laundering is the process of making unlawfully or illegally obtained funds legitimate by hiding their source.

It’s a serious financial offense with worldwide effects. According to statistics, yearly, between 2% and 5% of the world GDP, or $800 billion to $2 trillion, is laundered. Therefore, to maintain the integrity of the financial system and guarantee economic stability, it is essential to know how money laundering operates and how to stop it.

Why is understanding money laundering important?

The societal and economic effects of money laundering are enormous, therefore, understanding it is essential.

Social Impact

Promotes criminal activity: Drug trafficking, terrorism, human trafficking, and organized crime are just a few of the illicit activities that money laundering helps to support. Both social stability and public safety are seriously threatened by these actions.

Damages trust: The image and trust of legal and financial institutions can be severely damaged by these money laundering activities. People are less willing to interact with the financial system when they think it is tainted, which lowers economic development and participation.

Corrupts institutions: As criminals try to bribe officials to avoid legal action, money laundering can result in corruption in governments and other institutions. The governing institutions and the rule of law are undermined by corruption.

Economic Impact

Laundered money warps financial markets and economic statistics. It causes artificial and unreasonable inflation.

Unfair Competition: Laundered money can be used by criminals to undercut respectable companies. This creates unemployment and unstable economics.

Revenue Loss: Money laundering costs governments large sums of money in taxes, which can benefit public services, including infrastructure, education, and healthcare.

Stages of money laundering

Three steps usually go into money laundering: placement, layering, and integration. Every level is intended to make it harder to track down the source of money laundering work.

Placement

The first step is introducing funds gained illegally into the financial system, known as placement. Moving huge sums of illegal currency makes this stage of the money laundering process the most susceptible to detection.

Cash transactions: To evade detection, criminals frequently deposit small amounts of stolen cash into several bank accounts. By a technique called smurfing, large payments are divided into smaller, less dubious quantities.

Bulk cash smuggling: This technique is performed by physically moving a substantial amount of money across borders to deposit in foreign banks with fewer regulatory actions.

Gambling profits: After buying gaming chips with illicit money, criminals wager a little and then withdraw their profits with “clean” money. This approach uses a large number of cash transactions that occur in casinos.

Layering

Moving money through a convoluted network of various other financial institutions and transactions to hide its source is known as layering. At this point, it is challenging to track the illicit origin of the money.

Multiple accounts: To produce a bewildering paper trail, criminals move money between several bank accounts, frequently under different names and nationalities.

Currency exchange: Money launderers can make the trail even more difficult to follow by using a variety of currency trades.

Shell companies: These companies merely exist on paper, without actual operations. They are employed to hide and channel the money.

Integration:

Reintegrating the laundered money into the legal financial system is another way of laundering money. The money appears to be clean at this point and can be utilized without raising suspicions.

Legal Business: Criminals can make clean money by investing in legal businesses. Since they are mixed in with real legitimate income, illegal income is difficult to find.

Luxury purchase: Purchasing valuable assets like real estate, automobiles, and artwork turns illegal money into movable assets that can be sold or used as collateral.

Business Loans: Another way to further integrate illicit money into the legitimate financial system is to use loans to businesses, which are then repaid with clean money.

Common techniques used in money laundering

Money launderers use several strategies and techniques to launder money and hide their illegal operations. Among the most often used techniques are:

Smurfing

Smurfing, popularly known as structuring, is splitting large sums of money into smaller, less suspicious amounts and putting them into several bank accounts. The regulatory agencies that look for large cash transactions find this method difficult to spot.

Trade-based money laundering

Falsifying the value or quantity of products in commercial transactions is known as trade-based money laundering (TBML). Through over- or under-invoicing of products and services, criminals can transfer money across borders while passing for legitimate personal or business advantage. The complexity of international trade makes this approach very difficult to identify.

Shell companies

Shell firms do not do any real business; they simply exist in documents. They are used to transfer money and hide illicit funds from their source. It is hard to follow the money back to its source because these businesses can operate transactions and own bank accounts.

Casinos

Because there are so many cash transactions at casinos, money launderers find them appealing. Cashing out with clean money, criminals use illegal money to purchase chips and gamble a little. This approach takes advantage of the anonymity and high cash flow of the gaming business.

Money mules

Money mules are people who, intentionally or inadvertently, gain illegal money on behalf of others. After depositing money into one account, dirty money mules move it to another and get paid for their services.

How to prevent money laundering?

Money laundering prevention calls for an integrated strategy, including technological and regulatory actions.

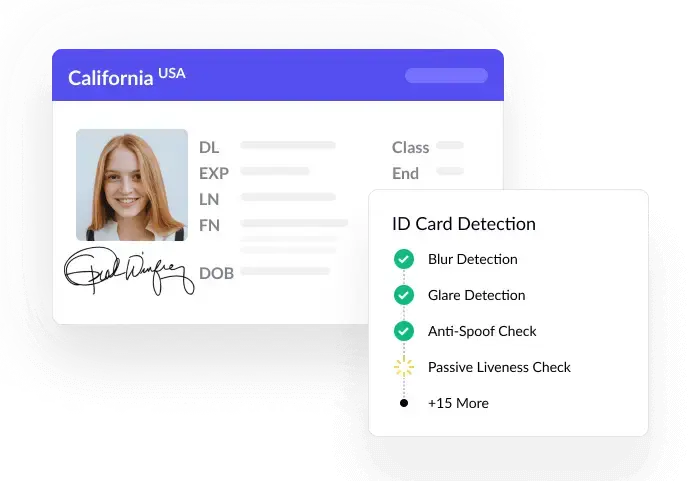

Identity verification

Customers’ identities must be confirmed both when opening accounts and making transactions. Know Your Customer(KYC) is a procedure for customer due diligence used to verify that people are legitimate and are not using phony identities. Strict identity verification procedures can stop criminals from laundering money under fictitious names.

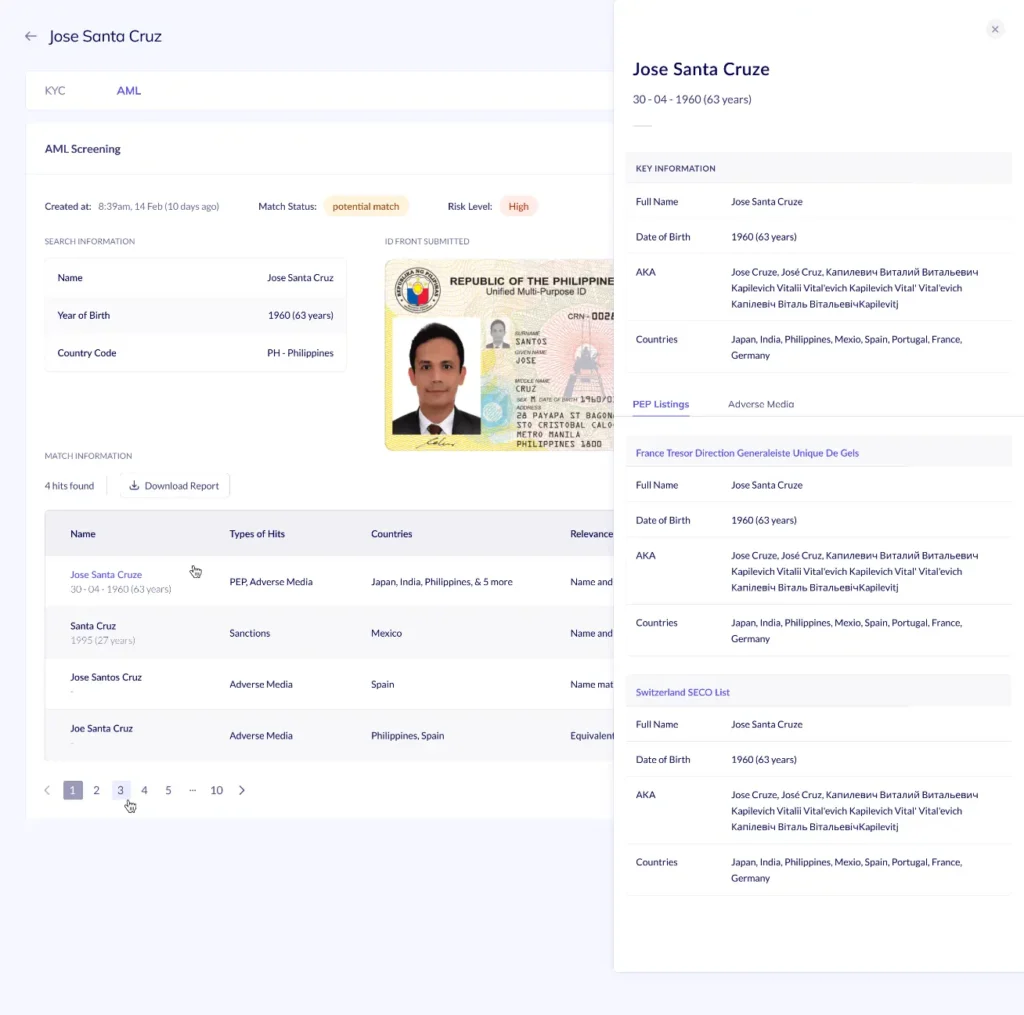

Risk screening

Assessing the risks of the clients and transactions helps to find high-risk people and their illegal activities. This can entail running names through databases of known criminals and watchlists. Every customer’s risk profile must be assessed by financial institutions, who also need to keep an eye out for unusual activity.

Transaction monitoring

Financial organizations have to watch transactions for any unusual activity. Among these are patterns like big cash deposits, quick money transfers across accounts, and transactions in high-risk countries. Transaction monitoring can be improved in accuracy and speed using advanced analytics and machine learning.

Recordkeeping and reporting

It’s critical to keep thorough transaction logs and notify authorities of any unusual activity. Records of consumer transactions must be kept on file by financial institutions for a predetermined amount of time. Law enforcement agencies might use the paper trail, and these records help look into and prosecute money laundering schemes.

CTA (Banner): Prevent money laundering with advanced AI-powered solutions

Stay compliant with effective AML solutions

Financial institutions must maintain their adherence to Anti-Money Laundering (AML) laws. The automation of AML processes by advanced AI technologies guarantees efficiency and compliance with anti-money laundering legislation.

Artificial Intelligence Driven Monitoring: AI-based Real-time analysis of enormous volumes of data allows it to spot trends and abnormalities that human analysts would overlook. Transaction monitoring is now faster and more accurate. Artificial intelligence can identify odd transaction patterns and point out money laundering operations.

Identity confirmation: When AI technology can precisely and quickly confirm consumer identities like document and facial recognition identities, the chance of fraud is lower. To guarantee KYC laws are followed, these systems can compare client data against several databases and watchlists.

Risk assessment: By examining several data points, AI can conduct thorough AML risk assessments. It facilitates the efficient classification of transactions and customers according to risk level. AI systems offer continuous risk assessment by adjusting to new threats and patterns.

How HyperVerge can help you fight against money laundering

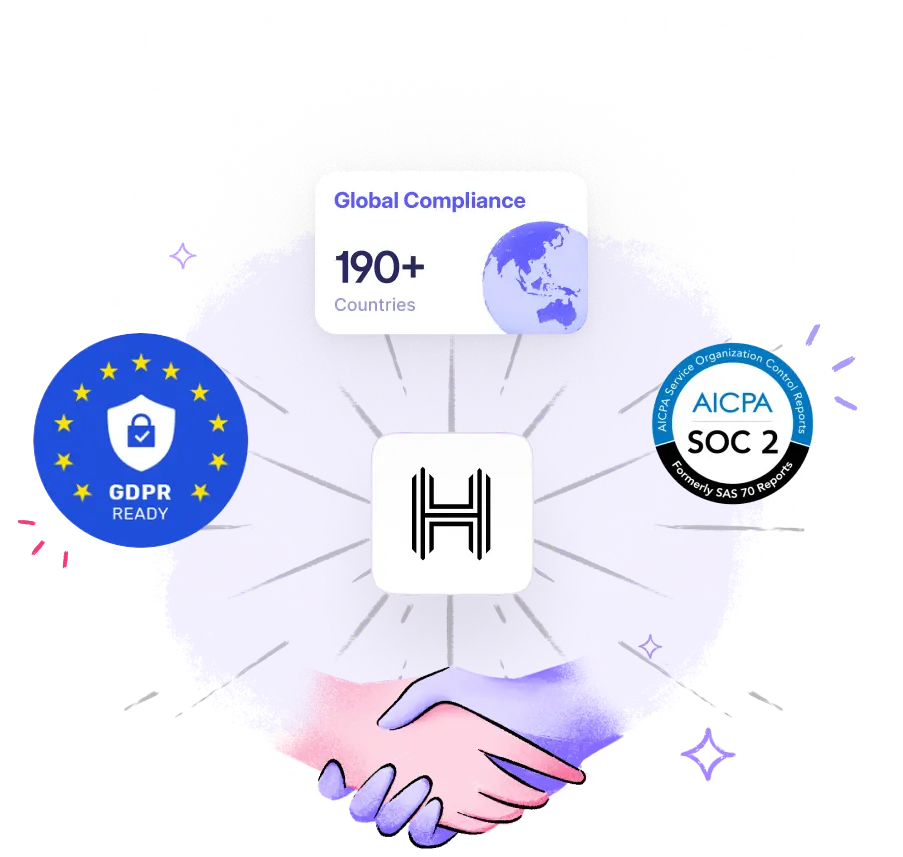

HyperVerge offers advanced AI technologies specifically designed for AML compliance. These cutting-edge features benefit financial institutions in many ways:

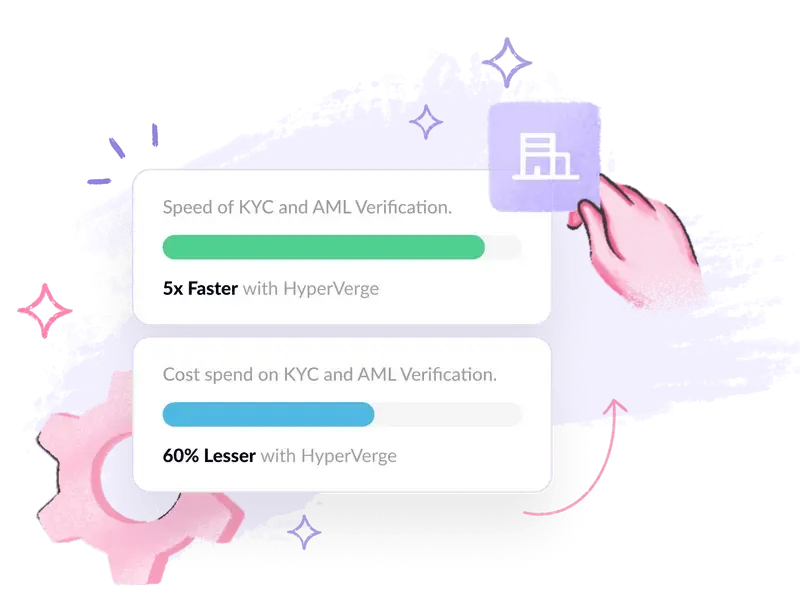

Automate Compliance: Along with reducing human effort, automation ensures that AML rules are followed strictly. The AI solutions from HyperVerge automate the transaction monitoring, identity verification, and risk assessment processes.

Improve Security: Improves the security in identity confirmation and transaction monitoring procedures. The products provide precise and effective ways to identify and restrict fraudulent activity.

Boost Efficiency: Simplify AML processes so people can concentrate on essential jobs. HyperVerge helps financial organizations to better distribute resources by automating standard AML processes.

The main characteristics of the AML solutions from HyperVerge are:

Real-Time Data Analysis: AI-driven algorithms timely identify suspicious activity by analyzing transaction data in real-time.

Advanced Identity Verification: To guarantee genuine consumer identities, apply cutting-edge document and facial recognition technology.

All-Inclusive Risk Assessment: Offer a complete picture of client risk by combining information from several sources to produce precise risk profiles.

Regulatory Compliance: Offer up-to-date information on changing AML rules and make sure organizations stay in compliance.

Final words

Preserving the integrity of financial systems and safeguarding economies need an understanding of and ability to fight money laundering. Financial institutions can maintain compliance and security by using cutting-edge AML solutions like those from HyperVerge, restricting the flow of illicit money. The ability to use AI and cutting-edge technology to combat money laundering and build a more reliable and transparent financial ecosystem. Explore our product offerings and sign up today!