What is face identification and face match technology?

Facial recognition technology has emerged as a significant advancement in identity verification and authentication systems. By analyzing facial features and patterns, this technology enables the identification and verification of individuals, providing a wide array of applications across various industries such as financial services, fintechs, lending businesses, and more.

What is a face match?

Face match is a biometric technology that compares two different images to ascertain if the subject’s facial features match. This method finds extensive application in user onboarding and identity verification processes.

For instance, in the banking sector, it ensures secure customer authentication by matching the selfie provided during account registration with the photo on their government-issued ID. Similarly, in online gaming and financial services, it aids in preventing fraudulent activities by verifying the identity of users against their uploaded identification documents, thereby enhancing the overall security and trustworthiness of the business.

How does face identification and face match API work?

Here’s a step-by-step process outlining how a face identification and face match APIs work:

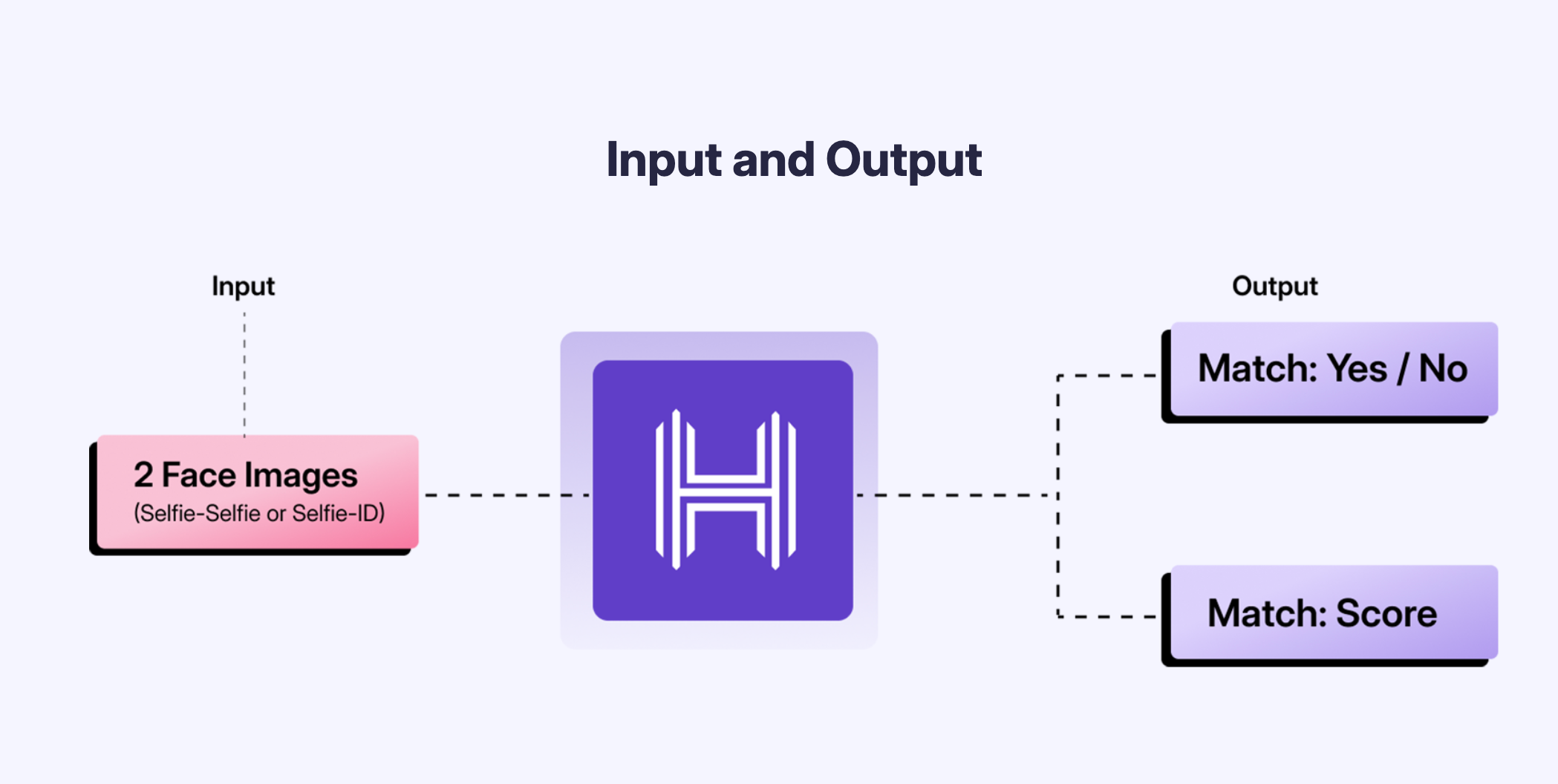

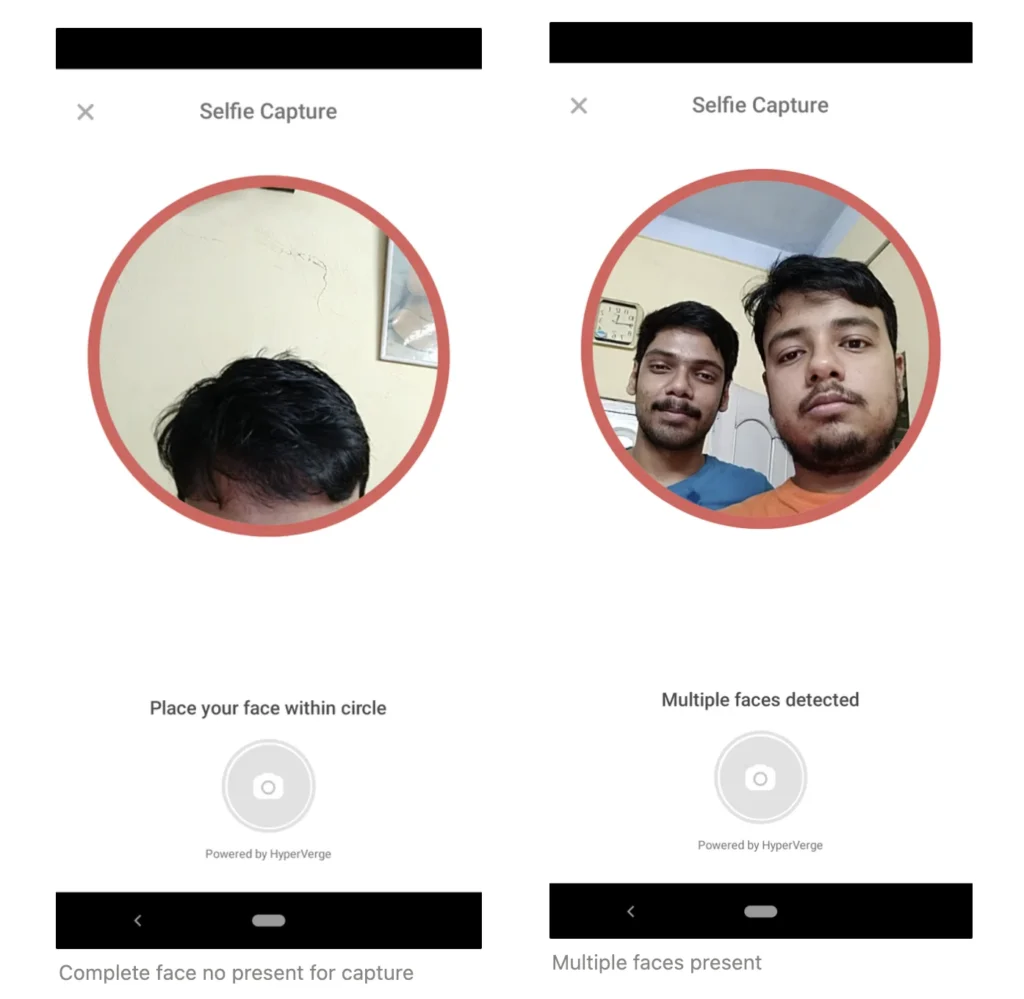

1. Input Images: The API takes face images as input, which could be sourced from selfies or identification documents such as driver’s licenses or passports. These images may be captured through a camera or uploaded from a file.

2. Preprocessing: Before analysis, the images undergo preprocessing to standardize factors like size, orientation, and lighting conditions. This step ensures consistency and accuracy in the subsequent facial recognition process.

3. Facial Feature Extraction: The API employs sophisticated algorithms to extract key facial features from each image. This involves identifying landmarks such as the eyes, nose, mouth, and other distinguishing characteristics.

4. Feature Encoding: After feature extraction, the API converts these facial features into a numerical representation or vector, often referred to as a face embedding or descriptor. This numerical representation captures unique characteristics of the face in a format suitable for comparison.

5. Comparison and Matching: The API compares the face embeddings generated from the input images. It computes a similarity score, often using techniques like cosine similarity or Euclidean distance, to quantify the likeness between the two faces.

6. Match Decision and Match Score: The API determines whether the faces match or not. If the similarity score exceeds the threshold, the API indicates a positive match; otherwise, it indicates no match. Additionally, the API may provide a match score, indicating the degree of similarity between the faces. This score offers insight into the strength of the match, enabling users to make informed decisions based on the level of confidence in the match result.

Challenges with face identification and face match

1. Low Face Match Accuracy: Despite the advancements in modern facial recognition software, low face match accuracy remains a persistent challenge. This issue results in increased manual reviews, false rejection rates, and false acceptance rates, thereby escalating operational costs. Despite the utilization of deep learning and sophisticated face recognition algorithms, the accuracy of recognizing the same person across different facial images or in various facial expressions poses significant hurdles.

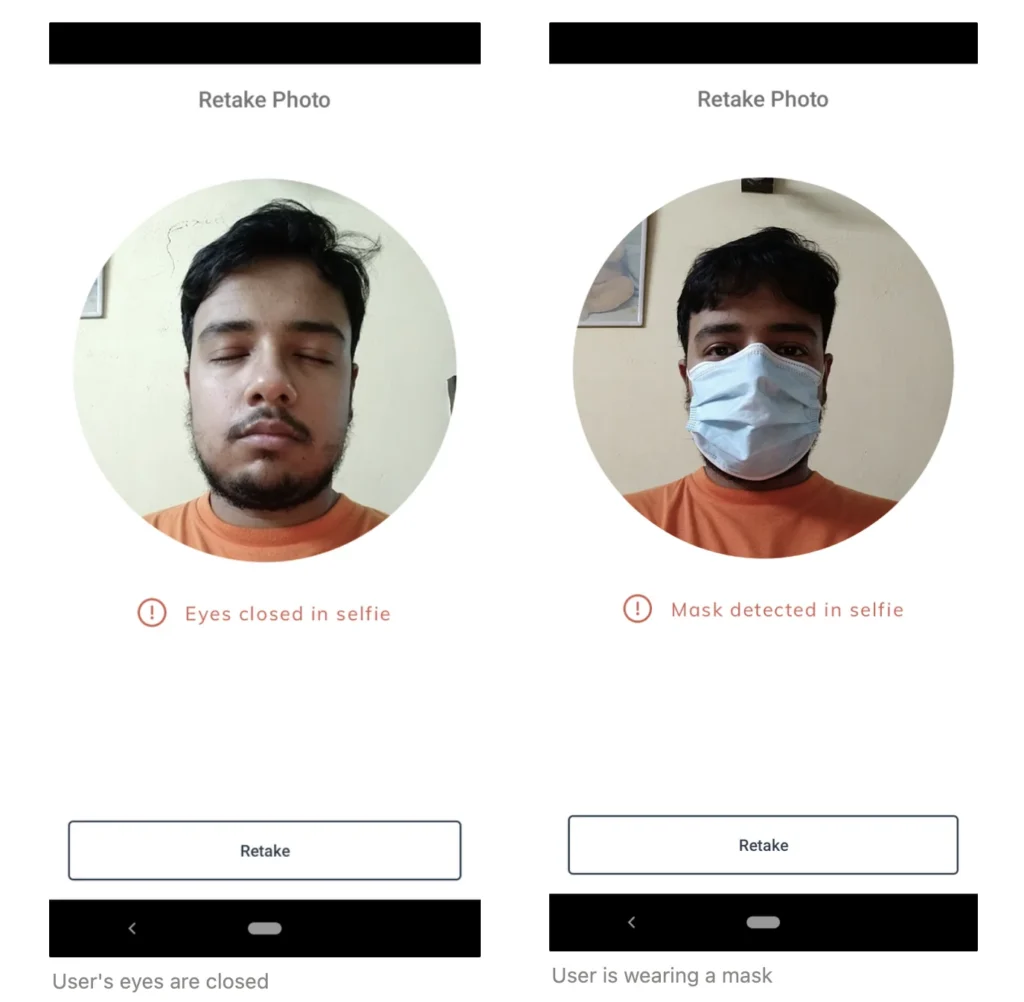

2. Incompatibility with Low-Quality Images: Several facial recognition systems encounter difficulties when dealing with low-quality images. These images, often encountered in law enforcement or border control scenarios, can hinder accurate face detection and recognition. Additionally, personal devices capturing digital images may produce subpar quality, further challenging face recognition accuracy.

3. Discrepancies Between Document Photos and Selfies: Face recognition systems face challenges when attempting to match faces captured in document photos with selfies. Factors such as changes in facial hair or aging can lead to discrepancies, affecting the recognition accuracy. Despite the utilization of biometric technology and face analysis techniques, aligning facial features across different images remains a complex task.

4. Inability to Detect Deepfakes: Despite the integration of artificial intelligence in facial recognition systems, detecting deepfakes remains a formidable challenge. Deep learning techniques used to create convincing synthetic facial images pose significant threats to recognition accuracy. The inability to distinguish between genuine facial images and manipulated content jeopardizes the integrity of recognition data, especially in sensitive applications such as law enforcement or border control.

Addressing these challenges requires advancements in facial recognition technology, including improved recognition algorithms, enhanced sensitivity to subtle facial features, and robust countermeasures against deepfake manipulation.

Additionally, deploying a well-trained and unbiased AI-model for biometric identification enhances the overall recognition accuracy and security measures.

HyperVerge’s face match API

HyperVerge’s Face Match API leverages cutting-edge facial recognition algorithms and machine learning, and accurately identifies individuals based on their facial features. This advanced face recognition system not only detects faces but also measures facial landmarks with precision, enabling the extraction of biometric data crucial for biometric identification technology.

With proprietary AI-powered facial recognition technology, HyperVerge ensures the utmost security of sensitive data, surpassing the capabilities of most security software available. Moreover, the API’s integration of passive liveness check eliminates the need for complex gestures on the user’s part and simplifies the user onboarding process.

End-to-end and no-code verification with HyperVerge ONE

Is your financial product onboarding process stitched together with several point solutions? With HyperVerge ONE you can build seamless end-to-end journeys. With our integration capabilities, you can effortlessly configure user onboarding workflows and craft intuitive UI/UX experiences without ever touching a line of code.

Worried about user drop-offs during downtimes? HyperVerge allows you to set up automated fallback options, ensuring a smooth journey for your users regardless of the circumstances. You can also dive deep into analytics on conversion rates, identifying and optimizing friction points to enhance user experience and drive higher success rates.

Explore HyperVerge ONE here. Want to see it in action? You can request a customized demo here.