More than 500 million digital accounts in India were verified through video KYC in 2023, and the number keeps climbing!

As banks cut onboarding time from hours to minutes and NBFCs report fewer fraud incidents, video KYC has moved from a convenience to a core part of digital identity checks. The rise of contactless verification after the pandemic only pushed this adoption faster, and global banks are now using AI-driven video KYC to improve accuracy and compliance.

The growth is simple to explain: users want fast onboarding, and companies want safer, low-cost verification. Video KYC delivers both.

This guide will walk you through what video KYC is and why this KYC system differs from other verification methods.

What is Video KYC?

Video KYC or VKYC is a remote identity verification process that confirms a person’s identity using a live video call. Also known as video-based customer identification, or V-CIP, this method eliminates the need for you to visit a branch or office in person. Instead, verification happens through a secure digital session.

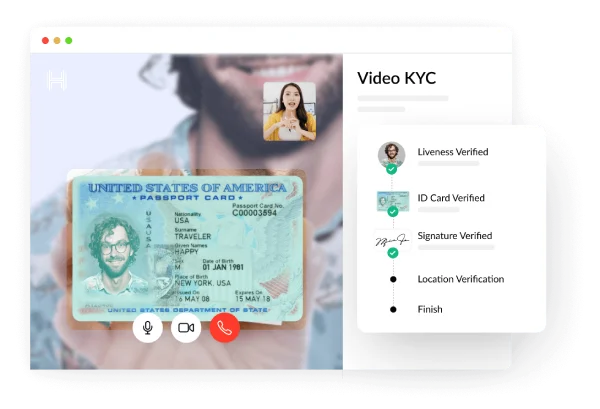

The session is far more than a simple video chat. During the video KYC process, A trained agent guides you through the steps. You will show your original identity documents, like an Aadhaar card, directly to the camera. And, while this happens, automated systems work in the background.

Specialized software uses Optical Character Recognition (OCR) to instantly read the text on your document and check its validity. At the same time, facial recognition technology compares your live face to the photograph on your ID. Liveness detection further confirms that a real person is present, preventing the use of masks or video recordings.

You may question: Is video KYC safe? The answer is yes. All the data from the session, including the video itself, is protected with strong encryption.

What is the most secure Video KYC solution for financial services?

The most secure Video KYC solutions for financial services are those that combine end-to-end encryption, secure data isolation, regulatory compliance (such as RBI Video KYC guidelines), and tamper-proof audit trails.

In practice, this means encrypting live video streams, stored recordings, biometric data, and identity documents using AES-256 encryption at rest and TLS 1.2+ encryption in transit, while ensuring that all Video KYC workflows meet local regulatory requirements for customer due diligence, consent, and record retention.

How secure Video KYC works:

1. End-to-end encryption

A secure Video KYC system encrypts customer data at every stage of the verification process. Live video streams, customer images, identity documents, and biometric signals are protected using AES-256 encryption for data at rest and TLS 1.2 or higher for data in transit.

This ensures that sensitive Personally Identifiable Information (PII) remains unreadable even if network traffic or storage systems are compromised.

2. Secure storage and access controls

Video KYC recordings and associated metadata are stored in isolated, access-controlled environments. Role-based access control (RBAC), audit logging, and key-management systems ensure that only authorized personnel can access verification data, supporting both internal security policies and regulatory audits.

Video KYC Security Overview

• Encryption at rest: AES-256

• Encryption in transit: TLS 1.2+

• Secure storage with role-based access control

• Tamper-proof audit logs

• Designed for RBI-compliant customer due diligence

• Supports regulatory audits and dispute resolutionVideo KYC data flow in secure financial systems

In a secure Video KYC workflow, customer data flows through clearly defined, encrypted stages. First, the live video session is initiated using a secure TLS-encrypted connection. During the session, facial video, voice, and document images are processed in real time for identity and liveness checks.

Once the verification is complete, encrypted recordings and verification logs are stored in compliance-approved infrastructure. Access to this data is governed by strict policies, ensuring traceability, non-repudiation, and regulatory compliance throughout the data lifecycle.

Importance of VKYC

VKYC became essential to fight modern fraud. Traditional paper-based methods were vulnerable. Bad actors could easily create fake documents or steal identities to open fraudulent accounts. Simple digital uploads could be spoofed with edited photos or pre-recorded videos.

This KYC system directly counters those threats. The live, real-time interaction is its core strength. An agent can ask you to tilt your ID to check for official holograms, a simple action that is difficult to fake in real time.

This combination of human oversight and automated checks creates a powerful barrier against spoofing. For regulators, this process closes critical loopholes that enabled money laundering and synthetic identity fraud. For banks and businesses, this means a significant reduction in fraud losses and compliance risks. And finally, for users, it meant better identity and account protection.

Regulatory compliance for secure Video KYC in India

In India, Video KYC implementations for banks, NBFCs, and regulated financial institutions must comply with guidelines issued by the Reserve Bank of India.

These guidelines require institutions to ensure secure customer identification, explicit customer consent, real-time verification conducted by authorized officials, and secure storage of Video KYC records for audit and regulatory review. Encryption, audit trails, and access controls are therefore not optional features but foundational requirements for compliant Video KYC systems.

To ensure a smooth VKYC experience, you need to have the right documents and environment ready. Here’s everything you need for quick VKYC per RBI:

Essential documents for the VKYC

- Proof of Identity: You need a valid Officially Valid Document (OVD). This includes your Passport, Driver’s Licence, Voter ID card, or Aadhaar.

- Proof of Address: If your current address is different from the one on your OVD, you must provide separate address proof. A recent utility bill (electricity, water, gas) or a bank statement less than two months old is acceptable.

- PAN card: Your Permanent Account Number (PAN) card is mandatory. You will need to display it clearly on the video call.

Technical and location requirements

- Stable internet connection: A strong and stable internet connection is crucial for a seamless, uninterrupted video call.

- Smartphone or computer: You need a device with a working camera and microphone. The video quality must be clear enough for the official to identify you.

- GPS/location access: The application will capture the live GPS coordinates of the location where you are performing the VKYC. You must enable location services on your device.

- Quiet, well-lit space: Choose a quiet environment with good lighting. This allows the official to see you and your documents clearly without any distractions or prompting from others.

Verification process during the call

- Liveness check: You will be asked to perform a simple, random action (like turning your head or blinking). This proves you are a real person present live and not a pre-recorded video.

- Document display: You will be instructed to show the front and back of each original document (Aadhaar, PAN, etc.) to the camera. The official will check that the details match the information you provided and that the photograph matches your face.

- Aadhaar authentication: If you use Aadhaar, you may be asked to complete an OTP-based authentication or a verification using the QR code on your Aadhaar card or letter. The XML file or QR code used should not be older than three days.

- Consent and confirmation: You will need to provide your explicit consent for the process. The entire video call, along with the geo-tagging and time-stamp, is recorded and stored securely as an audit trail.

VKYC vs e-KYC vs traditional KYC: Key differences

While all three methods are prominently used to verify individuals’ identity, Let’s understand what the basic differences between them are

| Video KYC | Traditional KYC | e-KYC |

| Customers can verify their identities remotely through a video interface anywhere and at any time. | Customers need to visit the branch in person for identity verification. | Customers can verify their identities online by submitting their Aadhaar details. |

| An individual can submit digital documents. | An individual must provide physical copies of documents. | An individual must submit Aadhaar data to verify against the UIDAI database. |

| VKYC ensures quick onboarding and high efficiency. | This involves a lot of manual processing and takes up a lot of time. | e-KYC enables near-instant verification, often within minutes, making onboarding seamless. |

| More cost-effective due to automation and digitalized procedures. | Manual processing and resource allocation result in higher costs. | e-KYC is a zero-cost, paperless process. |

| VKYC has improved compliance by conducting real-time checks and following regulatory standards closely. | Compliance achieved through manual verification is potentially less robust. | e-KYC ensures data protection, consent-based access, and enhanced fraud prevention. |

| Utilizes advanced technologies like AI, biometrics, and end-to-end encryption for verification. | Manual verification processes are not integrated with advanced technology in this system. | Leverages Aadhaar authentication, biometrics, OTP verification, and encrypted data exchange to deliver secure, tamper-proof verification. |

Video KYC use cases

Video KYC is emerging as a transformative solution for various industries in India, particularly in the financial sector, due to its ability to streamline customer onboarding processes while ensuring compliance with regulatory standards.

Here are some key use cases of Video KYC:

- Banking, financial services, and fintechs: Major banks and financial institutions are at the forefront of implementing Video KYC to enhance customer onboarding and compliance.

- Insurance: Insurance companies are using Video KYC to verify customer identities quickly and efficiently, which is essential for policy issuance and claims processing.

- E-commerce and payment gateways: E-commerce platforms and payment gateways are leveraging Video KYC for merchant onboarding. This accelerates the process, enabling businesses to start accepting payments within hours rather than days.

- Logistics and delivery services: Companies in the logistics sector, such as Swiggy (a HyperVerge customer), utilize Video KYC for onboarding contract staff like delivery personnel. This allows for rapid verification and hiring.

Benefits of video KYC

Video KYC can benefit businesses and customers in several ways, including:

Improved customer experience and convenience

Video KYC provides a frictionless and hassle-free experience to customers. They can verify from anywhere and at any time. Moreover, they do not need to visit the branch or submit physical documents. This certainly has benefits in improving customer satisfaction and increasing retention rates.

Higher efficiency and lower costs

Digitization of KYC helps reduce the time and resources spent on customer verification by any financial institution. Automating identity checks and verification speeds up the onboarding process, hence cutting costs while improving operational efficiency.

Improved compliance and risk mitigation

Video KYC helps banks meet compliance standards set by the Reserve Bank of India (RBI). It puts much emphasis on strong cybersecurity, requiring periodic infrastructure up-gradation, and ensures connections only from IP addresses located in India. VKYC protects customer data using end-to-end encryption and geo-tags all customer interactions for added security. Banks follow these guidelines to avoid fraud risk and enhance safety in general.

Overcoming challenges regarding video KYC

Here are some of the challenges that V-KYC faces and strategies for overcoming them:

Limited network bandwidth in remote towns

Remote towns and rural areas are generally plagued with poor internet connectivity. This has to be made better for seamless video calling. Implementing some appropriate adaptive streaming technologies that enable automatic adjustment of video quality based on the available bandwidth can help and one can also partner with an available telecom provider in the area for better coverage.

Lack of awareness among customers

Some consumers need to be made aware of the video KYC process and they may need to be made aware of the advantages of such processes. Social media, email, and in-branch efforts should assist in putting out awareness campaigns. It’s essential to provide clear step-by-step guides and tutorials that customers can easily access to learn the process.

Customers reluctant to video calls

A few customers are hesitant to use video calls to verify identity. So to ease the process for them, make it secure and user-friendly with robust privacy measures and also address any fears of inconvenience and risks by providing alternatives for those who are more skeptical or by guiding them through the process.

How does Video KYC work

The Video KYC process is designed to ensure a secure and efficient way of verifying customer identities. Here is a step-by-step guide to the process:

1. Initiate video calling: A customer can initiate a video call with a KYC officer through a sent link.

2. Interview through video KYC: The officer will verify the identity of the customer in a suitable period with standard questions through video KYC procedure and by holding up his proof of identity in some manner.

3. Face matching and liveness: AI matches the customer’s face with the ID and performs the different levels of checks for the liveness of the person while ensuring that he is present there and not a photograph.

4. Document verification: Capturing and verifying documents of the surveyed customer on a real-time basis.

5. Completion and confirmation: Once the verification is completed, a notification goes to the customer. The process will continue for validation, and this will be used for logging compliance processes as well.

6. Face verification and liveness detection: An individual needs to be alive and physically present, not just a photo or video. This is done to prevent spoofing of the information and to preserve the integrity of the KYC process.

Regulatory and compliance framework for VKYC

In this section, we explore VKYC compliance frameworks for BSFI and other financial institutions with reference to Master Direction – Know Your Customer (KYC) Direction, 2016 (Updated as on August 14, 2025):

- Core infrastructure mandates

The V-CIP framework requires regulated entities to host the technology infrastructure within their own secure premises. Further, keeping in mind cybersecurity best practices, the data transmission between the customer and the hosting point must be encrypted end-to-end.

The system must also validate customer location using live GPS coordinates and incorporate face-liveness detection to prevent spoofing. Crucially, all data, including the complete video recording, must be stored on servers located in India, with immediate transfer from any third-party cloud after the session concludes.

- Operational and compliance protocols

The entire customer identification process must be a seamless, live audio-video interaction conducted by a specially trained official.

Institutions must verify customer-supplied documents in real-time, using Aadhaar, PAN from issuing authority databases, or equivalent e-documents from DigiLocker. The official must match the live customer to the document photograph and confirm all details.

Every account opened via V-CIP must undergo a concurrent audit before becoming operational to ensure process integrity and adherence to standards.

Industry-specific requirements for video KYC

Different industries modify video KYC requirements for their specific operational needs:

- Banking sector: Banks should have strict measures concerning customer authentication. They quite frequently use V-CIP during the onboarding of individual customers, proprietorships, and legal entities.

- Fintech companies: They use V-CIP to onboard customers faster and comply with regulatory standards. Fintech companies efficiently and safely carry out V-CIP processes, usually by integrating advanced technologies like AI in identity verification.

- Insurance companies: They leverage V-CIP to authenticate the identity of their policyholders while they make the application. They adhere to specific provisions regarding CDD and ensure to document and retain every customer interaction.

Each industry adapts to the general V-CIP rules. They must make customer identification effective and secure. The rules must fit with the industry’s compliance requirements.

Check out our blog for details on the RBI guidelines for V-CIP.

Data privacy and consent considerations

Manage consent to ensure customers explicitly agree to the use of their data in the Video KYC process. Enterprises should have concrete consent management systems to trace and record all consents.

Adhere to data privacy laws to protect customer information. Ensure that all data handling practices are transparent and secure.

Best practices for video KYC

Implementing effective video KYC requires a blend of advanced technology and customer-centric processes. Here are some best practices to ensure a smooth and secure video KYC experience:

Clear communication

Provide clear instructions and continuous support to the customers throughout the video KYC process. Clear communication enhances user experience and reduces confusion.

Robust security measures

Employ strict authentication and encryption to protect the customers’ data. Artificial intelligence and machine learning can further increase security by the real-time detection of anomalies and possible fraud.

Continuous training

Train KYC officers continuously on new technologies and processes. Such frequent updates ensure that the team is well-versed and better positioned to handle new challenges while maintaining compliance.

Seamless onboarding experience

Design an end-to-end frictionless onboarding workflow. Technology allows for flexible access, where most customers get hassle-free onboarding while high-risk cases are raised for further review.

Comprehensive identity verification

Utilize AI-driven facial recognition and liveness detection to ensure the accurate verification of customer identity. This not only prevents fraud but also makes the verification process quicker and more effective.

Transparency and compliance

Ensure transparency in your verification algorithms and maintain compliance with regulatory standards. This could be ensured by having periodic audits and refreshers of your KYC processes to help them stay updated with the evolving character of regulatory requirements.

Customer-centric approach

Ensure customer experience and trust is at the forefront. Make the KYC process less daunting at the end-user level by simplifying it with user-friendly interfaces and displaying multiple channels of communication for support.

Implementing video KYC

While selecting a video-based KYC solution, there are a number of factors that one should consider to ensure that the chosen technology aligns with the needs of the organization and the regulations that bind it. Below are some important criteria to guide your selection process:

Choose the right video-based KYC vendor

When selecting a video-based KYC vendor, one needs to prioritize stability, security, and the requirements of regulatory compliance. The vendor should provide easy system integration and leverage advanced technologies such as AI for identity verification and fraud detection. Assess customer support, training resources, and scalability in line with business needs. Look for features like real-time monitoring and customized workflows as features that bring in efficiency. Check the credibility of the vendor from client testimonials and industry ratings. Lastly, consider the overall cost-effectiveness to ensure the solution provides value without compromising quality.

Compliance with regulators

Ensuring compliance with all relevant regulators and regulations is crucial to avoid legal complications. A video KYC solution complies both locally and internationally with AML and KYC standards while adapting to changes in regulatory landscapes. HyperVerge’s solution fares well in this regard in that it uses advanced data encryption while following global standards such as GDPR and CCPA. It continuously updates its compliance framework to incorporate new regulations and best practices. Additionally, HyperVerge offers real-time monitoring and extensive audit trails, providing transparent and accountable processes that satisfy regulatory scrutiny

Integrate with existing systems and workflows

Incorporating Video KYC into current systems and workflows to boost productivity and adherence to rules seamlessly. This integration simplifies day-to-day tasks, getting rid of hold-ups while making sure one meets all the rules. By adding Video KYC, one can strengthen workflows and improve customer experience without messing up the current protocols.

Security features of enterprise Video KYC solutions

Enterprise-grade Video KYC platforms for financial services typically include encrypted live video verification, AI-based liveness detection, document authenticity checks, consent capture, audit logging, and secure archival of verification records.

Together, these features ensure that Video KYC not only improves onboarding speed but also strengthens fraud prevention and regulatory compliance.

The future of KYC: How will VKYC evolve?

With growing demand for remote verification, the next phase of VKYC is predicted to be fully AI-driven, combining facial recognition and deepfake prevention for safer, faster onboarding.

Also, VKYC platforms are now being designed to run on low bandwidths, some as low as 75 kbps, to reach rural users. The evolution also points toward multilingual and mobile-first verification, helping institutions onboard customers across regional languages.

Key takeaways: Video KYC in India

- Video KYC is a live, remote identity verification process that allows banks, NBFCs, and regulated entities in India to verify customers through a secure video interaction instead of physical branch visits.

- It combines human oversight with AI-based checks, including face matching, liveness detection, document verification, and geo-tagging, making it more secure than image-only or paper-based KYC methods.

- In India, Video KYC must comply with RBI’s V-CIP guidelines, which mandate real-time verification, explicit customer consent, encrypted data transmission, audit-ready recordings, and India-based data storage.

- Video KYC significantly reduces onboarding time and fraud risk, enabling institutions to open accounts in minutes while maintaining strong AML and compliance controls.

- Modern Video KYC platforms are evolving toward automation, low-bandwidth support, deepfake detection, and multilingual workflows to scale secure onboarding across urban and rural India.

HyperVerge is leading this evolution with 100% RBI-compliant video verification that cuts onboarding time and boosts conversions. Its AI-powered system performs PAN, Aadhaar, and CKYC checks before calls, reducing friction. During the call, agents or automated flows handle randomized checks, face matches, and fraud detection in real time.

With live traffic management, audit-ready portals, and deepfake prevention, HyperVerge’s VKYC solution is helping institutions onboard more users faster with lower operational costs.

To know, book a demo today!

FAQ’s:

What is Video KYC?

Video KYC is a remote customer verification process where identity is confirmed through a live video call. A trained official verifies the customer’s face, original identity documents, and performs liveness checks in real time to meet regulatory KYC requirements.

Is Video KYC safe and secure?

Yes. Video KYC is considered secure because it uses live interaction, encrypted video streams, liveness detection, and audit trails. Unlike document uploads, it reduces risks of impersonation, deepfakes, and forged identity documents.

Is Video KYC allowed in India?

Yes. Video KYC is permitted in India under RBI’s Video Customer Identification Process (V-CIP) guidelines. Banks, NBFCs, and regulated entities must follow requirements such as real-time verification, consent capture, encryption, and secure record storage.

How long does Video KYC take?

Most Video KYC sessions take between 3 and 10 minutes, depending on document readiness, network quality, and verification checks. Automated pre-checks can further reduce onboarding time.

How is Video KYC different from e-KYC?

e-KYC typically relies on Aadhaar-based OTP or biometric verification, while Video KYC involves a live video interaction. Video KYC provides higher assurance by combining human verification with AI checks and is suitable when full KYC compliance is required.

Which documents are required for Video KYC?

Commonly required documents include a PAN card and an Officially Valid Document such as an Aadhaar, a Passport, a Driving Licence, or a Voter ID. The documents must be shown in their original form during the live video session.