Remember Breaking Bad and Ozark and how they funnel dirty money through car washes, strip malls, and stacks of small transactions to stay off the radar? Well, real-life criminals do the same—but smarter.

This trick is called smurfing—where large amounts of illegal cash are whitewashed through different people, bank accounts, or shell companies. The goal? To dodge suspicion and slip through financial safeguards. Smurfing fuels drug cartels, tax evasion, and even terrorism. And it’s no small game—globally, up to $2 trillion is laundered every year and smurfing plays a huge role here.

Authorities are fighting back, but businesses need to plan more smartly because as long as money moves, smurfing will keep evolving. This blog sheds light on what smurfing actually is and how organizations and businesses can proactively shield themselves from such money laundering tactics.

What is smurfing in money laundering?

Smurfing is a technique used in money laundering to break down large sums of money into smaller, less suspicious transactions. These smaller amounts are then deposited into multiple bank accounts or shell companies to avoid detection by authorities.

Such money laundering schemes often involve money mules—people who transfer funds on behalf of criminals, sometimes unknowingly. But note this: smurfing cannot be classified as legal or illegal; however, it frequently facilitates other serious crimes like terror financing and drug trafficking.

- What is a smurf?

In money laundering, a ‘smurf’ is an individual who conducts small, seemingly innocent transactions to avoid raising red flags. These individuals, often unaware of the larger scheme, help move illegal funds by depositing or transferring money in amounts below reporting thresholds.

| Did you know? The Bank Secrecy Act (BSA) requires financial institutions to report cash transactions over $10,000 and suspicious activity to help detect money laundering, tax evasion, and other crimes. |

- Why is money laundering called smurfing?

The term ‘smurfing’ originates from the 1980s and is attributed to Miami-based lawyer Gregory Baldwin. It is inspired by the popular animated TV show The Smurfs, where small characters work together to achieve larger tasks, mirroring how criminals break large transactions into smaller, undetectable ones.

- How does smurfing affect various industries?

Smurfing can directly impact industries that handle large amounts of cash and financial transactions. Some common targets of smurfing schemes include:

- Banking and financial services: Criminals exploit vulnerabilities in banking systems, staying below transaction thresholds to avoid triggering suspicious activity reports.

- Retail and e-commerce: Large purchases of high-value items like jewelry or electronics can hide illicit activities.

- Real estate: Smurfing is used to purchase property, making it difficult to trace the source of the funds.

- iGaming and gambling: Criminals funnel money through online platforms and casinos, disguising illicit funds as legitimate winnings.

Cuckoo smurfing

Unlike traditional smurfing, cuckoo smurfing exploits unsuspecting customers’ legitimate bank transactions to launder money. This method is more complex than traditional smurfing because it involves disguising illegal money within legitimate transactions, making it harder to detect.

The term ‘cuckoo’ comes from the cuckoo bird’s practice of laying its eggs in other birds’ nests, similar to how criminals insert their funds into legitimate transactions.

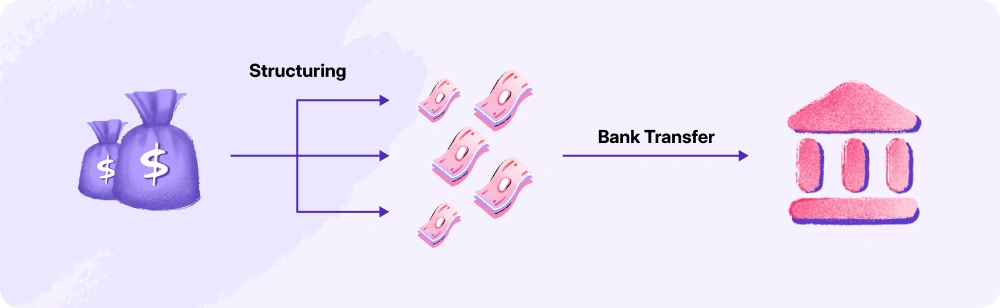

Smurfing vs. structuring

Smurfing and structuring are often used interchangeably. And, while they do share similarities, understanding their distinctions is crucial for effective detection and prevention.

We already know that smurfing involves breaking down a large sum of illicit money into numerous smaller transactions to evade regulatory scrutiny. For instance, imagine a criminal organization wanting to $500,000 into banks without raising suspicion.

Instead of depositing it all at once, they recruit 10 ‘smurfs’, each depositing $5,000 into different bank accounts at various branches across multiple cities over several days. These smaller transactions help the criminals bypass bank reporting limits, and subsequently regulatory authorities.

Structuring, on the other hand, involves splitting large cash transactions into smaller ones to hide the source of the fund.

Imagine an individual receives $150,000 in undeclared income and wants to deposit it into their bank without triggering a suspicious activity report (SAR). Since banks must report deposits above $10,000, the person decides to deposit $9,500 in cash every few days across different branches of the same bank. They may also withdraw and redeposit money in similar amounts to create a complex pattern.

The goal is to successfully integrate the money into the financial system without exposing the source of the funds.

Remember it this way–The purpose of smurfing is to avoid detection by authorities whereas structuring is done to camouflage the origin of the fund source.

Below is a quick table that summarizes both these money laundering techniques and their differences.

Key differences between smurfing and structuring

| Aspect | Smurfing | Structuring |

| Participants | Involves multiple individuals (smurfs) conducting small transactions across various accounts or institutions. | Can be carried out by a single person manipulating transaction amounts. |

| Purpose | Bypass reporting requirements and evade regulatory authorities. | Conceals the source and nature of illicit funds. |

| Complexity | More complex, involving many transactions across several institutions, making detection harder. | Simpler, focusing on splitting a large transaction into smaller parts. |

| Geographical scope | Often spans multiple regions or countries, utilizing various banks and financial systems. | Generally confined to a single jurisdiction, making use of local financial institutions. |

| Detection difficulty | Harder to detect because of the dispersed nature of transactions across various accounts and individuals. | Easier to detect through monitoring patterns of transactions just below reporting thresholds. |

What is smurfing in iGaming?

Smurfing in iGaming involves creating multiple accounts on online casinos, betting platforms, or poker sites to place bets and withdraw ‘clean’ money as gambling winnings.

Players often do this to evade bans, claim multiple sign-up bonuses, or manipulate games by colluding with themselves across accounts. For instance, in poker, a smurfer might use several accounts at the same table to control outcomes.

Smurfing is also a prevalent tactic in cryptocurrency money laundering, where small transactions are made across various wallets to obscure the trail of illegal funds.

Examples of smurfing in fraud

Here are some real-world cases where smurfing was used to deposit illicit money into online gaming accounts, later withdrawing it as clean funds.

- Operation Shadow Web (2016): A major European smurfing network laundered over €200 million by using smurfs to deposit small amounts of illicit cash into online gaming accounts. The ‘clean’ winnings were withdrawn across various countries.

- Australian Casino Laundering Case (2019): Smurfs laundered money by placing small bets on casino games using criminal proceeds. They deposited funds into multiple casino accounts and later claimed the funds as legitimate winnings.

How is smurfing carried out?

Smurfing involves the following tactics to create a complex web of transactions to evade regulators and ultimately hide the true source of the funds:

- Breaking transactions into smaller amounts

Criminals divide large sums into smaller cash transactions to stay below reporting thresholds. For example, instead of depositing $20,000 in one account, they may deposit $2,000 into ten different accounts to avoid scrutiny.

- Use of multiple accounts or intermediaries

Smurfers often use multiple intermediaries or deposit funds into each bank account strategically to make their transactions appear legitimate. This makes it more challenging for law enforcement agencies and regulatory authorities to track the flow of money.

- Movement of funds across different financial institutions

By spreading transactions across multiple banks, credit unions, or payment processors, criminals make it harder for any one institution to detect the full scope of the laundering scheme.

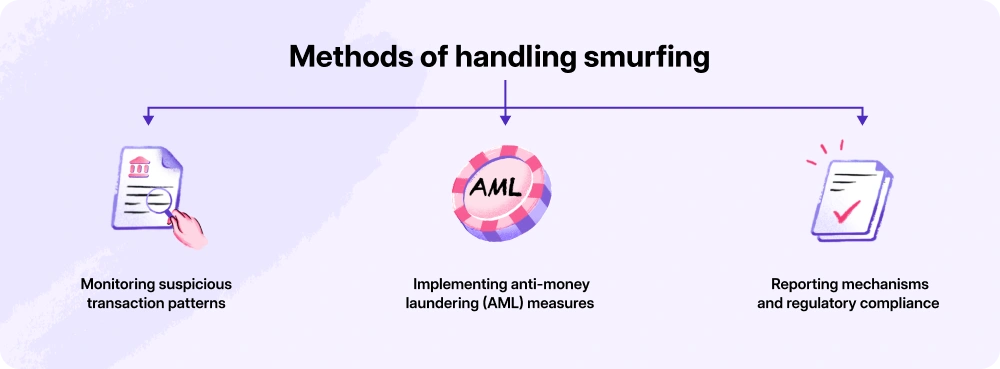

How to detect and handle smurfing?

Detecting and handling smurfing requires a combination of proactive monitoring and strong anti-money laundering (AML) laws and policies:

Monitoring suspicious transaction patterns

Look for red flags such as:

- Frequent small deposits or withdrawals: Multiple small transactions, especially from individuals not typically associated with frequent activity, can signal smurfing.

- Unusual transaction patterns: Watch for deviations from a customer’s usual behavior, such as large deposits followed by numerous small withdrawals.

- Multiple accounts: Customers with multiple accounts, especially those linked to different identities or locations, may be involved in smurfing.

- Complex transaction structures: Transactions involving multiple intermediaries, jurisdictions, or frequent movement of funds across institutions can indicate smurfing.

Implementing anti-money laundering (AML) measures

A robust AML program should include:

- Customer due diligence (CDD): To verify customer identities and understand their transaction behavior.

- Transaction monitoring systems: Automated systems that flag suspicious activities based on predefined rules and transaction patterns.

- Regular audits and reviews: Ongoing assessments to ensure internal controls and AML systems are functioning effectively, and to stay compliant with anti-money laundering laws.

Reporting mechanisms and regulatory compliance

When smurfing activity is suspected:

- Conduct internal investigation: Run an in-depth investigation to gather evidence and assess the scope of the fraudulent behavior.

- File Suspicious Activity Reports (SARs): Report suspicious activity to the relevant authorities once suspicions are confirmed.

- Block transactions and accounts: Temporarily block any accounts involved in the suspected activity to prevent further illegal transactions.

By combining these detection techniques, AML measures, and reporting mechanisms, businesses can effectively detect and address smurfing while ensuring compliance with regulations and reducing their exposure to financial crime.

| Fact: In 2020, banks worldwide paid $10.4 billion in fines for failing to prevent money laundering, exposing major gaps in financial crime enforcement! |

Best practices to prevent smurfing

To effectively prevent smurfing, businesses should:

- Conduct risk assessments

To effectively combat smurfing, begin with a comprehensive risk assessment of your business operations.

Identify vulnerabilities in your systems, such as weak points in transaction monitoring or customer onboarding processes. Evaluate geographic risks, customer profiles, and product offerings that could be exploited for smurfing.

Use data analytics to map out potential risk scenarios and prioritize areas needing immediate attention. Regularly revisit and update these assessments to reflect changes in regulatory requirements, emerging threats, and shifts in your business model.

- Establish internal controls and AML policies

Develop a detailed anti-money laundering (AML) framework that includes specific controls to deter smurfing. Implement transaction threshold limits and reporting protocols for cash deposits, withdrawals, and transfers.

Introduce automated systems to flag patterns indicative of smurfing, such as frequent, just-below-threshold transactions. Assign clear roles and responsibilities to staff for monitoring and reporting suspicious activities. Ensure your policies align with local and international AML regulations, and document all procedures for audit readiness.

Ensure these controls are continuously updated to address emerging threats, including various types of money laundering schemes.

- Execute Customer Due Diligence (CDD)

Strengthen your CDD processes by verifying customer identities using reliable, independent sources. Use advanced identity verification tools, such as biometric authentication or document verification software, to reduce the risk of fake or stolen identities.

Plus, maintain up-to-date customer profiles and periodically reassess their risk levels based on transaction behavior.

- Continuously monitor and audit the AML program

Deploy advanced monitoring systems to track transactional behavior in real time. Use machine learning algorithms to detect anomalies, such as repeated small transactions or unusual activity across multiple accounts.

Conduct regular internal audits to evaluate the effectiveness of your AML controls and identify gaps. You may also engage third-party auditors for an unbiased review of your program’s compliance with regulatory standards.

Conclusion

Smurfing has become an increasingly popular money laundering technique to disguise the origin of illegal proceeds. Key industries, including banking, retail, real estate, and iGaming, are highly susceptible to it. If your business falls in one of these categories, HyperVerge is here to help.

By leveraging AI-driven technology, HyperVerge offers real time AML screening and transaction monitoring, comprehensive risk profiling, and smooth compliance with regulatory standards. This enables your business to detect suspicious activities and proactively block fraudulent transactions before they cause damage.

What’s more? HyperVerge’s identity verification system enables fast, accurate, and compliant customer onboarding, ensuring only legitimate individuals are processed.

Book a demo today to check out how Hyperverge’s advanced AML solutions can protect your business from financial fraud.

FAQs

1. What is smurfing in cybercrime?

Smurfing in cybercrime disguises the source or destination of an attack by breaking it into smaller, seemingly harmless transactions, making it harder to trace.

2. What is an example of smurfing?

A classic example of smurfing could be criminal launders depositing $100,000 by making small deposits of $9,000, $8000, or $7000 in different permutations and combinations across bank accounts and countries to avoid detection.

3. What is smurfing in anti-money laundering?

In anti-money laundering efforts, smurfing involves breaking up large sums of illegal money into smaller transactions to evade detection by regulators.

4. Is smurfing a crime?

It may be difficult to classify smurfing as ‘legal or ‘illegal’. However, as it provides support to other money laundering activities like drug trafficking, tax evasion, and more, there can be severe legal and financial repercussions for the individuals involved.