Ultimate Beneficial Ownership (UBO) is the individual or entity with the ultimate control or ownership of a company, partnership, trust, or any legal entity. Identifying the Ultimate Beneficial Owner (UBO) is a pivotal aspect of both Know Your Business (KYB) and Know Your Customer (KYC) processes.

Regulatory authorities require businesses and financial institutions like banks, investment firms, credit unions, and insurance companies to diligently identify and verify the UBOs involved in their business transactions.

Neglecting UBO identification can result in heavy penalties, damaged reputation, and increased risks for businesses. Therefore, businesses need to comply with UBO identification requirements to ensure transparency, accountability, and legal compliance.

What is an Ultimate Beneficial Ownership (UBO)?

Ultimate Beneficial Ownership (UBO) is the individual or entity with the ultimate control or ownership of a company, partnership, trust, or any legal entity. While their name might not appear on official paperwork as the owner, they possess significant control, voting rights, and influence over the entity’s decisions, risk management, and direction.

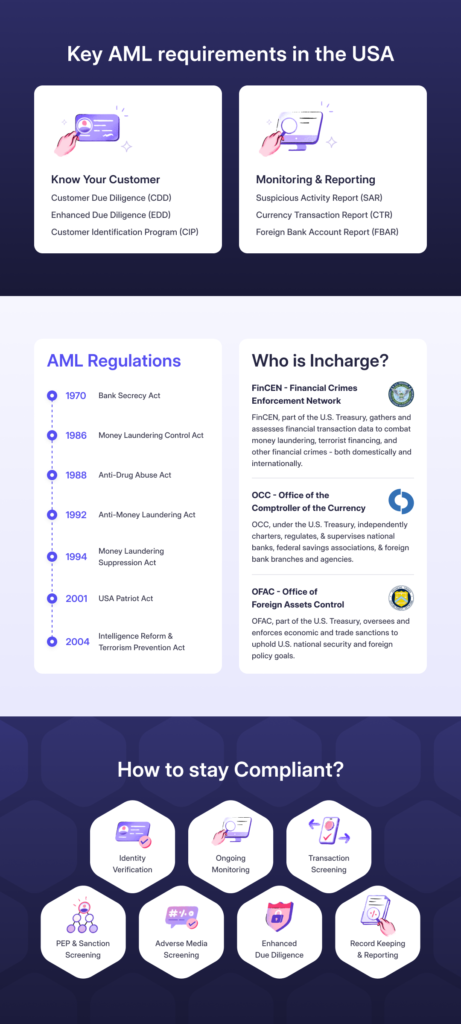

UBO identification is important to prevent serious crimes like money laundering and terrorist financing. When UBOs remain undisclosed, they open routes for individuals to launder money through companies. Prioritizing UBO identification allows countries to combat financial crimes and illicit activities in the financial sector.

Who is the Ultimate Beneficial Owner?

The Ultimate Beneficial Owner (UBO) is the individual or entity that ultimately holds control over a company, even if their name may not appear on official documents.

The UBO can be described as follows:

- People who hold at least a 25% stake in the capital of the legal entity

- People who hold at least 25% voting rights in the general assembly.

- People who are beneficiaries of at least 25% of the capital of the legal entity

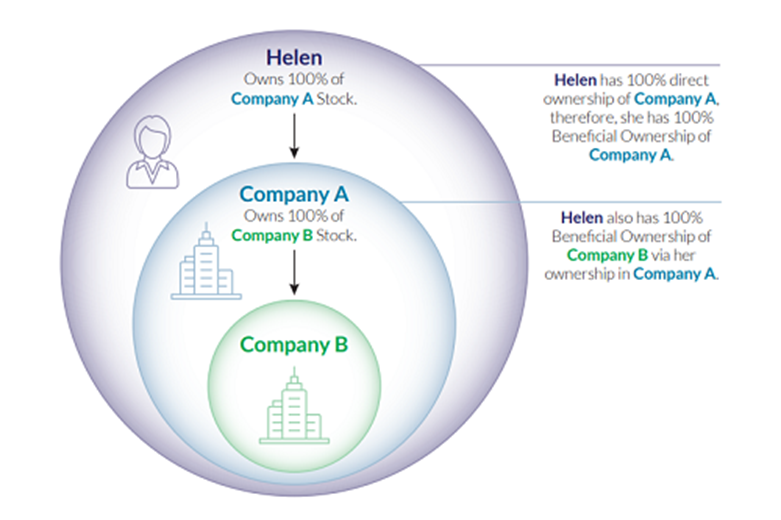

Let’s use Helen as an example to illustrate this concept:

Helen owns 100% of Company A. This means she has complete ownership and control over Company A. In this scenario, Helen is the Ultimate Beneficial Owner (UBO) of Company A, as she directly owns and controls the company.

Now, if Company A, which is wholly owned by Helen, also owns 100% of Company B, the situation becomes a bit more complex. Even though Helen doesn’t directly own Company B, she indirectly controls the beneficial ownership information and the ownership structure of it through her ownership of Company A.

Therefore, in this case, Helen is still considered the natural person, legal owner, ultimate beneficiary, or Ultimate Beneficial Owner (UBO) of Company B, even though her ownership is indirect. This is because she ultimately owns and controls Company B through her complete ownership of Company A.

The Ultimate Beneficial Owner is the person or entity who ultimately benefits from a transaction or legal arrangement. They’re the real person behind the scenes of legal arrangements, even if they’re not directly involved in the transaction paperwork. It also includes those persons who exercise ultimate effective control over a legal person or arrangement.

Identifying UBOs or who controls a company has become a major problem worldwide. It’s important for keeping things transparent, ensuring the financial system runs smoothly, and helping law enforcement.

Both the Financial Action Task Force (FATF) and the European Union stress the increased risk of financial crimes like money laundering and terrorist financing when dealing with third parties and their Ultimate Beneficial Owners (UBOs).

The EU’s Fifth Anti-Money Laundering Directive (5AMLD) mandates UBO screening for senior managers and higher-ranking individuals, a task facilitated by powerful, AML compliance software tools.

Read more: EU Money Laundering Directive (AMLD): Latest Updates 2024

Why UBO Scanning is Important?

International Monetary Fund (IMF) says that money laundering and terrorism funding amounts to more than 800 Billion dollars, somewhere between 2.5% to 5% of the world’s GDP.

Ultimate Beneficial Ownership is mandated for knowing the real entity natural person behind any money transfer businesses or transactions and whether they are by the legitimate owner or not. To prevent any kind of financial fraud, all financial institutions or parties involved want to know the real owner of mutual funds or the to identify ultimate beneficial owners or beneficiary.

Major entities requiring UBO checks are financial institutions, BFSI, crypto agents, market regulators, or any other organization involved in currency-based financial transactions anywhere. These include:

- Banks

- Stock market dealers/brokers

- Financial Market Agents

- Foreign currency exchange agents

- Commodity brokers

- Hedge fund agents

- Future & Options Merchants

- Blockchain agents

- Digital lenders

- Casinos

Many fraudsters and terror agents hide behind fake corporations and organizations’ doors, which must be monitored regularly. UBO scanning helps in identifying such fraudulent entities and organizations. UBO identification prevents any such malicious intents of these fraudsters.

So many mala fide practices have been revealed in government agencies in the past via tax evasion, havens for financial crime, terrorism financing, and offshore island frauds. Most of them were successful in criminal activities while framing ‘Ghost Firms’ using fake account details, emails, and identities.

UBO helps establish the credibility of any organization, and when they fail to provide valid financial statements, they become a suspect and a cause for investigation.

UBO helps businesses in:

- Regulatory requirements

- Enhancing customer experience

- Reducing operational costs

- Improving productivity

- Gaining competitive advantage

How to Identify the UBO?

Identifying the Ultimate Beneficial Owner of a company can be challenging, particularly in organizations with complex corporate structures and. However, it’s crucial for maintaining transparency and complying with regulations. Here’s a structured approach to UBO identification:

Acquisition of Credentials

Start by collecting information about the company, including its registration number, name, official status, address, and key management personnel. This data is crucial for complying with Anti-Money Laundering/Counter-Terrorist Financing (AML/CTF) regulations.

Understand the Company’s Ownership Structure

Research who holds shares or interests in the company, and whether this ownership is direct or indirect.

Identify the UBO

Identify individuals who hold substantial shares or control within the company, extending the investigation beyond immediate shareholders to those exerting indirect influence. Assess the total percentage of shares, management control, and ownership stake held by each individual to date information to determine if any meet the criteria for being classified as Ultimate Beneficial Owners (UBOs).

Verifying the UBO with KYC/AML Checks

Once the UBO is identified, conduct thorough Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to verify their identity and assess any potential risks associated with their involvement in the company.

Assess the UBO’s Potential Risks

Once the former UBO’s identity or identity has been verified, it’s crucial to assess their potential risk for involvement in money laundering or other financial crimes. This assessment may entail reviewing their financial history, their other business relationships and dealings, relationships and activities, and any other pertinent factors that could signal potential risk.

Read more: What is the AML risk assessment process?

Recordkeeping and Ongoing Monitoring

Maintain detailed records of the UBO identification process, including all documentation and due diligence conducted. Implement ongoing monitoring to stay updated on any changes in the UBO’s status or potential risks associated with their involvement in the company. Regular reviews and updates are essential to maintaining regulatory compliance with UBO regulations and mitigating risks effectively.

Read more:

- What is transaction monitoring?

- What is a Suspicious Activity Report?

Best Practices to Verify the UBO

Let’s discover effective strategies for confirming Ultimate Beneficial Ownership (UBO), ensuring transparency and compliance in financial transactions and business dealings.

Use Advanced AI Technology to Automate the Verification Process

Companies can automate UBO verification using AI technology by employing document recognition, facial and biometric authentication, and fraud detection algorithms. This streamlines the verification process and improves accuracy, and security by quickly analyzing data, detecting fraud, and ensuring compliance.

Automation saves time and resources while maintaining regulatory standards, making the verification process faster and more efficient.

Regularly Review UBO Information

Regularly reviewing Ultimate Beneficial Ownership (UBO) information helps prevent financial crimes by allowing companies to detect any suspicious transactions and activities promptly, guarantee transparency in new business relationship relationships, and comply with regulations. This helps safeguard the company’s reputation and financial integrity.

Document and Maintain the Records

Companies can maintain comprehensive UBO documentation by collecting and verifying ownership information. This involves identifying beneficial owners and their ownership percentages. Keeping accurate records of Ultimate Beneficial Owner (UBO) details and ownership structures is crucial. Employing secure databases or AML software can streamline record-keeping processes and ensure data integrity.

Regular reviews and updates of UBO information are essential to comply with regulations and mitigate the risk of financial crimes.

UBO Compliance Made it Easy

Advanced AI technology can automate UBO verification processes, including document recognition, facial and biometric authentication, and fraud detection algorithms. Regularly reviewing UBO information, and documenting and maintaining comprehensive ownership records is important for detecting suspicious activities, ensuring transparency, and complying with regulations.

Learn more about HyperVerge’s AML solutions and sign up here for a demo.

Read more: What is FBO?