Money Service Businesses (MSBs) play an important role in financial services. Unlike traditional banks, MSBs facilitate the transmission, exchange, or conversion of money; they include entities such as fintechs, cryptocurrency platforms, and currency exchange services.

Even though they’re not banks, MSBs still have to comply with regulations like the Bank Secrecy Act (BSA) to ensure they’re not involved in illegal money activities. This means MSBs must be careful about preventing money laundering.

MSBs must follow strict rules to prevent money laundering, making it essential for them to watch out for illegal financial activities. This article will help you understand the types and examples of money services businesses, regulatory requirements for MSBs, and how to stay compliant with AML requirements and regulations.

Types of Money Services Business

As defined by the Financial Crimes Enforcement Network (FinCEN), the Money services business includes five distinct types of service providers and the U.S. Postal Service:

- Currency Dealers or Exchangers: These businesses deal with buying and selling physical currency, including foreign currency. They may operate exchange bureaus, kiosks at airports, grocery stores, or storefronts where individuals can exchange one currency for another.

- Check Cashers: Check cashing services accept checks from customers and provide them with the equivalent amount in cash in one or more transactions minus a fee. They cater to individuals who may not have access to traditional banking services or need immediate access to funds.

- Issuers of Traveler’s Checks, Money Orders, or Stored Value: These MSBs provide financial instruments such as traveler’s checks, money orders, or stored value bank cards (like prepaid debit cards). These instruments can be used as alternatives to cash for making payments or accessing funds securely.

- Sellers or Redeemers of Traveler’s Checks, Money Orders, or Stored Value: Unlike the issuers, these MSBs primarily sell or redeem traveler’s checks, money orders, or stored value instruments to consumers. They act as intermediaries between customers and the issuers, providing convenient access to these financial products.

- Money Transmitters: Money transmitters facilitate funds transfer between individuals or businesses. They often use electronic means to transmit money domestically or internationally, offering services such as wire transfers, online money transfers, and remittances. This category includes a wide range of entities, from traditional wire transfer services to fintech startups and cryptocurrency platforms.

These different types of Money Service Businesses play important roles in providing financial services to consumers and businesses, catering to various needs such as currency exchange, check cashing, payment transfers, and access to alternative financial instruments.

Examples of Money Service Business

Here are some examples of money services business:

- Currency Exchange: These businesses specialize in swapping one currency for another, covering both traditional fiat currencies and cryptocurrencies. Examples include Forex, Coinbase, eToro, Gemini, Binance, and Robinhood, all of which offer currency exchange services to their client.

- Digital Payment Processors: Digital payment processors facilitate electronic funds transfers between parties. In the U.S., popular examples include PayPal, Cash App, and Venmo. Globally, platforms like JumiaPay in Africa, Mercado Pago in Latin America, and SeaMoney in Southeast Asia serve similar functions.

- Money Transfer Services: These services enable the transfer of money from one individual to another. Well-known names in this category include MoneyGram, Western Union, Wise (formerly TransferWise), and Flywire.

- Remittance Processors: Remittance processors focus on facilitating money transfers from individuals in different countries to their family, friends, or acquaintances in other countries. Examples include Remitly, WorldRemit, Instarem, and Xoom. It’s worth noting that many money transfer services also provide remittance services alongside their primary offerings.

Requirements for MSBs

Money Services Businesses (MSBs) must follow various requirements to ensure compliance with regulations and mitigate risks associated with money laundering and illicit financial activities. Here are some key requirements that MSBs must fulfill:

MSB Registration Requirements

All Money Services Businesses (MSBs) in the US must register with the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). New MSBs must file FinCEN Form 107 within six months of starting operations and renew filing it every two years. They must also keep registration documentation for at least five years at a US-based location.

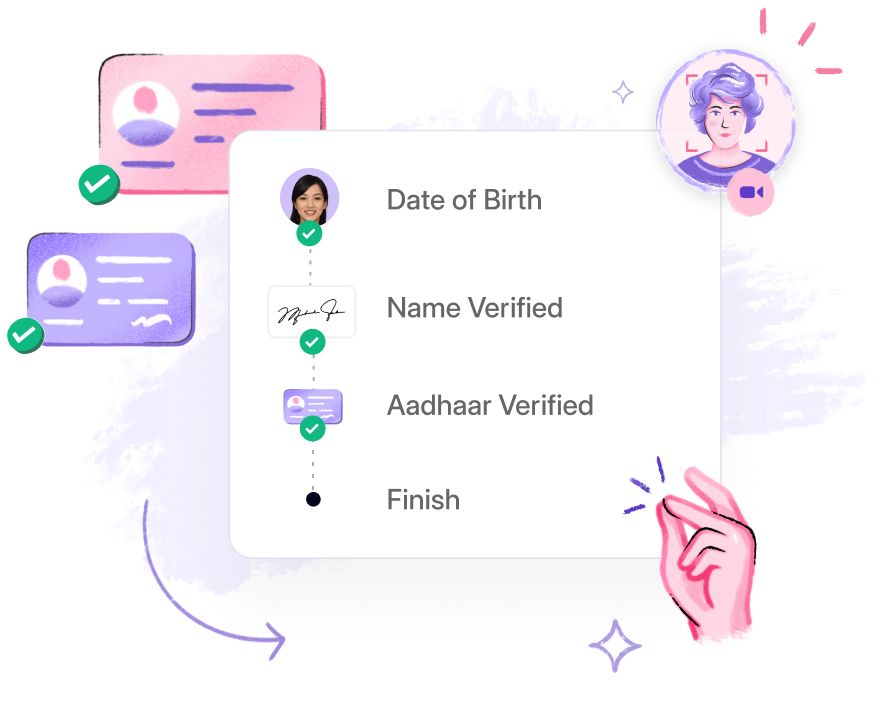

Know Your Customer (KYC)

MSBs must verify customers’ identities before providing services to prevent unauthorized transactions and ensure traceability. This involves a KYC process, which collects essential information like name, date of birth, address, and taxpayer ID, such as SSN or TIN. Verification methods may include government ID checks, database inquiries, or document authentication.

AML-based Risk Approach

Financial institutions, including MSBs, must adopt a risk-based approach to AML. This means tailoring AML policies to the specific money laundering risks of the business. This approach should be informed by both an internal AML program and risk assessment, as well as a customer risk assessment. It should periodically be adjusted as the risk profile changes.

Read more:

What is AML risk assessment?

Suspicious Activity Report (SAR)

Money Services Businesses (MSBs) offering specific services are obligated to monitor customer activities and report any suspicious transactions. These services include :

- Transmitting money.

- Issuing, selling, or redeeming money orders.

- Issuing, selling, or redeeming traveler’s checks.

The Money services business must file a Suspicious Activity Report (SAR) whenever a transaction is suspected or known to involve unlawfully acquired funds. Additionally, a SAR must be submitted if a transaction appears to be structured to evade reporting requirements or lacks a lawful purpose.

The Money services business must file the SAR within 30 days of becoming aware of the suspicious activity. Moreover, MSBs are mandated to submit a Currency Transaction Report (CTR) for any cash transaction exceeding $10,000.

Complying with the AML Regulations

Compliance with Anti-Money Laundering (AML) regulations is essential for Money Services Businesses (MSBs) to maintain integrity and legality in their operations.

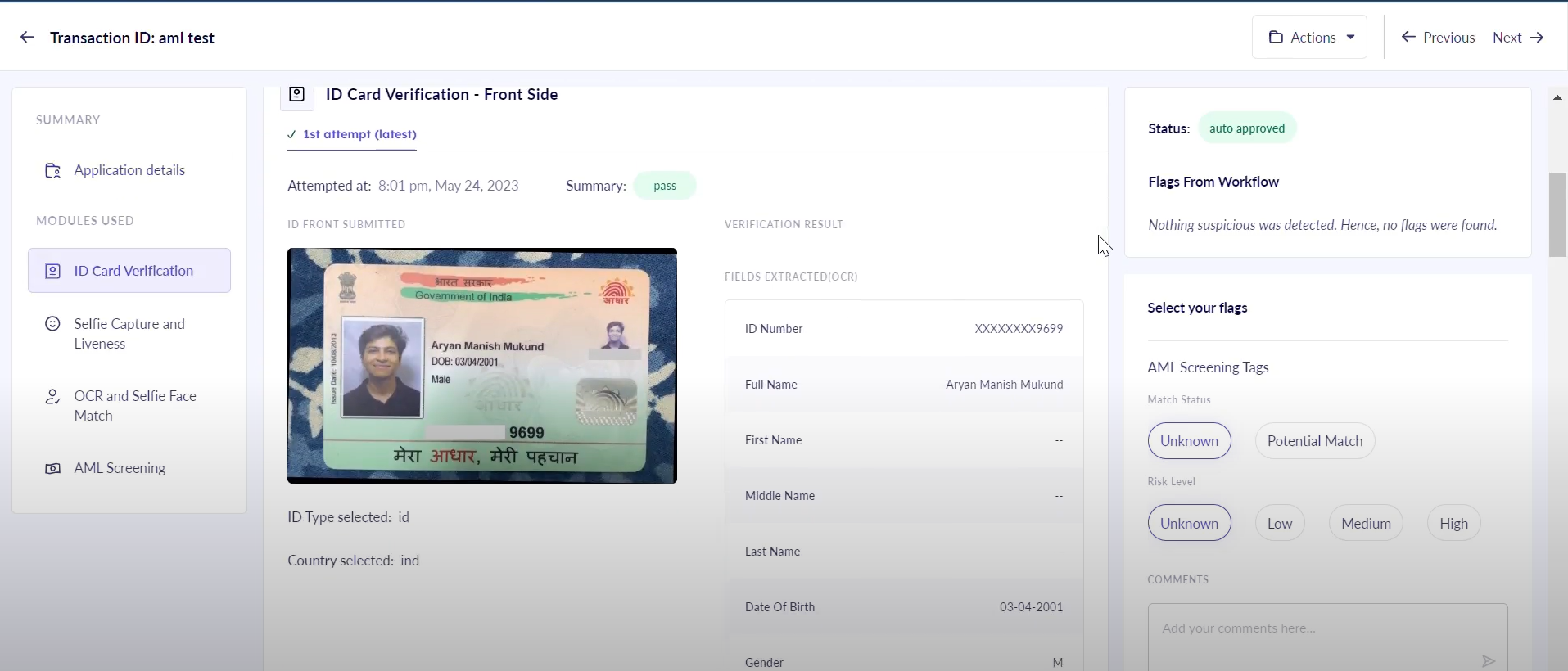

Our AML solutions play an important role in helping MSBs achieve compliance by enabling thorough customer due diligence, real-time transaction monitoring, automated reporting of suspicious activities, and implementation of risk-based approaches to AML compliance.

By leveraging advanced technologies, MSBs can detect and prevent illicit financial activities while ensuring regulatory compliance. To learn more about our AML solutions that can benefit your MSB, visit HyperVerge’s AML Solutions.

US

US

IN

IN