Reliable identity verification is important for businesses to protect transactions and optimize the customer onboarding process.

However, businesses using AI-driven identity verification solutions like Socure face practical challenges.

Despite Socure’s advanced capabilities, some users find it expensive and difficult to scale as their businesses grow.

Check out the alternatives beyond Socure with our curated list of the top 10 Socure competitors to help you select the one that suits your requirements.

Why should you consider Socure competitors?

When it comes to Socure, the first thing that comes to mind is its expertise in identity verification. Socure is known for its powerful tools that assist businesses in verifying identities and meeting KYC compliance standards. However, with the advancements in technology, constantly keeping an eye on competitors is essential to adopting the latest authentication methods and fraud prevention techniques.

Check out the reasons why you should consider Socure alternatives.

| • Advanced fraud detection: Competitors use advanced artificial intelligence and machine learning technologies to analyze vast datasets, detect complex patterns, and adapt to emerging fraud tactics. • Superior document verification: Alternatives provide high-resolution document analysis and multilingual OCR to ensure quick and accurate verification of diverse global docs. • Flexible pricing options: Competitors offer more adaptable pricing structures and tiered plans to accommodate diverse budgetary needs without compromising quality. • Regulatory expertise: Providers with deep regional compliance knowledge offer tools and support to navigate complex regulations like GDPR or CCPA to ensure legal adherence and decrease compliance risks. |

Let’s discuss the entire process we follow to shortlist the top 10 competitors of Socure.

How we analyzed and selected the Socure competitors & alternatives

We followed an extensive process that involved thorough market evaluation and detailed analysis to shortlist the best competitors. Here is our manual process to identify and list these leading Socure alternatives.

- We evaluated almost 50+ Socure alternatives that specialize in providing powerful identity verification solutions.

- We compared each company’s reviews and ratings on reliable platforms like G2 and Capterra.

- We shortlisted the provider based on factors like identity verification features, pricing models, scalability, data security measures, and customer support.

We followed this complete process to save time and effort. This evaluation process also helps us find a reliable alternative for your unique verification requirements.

A complete overview of the 10 best Socure competitors

Here is the table containing the overview of the top competitors, highlighting their core capabilities, free trial availability, and the type of business these competitors serve.

| Top competitors | Core capabilities | Free trial availability | Best for |

| Automated KYC process with verification done in 3 seconds | A 30-day free trial is available with a sandbox environment | • Startups • Small-scale businesses • Mid-sized companies • Enterprises | |

| Covers 15,000+ global AML sources | No free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Boasts a High pass rate of 91.64% in the US | A 14-day free trial is available | • Small-scale businesses • Mid-sized companies | |

| Using Smart Capture SDKs to reduce verification time | No free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Extracts data from 3,500+ government-issued documents | A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Integrates AML screening, case management, and regulatory reporting | A 30-day free trial is available | • Startups • Mid-sized companies | |

| Boosts conversion rates by up to 2x | A 60-day free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Automates 98% of identity checks | A 15-day free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Quickly identifies anomalies with a high level of certainty | A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | |

| Uses 3,000+ data points for comprehensive KYC checks | A 14-day free trial is available | • Small-scale businesses • Enterprises |

Here is an in-depth look at the top 10 Socure alternatives and competitors, providing detailed insights into what each brings to the table.

An in-depth list of the top 10 Socure alternatives and competitors

1. HyperVerge

HyperVerge ONE is a leading identity verification software known for reducing drop-offs during customer onboarding. It has 98% completion, 99% auto approval rates, and a 50% decrease in user drop-offs. The low code approach of HyperVerge helps businesses to go live within 4 hours.

The platform streamlines the onboarding process, freeing up resources for strategic initiatives while optimizing the customer conversion funnel. Not only this, but the software enhances conversion rates and prevents fraud.

Also, the platform’s security features, including AI-driven face validation, ID verification, and real-time fraud detection, ensure compliance with global standards such as GDPR and ISO 27018. With a focus on customer satisfaction and operational excellence, HyperVerge has earned recognition as a top face recognition solution in the US and APAC regions.

Targeted industries

Financial services, education, gaming, remittance, crypto, marketplaces, logistics and eCommerce.

Features better than Socure

- Third-party integrations: The open architecture allows easy integration with various third-party systems and databases. This flexibility helps businesses to create a tailored ecosystem.

- Address validation: Matches user-provided address information with reliable databases to ensure accuracy and detect potential fraudulent activities related to false addresses.

- Transaction monitoring: Analyzes patterns, flags suspicious activities, and helps businesses comply with regulatory requirements by identifying potential money laundering or fraudulent transactions.

- Face analysis: Beyond basic recognition, the software detects all the other information, such as age and gender, to provide an extra layer of security and enable personalized user experiences.

HyperVerge pricing

HyperVerge excels at providing various pricing models for all types of businesses. Let’s check out the detailed pricing.

| Start plan (Startups) The Start plan includes a free trial and easy integration within 4 hours. It also offers tools to view and manage verification for one month. | Grow plan (Mid-size companies) The Grow plan involves everything covered in the Start plan, and it also includes an end-to-end ID verification suite, access to AML checks, central database checks, and customized business workflows. | Enterprise plan (Enterprise-level organizations) The Enterprise plan involves all the features and offerings from the Grow plan, along with a custom price structure and collaborative tools. |

What do HyperVerge users say?

Client video testimonial

Check out how HyperVerge became a pillar of customer onboarding journey of PDAX.

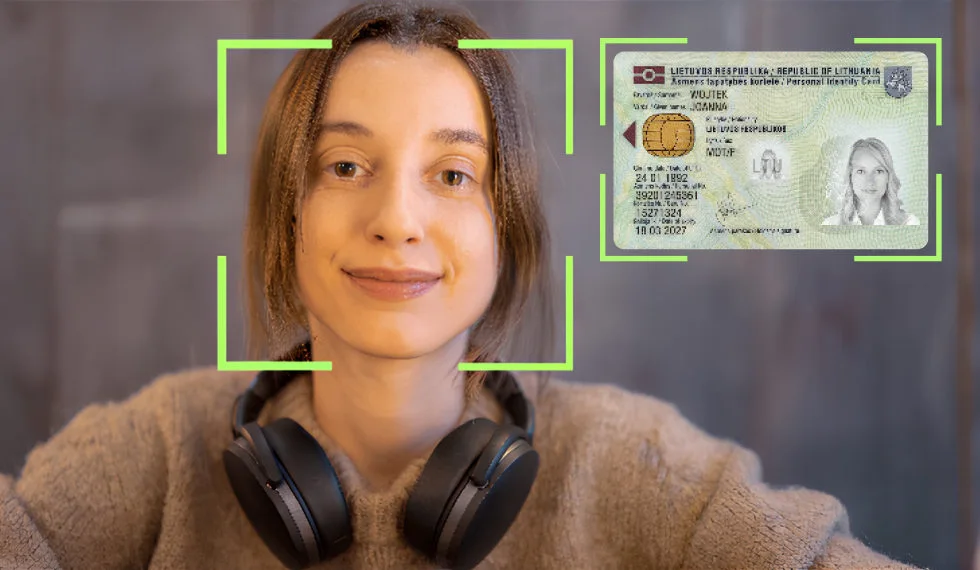

2. Ondato

Ondato is a reliable KYC solution that helps manage every aspect of client identity verification, from initial onboarding to ongoing lifecycle management. Ondato integrates essential Know-Your-Customer (KYC) and Anti-Money Laundering (AML) tools with digital identity verification services. This innovative solution enhances operational efficiency by simplifying internal processes and adapting easily to regulatory changes.

Targeted industries

Financial services, insurance, legal, gambling, cryptocurrency, and telecommunications.

Ondato pricing

Ondato pricing plans start at $0.99 per verification, and the monthly license fee varies depending on the plan. Custom options are even available for enterprise-level organizations.

Key features of Ondato

- Biometric face matching: Biometric technology is used to verify customers to ensure that the person presenting the ID is the same individual initiating the verification process.

- Document verification: The AI-powered document verification of Ondato checks for alterations, tampering, or inconsistencies to ensure that submitted documents are valid.

- Fraud prevention: Integrates multiple layers of security, including ID spoofing checks and registry confirmations, to help businesses mitigate the risk of identity theft.

| Pros of Ondato✓ Users say the software helps complete the verification process in a few minutes.✓ Simplifies user experience with an intuitive and straightforward interface.✓ Users report encountering zero bugs while using the software.Cons of Ondato✕ Users find the initial integration of the platform a bit tricky.✕ Some users find investigating specific adverse media findings or sanctions for rejected individuals challenging. |

Ondato compared with Socure

Ondato offers easier setup and administration, and users prefer it for business transactions over Socure.

3. Sumsub

Sumsub is a top-notch identity verification software that helps secure every step of the user journey through a unified dashboard. This solution helps businesses verify individuals, businesses, and transactions while managing cases and eliminating fraud risks. Through ongoing monitoring and behavioral analysis, Sumsub detects suspicious activities in transactions to enhance fraud prevention measures.

Targeted industries

Fintech, online gaming, trading, crypto, transportation and marketplaces.

Sumsub Pricing

Sumsub offers various plans starting at $1.35 per verification, with a monthly commitment and the availability of custom pricing for enterprises.

Key features of Sumsub

- ID verification: Facilitates smooth online identity verification globally to ensure compliance with local and international regulations.

- Liveness and face match: Uses advanced AI algorithms to verify identities with liveness checks and accurate face matching.

- AML screening: Performs thorough screening against Politically Exposed Persons (PEP) and sanctions lists to minimize financial risks related to money laundering.

| Pros of Sumsub✓ Sumsub’s fast and easy verification process reduces drop-outs, which increases conversion rates.✓ Offers automated rejection tag that helps reduce manual work and provides exceptional accuracy.✓ Users find the technical team to be friendly and supportive.Cons of Sumsub✕ There are instances where Sumsub declines to accept diverse versions of the same documents.✕ Certain users face issues, like the automatic check for expired documents not being included. |

Sumsub compared with Socure

Sumsub provides specific features like compliance reporting and transaction monitoring, which is something that Socure fails to deliver.

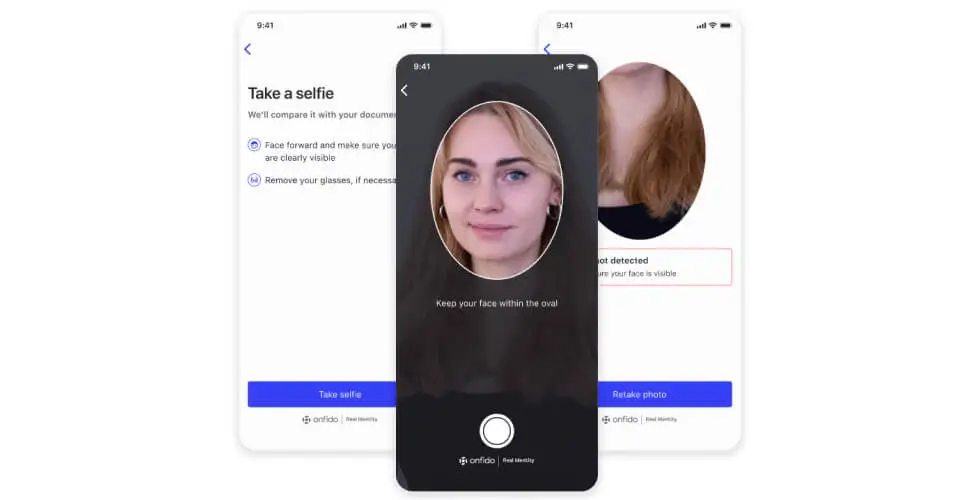

4. Onfido

Onfido is a trusted platform offering a complete suite of identity verification solutions tailored to meet the unique needs of global businesses. The platform combines advanced AI technology with a user-centric approach to streamline customer onboarding processes. It also integrates document and biometric verifications, global data checks, and robust fraud detection signals. Whether ensuring compliance with KYC and AML regulations or enhancing customer trust with secure digital interactions, Onfido helps businesses confidently onboard new users.

Targeted industries

Financial services, banking, remittance, gaming, transport, eCommerce, healthcare, and telecommunication.

Onfido pricing

Contact Onfido for current pricing.

Key features of Onfido

- Document verification: Supports several ID types and uses AI to authenticate documents swiftly and accurately which ensures compliance with global regulatory standards.

- Biometric verification: Enhances identity verification accuracy and security with advanced biometric capabilities like facial recognition and liveness detection.

- Fraud detection: Fraud detection signals are used to identify and prevent fraudulent activities during the onboarding process.

| Pros of Onfido✓ Provides integration options to integrate into existing workflows.✓ Offers effective detection of false documents with low false positive rates. ✓ Applies strong algorithms to identify fraud documents and offers fair visibility of checks through the dashboard.Cons of Onfido✕ Some users find the reporting options to be not sufficient.✕ Users face issues with rejecting the genuine document even after uploading it multiple times. |

Onfido compared with Socure

Onfido easily integrates with known software solutions like Microsoft 365, Bitstamp, and Okta, whereas Socure fails to do so.

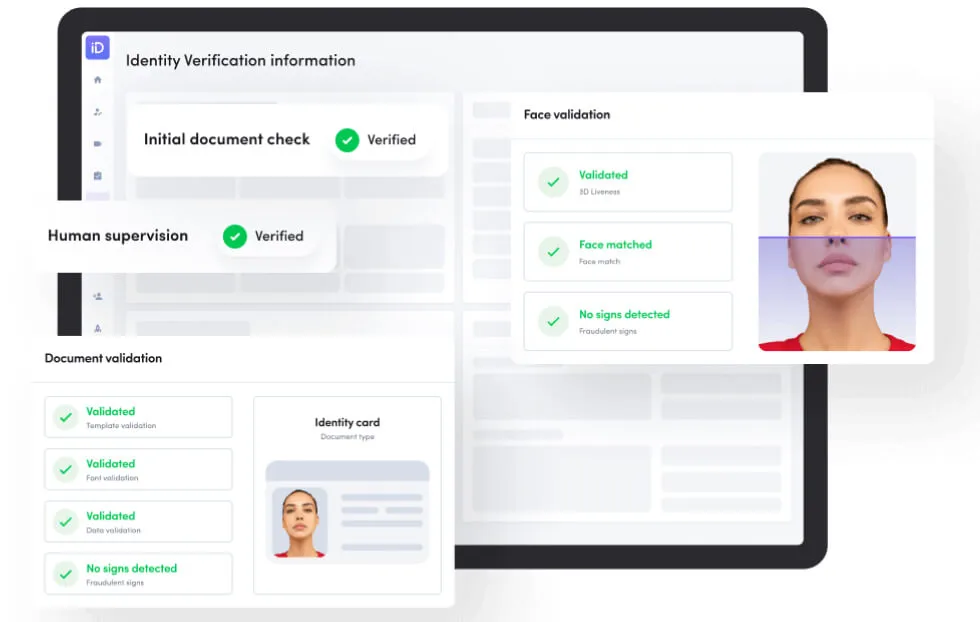

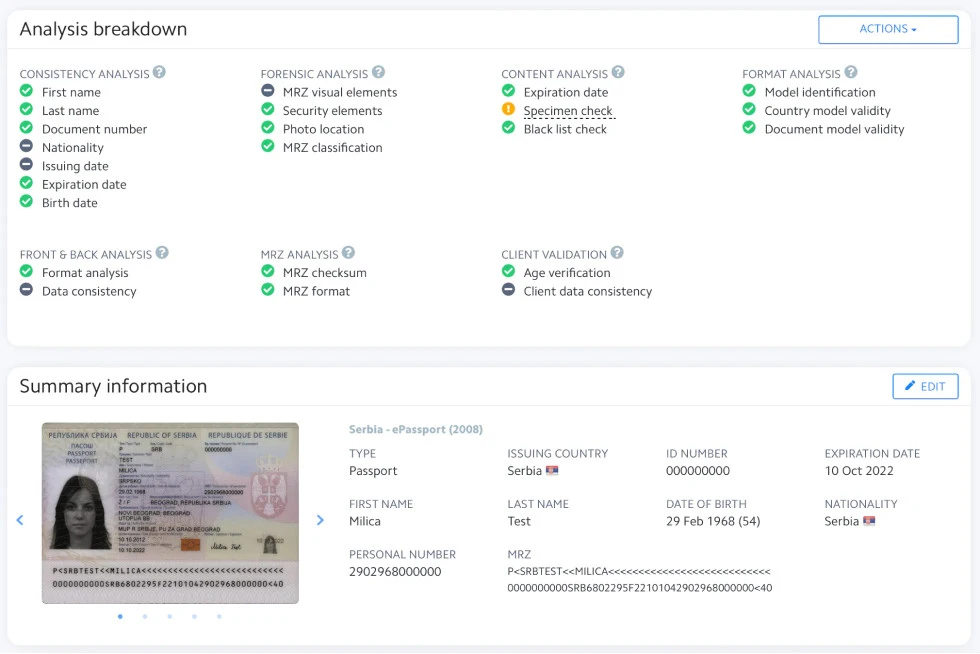

5. iDenfy

iDenfy is a powerful identity verification platform that streamlines user onboarding and strengthens security measures for businesses across various industries. By integrating advanced technology with a user-friendly interface, iDenfy helps businesses to scale rapidly while mitigating fraud risks. The platform offers easy integration for web, mobile apps, and iFrames. iDenfy supports regulatory requirements like KYC, Know Your Business (KYB), and AML to ensure adherence to global standards.

Targeted industries

Fintech, crypto & blockchain, online gambling, eCommerce, gaming, and transportation.

iDenfy pricing

Contact iDenfy for current pricing.

Key features of iDenfy

- Document extraction: Extracts data from over 3,500 government-issued documents to enable quick and accurate identity verification processes.

- Advanced fraud detection: Uses AI-powered biometric recognition and 3D liveness detection technology to identify fraudulent attempts in real-time.

- Continuous monitoring and screening: Offers ongoing screening against watchlists, sanctions lists, and PEPs to minimize risk exposure.

| Pros of iDenfy✓ Setup is easy, and the validation of ID documents is much faster.✓ Users like their pricing structure, which covers denied and unsuccessful verifications.✓ iDenfy’s readily accessible documentation and assistance is exceptional.Cons of iDenfy✕ Some users find the cost to be high.✕ Users are not clear about several anti-money laundering features of the software. |

iDenfy compared with Socure

iDenfy offers features like PEP & sanctions screening, and phone verification that Socure does not provide.

6. SEON

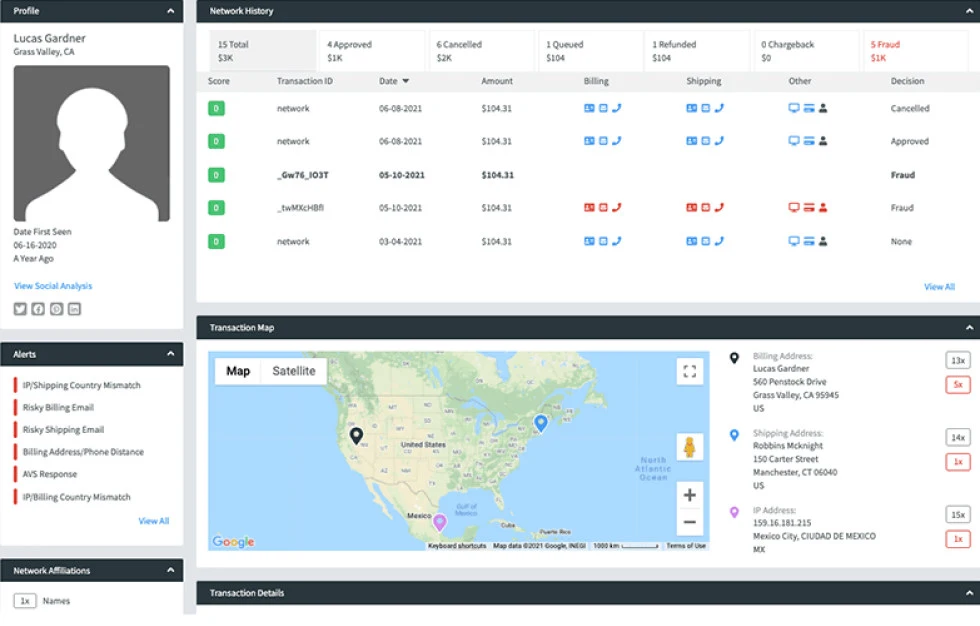

SEON is a leading AI-driven fraud prevention platform that protects businesses from fraudulent activities like account takeovers, synthetic identities, and money laundering. SEON provides a complete solution that keeps up with changing fraud risks while ensuring a smooth customer experience. From onboarding to real-time activity monitoring, the platform monitors user behavior continuously to identify and block suspicious activities while facilitating smooth transaction validations for legitimate users.

Targeted industries

Financial services, gaming, retail, payment fraud, and fintech.

SEON pricing

Contact SEON for current pricing.

Key features of SEON

- Advanced digital footprinting: Captures and analyzes extensive online user data to verify identity and detect fraudulent patterns during the onboarding process.

- AI-driven fraud detection: Uses machine learning for dynamic updates and applies anti-fraud rules to allow businesses to adapt to new threats with minimal manual oversight.

- Integrated AML compliance: Consolidates AML screening, case management, and regulatory reporting into one system to ensure compliance and streamlined operations.

| Pros of SEON✓ Users find creating diverse fraud rules to detect fraud patterns easy.✓ Creates a customer experience with less friction with its anti-fraud detection process.✓ Easy to deploy makes SEON the best provider for businesses.Cons of SEON✕ There are instances where loading time takes longer than expected.✕ Use of SEON is a bit tricky at first and fails to offer a better user experience. |

SEON compared with Socure

SEON provides several software solutions, like bot detection and crypto compliance, that Socure can’t offer.

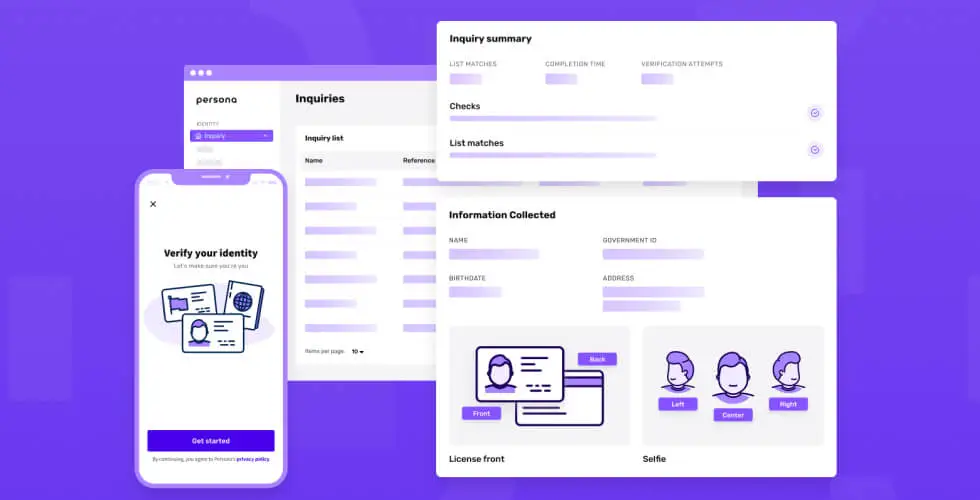

7. Persona

Persona is one of the best identity verification solutions, tailored to meet unique needs. The platform offers customizable building blocks to collect, verify, understand, and orchestrate customer identities. The platform integrates risk signals from third-party sources to consolidate into a unified fraud detection and investigation hub. Persona is a flexible solution that automates identity processes and securely handles sensitive personal data without requiring extensive IT support.

Targeted industries

Fintech, digital health, eLearning, cryptocurrency, and public sector.

Persona pricing

Persona offers different plans starting at $250/month for the Essential plan, with volume-discounted and custom pricing available for Growth and Enterprise plans.

Key features of Persona

- Automated verifications: Achieves up to 98% automation in KYC and KYB processes to optimize compliance and operational efficiency while reducing manual intervention.

- Fraud detection and prevention: Enables proactive identification of fraudsters by consolidating risk signals and employing advanced analytics.

- Flexible identity workflows: Businesses can automate identity-related tasks within Persona, like record updates and user follow-ups.

| Pros of Persona✓ The dashboard is intuitive, and the technical team’s support is exceptional.✓ Offers comprehensive APIs that are simple and easy to integrate.✓ Even for non-technical users, setting up the system is uncomplicated and manageable. Cons of Persona✕ Some users find it inconvenient to pay extra fees and handle manual setup for API integration.✕ Certain users report that the OCR feature sometimes malfunctions. |

Persona compared with Socure

Persona excels at adverse media screening, a feature that Socure does not offer.

8. Veriff

Veriff is a top-tier AI-powered identity verification platform that helps authenticate users while preventing fraudulent activities. The software also offers strong fraud prevention solutions that simplify the customer journey. Veriff offers unmatched accuracy and coverage, with 11,500 government-issued IDs recognized. The platform is built for rapid customer onboarding, automating 98% of genuine users on the first attempt.

Targeted industries

iGaming, dating, HR management, crypto, education and healthcare.

Veriff pricing

Veriff offers various pricing plans that start at $0.80 per verification with a monthly minimum commitment of $49 and extend up to custom pricing.

Key features of Veriff

- Biometric verification: Uses facial recognition for user authentication. This feature offers a secure, password-free login that improves security and user convenience.

- AML screening: Performs AML checks by scanning users with international watchlists to ensure compliance and protection against financial crimes.

- Proof of address: Checks the user’s address by comparing the details with trusted databases. This helps meet KYC rules and prevents fraud.

| Pros of Veriff✓ Users praise the tool as ideal for offering customizable integration options.✓ There are users who find the tool excellent in terms of security, fraud prevention, and compliance.✓ Constant improvement and innovation seen in the software is remarkable.Cons of Veriff✕ Reaching out to Veriff’s support team is a bit lengthy process.✕ Certain users face issues integrating Veriff with some CRM systems. |

Veriff compared with Socure

Veriff offers several capabilities that Socure lacks, like passwordless authentication, Customer Identity and Access Management (CIAM), and crypto compliance.

9. Fraud.net

Fraud.net excels at providing solutions like identity verification and fraud prevention using advanced AI technologies. The platform ensures high accuracy in verifying user identities, order details, and transaction authenticity. With a strong suite of real-time protection features, the software enables smooth and secure online interactions to ensure businesses engage in digital commerce without compromising user security.

Targeted industries

Financial services, eCommerce, travel, gaming, insurance, marketplaces, lending, and telecommunications.

Fraud.net pricing

Contact Fraud.net for current pricing.

Key features of Fraud.net

- Anomaly detection: Identifies anomalies and automatically triggers counter-measures to enhance security against potential threats within digital channels.

- Deep learning models: Uses deep learning models that analyze several features to detect anomalies and verify identities in real-time.

- Modular verification: Offers flexible and modular verification capabilities that are crucial for confirming identities, validating order details, and securing purchasing methods.

| Pros of Fraud.net✓ Users find the implementation time to be extremely fast.✓ The responses from their customer support team are very helpful, and the team is quick to answer queries.✓ Setting up rules becomes easier with this software.Cons of Fraud.net✕ There are instances where the software provides false positives.✕ Some users find it difficult to link this software to other tools used daily. |

Fraud.net compared with Socure

Fraud provides a wide range of solutions, like fraud monitoring and custom fraud parameters, which Socure lacks to provide.

10. ComplyCube

ComplyCube is a leading online identity verification and KYC solutions provider that streamlines customer onboarding processes while ensuring compliance with global regulations. The platform enables rapid identity verification through a combination of ID documents, selfies, and trusted data sources. ComplyCube offers a top-notch platform to verify identities in under 30 seconds. ComplyCube’s flexibility, efficiency, and scalability enhance customer trust and operational efficiency.

Targeted industries

Financial services, telecoms, healthcare, crypto, FinTech, eCommerce, Lending, and remittance.

ComplyCube pricing

ComplyCube’s pricing starts at $249/month for the Basic plan and goes up to custom pricing for the Enterprise solutions tailored to specific business requirements.

Key features of ComplyCube

- Global coverage: Supports 220 countries and territories and uses 3,000+ trusted data points for comprehensive global KYC checks.

- Identity verification: Uses AI to quickly and accurately verify identities, combining ID validation, facial recognition, and biometrics.

- Liveness detection: Integrates strong liveness checks to ensure the authenticity of users during the verification process.

| Pros of ComplyCube✓ Offers a straightforward process to complete KYC for applicants, buyers, sellers, and tenants.✓ Supports all relevant language scripts, including Latin, Chinese, and Arabic.✓ The platform’s intuitive interface and smooth integration facilitate easy adoption by our team.Cons of ComplyCube✕ Provides customizable reports via API but not as fully through the dashboard.✕ The ComplyCube database lacks integration with local regulator blacklists. |

ComplyCube compared with Socure

ComplyCube offers features like behavioral analytics and case management that Socure fails to offer.

Let’s check out the entire process of selecting the right alternative for your business.

How to choose the best Socure alternative for your business

Here is the entire process of choosing the right Socure alternative for your business.

Step 1. Identify Socure alternatives and research options

To ensure you choose the best solution provider that aligns with your unique requirements, you must conduct thorough research and select the suitable Socure alternative. Here are the various options for research.

- Look into other leading identity verification providers besides Socure.

- Consult industry reports and reviews to identify emerging players.

- Ask industry peers or forums for recommendations on reliable Socure alternatives.

- Analyze customer reviews and testimonials to gauge user satisfaction.

- Explore niche solutions that might cater better to specific business needs.

Step 2. Compare key features and capabilities

Once you have a list of all the Socure alternatives, compare each alternative’s features and capabilities with Socure. Consider the following factors during this step.

- Evaluate the verification methods offered by each alternative, such as document verification and biometrics.

- Check if the Socure alternatives comply with industry regulations like GDPR or CCPA.

- Assess how easily the solution integrates with your existing systems.

- Determine if the alternative can scale with your business growth.

- Compare the level and quality of customer support each alternative provides.

Step 3. Evaluate suitability for your business needs

Then, evaluate the suitability of each alternative by aligning each feature with your specific business requirements. Consider factors like the volume of transactions requiring verification, the sensitivity of customer data, and the level of integration needed with your existing systems. Ensure the alternative meets your current needs and adapts to future growth and regulatory demands.

Step 4. Assess pricing structures and potential ROI

Understanding the financial aspects and potential return on investment (ROI) is important. Consider the following factors during this step:

- Cost transparency: Ensure clarity in pricing structures like setup fees and ongoing costs.

- Scalability costs: Assess how pricing scales with your business growth.

- ROI potential: Evaluate potential savings in fraud prevention and operational efficiencies.

Step 5. Request demos, gather feedback, and decide

After narrowing down the choices, engage directly with the shortlisted providers. Request demos to see how each solution works. Gather feedback from the IT teams, compliance officers, and customer service representatives to check the usability, integration, and support of the alternative. Considering such aspects helps you make better decisions that balance functionality, cost-effectiveness, and long-term business benefits.

Improve your digital identity verification process with the best Socure alternative

Identity verification is an important part of onboarding customers. While Socure offers powerful features, there are areas where it falls short. Exploring alternatives to Socure, like HyperVerge, becomes crucial in filling these gaps.

HyperVerge ONE ensures smooth customer onboarding with a 98% completion rate and a 99% auto-approval rate. The platform cuts down user drop-offs by half and performs well even in low bandwidths. It also offers 100+ onboarding APIs to facilitate seamless integration into your existing workflows. With their web and mobile SDKs, you can easily integrate it within 4 hours. Schedule a demo today to discover more.

Frequently asked questions about Socure competitors

1. Is Socure a fintech company?

Yes, Socure is a fintech company that specializes in providing digital identity verification and fraud prevention solutions. Socure helps businesses verify identities and reduce fraud in real-time by using advanced machine learning and artificial intelligence. This also helps in preventing account takeover, synthetic identity fraud, and other types of financial fraud.

2. Which industries does Socure serve?

Socure serves financial services, healthcare, eCommerce, retail, telecommunications, gaming, gambling, and the government & public sector. From enabling banks and fintech companies to comply with KYC and anti-money laundering regulations to securing patient identities in healthcare and reducing fraud in online retail, Socure’s solutions provide advanced identity verification and fraud prevention across these sectors.

3. Is there a free version of Socure available?

Socure does not offer a free version. However, it provides a range of pricing options and scalable solutions tailored to different business needs and sizes. Socure’s pricing is generally customized based on the volume of transactions and the client’s specific requirements.

4. Who are Socure’s competitors?

Here are the top Socure alternatives to consider:

- HyperVerge

- Ondato

- Sumsub

- Onfido

- iDenfy