A good LOS is important for banks, NBFCs, and fintech companies. It reduces paperwork, avoids errors, and speeds up loan approvals.

One such example is Perfios InteGREAT, a Loan Origination System (LOS) that helps lenders process loans faster by automating data collection, verification, and approvals. However, not every business has the same needs.

Some may look for alternatives with better features, pricing, or flexibility. In this article, we’ll explore the best LOS alternatives to Perfios InteGREAT in 2026.

Why consider alternatives to Perfios InteGREAT?

Perfios InteGREAT is a strong LOS platform, but it may not fit every business. Here are some reasons why lenders look for alternatives:

- Flexibility and API integration: Some businesses need a LOS that integrates easily with their existing systems. Alternatives may offer better API support and customization.

- Pricing and scalability: Costs can vary based on business size and needs. Some alternatives offer better pricing plans or more scalable solutions.

- Ease of use: A complex technical system can slow down operations. Many alternatives focus on a simple and user-friendly interface.

- AI capabilities: Advanced AI features can automate decision-making, detect fraud, and improve efficiency. Some platforms offer stronger AI-driven insights.

- Geographical availability: Not all LOS platforms support every region. Businesses operating in multiple countries may need a solution with wider coverage.

- Data security and fraud prevention: Secure handling of customer data is a priority. Some alternatives offer stronger encryption and fraud detection tools.

Choosing the right LOS depends on your business needs. The next section will explore the best alternatives to Perfios InteGREAT.

How do we evaluate the top alternatives?

We analysed several alternatives to Perfios InteGREAT based on features, pricing, scalability, and overall solution quality. After evaluating their performance and user feedback on platforms like G2, Capterra, and Reddit, we reviewed multiple options and shortlisted the best ones. We also considered competitor comparisons to ensure our list is relevant and comprehensive.

| Top alternatives | Free trial availability | Standout features |

| HyperVerge | Comprehensive user onboarding solution | |

| Jocata | Delivers real-time actionable insights | |

| FinBox | Custom credit products within seconds | |

| Finflux | Multi-channel loan servicing | |

| Lentra | Scalable and secure digital lending | |

| Decimal | Embedded finance capabilities and instant risk assessment | |

| Bryt Software | Built-in reporting and documentation | |

| Newgen | Low-code platform and real-time analytics | |

| Loan Pro | Detailed audit logs and fraud prevention | |

| Turnkey Lender | Automated debt collection and enterprise-grade reporting |

A detailed list of the 10 best Perfios alternatives for automated loan journeys

1. HyperVerge

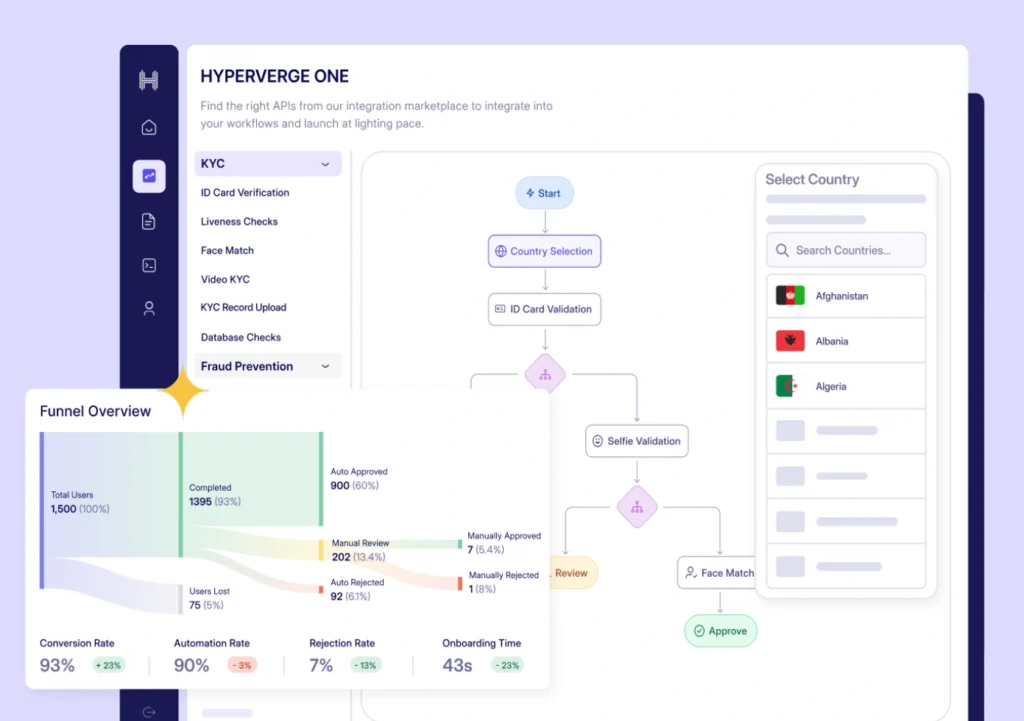

HyperVerge offers AI-powered automation for loan processing, KYC verification, and fraud detection. Its advanced OCR technology extracts data from structured and unstructured documents with high accuracy. The platform enables businesses to streamline onboarding and compliance processes with automated workflows. Top financial institutions like L&T, LIC, and Acko use HyperVerge to enhance their digital identity verification systems.

Best For

Banks, NBFCs, insurance companies, fintech startups, and financial service providers looking for seamless document verification and fraud prevention.

Pricing

HyperVerge offers flexible pricing plans:

- Startup Plan – Free one-month trial with quick integration.

- Grow Plan – Includes custom workflows and document processing management.

- Enterprise Plan – Offers advanced features, custom pricing, and dedicated support.

What do the users say?

2. Jocata

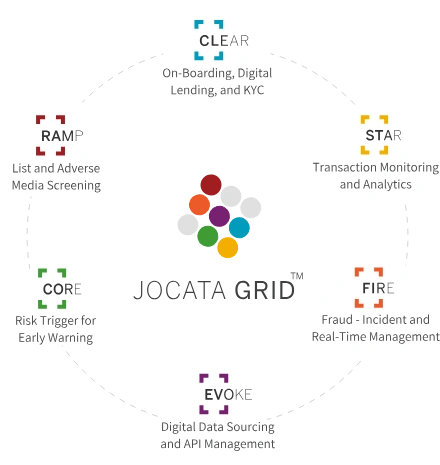

Jocata is an automated loan origination platform designed to streamline credit underwriting, KYC verification, and fraud detection. It leverages AI and machine learning to assess borrower risk and accelerate loan approvals. The platform integrates seamlessly with banking systems, ensuring a smooth end-to-end digital lending experience. Jocata GRID provides an integrated real-time view of business, risk, operations, and compliance.

Some leading financial institutions, including Axis Bank, Airtel Payments Bank, and American Express, trust Jocata for their digital transformation goals.

Best for

Banks, NBFCs, fintech companies, and financial institutions that need automated loan processing and fraud prevention.

Pricing

Jocata offers customized pricing based on business needs and scale. Interested users can request a demo or pricing details from the Jocata team.

What do the users say?

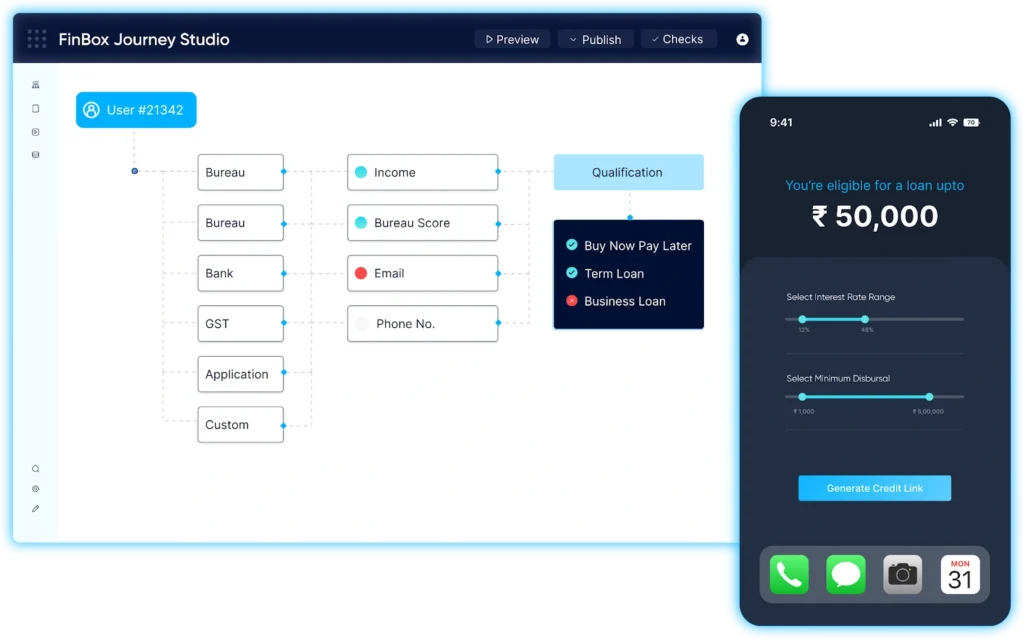

3. Finbox

FinBox provides a smooth end-to-end loan journey. From automated demos to personalized engagement, this platform has you covered. The platform enables all types of KYC requirements natively in the onboarding journey. This helps you speed up processes and ensure compliance.

FinBox provides agile support for different products. Whether you are looking for working capital loans or BNPL, it provides the right support. Lastly, it comes with 30+ integrations to simple onboarding and repayment setup.

Best for

Digital lenders looking to automate loan origination, credit risk assessment, and KYC verification.

Pricing

FinBox provides flexible pricing based on business needs. Interested businesses need to contact FinBox for a customized quote.

4. Finflux

Finflux leverages 100+ parameters and provides loan services for 15+ products. These include personal loans, business/SME loans, vehicle loans, gold loans, education loans, etc. Its wide range of loan solutions has successfully served 15 million+ borrowers.

Along with loan origination software, the platform also provides loan management services. It is highly configurable and enables lenders to enable every part of the process. Whether it’s flexible repayment options, loan structuring, or DPD and NPA tracking, the lenders are covered.

Best for

Fintech companies looking for a scalable and cloud-first loan management system.

Pricing

Finflux offers customized pricing based on business size and needs. Companies must contact Finflux for a tailored quote.

What do customers say?

5. Lentra

Lentra is a cloud-based digital lending platform offering end-to-end solutions for financial institutions. Whatever the type of loan, Lentra has a solution. It provides instant decisioning, plug-and-play deployment, and a highly configurable microservices architecture. Lentra’s platform is designed for rapid deployment and customizable customer journeys.

You can expect a 7 times reduction in the turnaround time with this loan onboarding platform.

Best for

Financial institutions seeking a comprehensive, scalable, and secure digital lending solution.

Pricing

Lentra operates on a pay-as-you-go model, eliminating capital expenditure. Pricing is per user or transaction, making it cost-effective for various business sizes.

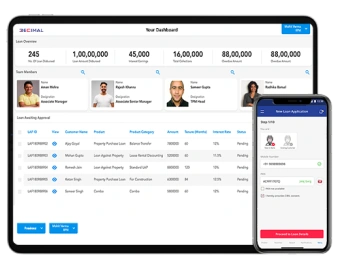

6. Decimal

Decimal is a digital lending platform designed to provide real-time, AI-driven credit decisions. It stands out with its hyper-personalized loan journeys, offering dynamic workflows that adapt to borrower profiles. Its pre-configured digital lending suite enables financial institutions to go live faster without extensive development efforts. Decimal also ensures seamless embedded lending, allowing lenders to integrate their services into third-party platforms effortlessly.

Decimal is the trusted choice of several leading financial institutions such as Kotak Mahindra Bank, Equitas Small Finance Bank, Bandhan Bank, and more.

Best for

Fintech companies looking for a highly customizable lending solution with embedded finance capabilities and instant risk assessment.

Pricing

Decimal offers flexible pricing based on usage, transaction volumes, and API integrations.

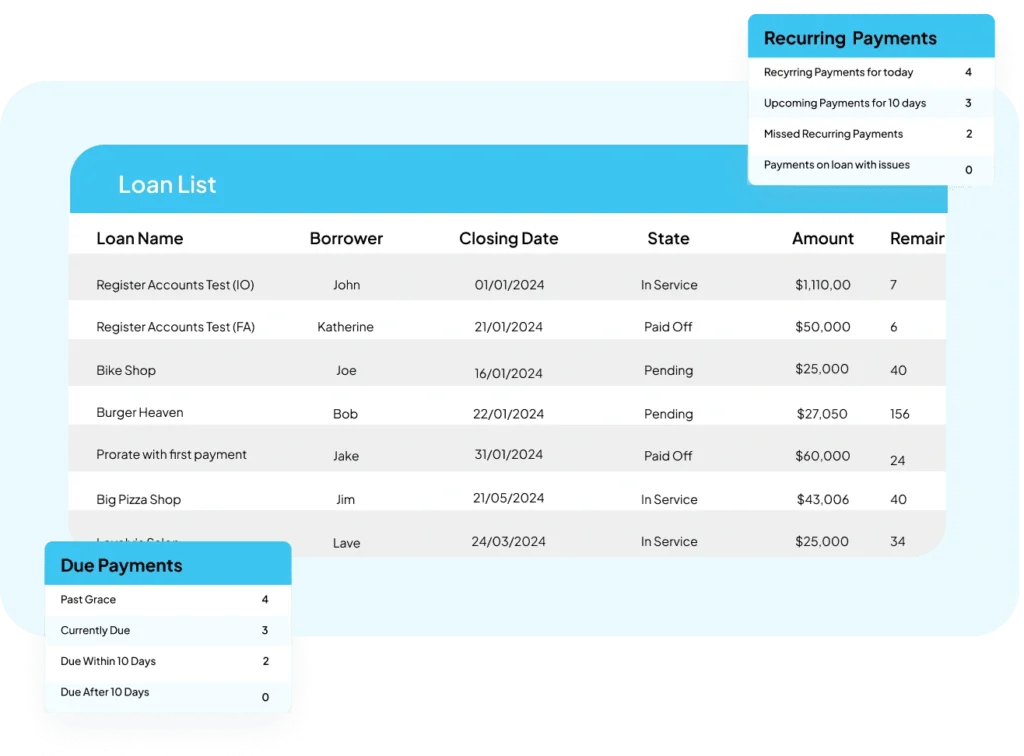

7. Bryt Software

Bryt Software is a cloud-based loan servicing platform. It helps lenders manage loans with ease. The platform offers tools for loan origination, servicing, reporting, and compliance. Unlike many others, Bryt allows custom workflows without coding. Its user-friendly automation makes loan management simple.

The platform provides detailed reporting, including 1098 & 1099 generation, payment tracking, and consolidated payments. It also offers insights into principal balances over 12 months, late payments, and historically weighted interest.

Best for

Credit unions, private lenders, banks, and financial institutions are looking for a flexible and easy-to-use loan servicing platform.

Pricing

Bryt Software offers transparent pricing based on the number of loans managed. A free trial is available, allowing lenders to explore its features before committing.

What do customers say?

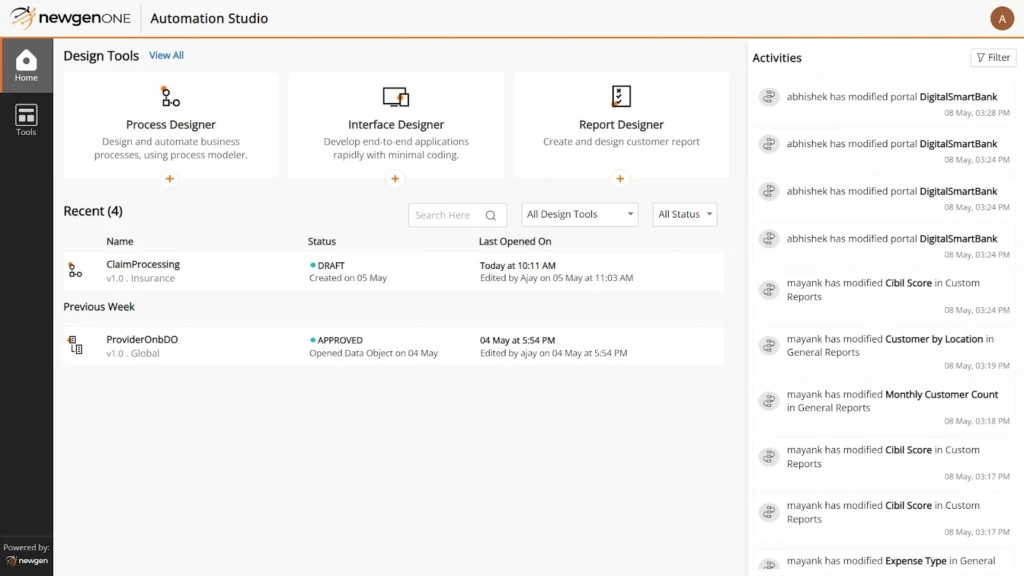

8. Newgen

Newgen is a comprehensive loan origination and management system designed for financial institutions. It automates the entire lending lifecycle, from loan application to disbursement and servicing. The platform uses AI-powered decisioning, machine learning, and real-time analytics to streamline operations and reduce manual effort.

Newgen stands out with its low-code platform, allowing lenders to build and customize workflows without extensive coding knowledge. It also supports multi-channel loan applications, enabling borrowers to apply via mobile, web, or in-person channels.

Best for

Banks, NBFCs, credit unions, and financial institutions looking for scalable and automated loan processing.

Pricing

Newgen offers custom pricing based on business needs. It provides modular solutions, so lenders only pay for what they need.

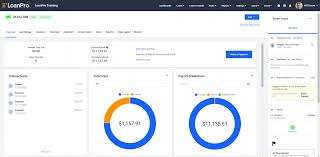

9. Loan Pro

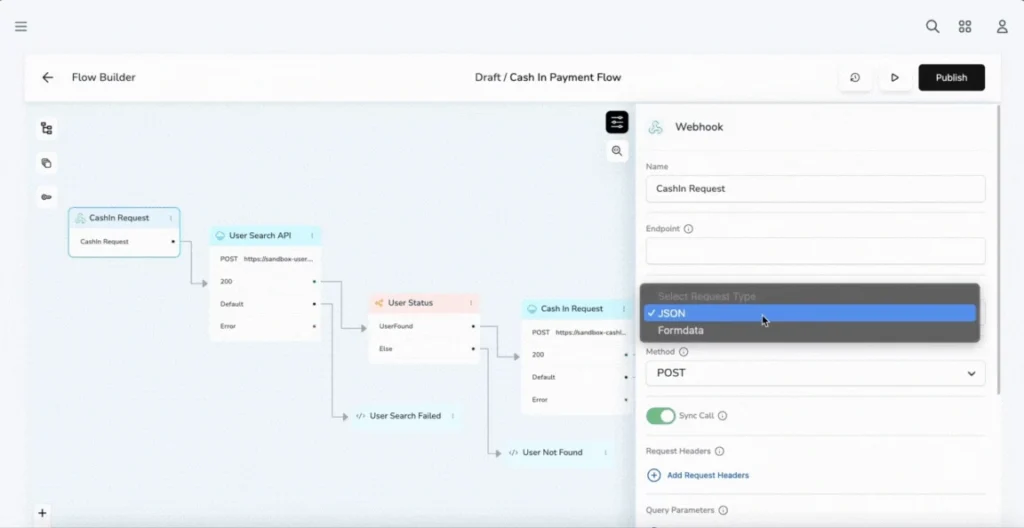

LoanPro stands out with its API-first approach, allowing seamless integration with other systems. It supports real-time data syncing, making loan servicing more efficient. The platform also provides customizable loan workflows, ensuring businesses can create unique lending experiences.

Security and compliance are a priority. LoanPro includes advanced fraud loan prevention, compliance tracking, and detailed audit logs. It also offers granular reporting tools, helping lenders gain insights into loan performance and customer behavior.

Best for

Lenders looking for a highly customizable and API-driven loan management system

Pricing

LoanPro offers custom pricing based on business needs. It provides a subscription-based model, ensuring scalability for different lenders. Businesses can request a quote for tailored pricing options.

10. Turnkey Lender

TurnKey Lender is an AI-powered lending platform for banks, fintechs, and credit unions. It automates loan origination, underwriting, servicing, and collections in one system.

Its AI decision engine quickly assesses credit risk for faster approvals. The platform supports various lending models, including BNPL, payday loans, and commercial lending.

With no-code customization, lenders can modify workflows without coding. Turnkey Lenders boasts clients such as National Iron Bank, BigPay, and USBC.

Best for

Companies looking for an all-in-one automated loan system

Pricing

TurnKey Lender offers custom pricing based on business needs. Lenders can request a quote for a tailored plan.

What do customers say?

How to choose the best Perfios alternative for your business

Finding the right loan management software is essential. The right tool improves efficiency, ensures compliance, and supports business growth. Here’s what to consider before making a decision.

1. Functionality and features

Check if the software includes key features like loan origination, servicing, accounting, and reporting. It should support the loan types your business handles. Make sure it fits your workflows to avoid inefficiencies.

2. Look for an end-to-end solution

An all-in-one platform simplifies loan management. It reduces the need for multiple tools. Choose software that covers the full loan journey, from application to repayment. A smooth process improves efficiency and the borrower experience.

3. Ease of use and onboarding

The software should be easy to use. A complex interface can slow down operations. Look for a platform that requires minimal training. Ensure the vendor offers onboarding support, tutorials, or guides.

4. Scalability and flexibility

The system should grow with your business. It must handle more loans as your company expands. Customization options are important. A flexible platform adapts to your needs without disruptions.

5. Integration and compatibility

The software should connect easily with existing tools. It must work with CRMs, accounting software, and credit bureaus. Seamless integration reduces manual work and errors. Check if it supports API connections or built-in integrations.

6. Security and compliance

Data security should be a top priority. Choose software with strong encryption and access controls. It should meet industry regulations to protect sensitive data. A secure system keeps your business compliant and reduces risks.

7. Customer support and reputation

Vendor reputation matters. Read reviews and testimonials to see customer satisfaction. A provider with strong support ensures quick issue resolution. Reliable support keeps your operations running smoothly.

Boost your approval ratings with automated end-to-end LOS

A Loan Origination System (LOS) helps lenders process applications faster. Automation reduces delays and errors, leading to quicker approvals. With the right LOS, you can improve efficiency, cut costs, and enhance the borrower experience.

HyperVerge One offers a feature-rich LOS designed for speed and accuracy. It streamlines loan processing, ensuring every step is smooth and hassle-free.

HyperVerge One and its LOS capabilities

- No-code workflow builder – Easily create and modify loan workflows without any coding. Automate document checks, approvals, and compliance processes. Reduce manual work and improve efficiency.

- Customizable UI – Adapt the interface to match your business needs. Offer a seamless experience for borrowers and staff. Ensure clear navigation and easy access to critical information.

- Downtime protection – Stay operational 24/7 with a reliable and secure system. Prevent disruptions and ensure smooth loan processing, even during peak hours.

- Application review portal – Get a centralized platform to review, track, and manage applications. Make faster, data-driven decisions with all necessary details in one place.

HyperVerge One helps lenders simplify and speed up the loan process. It ensures better accuracy, fewer errors, and improved customer satisfaction. Upgrade to HyperVerge One and transform your loan approval process today!

Frequently Asked Questions

1. What is Perfios InteGREAT, and why are companies looking for alternatives?

Perfios InteGREAT is a Loan Origination System (LOS) that automates onboarding, verification, underwriting, and loan disbursal workflows, mainly for banks, NBFCs, and fintechs.

Companies often explore alternatives because they may need greater customization, faster deployment, better integration capabilities, improved support, or more competitive pricing models.

2. What are the key factors to consider when choosing an alternative to Perfios InteGREAT?

When evaluating alternatives, lenders should consider:

- Ease of integration with core banking and third-party APIs

- Customization flexibility for different loan products

- Speed of deployment

- Built-in risk management tools (fraud detection, credit analytics)

- Regulatory compliance readiness

- Cost of ownership

- Scalability to support growth and multiple lending models

3. What is a Loan Origination System (LOS)?

A Loan Origination System (LOS) is a software platform that manages the entire process of originating a loan, from initial application and document collection to underwriting, approval, and disbursal. It automates and streamlines workflows such as KYC verification, credit assessment, fraud checks, compliance checks, and loan offer generation.