As the financial industry continues to evolve, the demand for effective loan origination software grows stronger. According to a study by Research and Markets, the global loan origination software market was projected to grow at a CAGR of 7.8% from 2020-2025. This growth highlights the increasing importance of efficient loan origination processes.

With many businesses looking to optimize their operations, choosing the right loan origination software becomes crucial.

As of 2024, two prominent players in this space are Jocata and HyperVerge. Both offer unique features designed to enhance the loan origination process.

But how do you decide which one is best for your needs?

This article dives into the pros and cons of Jocata vs HyperVerge, helping you make an informed decision. Understanding these options can significantly impact your operational efficiency, whether you’re a financial institution or a technology partner.

What is Jocata?

Jocata is revolutionizing digital lending with its innovative platform, Jocata’s GRID. This robust system leverages artificial intelligence (AI) to enhance decision-making, making it a valuable asset for businesses in the financial sector.

This cloud-based platform not only assists lenders in managing customer relationships but also enhances the borrower experience throughout the lending process. Whether it’s loan origination or servicing, Jocata’s comprehensive solutions streamline the entire journey from application to repayment.

Let’s explore some of its standout features:

- AI-powered decision-making: Jocata transforms the lending landscape by leveraging AI to evaluate applications with precision. Think of it as having a tireless, smart assistant that speeds up decision-making, ensuring you never miss a beat.

- Enhancing the borrower experience: Beyond its advanced AI, Jocata prioritizes a smooth, user-friendly loan application process. The platform’s borrower-centric approach helps create a seamless journey, leading to higher completion rates and better customer satisfaction.

- Outstanding customer support: Jocata offers exceptional support with a dedicated team ready to assist you. From answering your questions to guiding you through the implementation process, their customer service ensures you get the most out of the platform.

Ideal for large enterprises in the financial and banking sectors, Jocata’s GRID platform empowers you to elevate your lending operations with ease and efficiency.

What is HyperVerge?

HyperVerge is an all-in-one, cloud-based platform that streamlines the entire loan lifecycle. It’s designed to simplify loan management, making the process smooth and user-friendly. With powerful integration capabilities, it easily connects with various databases, automating the necessary document checks based on the type of loan. This automation boosts efficiency significantly, reducing manual effort and errors.

What sets HyperVerge apart is its use of AI and Machine Learning (ML), which helps the platform adapt quickly to new laws and regulations. Unlike traditional systems that need constant manual updates, HyperVerge adjusts effortlessly, keeping your loan processes compliant. The platform also comes with robust fraud detection features, ensuring the highest level of data security—a key advantage over many other options.

Here’s what makes HyperVerge stand out:

- Cloud-based and mobile-friendly: With its cloud architecture, you can manage loans from anywhere, anytime, offering complete flexibility.

- Intuitive interface: Its user-friendly design requires little to no training, making it accessible to everyone, whether new or experienced.

- Scalable solution: Whether you’re a small business or a large enterprise, HyperVerge effortlessly scales to meet your growth needs.

- Open API: Its open API allows seamless integration with your existing systems, creating a cohesive and efficient workflow.

- Intelligent risk assessment: HyperVerge uses AI for smart risk assessment, diving deep into risk factors and borrower profiles. This helps lenders make more precise and informed credit decisions.

- Seamless integration: The system offers seamless integration with current banking infrastructure and third-party services, ensuring a smooth transition and boosting overall operational efficiency.

Ideal for banks, financial institutions, telecom companies, digital lenders, crypto businesses, and even gaming companies, HyperVerge is designed to support a diverse range of industries. It is especially suited for organizations aiming to enhance efficiency, compliance, and decision-making.

Whether you’re a large bank dealing with high volumes of applications or a smaller firm struggling with online identity verification, HyperVerge offers flexible solutions tailored to various lending needs.

How Do We Evaluate the Two Products?

Wondering how we’ll compare Jocata and HyperVerge?

Here’s the plan: We’ll thoroughly evaluate both platforms, examining their features, pricing, pros, and cons. This means looking closely at core functionalities, cost-effectiveness, and each system’s strengths and weaknesses.

Next, we’ll review user reviews on G2 and Capterra to gather insights into real-world experiences and satisfaction levels. We’ll also consider Reddit reviews for additional viewpoints.

By taking this comprehensive approach, we’ll help you determine which loan origination system—Jocata or HyperVerge—best meets your needs and delivers the most value for your organization.

So, let’s start by exploring their features.

Overview of Jocata vs HyperVerge

Here’s an overview of Jocata vs HyperVerge:

| Aspect | Jocata | HyperVerge |

| Platform Type | Cloud-based loan origination and servicing platform | Cloud-based, end-to-end loan origination software |

| AI Integration | AI-powered decision-making for intelligent loan evaluations | AI and Machine Learning for compliance updates and automation |

| Focus on Browser Experience | Prioritizes user-friendly loan application and servicing | Intuitive design with a seamless application process |

| Scalability | Best suited for large enterprises in the financial and banking sectors | Highly scalable, adapting to businesses of any size |

| Fraud Detection | Basic fraud management capabilities | Advanced fraud detection ensuring high-level data security |

| Customer Support | Dedicated support team for implementation and troubleshooting | Provides dedicated support with an emphasis on quick issue resolution and minimal downtime |

| Integration Capabilities | Easily integrates with existing systems and processes | Open API for smooth integration with existing workflows |

| Accessibility | Cloud-based with flexible access | Cloud-based, mobile-friendly, enabling access anytime, anywhere |

| Target Audience | Financial and banking sectors | Banks, financial institutions, digital lenders, telecom, gaming, and crypto companies |

| Unique Strengths | Exceptional borrower experience, strong customer support | Comprehensive automation, advanced fraud detection, and AI adaptability to regulations |

Key Comparisons

Now that we have a fair understanding of the features both tools provide, let’s take a broader look at them to help you choose the right tool.

Features

Both Jocata and HyperVerge are designed to enhance loan origination and servicing, but they differ in their approach and feature sets.

Jocata focuses heavily on AI-powered decision-making, streamlining the loan evaluation process with advanced algorithms that enhance speed and accuracy. It emphasizes delivering a smooth borrower experience, ensuring a frictionless application journey that boosts customer satisfaction. Jocata also offers dedicated customer support, assisting users throughout the implementation process, making it ideal for businesses that need hands-on guidance.

On the other hand, HyperVerge’s standout feature is the use of AI and ML, which allows the platform to adapt to changing regulations without manual updates. This makes it particularly efficient for maintaining compliance.

HyperVerge also excels in fraud detection, with robust security measures protecting customer data against breaches. The platform’s scalability and open API make it adaptable to any business size and offer seamless integration with existing systems.

Pricing

Jocata and HyperVerge offer flexible pricing models tailored to the needs of different businesses. Jocata’s pricing typically aligns with the scale and complexity of the lending operation, making it a good fit for larger enterprises with extensive needs. It often includes costs for implementation and support, reflecting its focus on providing comprehensive customer assistance.

HyperVerge ONE, on the other hand, tends to offer a more modular pricing approach, allowing businesses to scale up as needed. Its pay-as-you-grow model makes it accessible for both small and large organizations, providing value for money through its advanced AI features and automation capabilities.

HyperVerge offers several pricing plans tailored to different needs:

- Start Plan (for startups): This plan includes a free one-month trial and ensures seamless integration within four hours.

- Grow Plan (for midsize companies): Building on the Start Plan, this option adds features such as custom workflows and advanced document processing management.

- Enterprise Plan (for large organizations): This comprehensive plan enhances the Grow Plan with collaborative tools, a customized pricing structure, and dedicated support.

HyperVerge’s pricing model can be more cost-effective for businesses prioritizing compliance and fraud detection than Jocata, especially when considering integrated fraud prevention tools.

Target Audience

Jocata primarily caters to large enterprises within the financial and banking sectors, making it ideal for businesses that require robust AI-driven decision-making and a strong focus on borrower experience.

HyperVerge, however, serves a broader audience, including banks, financial institutions, telecom companies, digital lenders, crypto businesses, and even gaming companies. Whether it’s for KYC verification, fraud detection, electronic identity verification, or document processing, HyperVerge offers cutting-edge automation. Its focus on high-tech solutions makes it an excellent choice for organizations looking for specialized, state-of-the-art tools.

Security

Security is a key consideration for both platforms, but they approach it differently. Jocata employs standard security measures to protect customer data and ensure secure loan processing. It provides reliable protection but lacks the advanced fraud detection capabilities that HyperVerge offers.

HyperVerge stands out with its powerful fraud detection features, which add an extra layer of security. Its AI models are meticulously designed with privacy at their core, ensuring customer information is handled with the highest level of protection.

User Experience

Jocata focuses on creating a seamless user experience, emphasizing a borrower-centric design that enhances customer satisfaction.

Its intuitive interface ensures that users, whether seasoned professionals or new employees, can navigate the platform with ease. Jocata’s dedicated customer support team is a significant asset, offering guidance through the platform’s setup and ongoing use, which is especially beneficial for businesses that value hands-on assistance.

HyperVerge also delivers a strong user experience with its mobile-friendly, cloud-based platform. Its intuitive design reduces the learning curve, making it accessible to all users.

However, the real advantage is its adaptability; the platform evolves with your business, scaling easily as needs change.

Integrations

Both Jocata and HyperVerge support extensive integrations, but their approaches differ slightly. Jocata GRID offers smooth integration with existing systems, enhancing the overall workflow for lenders by connecting easily with other tools and databases commonly used in the financial industry.

HyperVerge’s open API takes integration a step further, allowing businesses to connect the platform seamlessly with their current systems and tools. This flexibility ensures that HyperVerge fits into diverse IT environments, offering a unified experience that helps streamline operations across various departments.

Its compatibility with a wide range of tools makes it particularly appealing to businesses looking for a scalable and adaptable loan origination solution.

Each platform has its unique strengths, catering to different needs and industries. Jocata’s GRID excels in customer experience and decision-making, while HyperVerge leads with compliance adaptability, security, and integration flexibility.

Pros and Cons

HyperVerge Pros

Given below are some of the pros of HyperVerge:

- Comprehensive Solution: Provides a cloud-based loan origination system that manages the entire loan lifecycle, from intake to closing.

- Automation: Streamlines various stages of the loan process, boosting efficiency and cutting down on manual work.

- User-Friendly Experience: Ensures a smooth and intuitive borrower experience, making the application process easier and more accessible.

- Advanced Fraud Detection: Features sophisticated mechanisms to secure and validate loan transactions.

- Simplified Processes: Reduces technical hurdles and enhances overall system accessibility for digital lending.

- Cost Savings: Helps organizations save money by optimizing operations and minimizing manual processing.

- Faster Approvals: Speeds up loan approval times, facilitating quicker decision-making and service delivery.

HyperVerge Cons

User satisfaction says it all – with HyperVerge, you might be so impressed by the efficiency that you forget to look for any downsides.

(However, if you do spot any, we welcome your feedback to help us continually enhance our service.)

Jocata Pros

Users like the platform for these reasons:

- AI-Powered Decision-Making: Utilizes advanced AI to streamline and accelerate loan application assessments.

- Enhanced Borrower Experience: Designed to provide a smooth and user-friendly application process, boosting customer satisfaction.

- Comprehensive Loan Management: Covers the entire loan lifecycle, from origination to servicing, within a single platform.

- Cloud-Based Flexibility: Accessible from anywhere, supporting remote work and operational efficiency.

- Exceptional Customer Support: Dedicated team available to assist with queries, troubleshooting, and system implementation.

Jocata Cons

Jocata might be more feature-rich and complex than necessary for smaller organizations with simpler needs. It also requires significant effort to integrate with existing systems or third-party services.

Moreover, the platform’s pricing is higher compared to more basic solutions, especially for smaller businesses.

Hear it Directly From the Users

Jocata

HyperVerge

Choose HyperVerge for the Smoothest Loan Management Cycles

HyperVerge is all about simplifying loan origination with its no-code, cloud-native platform. It’s built to offer scalability and agility, making it a great fit for lenders of all sizes.

The platform emphasizes ease of use and strong security while providing a host of features designed to streamline every step of the loan process. From identity verification to KYC to underwriting, HyperVerge covers it all, helping lenders operate more efficiently.

Flexible and Modular Design

One of HyperVerge’s key strengths is its modular design, which prioritizes flexibility. Its architecture is built to integrate smoothly with your existing systems, making the onboarding process seamless.

Plus, it offers plenty of configuration options, allowing you to tailor the platform to perfectly match your lending needs and risk profiles.

Powered by Advanced AI

At its core, HyperVerge is driven by a powerful AI engine that utilizes advanced machine learning algorithms. This technology automates time-consuming tasks, such as identity verification and document authentication, which are usually handled manually.

HyperVerge’s KYC (Know Your Customer) capabilities significantly cut down on processing time and reduce errors, making the loan origination process faster and more reliable.

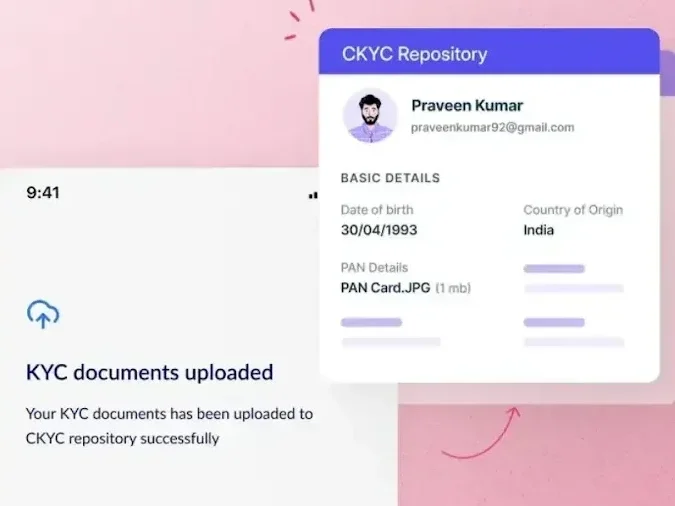

CKYC Repository for Accurate Data Verification

HyperVerge uses sophisticated tools, such as optical character recognition (OCR) and facial recognition, to extract and validate borrower data from government-issued IDs.

This feature not only ensures compliance with regulatory requirements but also enhances operational efficiency.

It’s no wonder HyperVerge is considered one of the top identity verification solutions on the market.

End-to-End Loan Origination Journeys

HyperVerge excels in providing a complete journey through the loan origination process, ensuring that every stage is covered seamlessly. Its well-structured workflows reduce drop-off rates by guiding users smoothly from start to finish.

With efficient processing and thorough verification steps, HyperVerge boasts a 99% approval rate, making it a go-to choice for lenders eager to optimize their systems.

Choose HyperVerge for End-to-End Loan Origination

Loan Origination Software (LOS) platforms have revolutionized the lending landscape in the US, bringing unparalleled efficiency and innovation. As technology advances, selecting the right LOS becomes crucial for staying ahead in a competitive market.

AKA—HyperVerge!

The platform offers a comprehensive, cloud-based solution that streamlines the entire loan lifecycle. By choosing HyperVerge, financial institutions can simplify complex processes, accelerate approvals, and reduce manual tasks.

Sign up now to begin your journey with loan origination!

FAQs

1. What does Jocata do?

Jocata offers a cloud-based platform that manages the entire loan lifecycle, using AI to streamline origination and servicing processes.

2. What is loan origination software?

Loan origination software (LOS) automates and manages the entire loan process, from application to servicing, improving efficiency for lenders.

3. What are the features of a good loan origination software?

A good loan origination software provides automation, user-friendly interfaces, robust fraud detection, seamless system integration, and comprehensive reporting.