“You have to survive to tell the story”

Introduction

MoneyTap was founded about 5 years ago, but its founders have been building businesses for decades. Of its three founders Bala Parthasarathy in particular has built, scaled, sold, and invested in over 30 startups since he left college. Along the way he has inspired many a student to embark on the entrepreneurial journey. One of whom was present in a talk he delivered at IIT Madras in 2012. That student was Kedar Kulkarni, our co-founder and co-host of the first episode on the second season of HyperInsights. In this hour long conversation with Bala, we cover topics ranging from remote onboarding to entering a market like Vietnam.

The summary of this conversation is given below.

The future of remote onboarding and recovery (link)

The context

The coronavirus was the catalyst to accelerate the adoption of remote onboarding. Although remote onboarding is more efficient and user friendly, concerns around privacy and fraud has led regulators to mandate physical verification for most fintech use cases. However, new onboarding processes such as video KYC has been able to ease onboarding during these times. Bala had several interesting insights on how we may incorporate remote onboarding into our future and the path of recovery.

HyperInsights

- Remote onboarding is the future and regulatory changes need to allow for its wider adoption.

- Confusion around the moratorium need to be resolved for new customer onboarding strategies as demand starts to recover.

- We cannot assume that recovery will be straight forward.

- The economic downturn was akin to steep drop, the recovery will be more like an upward slope.

- Geographically the recovery will follow a “Whack a mole” pattern as they calibrate and contextualise “unlock” strategies across Indian cities.

- From a MoneyTap perspective: data from their app, bureaus, and job markets are being used to recalibrate their offerings across cities.

- Although we can predict the path of recovery, it pays to keep in mind that this may be invalid if the virus resurges.

- There is enough being done to ensure a supply of credit, however, the demand for the credit from “credit worthy” individuals will need to be revisited.

Building resilience (link)

The context

Every decade or so we are faced with a crisis that seems to be all consuming. Today the eerie pattern of periodic global shocks comes in the form of the pandemic we face. One other such crisis in living memory was what followed 9/11. When the twin towers came crashing down, so did the business model of Bala’s first company: Snapfish. Overnight, the film roles that Snapfish digitised as a part of its service could no longer be routed thru Washington, as the government took measures to irradiate mails. Bala reflects on what Snapfish and his subsequent ventures has taught him.

HyperInsights and some wisdom

- The duty of an entrepreneur is to ensure survival during these times. Because you have to survive to be able to tell the story.

- There is no pride in failure.

- During these times, an entrepreneur gains invaluable time to reflect on more fundamental and longer term horizons of his/her venture.

- Use this time to explore pivots that will prepare you for the world that reemerges.

- Above all, plan and ensure you have a runaway of 18-24 months.

India and Vietnam (link)

The context

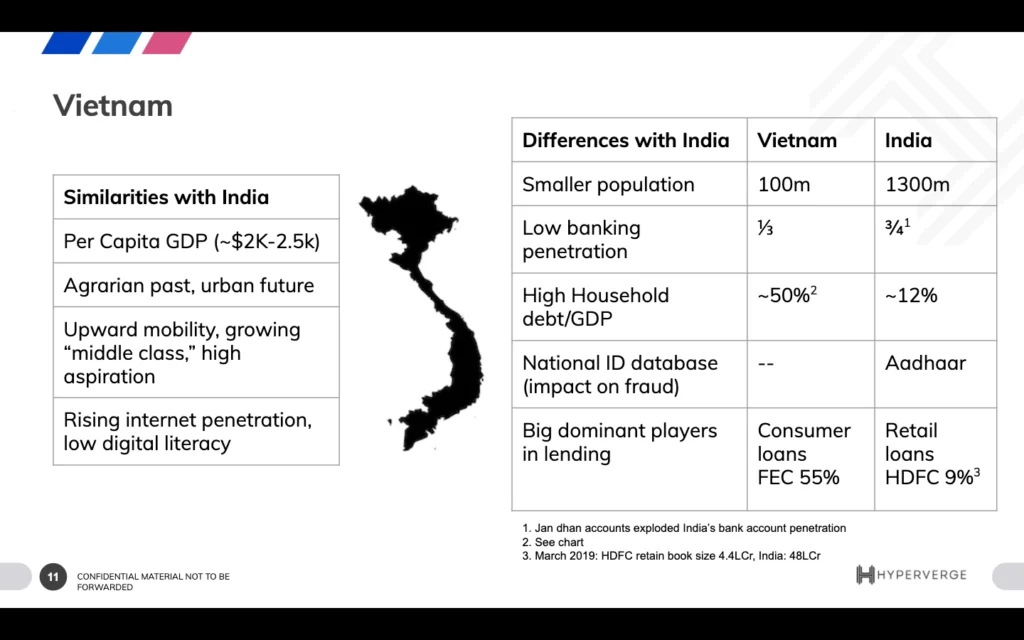

India and Vietnam share more in common than first meets the eye. HyperVerge and MoneyTap have both spent years in making inroads into one of the most promising markets in South East Asia. Bala and Kedar traded insights from their experience in building a base in Vietnam and conversely what Vietnam has taught them about building for India.

HyperInsights

Differences

- Regulations: India is far more regulated than Vietnam. Vietnam has a more experimental and digital approach to regulations.

- Digital adoption: Contrary to what could be popular opinion, Vietnam is more digitally savvy than India. This is reflected in penetration of internet services as well as the way regulators view fintech.

- COVID-19 context: Vietnam is a better market to be in at the moment. With no signs of the coronavirus severely impacting the country, the pace and path of recovery is more favourable.

- Nature of fraud: Although both countries have instances of fraud, the Vietnamese seem to be more sophisticated. The absence of central identity database like Aadhaar exaggerate the scope for fraud. Curiously, this is something that both MoneyTap and HyperVerge have used to build better products back home.

- Credit demand: The Vietnamese have a stronger appetite for credit (especially with respect to consumer durables) than Indians.

Similarities

- User profile and behaviour: Indians and Vietnamese have similar consumption and cultural behaviour.

- Attitude towards each other: There is a healthy amount of respect for Indians in Vietnam and vice versa. A number of factors from the chaotic nature of the cities to patterns of development might be the cause.

Regulations (link)

The context

Fintech based regulations in India have always been a divisive subject. The general pattern of regulation has been to be overarching, yet, light on specifics. Bala draws on his experience of working with think tanks like iSpirit and government bodies like UIDAI to offer his views on regulations.

HyperInsights

- The insistence on the requirement for physical verification of Officially Valid Documents (OVDs) has been disappointing.

- Regulating in India is very complex owing to the large and interconnected nature of ministries.

- While working with regulators it is important to understand that it is a practice of taking two steps forward and one step back.

- Understanding all the regulations in the context of the needs of your company is critical, for example, C-KYC is unexpectedly picking up demand during COVID.

Questions

- On the future of Video KYC (link)

- On the “sachet-ing” of financial products (link)

- On the nature of B2B lending (link)

- On how the Indian economy will react to China (link)

- On how to approach raising funds (link)

Recurrent theme

A common theme during the conversation between Kedar and Bala was about the role that people play in organisations. Bala reiterated the importance of having a team that comes together rather than falls apart during tough times and how that helped him get to where he is.

Following up from Bala would be a tough act. Anuj Rathi VP Product, Growth, and Revenue at Swiggy offered a different perspective of building for consumers that BFSI could learn from.