70% of financial professionals anticipate a rise in fraud risks in the next 12 months! Headlines of fraud, identity theft, and financial crimes dominated 2023. Add the rapidly changing technological landscape to the mix — with advancements in AI, machine learning, and deepfakes.

Here’s how financial institutions prepare: more than two-thirds prioritize technology investments to combat the looming risk of fraud.

In this blog, we’ll take a deeper look into how technology, specifically AI can help fintech, banks, and other financial institutions find fraud patterns and prevent fraud.

What is Fraud Detection with AI?

Fraud Detection using AI uses various machine learning models to filter through large datasets, identifying suspicious activities by recognizing patterns and anomalies. As these algorithms continuously learn from new data, they become more proficient at predicting and preventing fraudulent user behavior itself. This assertive approach equips businesses with a powerful defense mechanism, safeguarding transaction integrity and security.

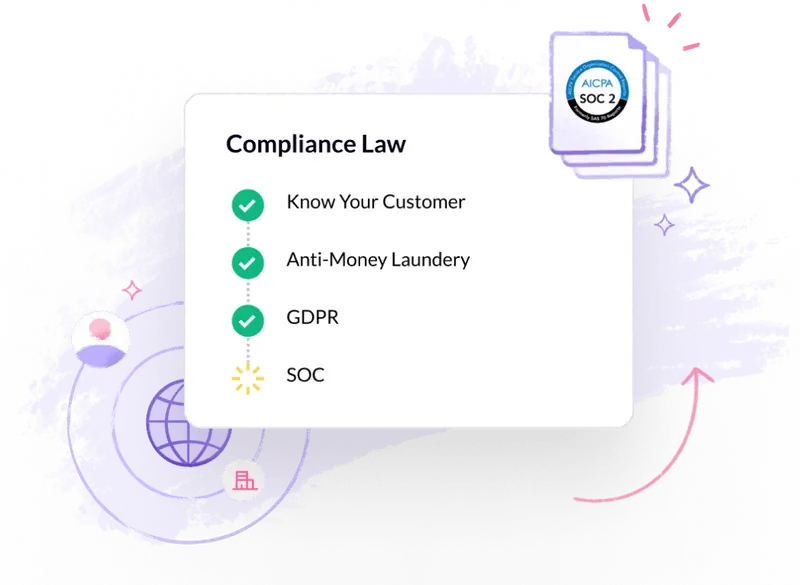

Fraud detection with AI is helpful across various industries for its accuracy, real-time fraud detection models and capabilities, adaptability to evolving methods, cost-effectiveness compared to traditional methods, enhancement of customer experience, risk management, and facilitation of regulatory compliance.

Benefits of Using AI Fraud Detection

Here are some Benefits of using AI Fraud Detection Solutions:

- Fast and More Efficient Solution: The best AI fraud detection processes incoming data and blocks new threats in milliseconds, providing outstanding security. Its active nature and speed guarantee quick action against fraudulent activities, strengthening overall defense tools.

- Reduced Manual Review Time: AI fraud detection minimizes manual review time, allowing employees to focus on proactive measures. With less time spent investigating threats, employees can allocate their resources to strategic projects that drive business growth forward.

- Better Predictions with Larger Datasets: AI develops better over time with larger data input, improving its predictive capabilities. Models of AI can share knowledge globally, collectively improving fraud detection effectiveness. For example, when one AI instance detects a new threat pattern, it shares it with all others, enriching their collective knowledge base.

- Cost-effective: Implementing AI fraud detection solutions like HyperVerge leads to cost savings by minimizing manual intervention and investigation, making it a cost-effective solution for businesses of all sizes.

Drawbacks of Using AI Fraud Detection

- False Positives: Despite advancements, false positives remain a concern. While AI systems aim to minimize them, occasional genuine users may be flagged erroneously, especially those employing less common browsers or VPNs.

- No Human Understanding: AI may struggle to combat social fraud threats such as phishing and social engineering, which rely on human interaction rather than automation. Educating teams about these risks remains important, as one employee falling victim could compromise the entire organization.

- Less Control: Depending solely on AI for fraud detection may result in less control over the detection process. Businesses may become overly dependent on automated systems, reducing their ability to intervene or override decisions when necessary. However, top fraud detection solutions offer customizable rules to provide users with control and transparency.

Protect Your Business from Fraud with AI

When choosing AI fraud detection software, businesses must prioritize high accuracy to minimize false positives, maintaining trustworthy fraud detection while maintaining legitimate transactions. Ensure the software can adapt to evolving fraud methods and handle large data volumes for scalability.

Transparency into algorithms and customizable rules are important for aligning with specific business needs. Lastly, opt for software offering comprehensive protection against various fraud types, including automated threats, social engineering, phishing attacks, document fraud, biometric spoofing, and deepfake manipulation, to effectively cover all potential fraud vectors.

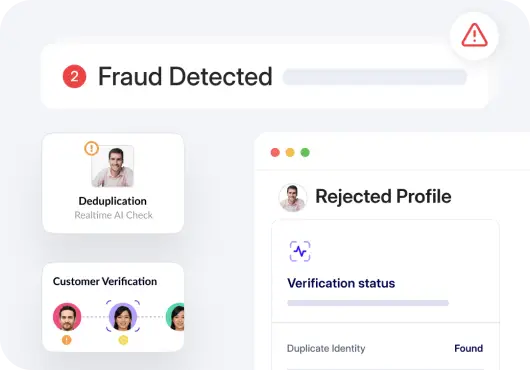

HyperVerge’s Identity Verification solution uses AI for Identity Verification and fraud detection. It excels in fulfilling these requirements.It offers high accuracy with fewer false positives, scalability with large datasets, transparency, and comprehensive protection against various fraud types through our verification tools.

With advanced AI technology and customizable features, HyperVerge ensures effective fraud prevention while adapting to evolving threats and business needs. Stay safe with HyperVerge’s solutions. Sign up now!

How Does AI-driven Fraud Detection Work?

AI-powered fraud detection models utilize your historical transaction data, and can proactively alert you on potential fraud attempts. Leading financial institutions are AI-powered identity verification solutions to combat the rising threat of identity fraud and deepfakes.

Let’s take a deeper look at how AI-driven fraud detection works:

Data Analysis

Machine Learning (ML) is a used data collection using of AI algorithms that are trained with your historical data to suggest risk rules. Additionally, data mining analyzes enormous volumes of data to spot patterns and anticipate future occurrences.

Pattern Recognition

AI algorithms then detect patterns indicating possible fraud, such as unusual transaction volumes, atypical access times, fraudulent transactions, or irregular account activity.

Predictive Modeling

An AI model is only as good as its training! Predictive models leverage historical data to proactively recognize patterns of fraudulent behavior.

Anomaly Detection

Real-time fraud detection systems also have the ability to alert you on the red flags whenever there’s suspected fraudulent activity.

Biometric Authentication

Modern fraud detection systems include biometric verification like facial recognition and liveness detection to ensure that the person is who they claim to be. AI-powered facial recognition is critical in preventing identity fraud and deepfakes.

Read more: Effective Fraud Detection and Prevention Strategies You Should Know

Types of Fraud and How AI can Help Prevent

Fraudsters find loopholes in such systems and invent new ways to deceive financial institutions. Here are some commonly deployed financial fraud types and how you can combat each one with AI:

Phishing

Phishing is an attempt to collect sensitive information, like usernames, passwords, and bank account details, by posing as a trustworthy entity. This can occur through emails, messages, or even fake websites.

How to leverage AI 💡

AI is a powerful ally in the fight against phishing. Advanced machine learning algorithms can analyze patterns in communication and identify phishing attempts. For eg, ML algorithms assess emails for suspicious subject lines or content and alert you for potential phishing attempts.

Identity Theft

Identity theft involves stealing someone’s personal information to commit fraudulent activities. This can range from opening unauthorized accounts to conducting financial transactions in the victim’s name.

In the case of synthetic identity fraud, fraudsters create a completely new “synthetic” identity to open an account or issue credit cards, after which they bust out or simply disappear.

How to leverage AI💡

Advanced AI-powered identity verification solutions form a formidable line of defense against identity theft. This includes technologies such as face recognition which ensures a robust layer of security in ai system by authenticating individuals through their unique facial features and matching relevant data from that against the pictures present on the official ID documents.

Liveness checks add an extra dimension by verifying the user’s presence in real-time, eliminating the risk of impersonation through static images or videos.

Document verification, on the other hand, leverages AI algorithms to scrutinize the authenticity of official documents, making it significantly harder for malicious actors to forge or manipulate identification credentials.

Money Muling

Money muling is a growing concern in the world of financial crime, posing a serious threat to the global economy. Money Muling involves individuals who, often unwittingly, become intermediaries in illegal financial transactions. Criminals recruit these individuals to move illicit funds through their bank accounts, exploiting them as a means to obscure the true origins of the money.

How to leverage AI💡

To counter this threat, financial institutions are increasingly turning to advanced technologies such as AI-powered Anti-Money Laundering (AML) solutions. These solutions leverage machine learning algorithms for transaction monitoring, enabling them to identify which transaction patterns as indicative of money-muling activities and detecting fraud. Additionally, AI is employed in sanctions screening, which helps flag transactions involving a Politically Exposed Person (PEP) or entities on watchlists.

AI is helping financial institutions not only enhance their ability to detect and prevent money laundering, but also help them comply with AML compliance regulations.

Document Forgery

Document forgery involves creating or altering official documents. Fraudsters use sophisticated techniques to produce counterfeit identification, bank statements, and other critical documents, undermining the integrity of transactions and compromising the security of financial systems. This illicit activity can result in severe consequences, including financial losses, legal complications, and damage to a company’s reputation.

How to leverage AI💡

AI-powered ID document verification solutions scrutinize documents for inconsistencies, anomalies, and other signs of manipulation. These solutions also compare the provided documents against vast databases of genuine IDs and accurately identify potential forgeries.

Implementing AI-powered ID verification not only fortifies the security measures of financial services but also streamlines customer onboarding processes, enhancing overall efficiency and customer experience.

Account Takeover

Account takeover fraud is a malicious practice wherein cybercriminals gain unauthorized access to a user’s online accounts, exploiting personal information for nefarious purposes. This type of fraud typically involves stealing login credentials through various means such as phishing, credential stuffing, or malware attacks. Once infiltrated, fraudsters can manipulate the account, posing as a legitimate user to make unauthorized transactions or access sensitive information.

How to leverage AI💡

AI-powered identity verification solutions verify the identity of an individual with biometric authentication, liveness check, and document verification. Additionally, real-time monitoring and adaptive risk assessment further enhance security measures.

Deepfake Fraud

Deepfake fraud is a rapidly evolving form of cybercrime that leverages artificial intelligence (AI) to manipulate or mine data science and generate realistic-looking multimedia content, often using facial or voice synthesis technology. Fraudsters use deepfakes for malicious purposes, such as identity theft, spreading misinformation, or committing financial fraud.

How to leverage AI💡

Forward-thinking organizations are turning to advanced AI-powered identity verification and biometric verification solutions with liveness checks. These technologies add an extra layer of security by ensuring that the identity being verified is not only authentic but also physically present. Liveness checks use dynamic interactions, such as facial movements or gestures, to confirm that the biometric data is being captured from a live person and not from a prerecorded or manipulated source.

AI-powered deepfake detection can ensure that you’re onboarding real individuals every time, ensuring that you don’t lose money or reputation to deepfake fraud.

How FE Credit Saved $15M+ with Proactive Fraud Detection

Let’s look at a real-world example of an AI-powered fraud detection system.

FE Credit is a leading financial institution in Vietnam with 12 million+ customers, including 30% of new loan contracts each year. It is a subsidiary of VPBank (Vietnam Prosperity Bank), one of the leading banks in Vietnam.

With HyperVerge’s proactive fraud prevention, FE Credit was able to save a whopping $15+ Million! How did they do it?

HyperVerge enabled FE Credit to:

- Prevent past fraudsters from onboarding

- Detect and prevent synthetic identity fraud proactively

- Leverage proprietary face AI for implementing blocklist and golden records

- Provide superior experience to customers

To read more about success stories like this, check out our customer stories here!

Stay Ahead of Fraudsters with HyperVerge

Financial fraud is a real threat and you need to invest in technology that is reliable and scalable. Look for a comprehensive payment fraud, detection and prevention solution that can help you with:

Document verification

Biometric verification

Liveness verification

Deepfake detection

Leading financial institutes have seen powerful results with HyperVerge:

- 2x more frauds detected

- 50% lower customer drop-off

Want to see how we fit into your workflows? Sign up for a customized demo here.