Addressing fraud, money laundering, and rule violations in a marketplace would be much easier if your security teams could predict and handle each issue as it arises. Unfortunately, this is rarely the case.

To manage these challenges, anti-fraud and AML teams use fraud case management. This approach involves organizing the investigation and resolution of suspicious activities in a structured way, ensuring faster and more efficient responses.

It also minimizes financial damage, helps businesses maintain regulatory compliance, and protects their reputation.

What is fraud case management?

Fraud case management is a process designed to ensure that investigations into fraudulent activities are conducted swiftly, efficiently, and collaboratively across teams. Fraud case management software is a specialized tool used to prevent, manage, and investigate fraudulent activities. Given the complexities of fraud, different teams must remain aligned throughout an investigation.

Payment fraud cases are typically more intricate and costly than other types of fraud investigations. They often involve numerous parties, including internal investigators, legal counsel, and law enforcement officials, and span multiple business tools and software platforms. This complexity makes organization and collaboration vital for a successful outcome.

Fraud case management facilitates keeping track of all aspects of an investigation. It allows users to securely gather and store data from various sources, such as emails, reports, and documents, and share this information across departments.

These features help fraud teams streamline their processes, reducing the time spent on manual tasks like emailing multiple stakeholders relevant information, sifting through hard drives for relevant evidence, or differentiating fake documents from real ones.

Key components of effective fraud case management

Here are the key components of effective fraud case management:

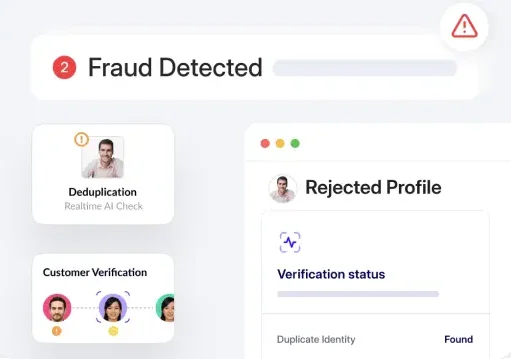

Real-time fraud monitoring and detection

Fraud case management systems that are modern use advanced AI technologies, as well as machine learning algorithms, to detect fraudulent activities. As a result, these technologies can analyze large amounts of data in real time and discover many patterns or any unusual strings of numbers which might indicate fraud such as.

For example, the system can flag unusual transaction patterns or those that deviate from the normal human behavior of a customer account. This will allow the business to see as early as possible any suspiciousness and to take appropriate action. If businesses are to combat fraud effectively, they must monitor continuously transactions and activities.

This new data allows companies to detect and respond to fraudulent transactions and actions as they occur, helping to identify new and evolving fraud patterns and ensuring they stay one step ahead of fraudsters.

Comprehensive customer risk assessment

Effective fraud case management requires a holistic view of customer risk. Aggregating data from many sources, including transaction histories, credit scores, behavioral data, etc. To establish a full picture of the customer’s risk, businesses can create detailed profiles for each individual by compiling this information.

With detailed risk assessments, companies can make informed judgment calls about customer onboarding procedures and transactions. For instance, a customer with a high-risk profile may need more identity checks before they can carry out a transaction.

This proactive approach minimizes the risk of fraud while ensuring legitimate customers are not unduly burdened.

Streamlined compliance processes

Anti-money laundering (AML) regulations are designed to prevent the flow of illicit funds through the financial system, and businesses must adhere to these regulations to avoid legal penalties and reputational damage.

Fraud case management systems help ensure compliance by automating the monitoring and reporting of suspicious activities. Since financial regulations vary across jurisdictions and frequently change, staying compliant requires businesses to continuously update their AML fraud detection and prevention strategies.

An effective fraud case management system keeps businesses informed about these regulatory changes, ensuring they remain compliant across all operating regions.

Secure Your Operations. Discover how our effective fraud risk case management capabilities can protect your business and maintain trust.

Schedule a DemoBenefits of robust fraud case management

Here are the key benefits of robust fraud case management tool capabilities:

Reduced operational costs and increased efficiency

Implementing effective fraud case management systems reduces the need for extensive manual oversight, lowering operational expenses and boosting efficiency.

Automated systems can handle large volumes of transactions and alerts, freeing human resources to focus on more complex cases that require detailed investigation.

Enhanced customer trust and brand reputation

Fraud prevention strategies keep businesses as well as customers’ financial loss, They also bolster customer confidence in companies’ equity channels in an atmosphere of trust.

With a high profile in security and protection of user rights, corporation brands grow and win back customer loyalty in the long term.

Proactive fraud prevention and mitigation

Implementing a strong fraud detection system enables companies to catch and stop fraudulent transactions at the initial stage and combat potential threats.

By keeping well clear of criminals, companies can avoid problems causing a loss in investment and erosion in consumer confidence.

Seamless integration with existing systems

Modern fraud management systems and solutions offer seamless integration with an organization’s current operational frameworks. This ensures minimal disruption while empowering businesses to bolster their fraud prevention capabilities, leveraging existing infrastructure effectively.

Five steps to develop an effective fraud risk management strategy

Here’s a structured approach to developing and improving a fraud case management data mine and tracking program in five steps:

- Fraud risk assessment: Conduct a thorough evaluation to identify potential fraud risks, both internal and external. Assess the likelihood and potential impact of each risk, aligning them with the organization’s risk tolerance. Prioritize risks to focus resources effectively.

- Fraud risk governance: Establish a robust framework for fraud risk management, including clear policies, procedures, and responsibilities. Define internal controls and segregation of duties to mitigate risks effectively. Engage senior leadership to oversee and support these efforts.

- Fraud prevention and detection: Implement proactive measures such as continuous transaction monitoring and advanced analytics for detecting anomalies. Regularly assess the effectiveness of these measures and adjust strategies to address evolving fraud tactics.

- Monitoring and reporting: Maintain ongoing oversight of fraud analysts to ensure the effectiveness of fraud case management and efforts. Develop procedures for the fraud team to report suspected fraud incidents promptly and take swift corrective actions as needed.

- Continuous improvement: Adapt the fraud risk management program continually to enhance performance. Seek feedback from stakeholders to identify areas for improvement. Update via industry journals. Keep up-to-date with new advances in fraud detection technology and any upcoming fraud threats.

Conclusion

Fraud case management is essential for handling financial crimes like fraud and money laundering effectively. It organizes investigations, speeds up responses, and reduces financial damage while ensuring compliance and protecting business reputations.

Using these tools and specialized software, teams collaborate to monitor fraud in real time, assess customer risks comprehensively, and streamline compliance processes. This approach cuts costs, boosts efficiency, and builds customer trust by preventing fraud proactively.

HyperVerge’s advanced fraud detection and prevention solution is a proactive response for companies. We help them turn away financial losses and maintain the high efficiency they need for normal operations.

By simply integrating with existing systems, we not only raise the standard for fraud prevention but also have the effect of reducing costs.

To explore how HyperVerge can benefit your business, visit the fraud prevention solutions page for more information.