Loan Origination Software (LOS) is complicated, and for good reason. It needs to follow many different frameworks of compliance depending on the kind of loan being given, and it needs to make sure that all the necessary documents are in order.

With the many laws and policies being passed these days, loan management has become much harder. The increases in compliance complexity as well as the number of loan requests has made it difficult for manual compliance systems to keep up. This is where automated loan origination comes into the picture.

One of the most well-known ones is Finflux, designed to ease the process of loan management and act as a good servicing software. However, it may not be the perfect one for your organization. This kind of software is one of the most vital tools for any institution that deals with loans, and as such, it is important to select the loan servicing software that is best for your specific requirements.

In this article, we will take a look at some of the top Finflux alternatives, as well as their uses.

Why consider Finflux alternatives?

Finflux offers a broad array of features, all of them designed to make loan management easier. However, different countries have different requirements, and perfect customization is not always feasible. Finflux has achieved a great degree of success in its field, with 100+ global financial institutions relying on them to handle loan management. However, there are certain use cases where more specialized loan servicing software may be required. For example:

- API Integration: Not all banking institutions have giant server farms to run resource-intensive cloud computing software. These financial institutions may require better alternatives, designed closer to their requirements.

- Pricing Differences: Many companies don’t use regional pricing, often making their product prohibitively expensive in certain areas, or vastly underpriced in others.

- Ease of Use: Not all loan origination software is built alike. If a certain system tries to expand to handle the compliance laws of many different countries, it becomes far more complex to use than one specialized towards one region.

- AI Capabilities: With the recent advancements in Machine Learning and Artificial Intelligence, many loan origination software systems have started including AI capabilities. But since they are quite resource-intensive, it becomes important to analyze what your exact requirements are, and use one that’s best suited for you.

- Geographical Availability: Not all loan origination software systems can work everywhere. Specialized ones are often limited to the regions they can handle.

- Data Security: Given the fact that these loan origination systems are meant to handle a great deal of sensitive and private financial data, protecting the interests of your clients is of paramount importance. A proper loan origination software system should be able to provide proper data security as well as fraud prevention measures based on the requirements of the loan.

While there are no free alternatives to loan processing solutions as important as these, there are several companies that offer free trials, allowing you to pick your preferred software solutions after thorough testing.

How we evaluate the top Finflux alternatives

Of course, analyzing such a variety of Finflux alternatives is something that needs to be done as fairly as possible. To that end, we use several different ways of gathering data. G2 reviews and CapTerra reviews are given the most weight, since they are comprehensive and done by experts. Reviews on Reddit are also taken into consideration, especially since they may provide insight into edge cases. In order to make our reviews more relevant to anyone who needs assistance in selecting the right automated loan origination software for their requirements, we also analyzed the strengths and weaknesses of other software solutions on the market.

Overview of the top 10 Finflux alternatives

| Top Alternatives | Free Trial Availability | Standout Features |

HyperVerge | Yes | AI-enabled, Digital ID verification |

LoanPro | No | Payment process automation |

Lentra | No | Easy integration with legacy systems |

LendingWise | No | Strong compliance management system |

Bryt Software | Yes | Escrow account handling |

Perfios InteGREAT | Yes | High onboarding speed |

Jocata | Yes | Strong rule engine |

Finbox | Yes | Handles post-disbursement tasks |

Decimal | No | No-Code Platform |

Turnkey Lender | Yes | Functions across many countries |

A detailed list of the 10 best Finflux alternatives for automated loan journeys

HyperVerge

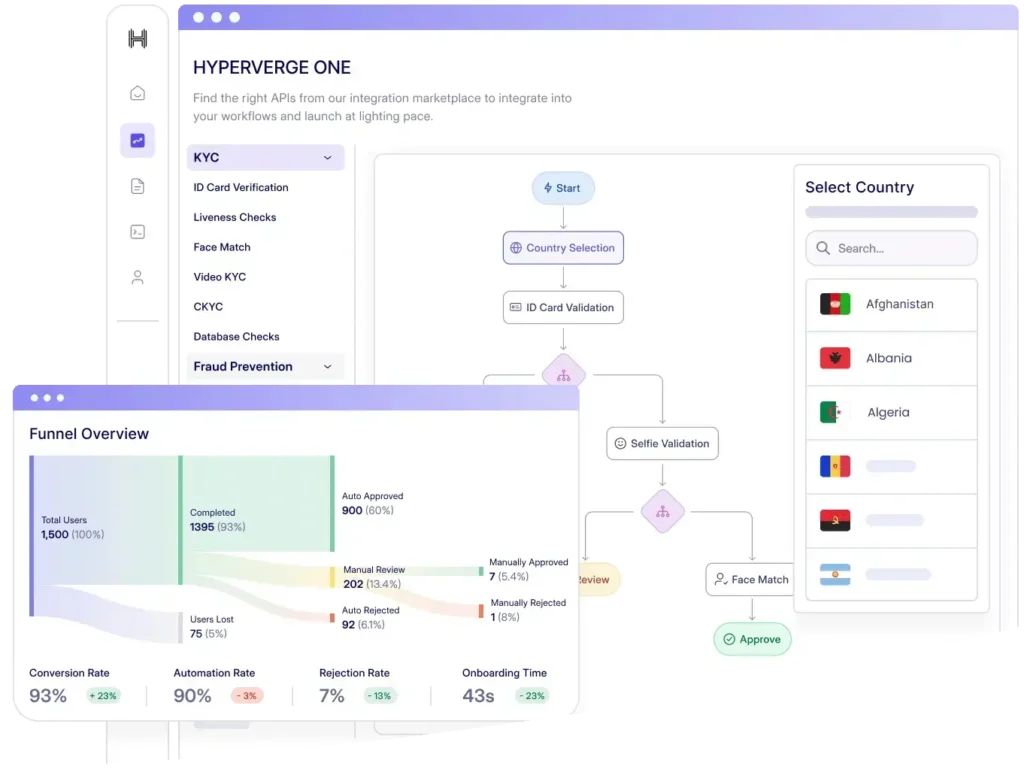

HyperVerge ONE is a cloud-based, comprehensive loan origination software platform, providing an end-to-end software solution to manage the entire loan life cycle. It does so by maximizing user-friendliness, as well as easing the integration process. Depending on the loan being disbursed, different kinds of documents need to be cross-checked. All of these checks can be performed via proper database integration and automation, allowing for a great increase in efficiency. The addition of AI and Machine Learning allows this platform to keep up with changing laws and rulesets, making it much easier to update requirements, as opposed to making manual changes every time a new law is passed. It also features powerful fraud detection features, giving you the assurance that your customer data will be as safe as possible, which is quite an important advantage over all the alternatives.

Best for

Banks, financial institutions, telecom companies, digital lenders, crypto companies, gaming companies

HyperVerge pricing

HyperVerge offers three pricing plans, which scale as per your requirements.

Start, for start-up companies

Key Features:

- Free trial in sandbox environment

- 1 month period

- Integrate in less than 4 hours

- View & Manage verifications

Grow, for midsize companies

Key Features include everything in Start, plus:

- End-to-end ID verification suite

- Central Database Checks

- Access to AML checks

- Custom workflow for businesses

Enterprise, for Enterprise-level organizations

Key Features include everything in Grow, plus:

- Collaborate-Lead-Solve

- Custom price structures

- Dedicated support

- Custom Collaborative Innovation

What do HyperVerge users say?

LoanPro

Basic info

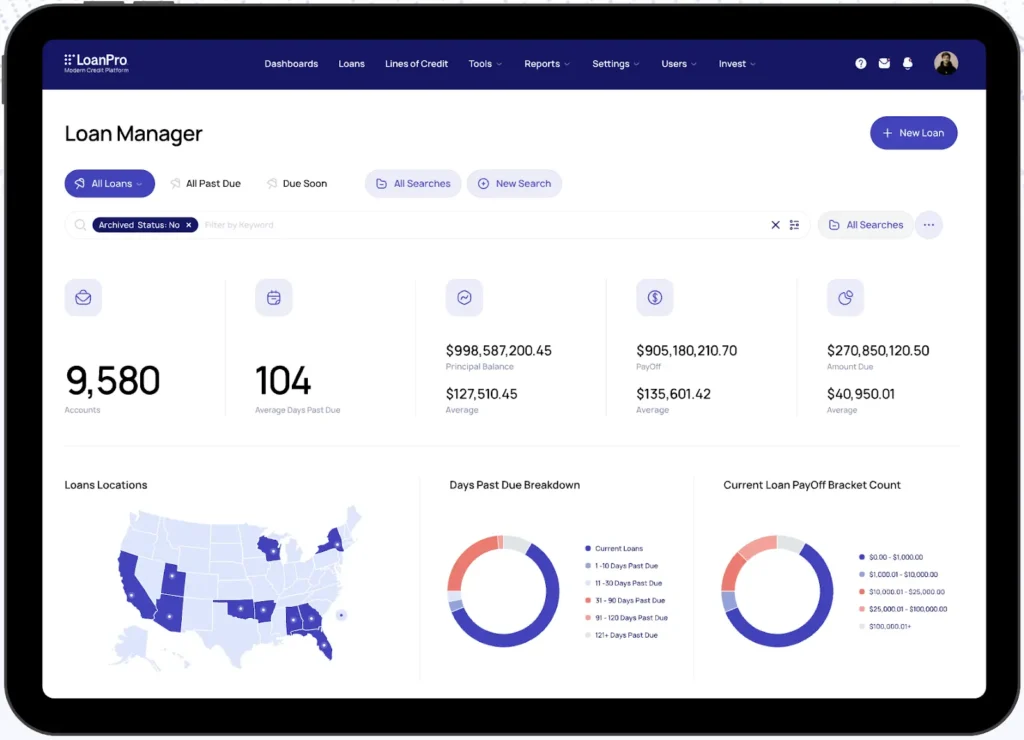

Designed for companies looking to grow in the lending industry, LoanPro offers a cloud-native loan origination architecture to manage the entire loan life cycle. It enables lenders by offering a number of tools, designed to ease the process of application management, payment processing, and compliance management. It makes heavy use of automated workflows, resulting in increased efficiency in customer communications and payment processing. This automated communication system also makes borrower engagement much easier.

LoanPro also has comprehensive reporting capabilities, allowing you to track performance and assess risk properly. The built-in compliance and accounting tools also make it easier to manage the loan process, resulting in fewer errors.

Best for

Mid-market and enterprise lenders, FinTech companies, banks, and alternative lenders

LoanPro pricing

LoanPro offers customizable packages depending on requirements and scalability.

What do LoanPro users say?

Lentra

Basic info

Lentra is a cloud-based Software-as-a-Service (SaaS) platform designed for financial institutions working in the field of digital lending. The loan origination platform is API-enabled and uses low-code tooling, allowing legacy systems to integrate with minimal issues. The ease of use makes it so older systems can use it to modernize, allowing them to start upgrading their systems to match customer requirements and policy changes.

Best for

Banks, Non-banking financial institutions, Fintech companies, Credit unions, Financial institutions looking to modernize

Lentra pricing

Lentra’s pricing and packages are not as they offer customized pricing for business requirements.

What do Lentra users say?

“We started our partnership with Lentra with consumer durable loans. Their product enabled us by giving us seamless API connections to all products of every credit bureau in the market. It helped us in creating bureau strategies, balancing business benefits and bureau usage costs, thereby increasing our efficiency. This partnership has led to seamless customer journeys and high satisfaction levels among our partners and customers.”

HDFC Bank

LendingWise

Basic info

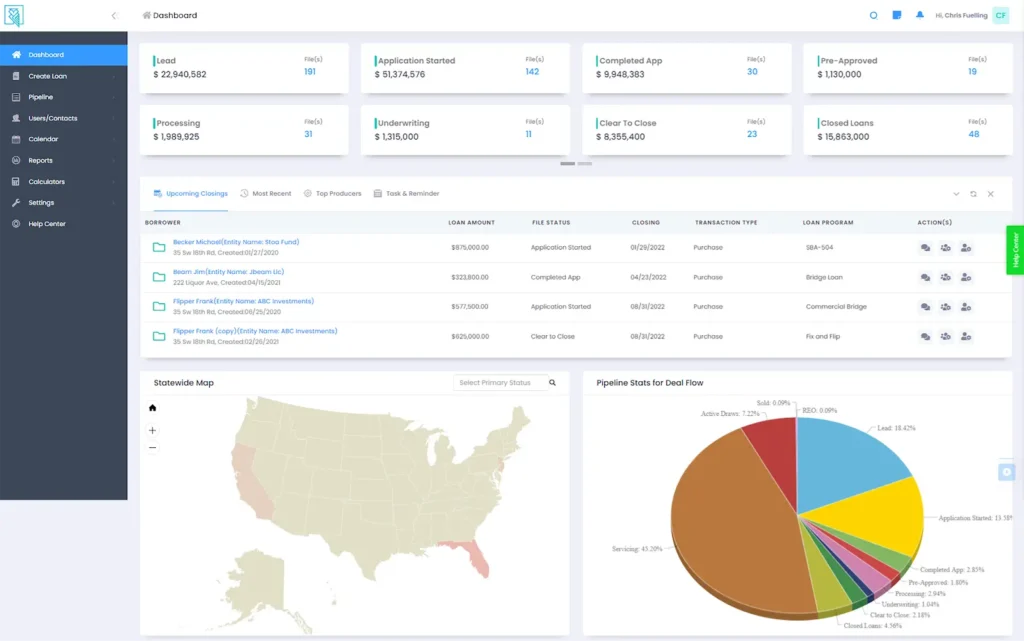

LendingWise is a comprehensive loan management solution designed to easily integrate with legacy systems. It heavily automates many sections of the loan management process, and features a vast number of customization options. The user-friendly interface is also designed to make it easier to use for lenders as well as borrowers, and the inbuilt compliance management system makes it safe to use.

Best for

Banks, NBFCs, Fintech companies, Mortgage lenders

LendingWise pricing

LendingWise has two plans.

For Brokers: $149+ per month

- One user included

- Minimal setup fee

- Addons sold separately

For Lenders: $749+ per month

- Five back office users

- Five LO/Broker users

- Minimal setup fee

- Addons sold separately

Both plans feature:

- CRM

- LOS

- Lender Marketplace

- Professional Services

What do LendingWise users say?

Bryt Software

Basic info

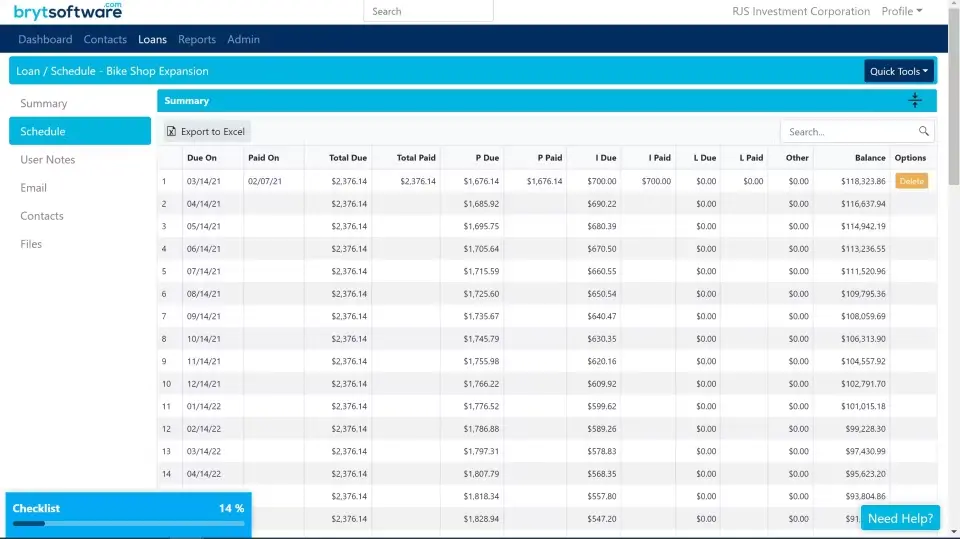

Bryt Software is a comprehensive loan management platform designed for financial institutions. One of its main draws is the degree to which it automates payment processing, making it much easier and more efficient. It can manage borrower escrow accounts, as well as enable lenders to store documents associated with each loan, for the entire loan life cycle. The modular system provides an excellent software solution, and gives them an advantage over their competitors.

Best for

Banks, NBFCs, Fintech companies, Mortgage lenders, Consumer finance companies, Loan servicing firms

Bryt pricing

Bryt software’s pricing plans start from $59/month, but can change depending on all the modules required.

What do Bryt users say?

Perfios InteGREAT

Basic info

Designed for maximum efficiency in onboarding, Perfios InteGREAT can onboard customers with minimal data input. In terms of loan origination, it is one of the better alternatives, and it can give an efficiency boost good enough to beat out competitors. Due to its strong KYC APIs, it can greatly reduce time to approval for loan applications. The increased verification speed and management via automation make it one of the better solutions for expediting the lending process.

Best for

Banks, Credit unions, NBFCs

InteGREAT pricing

InteGREAT offers a free trial to start, followed by a basic plan at $5/month and an advanced plan at $18/month.

What do InteGREAT users say?

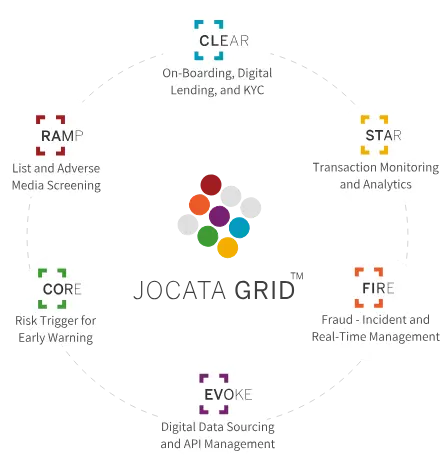

Jocata

Basic info

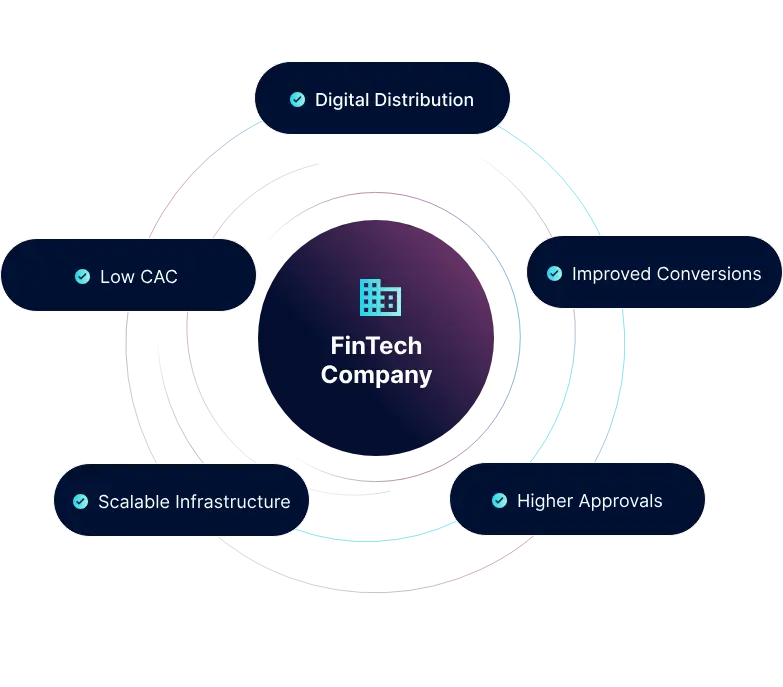

Designed to leverage AI for decision making, Jocata’s GRID is a robust platform, providing a number of advantages for businesses involved in digital lending. Key features like identity verification, risk management, operations, and regulatory compliance allow for easy and quick loan origination. With a strong rule engine and AI ensemble, it works well to prevent fraud and help with digital lending.

Best for

Large enterprises in the financial and banking sectors

Jocata pricing

Jocata has a free trial, and the paid plans are priced at approximately $1200 per feature per year.

What do Jocata users say?

Finbox

Basic info

Designed to start or scale a credit program, the Finbox tech stack enables lenders by giving them a wide variety of credit products across multiple channels and use cases. The loan origination software stack can handle loan applications from multiple channels, and can cover post-disbursement tasks like risk policies and underwriting, to make support easier. It primarily works with Micro, Small and Medium Enterprises, and assists them with closing the credit gap via proper loan management.

Best for

MSMEs, Financial institutions, Digital platforms

Finbox pricing

Finbox plans are customized, and priced according to requirements.

Decimal

Basic info

Designed for MSMEs, the Decimal Technologies loan origination software is built using low-code modular architecture for maximum ease of customization. The system is built to handle a wide variety of loans, including:

- Personal loans

- Business loans

- Gold loans

- Home loans

- Auto loans

- Loans against property

Best for

Banks, NBFCs, Microfinance institutions, Fintech companies, Credit unions, Embedded lenders

Decimal pricing

Decimal does not have fixed plans or packages, and instead provide a modular setup.

What do Decimal users say?

Turnkey Lender

Basic info

Turnkey lender offers the fastest time-to-market, and a degree of configuration freedom that gives stiff competition to other LOS systems. It provides advanced automation systems, with high-grade document and payment management systems. Plus, the KYC and AML compliance systems make sure that data from clients is kept safe.

Best for

Commercial lenders, Embedded lenders, Financial institutions operating in multiple regions

Turnkey Lender pricing

Turnkey Lender offers a free trial, and the paid plan starts at $500 per month. The final price depends on what modules are needed.

What do Turnkey Lender users say?

How to choose the best Finflux alternative for your business

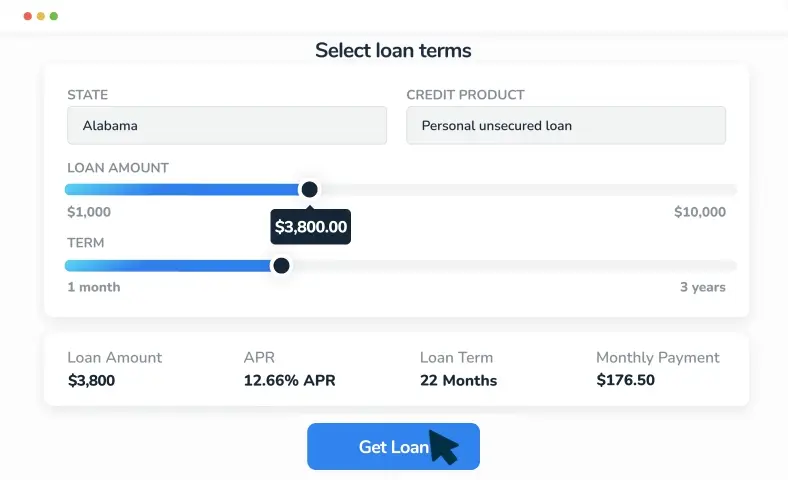

Functionality and Features

When choosing a Loan Origination Software, your first step is to make sure that it fits the needs of your business. As seen in this article, there are many different kinds of software solutions available in the market, with features geared towards different specializations. To select the right software for your business, you need to evaluate the core capabilities of the software, such as loan origination, servicing, accounting, and reporting.

The compliance requirements for companies are different depending on the kinds of products they offer. If your business is geared mainly towards, for example, loans for SMEs, then your compliance requirements will be different than a company that offers microloans. Make sure that the LOS you pick can handle the specific loan types and business needs of your organization.

Look for an end-to-end solution

Businesses involved in the digital lending space have to deal with vast amounts of data and manage a lot of requirements. Given the strict compliance policies and the large fines involved, it is best to reduce human error as much as possible, and automate the majority of the process. As such, it is in your best interest to look for an end-to-end solution, as it drastically improves the process, from onboarding, to security, to compliance, to disbursal.

Ease of Use and Onboarding

When performed manually, the process of onboarding takes up a huge amount of time. Checking and cross-checking documents, performing KYC, understanding and enforcing compliance requirements, making sure that all team members are trained properly – all these factors add up, costing your company time and money.

Simplifying and automating this process is quite important, and to do so, you need to look for software with an intuitive user interface that requires minimal training time. That said, given how complex these kinds of software need to be, you should also make sure that you and your team have access to proper support.

Scalability and Flexibility

Another important aspect to consider is planning for the future. Whatever software you pick, it needs to not only serve your present needs, but also your future ones. If you are planning to scale your business, your software needs to be able to scale alongside. If you are planning on growing your loan portfolio, you need to make sure that the software you pick is flexible enough to adapt to the new product offerings you are going to put forth.

To make sure that the software you pick is scalable and flexible, look for configurable and customizable features to adapt it to your unique workflows.

Integration and Compatibility

Unless you’re starting your business from scratch, you likely already have systems in place to handle loan processing. It is very inefficient to shift entirely to a new system while scrapping your old one. Any software worth using needs to be able to integrate with your current systems, while also allowing you to maintain a good amount of efficiency. As a result, it is important to make sure that the software you are choosing can easily interface with your existing systems, such as CRMs, accounting platforms, and credit bureaus.

The loan origination software also needs to be able to interoperate with external systems, as there needs to be seamless data exchange between it and other critical business tools.

Security and Compliance

Given the risks of financial crimes or fines from breaking policies, it is best to make sure that the software you pick has good security and compliance systems built in. The three features that are necessary are robust data protection, access controls, and industry regulations compliance systems.

To be safe, you should also verify the software’s security certifications and data privacy measures.

Customer Support and Reputation

Another good way of selecting the right software for you is by looking at the vendor’s reputation. Before you invest in it, research the vendor’s track record, customer reviews, and the quality of their technical support. Make sure that they have a good reputation in the lending technology space, to reduce the odds that you will have issues.

Boost your approval ratings with automated end-to-end LOS

Given the complex requirements that an LOS platform must fulfill, the best bet is to go with an automated end-to-end LOS like HyperVerge One. Designed for ease of use, the no-code workflow builder makes onboarding and integration easy, while the customizable UI reduces the level of friction when changing your system over. Security features like downtime protection make sure your customer data remains safe, while the application review portal makes customer service much more efficient. Think HyperVerge One is right for you? Click here to book a demo!

FAQs

1. What is Finflux?

Finflux is a cloud-based lending platform designed to streamline the loan origination and management process for financial institutions. It offers a suite of tools including loan origination, loan management, financial accounting, and more, aiming to make lending more accessible and efficient.

2. How do I choose the best Finflux alternative for my business?

Selecting the right Finflux alternative depends on your specific business needs and requirements. Consider the following factors:

- Business Size: Your business size will influence the scale and complexity of the software you need.

- Features: Identify the specific features essential to your operations, such as loan origination, underwriting, customer relationship management, and reporting.

- Integration: Ensure the software can integrate with your existing systems and processes.

- Pricing: Evaluate different pricing models and choose one that fits your budget.

- Customer Support: Reliable customer support is crucial for any software solution.

- Scalability: Consider your business’s growth plans and choose a software that can accommodate future expansion.

By carefully evaluating these factors and comparing different options, you can select the Finflux alternative that best suits your business.

3. Are there any free or open-source Finflux alternatives available?

While there might not be direct, fully-featured free alternatives to Finflux, there are some open-source options that can provide a foundation for building a custom lending solution. Apache Fineract is a popular open-source platform that offers core banking and microfinance functionalities. It can be customized to meet specific needs but may require technical expertise to implement and maintain.

Keep in mind that open-source options often involve additional costs for customization, implementation, and support. It’s essential to weigh the potential benefits and drawbacks before choosing an open-source alternative.