Are you seeking a reliable and efficient Know Your Customer (KYC) platform to automate KYC processes? Do you struggle with customer identity verification and want to avoid KYC and AML violation penalties?

Customer identity verification helps avoid identity thefts and impersonations, which are a common challenge today. A Federal Trade Commission report states that over 1 million identity theft cases were received in 2023. These cases are a result of flawed customer verification processes.

Using KYC automation platforms helps avoid violating KYC regulations and streamline compliance processes. However, with so many KYC platform options in the market, how do you find the right solution for your needs?

This blog provides detailed information on 10 of the best KYC software available. Know the features, pros, cons, and pricing of the top KYC solutions and make informed decisions for your business’s KYC automation.

What is KYC software?

KYC software solutions help businesses automate customer identity verification processes. Built using technologies like Artificial Intelligence (AI), Machine Learning (ML), and Optical Character Recognition (OCR), KYC tools ensure that real and authentic customers are onboarded to avail themselves of your services.

A KYC platform replaces manual KYC checks by automatically collecting and verifying customer information against databases. This includes the customer’s legal documents, addresses, financial histories, and criminal records.

Since KYC platforms are important to comply with Anti-money Laundering (AML) laws, choosing the right identity verification solution is important. We undertook the endeavor of finding the top KYC software options from the market to bring you the best ones. Let’s take a detailed look at how we shortlisted KYC platforms.

How we analyzed KYC software options

We analyzed over 30 available KYC software solutions. We assessed each software based on features, precision in digital identity verification, integration with existing AML systems and customer onboarding platforms, and AI capabilities.

We also evaluated each software against criteria like G2 reviews and ratings, Capterra ratings, user preferences, and feedback on community platforms like Reddit. By conducting this extensive research, we narrowed down our list to 10 of the best KYC software solutions. The following section sheds light on our selected KYC platforms.

10 Best KYC software at a glance

Here is a head-to-head comparison of the 10 best KYC platforms based on their G2 score and standout features.

| Platform | G2 Score | Standout Feature |

HyperVerge | 4.7/5 Stars (53 Reviews) | Verify customers in 3 seconds with best-in-class AI technology |

Veriff | 4.1/5 Stars (13 Reviews) | 98% check automation rate powered by AI |

Ondato | 4.7/5 Stars (43 Reviews) | Accurate biometric and face match technology |

Onfido | 4.4/5 Stars (87 Reviews) | 95% results in 10 seconds with Atlas™ AI |

Trulioo | 4.4/5 Stars (40 Reviews) | Comprehensive coverage with over 450 data sources |

iDenfy | 4.9/5 Stars (86 Reviews) | 3D liveness detection and authentication |

Sumsub | 4.6/5 Stars (83 Reviews) | Custom verification flow generator |

Socure | 4.5/5 Stars (102 Reviews) | AI-led risk decision automation |

ComplyAdvantage | 4.4/5 Stars (14 Reviews) | Risk assessment prioritization for high-risk profiles |

Persona | 4.5/5 Stars (36 Reviews) | Create customized KYC/AML workflow |

Automate your KYC processes with HyperVerge

Verify new customers in 3 seconds with HyperVerge KYC solution. Book a DemoThe above list provides a brief overview of the best KYC software options. We will then discuss each of the listed KYC solutions in detail.

Detailed information on the 10 best KYC platforms

Each KYC solution has unique capabilities, features, and best-for scenarios. We have provided detailed information on each identity verification platform to help you understand your options.

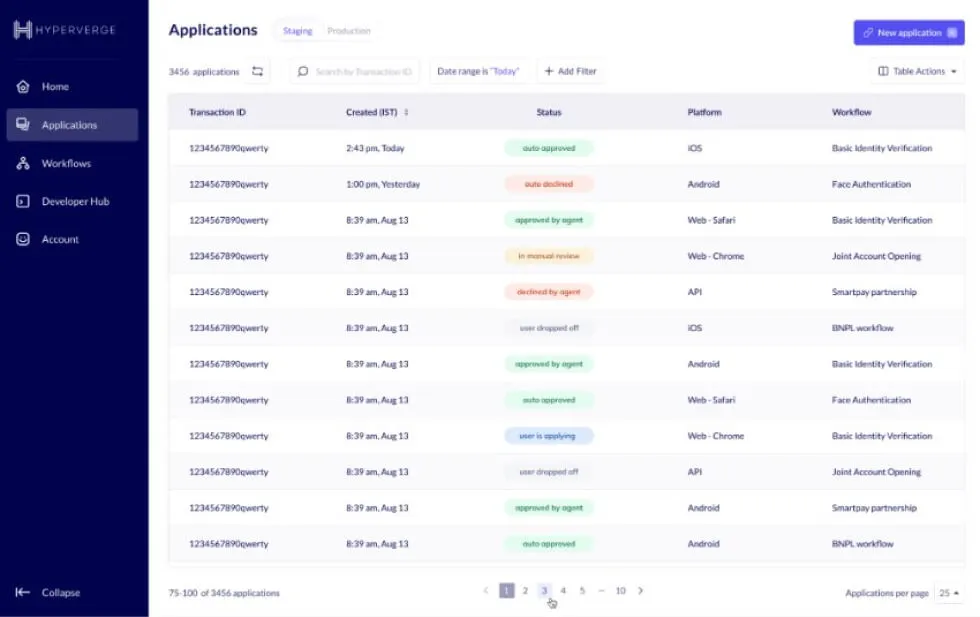

1. HyperVerge

About HyperVerge

HyperVerge enables onboarding of customers seamlessly and ensures end-to-end security compliance with its onboarding solutions. With a 99% accurate AI engine, HyperVerge helps minimize fraud causes and ensure business security—guarding businesses against fraudsters.

HyperVerge is trusted by over 200 brands worldwide, including renowned organizations like HSBC, Jupiter, and CRED. Their solutions are tailored to fit the compliance requirements of every industry, from FinTech and marketplaces to gaming and crypto. This makes HyperVerge a perfect onboarding and compliance solution for all your needs.

HyperVerge’s digital identity verification and KYC solutions help simplify KYC processes through automation and intelligence. With a 95% auto-approval rate, this KYC system helps ensure that your customers are who they claim to be.

With a record of verifying 750 million+ IDs, HyperVerge AI is reliable for conducting KYC checks. With a quick 3-second identity verification process, this tool is your best option for automated identity verification and KYC compliance.

HyperVerge pricing details

HyperVerge offers 3 pricing models: Start, Grow, and Enterprise. You can choose a model suitable for your business objectives and KYC regulatory compliance needs.

| Start For startup companies | Grow For mid-sized companies | Enterprise For enterprise-level companies |

| 1 Month Free Trial | Custom Quote | Custom Quote |

Key features of HyperVerge

- Database verification: Leverages government-recognized customer data to help users quickly and accurately verify identities.

- OCR for IDs: Automatically extracts information with 99% accuracy from recognized customer ID cards across 190+ countries.

- Biometric verification: Conducts image-based biometric authentication to ensure maximum coverage.

- Fraud detection: Blocks out fraudsters using AI-powered forgery checks, deep image analysis, and liveness detection.

- Quality checks: Assists customers in preventing bad-quality images. Streamlines the onboarding process and accelerates KYC efficiency through assisted image capture.

- AML checks: Implements ongoing monitoring mechanisms through KYC and AML configuration. Strengthens customer verification through AML checks.

Pros of using HyperVerge

- Users appreciate HyperVerge’s promptness in accommodating requests and offering support.

- Businesses admire HyperVerge’s accuracy, which ensures a user’s face is verified before proceeding with the KYC process, enhancing security and compliance.

- Organizations can easily expand operations to new countries and fulfill KYC compliance requirements with HyperVerge’s diverse location coverage.

- The no-code workflow builder helps users configure KYC steps with existing processes for streamlined implementation.

Client Testimonial

Check out the experience of Avail Finances in using HyperVerge’s solutions to eliminate KYC bottleneck processes.

Key highlights of HyperVerge’s KYC Solution

| 50 %Reduction in drop-offs | 99%Precise OCR for document verification | 332 Million+Popular coverage for the USA |

Streamline KYC compliance processes with HyperVerge

Onboard new customers and comply with KYC regulatory requirements with HyperVerge. Book a Demo2. Veriff

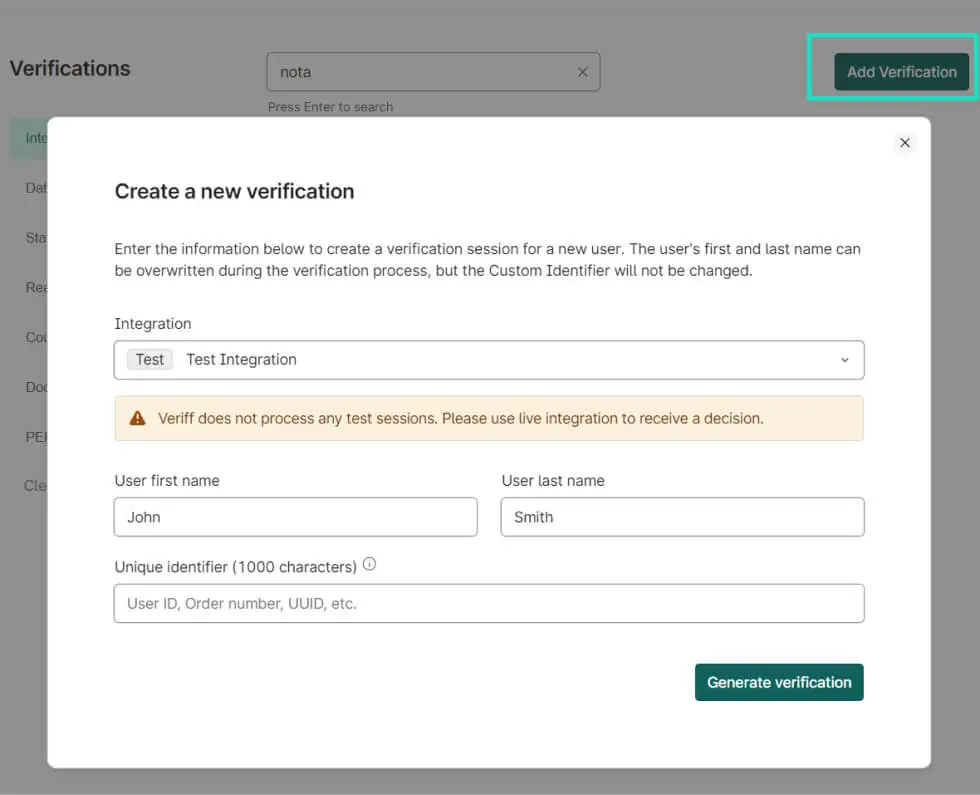

About Veriff

Veriff helps harness the potential of AI-powered automation, feedback learning, and manual reviews for KYC processes. This KYC platform helps convert more users through automated and guided KYC verification, thus streamlining customer onboarding with compliance.

Veriff’s KYC solution supports over 11,500 documents from more than 230 countries, giving your business an excellent edge in customer authentication. With multiple checkpoints and 98% accurate AI technology, this identity verification solution helps implement thorough verification processes for fail-proof identity verification.

Veriff pricing details

Veriff offers 4 plans for its KYC solution: Essential, Plus, Premium, and Enterprise. The starting price for these plans is $0.80/verification with a $49 monthly minimum commitment. The enterprise plan comes with a custom quotation based on your KYC requirements.

Key features of Veriff

- Ongoing monitoring: Continuously monitors users for adverse media and watchlists to identify potential fraudsters.

- PEP and sanctions screening: Screens potential customers against thousands of PEP watchlists and sanctions.

- Assisted image capture: Leverages ML technology to assist customers with image capture and streamline your verification process.

- Liveness detection: Uses algorithms to detect customer liveliness during onboarding and identify fake biometric samples.

Pros of using Veriff

- Users can utilize Veriff for diverse use cases. This platform adapts seamlessly to the KYC requirements of various industries—from financial institutions to online marketplaces.

- Users appreciate the Veriff team’s continuous efforts to improve the platform and introduce new technologies. They believe this helps them stay ahead of fraudsters.

- Organizations can significantly cut down the time spent on manual review through end-to-end KYC automation. The automated reviews are accurate and reliable.

Cons of using Veriff

- Some users report difficulty reaching out to Veriff’s customer support team for help, which may hamper the KYC system’s implementation.

- Veriff offers integrations with popular CRM systems. However, this integration may not always work well and can cause lags in KYC processes.

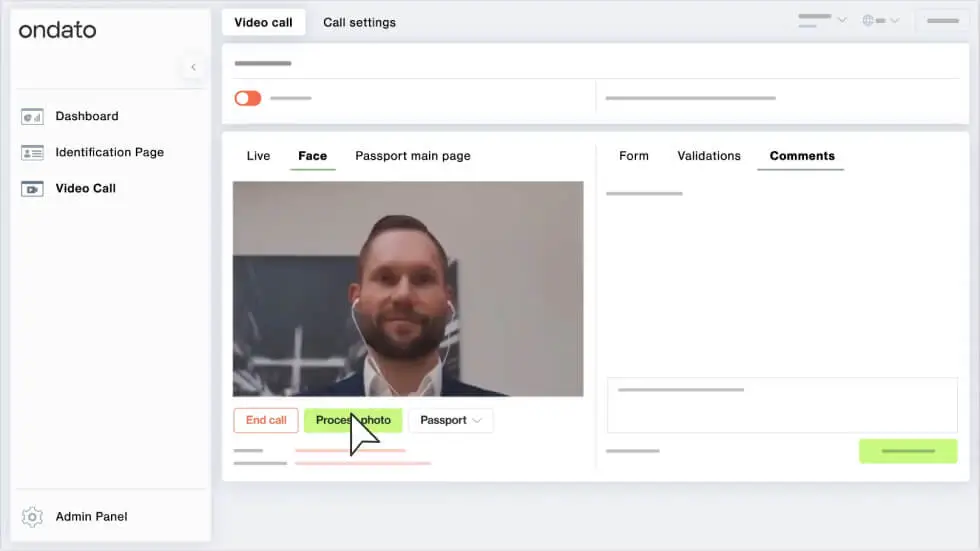

3. Ondato

About Ondato

Ondato helps businesses adapt to different KYC and AML jurisdictions, identification methods, and documents. You can use this eKYC platform to cut down KYC costs by 90% and onboard new users within 60 seconds.

Ondato offers useful integrations with existing systems to configure KYC checks during onboarding. This KYC solution is compliant with data protection regulations like GDPR and ISO 27001, ensuring data security. Use Ondato to effortlessly onboard new customers from across the globe.

Ondato pricing details

Ondato offers three plans for its KYC solution: Growth, Expansion, and Enterprise. The Growth plan starts from $1.03/verification and has a $279 license fee per month. You can get a custom quotation from Ondato’s team for the enterprise plan.

Key features of Ondato

- Fraud/Spoofing detection engine: Identifies and blocks deep fakes, fraudulent documents, fake identities, and liveliness imposters.

- Biometric analysis: Leverages machine learning capabilities to compare customer images with ML-generated 3D face maps. Blocks out suspicious users automatically.

- Client cards: Arranges customer information in cards and streamlines case management with client cards containing all verification documents.

- Sandbox integration: Tests KYC processes before implementing them in the organization.

Pros of using Ondato

- Users appreciate Ondato’s responsive customer support. They state that the customer service team is extremely helpful and quickly resolves all queries.

- Businesses can custom-create a stoplist or confirmed fraud list for known fraudsters. This helps the system automatically block out criminals.

Cons of using Ondato

- Some users state that Ondato’s risk-scoring feature could be improved for better flexibility and customization.

- For users not familiar with eKYC platforms, Ondato’s excessive functionalities may make the UI somewhat challenging to navigate.

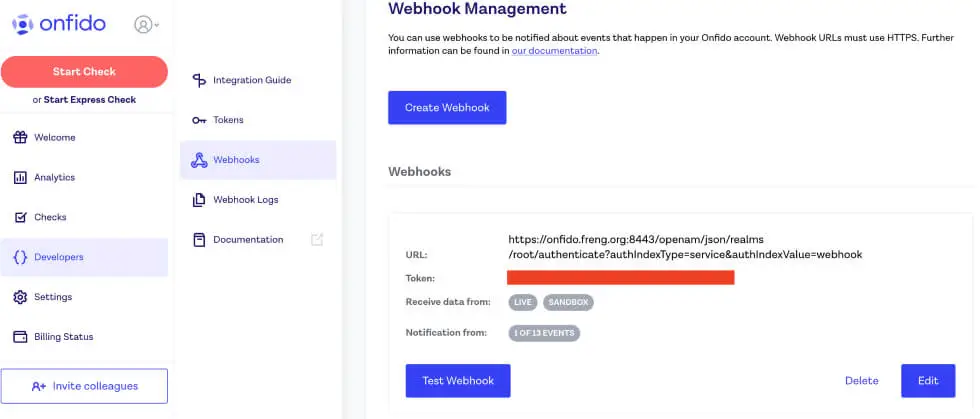

4. Onfido

About Onfido

Onfido offers a complete customer onboarding process automation suite with end-to-end KYC and AML compliance solutions. Ondato’s document verification, biometric verification, data verification, and fraud prevention solutions help simplify digital identity authorization.

Onfido helps organizations gain market trust and avoid violating KYC regulations through AI-powered KYC solutions. Onfido’s Atlas™ AI can verify documents and conduct biometric checks for global identity verification.

Onfido pricing details

Onfido offers a free trial for its KYC solution. You can also contact the Onfido team to get a quote based on your requirements.

Key features of Onfido

- Watchlist monitoring: Tailors monitor processes and sanction lists to track relevant customers. Offers reliable information from Onfido’s continuously refreshed data.

- AAMVA check: Leverages the American Association of Motor Vehicle Administrators (AAMVA) database to detect, identify and block fraudulent identities.

- Smart capture SDK: Automatically selects the best-quality pictures from a bundle of images and reduces quality-related image rejection rates by 70%.

- Block repeat attempts: Detects and blocks repeat identity usage through historical data. This feature works automatically in the background.

Pros of using Onfido

- Users appreciate Onfido’s excellent customer experience while switching from desktop to mobile for identity and document verification.

- Users appreciate Onfido’s easy-to-use identity verification platform. This ensures secure access to services and reduces the hassle of verification processes.

- Businesses appreciate Onfido’s easy and fast setup. It helps them configure Onfido’s KYC system in their processes with minimal effort.

Cons of using Onfido

- Some users report that while Onfido offers reliable document verification approaches, it cannot recognize genuine documents.

- It can be challenging for businesses to update the customer’s approval status for flagged users.

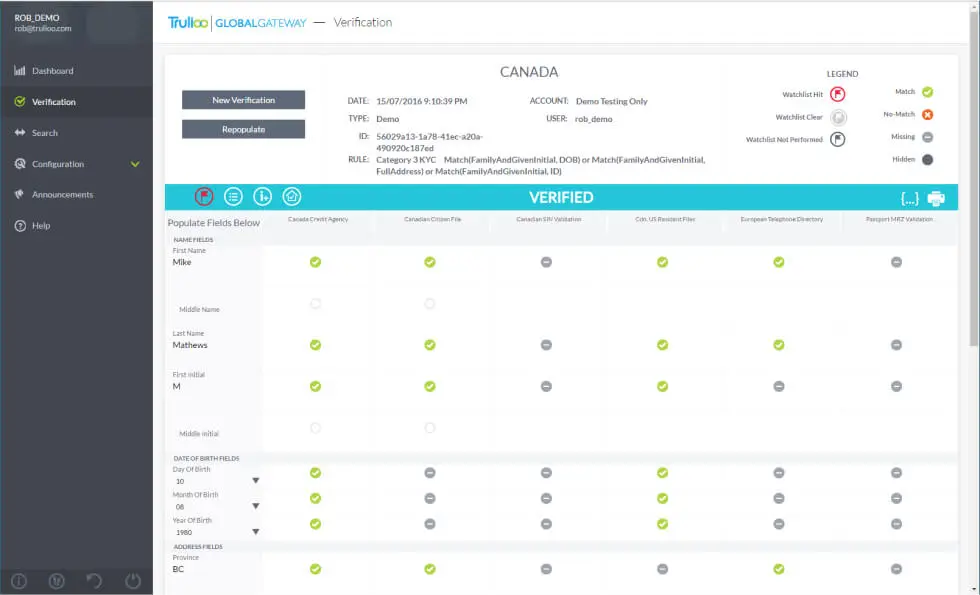

5. Trulioo

About Trulioo

Different businesses have different KYC requirements. Trulioo understands this challenge and offers organizations dynamic and adaptive identity verification solutions. Trulioo helps streamline customer onboarding through data and documentation authentication.

This solution can automate identity verification and fraud prevention processes and enables organizations to onboard new customers without worrying about compliance. This software’s Know Your Customer processes are tailored to ensure complete compliance with KYC regulations while maintaining verification speed.

Trulioo pricing details

Trulioo offers custom pricing options based on business requirements. Contact their team to get a tailored quotation for your customer verification needs.

Key features of Trulioo

- Person match: Speeds up identity verification processes by comparing Personally Identifiable Information (PII) against local and global data sources.

- Real-time ID document verification: Captures, analyzes, and authenticates over 13,000 document types for smooth onboarding and compliance.

- Utility data: Connects with over 2,200 utility providers worldwide to verify customer data on official documents like names and addresses.

- Trulioo electronic identification: Verifies customer identities using e-IDs through one contract.

Pros of using Trulioo

- Users appreciate Trulioo’s simplified identity verification processes that eliminate unnecessary steps, thus balancing KYC accuracy with efficiency.

- Businesses can implement Trulioo’s identity verification solution through a simple-to-integrate API.

- Organizations can use the extensive customization options to create rules for verification steps—ensuring your particular KYC regulation needs are met.

Cons of using Trulioo

- Some users report that using Trulioo to verify certain types of customer information, like rural area addresses, can be tricky and requires some trial and error.

- Users report facing challenges with data accuracy. While Trulioo covers cast data, it might not always be reliable.

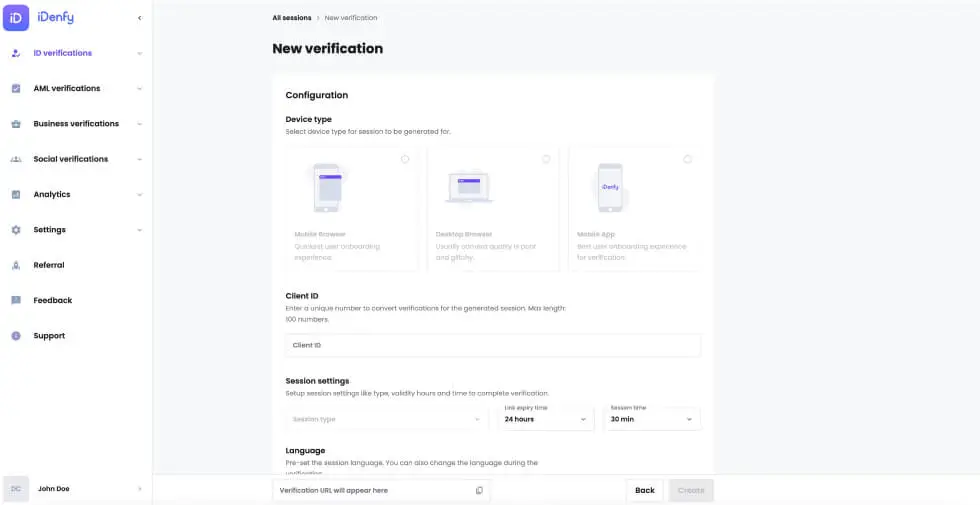

6. iDenfy

About iDenfy

iDenfy offers comprehensive KYC solutions for identity verification and AML compliance. Using this KYC platform helps automate identity verification for customers across 200+ countries.

With 3,000+ recognized ID documents and a 99.99% success rate, iDenfy is a competitive KYC software option on the market. This platform also has advanced solutions like biometric and facial recognition engines to ensure reliable customer verification.

iDenfy pricing details

iDenfy offers custom prices based on the selected identity verification services and the number of monthly transactions.

Key features of iDenfy

- Face verification & matching: Uses facial recognition algorithms to compare your customer’s live image with a reference image from digital IDs.

- Unlimited data field extraction (OCR): Extracts information from your customer’s official documents, like passports and address proofs. Verify extracted data against documents.

- Template detection – recognition: Extracts information from official customer IDs and verify it against corresponding document templates for genuineness.

- Verification process sequence: Captures customer images during identity verification. Get images manually verified against documents by iDenfy’s document review team.

Pros of using iDenfy

- Users appreciate iDenfy’s functionality for identity verification through browsers. It helps them verify customer identities without installing an app.

- Businesses can easily implement iDenfy in their process by leveraging prompt services from the support team and detailed technical documentation for the solution.

- Users can implement this platform in their existing processes with minimal traction owing to its simple and intuitive setup.

Cons of using iDenfy

- iDenfy offers extensive functionalities and features, so it is priced higher. Therefore, implementation may not be feasible for small-scale businesses.

- Some users report that integrating iDenfy’s KYC system with existing onboarding platforms through API can take as long as 1-2 weeks.

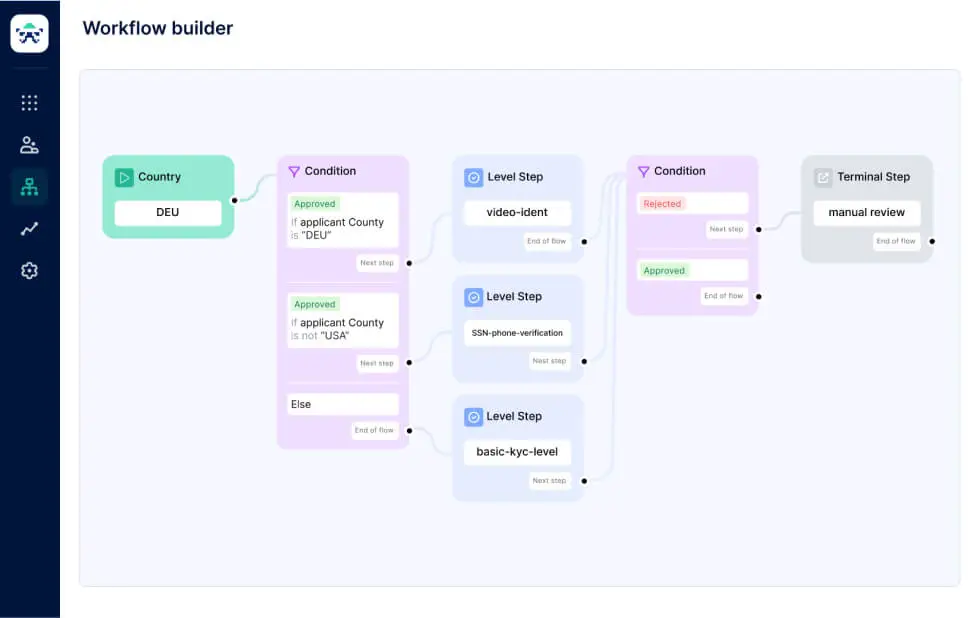

7. Sumsub

About Sumsub

Sumsub is another great customer verification solution known for its tailored workflows, which help customize KYC and AML compliance processes according to each organization’s requirements. With Sumsub, you can onboard users within 30 seconds.

With a 90%+ pass rate and coverage for 220+ countries, Sumsub is one of the best KYC software options for fail-proof customer identity verification. This KYC provider also verifies behavioral red flags and fraudulent networks to block near-100% fraud attempts.

Sumsub pricing details

Sumsub offers three pricing plans: Basic, Compliance, and Enterprise. The Basic plan costs $1.35 per verification and has a $149 minimum monthly commitment. The Compliance plan is $1.85 per verification and has a base price of $299/month. The Enterprise plan comes with custom quotations.

Key features of Sumsub

- Non-doc verification: Verifies and onboards users as quickly as 4.5 seconds. Ensures compliance with data checks across 10+ countries.

- AML screening: Evaluates potential fraudsters against global watchlists. Block out high-risk profiles automatically through AI.

- Database validation: Leverages trusted data sources from 50+ countries for authentic user information. Verify identities across government and commercial data.

- Biometric verification: Detects deepfakes through AI-based liveliness and face match technology. Upgrade from selfie checks to advanced fraud detection mechanisms.

Pros of using Sumsub

- Businesses appreciate Sumsub for its improved efficiency, accuracy, and compliance in identity verification. Its speedy and accurate system, user-friendly interface, and responsive customer support enhance customer experience.

- Users like the Sumsub customer team’s promptness and helpfulness. They are getting quick responses to their queries.

- Organizations can leverage Sumsub’s remarkable flexibility and customization for KYC rules and workflows. Business teams can set up customer onboarding processes within days.

Cons of using Sumsub

- Some users report that Sumsub’s interface is challenging to navigate through. Interrogating the underlying data is often difficult during CDD processes.

- Users state that the Document ID check feature does not work as expected. They often get faulty results during the verification process.

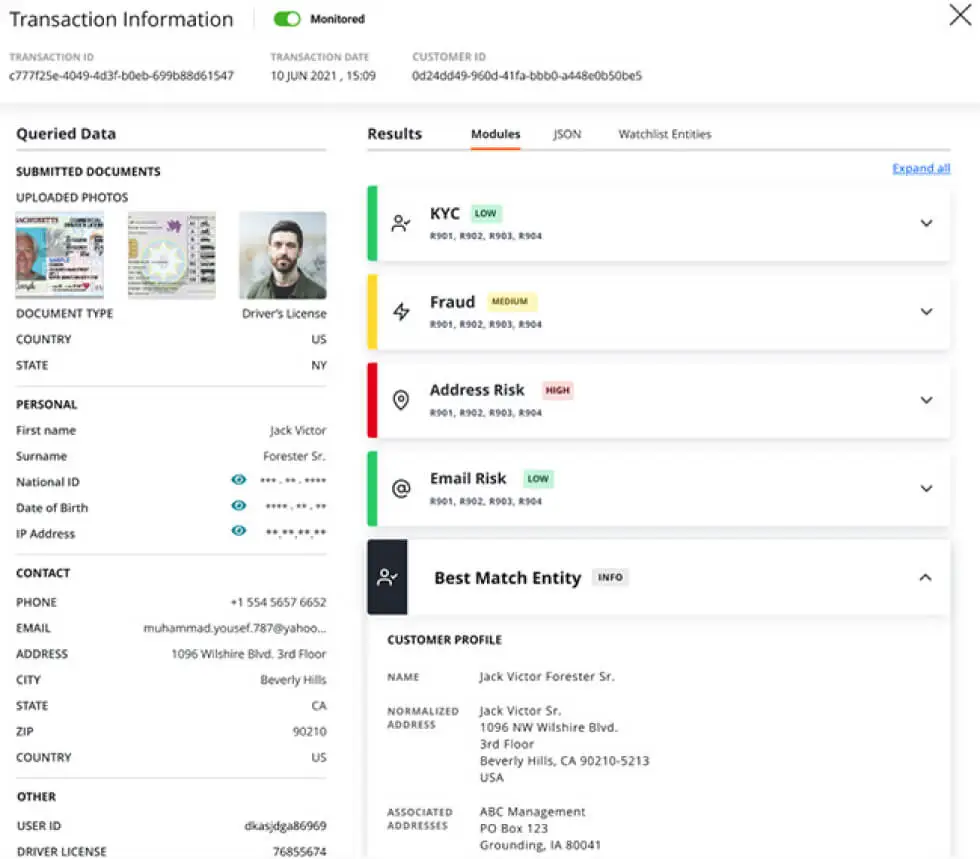

8. Socure

About Socure

Socure is a fully automated platform that elevates KYC efficiency and helps get a full view of your customer’s identity. Socure offers a one-platform-one-API solution and is a single-stop solution for all your KYC and AML needs.

With a remarkable 98% frictionless auto-approval rate, Socure is a useful platform for automating KYC processes accurately. This platform is configured with advanced machine learning models and 17,000+ predictive features to ensure the most reliable and accurate fraud detection and identity verification mechanisms for your business.

Socure pricing details

Socure offers tailored pricing options based on individual business needs. You can contact the Socure team for a custom quotation.

Key features of Socure

- 360-degree identity view: Offers a multi-dimensional customer view through authoritative data sources. Automatically omits duplicate records through persistent identifiers.

- Advanced SSN matching: Dodges common miskeys and typing mistakes and verifies customer data through diverse data sources.

- Algorithmic name matching: Helps get ahead of spelling mistakes, nicknames, permutations, and more, and identify customer names smartly.

- Insights dashboard: Streamlines manual reviews through side-by-side comparisons. Aid operational transparency through actionable data insights.

Pros of using Socure

- Businesses can use Socure’s continuously growing and advancing features in the KYC arena to tackle new and evolving KYC challenges.

- Organizations appreciate the implementation team’s great support for business onboarding. The software is also highly intuitive, making onboarding quick and easy.

Cons of using Socure

- Some users report challenges with image KYC, including troubles with manual KYC with low-quality images.

- For some businesses, the iframe feature does not always recognize IDs accurately. It may also prevent users from retaking pictures for correction, potentially hindering the onboarding experience.

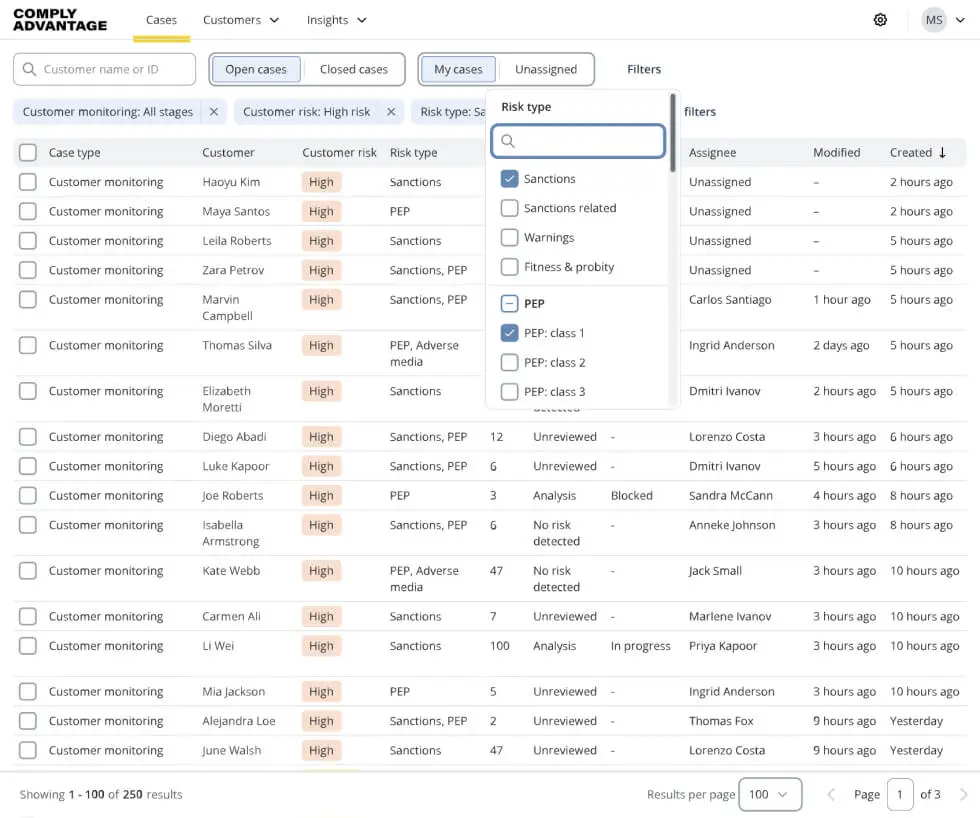

9. ComplyAdvantage

About ComplyAdvantage

ComplyAdvantage helps increase risk screening efficiency and streamlines the customer onboarding processes. Powered with market-leading proprietary data and fine-tuned algorithms, ComplyAdvantage is one of the best KYC software for screening customers and verifying their identities.

ComplyAdvantage enables businesses to leverage AI for sanction screening, PEP checks, and negative news insights. This platform also helps create custom customer profiles based on your business risk levels and seamlessly identifies fraud during onboarding and operations—ensuring efficiency throughout the onboarding process.

ComplyAdvantage pricing details

ComplyAdvantage offers custom quotations based on individual KYC requirements. The ComplyAdvantage team can provide a unique quote based on your needs.

Key features of ComplyAdvantage

- Sanctions and watchlist screening: Identifies changes in customers’ risk status and minimizes risks. Implements continuous screening against AML databases.

- Adverse media screening: Deploys custom category-based screening mechanisms for adverse media. Leverages rich and dynamic customer data for accurate verification.

- PEP screening: Implements custom search profiles to monitor PEP identities. Creates PEP status swiftly through diverse and live profile data from international, local, and regional sources.

Pros of using ComplyAdvantage

- Businesses can leverage ComplyAdvantage’s comprehensive and extensive customer database that spans local and international profiles. The data is continuously updated for accuracy.

- Users appreciate ComplyAdvantage’s analytics algorithms. They state that the algorithms accurately recognize patterns and relationship networks to mitigate risks.

- It is easy for organizations to integrate the ComplyAdvantage platform with existing systems through an API. This helps businesses continue using legacy systems.

Cons of using ComplyAdvantage

- Some users report facing duplicate profiles in ComplyAdvantage’s database. Eliminating these profiles may require additional manual work.

- ComplyAdvantage offers comprehensive functionalities that may not be useful for all organizations. Owing to its vast coverage, the solution is priced higher, limiting implementation to mid-sized and enterprise organizations.

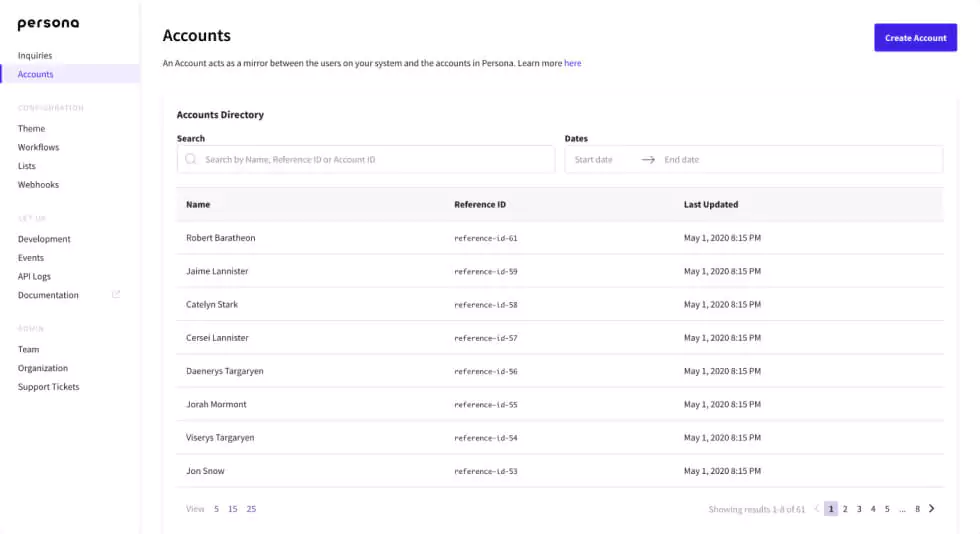

10. Persona

About Persona

Persona is a customizable solution for identity verification and Customer Due Diligence (CDD). This platform helps build custom KYC/AML programs to help organizations adjust their screening processes to meet changing regulations and risks.

Persona offers off-the-shelf KYC/AML solutions along with the option to build a tailored solution for globally-compliant onboarding processes. This KYC platform covers 200+ countries and territories—giving your business comprehensive mechanisms for customer identity verification and risk management.

Persona pricing details

Persona offers three pricing options: Essential, Growth, and Enterprise. The Essential plan starts at $250/month, while the Growth and Enterprise plans come with custom quotations. You can contact the Persona team for a custom quote.

Key features of Persona

- Custom KYC/AML flow: Tailors KYC and AML workflows while maintaining the highest data security standards. Streamlines user journeys with compliance efficiency.

- User verification: Leverages automated and customizable verification check sets to convert and onboard good users efficiently.

- Watchlist screening: Utilizes Persona’s rich and continuously updated data sources to ensure continuous compliance.

- Manual review: Creates a single hub to review, investigate, and decide customer verification.

- Decision automation: Builds KYC processes that align with your risk levels. Automate KYC processes with self-orchestration for sleek customer lifecycle management.

Pros of using Persona

- Businesses can self-resolve queries and streamline implementation through Persona’s comprehensive documentation.

- Organizations can automate checks through a single integration, thus saving significant time and capital, reducing costs, and eliminating manual KYC and KYB bottlenecks.

Cons of using Persona

- Some users report facing challenges with Persona’s customer support. They state that while the software is great by itself, the customer support team is slow to respond to their queries

- Users state that they face high false positive rates in Persona’s data. This may require some additional work for manual reviews.

The above-given list of the 10 best KYC software provides detailed information on each listed platform. However, what are the benefits of using KYC platforms for customer verification? Let’s find out.

What are the benefits of using KYC software?

In summary, top KYC solutions replace manual KYC reviews and streamline KYC processes through automation. Let’s understand the benefits of using KYC tools to verify customer identities.

1. Enhances legal compliance

KYC and AML regulations are mandated legislations in many countries, like the US, the UK, EU countries, and Canada. Using KYC software helps banks and other financial institutions comply with customer onboarding processes.

KYC systems are eccentric to anti-money laundering laws and requirements. Moreover, some of the best KYC software providers, like HyperVerge, offer comprehensive solutions for KYC and AML compliance—ensuring nothing is left to chance and helping avoid violation penalties.

2. Elevates customer experience

Manual KYC checks are time-consuming. Since verifying each document individually takes time, the KYC process can take months. In fact, a FinTech Times report states that globally, banks took an average of 95 days to complete a KYC review in 2023. A lengthy KYC review time delays onboarding and negatively impacts customer experience.

Using digital KYC platforms helps reduce KYC review time from months to seconds. Quick KYC verification accelerates onboarding time—enabling brands to improve their overall customer experience.

3. Prevents frauds

Customer due diligence is a major challenge in 2024. With more customers preferring online facilities, ensuring customer authenticity is a major challenge. Today, businesses require stricter KYC processes for fail-proof identity verification.

KYC platforms help overcome this challenge by employing smart technologies like machine learning algorithms and artificial intelligence. Modern KYC solutions like HyperVerge utilize advanced automation capabilities to ensure flawless KYC checks for all customers—balancing efficiency with accuracy.

4. Improves risk screening

Customer risks are often complex to identify due to complex networks, hidden connections, and diverse data sets. This makes compliance with regulatory requirements often a challenge.

KYC systems use advanced security mechanisms for deep network analysis, PEP checks, and watchlist checks—enhancing due diligence. Moreover, AML solutions integrated with KYC tools help elevate risk screening by enhancing screening scope to continuous activity monitoring.

5. Helps reduce verification costs

Financial service providers like banks and credit card agencies onboard thousands of customers annually, and running KYC checks on each customer can be costly.

KYC automation platforms help reduce admin costs by automating KYC processes. Since verifications are done automatically, businesses don’t need to hire KYC specialists and analysts, which increases profitability and reduces KYC costs.

6. Minimizes human errors

Manual KYC is prone to human negligence and errors. A minor negligence in customer verification can result in onboarding the wrong customers.

Due to their machine learning and intelligence capabilities, KYC platforms are accurate and reliable at catching fraudulent profiles. KYC providers like HyperVerge offer 99% accurate AI models to help minimize error chances.

Boost your KYC pass rate to 95% with HyperVerge

Safeguard your business from cyber criminals and focus on business growth with HyperVerge—your reliable KYC provider. Book a DemoNow that you know the benefits of using KYC platforms, you are all set to automate KYC processes through software. We have provided a list of the best KYC software. Now let’s take a look at how to pick out the right software from this list.

How to choose the right KYC software

Picking the right KYC provider is important to ensure KYC compliance and streamline verification processes. Here are a few factors to consider when weight different KYC software options:

| Factor | Why It Matters |

| Integration Options | Diverse integration options help ensure your KYC platform is configured with legacy systems. |

| Database Access | Rich database access helps maximize KYC verification coverage and ensures maximum compliance. |

| Compatibility | Customizable KYC tools ensure that your KYC processes are compatible with your KYC processes. |

| Automation Capabilities | Automation helps minimize manual KYC efforts, maximize precision, and ensure efficiency. |

| Ease of Implementation | Platforms offering quick and hassle-free implementation are great for saving time and resources. |

| Affordability | Controlling cost-per-verification is important to reduce customer onboarding costs. |

These are a few factors to consider when picking a KYC platform. Now that you have all the information required, you can automate KYC processes. All you need is a compatible KYC system.

Automate KYC processes with HyperVerge’s KYC solutions

HyperVerge is an end-to-end digital identity verification platform for complete KYC and AML compliance. We offer complete KYC, business verification, and AML compliance solutions to help you enable security, propel efficiency, and streamline compliance.

With a record of verifying over 750 million customers and a diverse dataset covering 332 million-plus US residents, HyperVerge KYC solution is reliable for KYC automation. Spike your pass-through rate by 95% and elevate your onboarding experience with HyperVerge, an AI-powered solution for flawless customer identity verification.

Book a demo with our team today and experience streamlined onboarding with HyperVerge.

Frequently asked questions

1. Why is KYC important?

KYC processes are important to prevent harmful fraudulents and criminals from onboarding your business. KYC checks help ensure that all your customers are verified, authenticated, and real. Moreover, KYC is an important regulatory requirement in many countries, making it an important part of business processes.

2. Is KYC a part of AML regulations?

Anti-money laundering (AML) is an umbrella term that covers numerous techniques and steps taken to avoid money laundering activities. KYC, transaction monitoring, and due diligence are all parts of AML. Therefore, we can say that KYC and AML are largely interrelated.

3. How is automated KYC better than manual KYC?

Manual KYC processes are time-consuming, prone to human error, and often result in negligence. On the other hand, KYC automation helps solve these challenges and makes KYC processes fast, efficient, and compliant. For this reason, automated KYC processes are better than manual ones.

4. Which industries need KYC verification?

KYC verification is essential for financial institutions like banks, credit card agencies, insurance companies, and other financial service providers. Moreover, sectors like real estate, online gaming, trading, and blockchain immensely benefit from KYC checks.

5. Can KYC software be integrated into our existing systems?

Yes, you can integrate KYC platforms with your existing customer onboarding platforms. Most KYC software has API-based integrations to help businesses configure their existing systems with KYC platforms.