Money laundering is a complex, dangerous, and age-old threat to the global economy and safety. It affects financial stability and can hamper any financial institution’s strength and integrity.

With technological advancements, digital money laundering has become way more complex and difficult to track, especially through cryptocurrencies. According to a recent report by the United Nations Office on Drugs and Crime (UNODC), between 2% and 5% of global GDP is laundered almost every year, which accounts for $800 billion—$2 trillion in current US dollars.

The growing complexities of money laundering processes

Technology and digitization have made it more challenging to track money laundering. The flow of data across industries, the rise of digital financial transactions, and the sheer volume of transactions have made tracking money laundering activities increasingly complex for the Financial Crimes Enforcement Network (FinCEN).

The rise of digital financial systems, including online banking, e-commerce, digital currencies, and virtual assets, has become another weapon for criminals to fool the system and launder money via layering and integration.

The need for setting up systems to adapt to the evolving landscape of AML compliance has become more crucial than ever. AML regulations help to enhance efficiency in the processes, reduce risks, and keep pace with regulatory changes.

Impact of these complexities on financial institutions

If not upgraded in time, loopholes in the AML compliance systems can lead to substantial damage to global social and economic health. Here are some examples of how these complexities hamper financial institutions and our economy:

- Undetected money laundering contributes to many underlying crimes; in the year 2017 in the United States, two-thirds of the underlying money laundering offenses included drug trafficking, while the others were theft, property destruction, and fraud. The damage and destruction these crimes can cause to the world are unimaginable.

- Money laundering can be extremely damaging and might lead to eroding of financial institutions. At times, even the most robust organizations can become the victim of money laundering due to a compliance issue or any fraudulent activities done by employees. This is not just a threat to these financial institutions but can also cause irrecoverable reputational risks. This is where financial institutions must develop capabilities to meet the changing AML compliance requirements and keep pace with the demanding times.

Understanding AML complexities and challenges

Progressive developments, economic growth, and continuous investments are crucial aspects of the stability and growth of any economy. Constantly evolving money laundering methods and technology help criminals create an illusion of investments in properties and businesses through fraudulent transactions, creating a more complex environment. It becomes nearly impossible to track, resulting in depressed economic growth and productivity.

Complexity of the money laundering methods

One of the major challenges for global bodies like the Financial Action Task Force is to identify and track various digital methods of money laundering activities like (but not limited to) the use of Shell Companies, Off-shore accounts, cryptocurrencies, and layering in multiple small and large money transactions and more.

The rising complexities of money laundering methods are a significant challenge that cannot be ignored. This requires a proactive approach that we will discuss later in the blog. Let’s look at the existing AML challenges:

Lack of collaboration between financial institutions

Financial institutions are bound by legal liabilities and have a lot at stake when it comes to their reputation. It can make them hesitant about sharing information with various legal authorities. In 2022, the European Banking Authority (EBA), with other authorities, published suggested approaches to information sharing, which require more collaboration between firms and legal entities for better results.

Money laundering has become way more complex and difficult to track. It can have a lasting impact on society and damage the credibility of any financial institution or industry in general. Thus, to gain a competitive advantage, regulatory bodies must:

- identify emerging trends and resources required to strengthen their teams

- use the latest technology

- adapt to changing trends and AI solutions

- upgrade and improve their legacy systems, and

- use data analysis for better decision-making

One such technology is Blockchain, which helps to gain visibility of funds in a highly complex environment.

Limited data and technology resources

Financial institutions may have limited access to various data sources, including customers’ complete financial data, transactions, or the third parties involved, due to which they have a higher risk of falling victim to money laundering. This is why most financial institutions have regulatory bodies and compliance officers liable to meet the evolving regulatory requirements.

Governance

Managing cross-border anti-money laundering compliance tasks can be difficult for financial institutions and banks. This requires effective frameworks that help to maintain compliance standards for ongoing monitoring and avoiding penalties, fines, and reputational damage. Due to increased governance, managing customer diligence needs have also risen. Hence, financial institutions must gather more information on customer records and their ultimate beneficial ownership.

Lack of skilled personnel

Shortage of qualified candidates or inability to find the right candidate is another challenge that weakens the anti-money laundering systems in any financial institution. Additionally, the rising turnover across industries causes a loop of hiring and training new people, making it a less time-efficient process.

Technology and complicated processes

Traditionally, organizations often find it hard to switch to technological advancements and integrate new processes like KYC or AI audits. It might look time-consuming or complex, but it is imperative to adapt to technology to keep up with the evolving regulatory landscape and ensure proper AML compliance.

Need for real-time screening and monitoring

To keep up with the advances of the money laundering systems and combat the complexities of these challenges, financial institutions must keep upgrading and evaluating their regulatory compliance programs.

This is where the need for real-time screening and monitoring of customers and transactions arises. There is a difference between monitoring and screening. Monitoring is analyzing payment patterns for any suspicious activity. In contrast, screening is the process where an individual’s transactions are looked at, and if there is any risk involved, those can be stopped irrespective of the customer’s past activity. Screening and monitoring work together and are a crucial aspect of anti-money compliance.

We discussed AML challenges in general. Now, let us look at AML compliance challenges.

Simplify Processes to Combat AML Challenges.

Get a demo now!AML compliance challenges

To meet regulatory and compliance obligations, the financial industry must have a risk-based approach. This includes adapting to new technologies, having proper reporting formats for legal entities, hiring efficient AML professionals who can perform AI-based checks, and ensuring compliance while having complete data protection. However, it is easier said than done. Let’s first understand the existing AML compliance challenges.

Changes in the regulatory landscape

The evolving sophistication and complexity of money laundering processes require continuous developments in AML regulations. This can be an overwhelming process for compliance teams and can also increase operational costs for financial institutions to keep up with the changes in the regulatory landscape.

Inefficiencies in AML compliance processes

Dependency on manual processes has a higher chance of causing human error in the compliance processes. Integrating artificial intelligence tools like robotic processes or adapting to automatic KYC processes can help combat the challenges of money laundering. It is vital to adapt to changing business trends like machine learning algorithms to improve the accuracy of screening and monitoring by analyzing patterns.

Data management challenges

From customer records to transactional data and third-party data, a lot of data flow comes from multiple sources. Any missing data or incomplete records can hamper the efficacy of risk detection, increasing the chances of money laundering. Updating technology solutions per the standards and having disparate systems that can control the flow of confidential data is crucial to maintaining data quality, data security, and data standardization.

Challenges with customer due diligence (CDD) and know your customer (KYC)

Verifying customer identity and managing customer due diligence procedures are vital for AML compliance. Investing in advanced technologies like AI and machine learning tools can help verify customer details, check for patterns, and highlight if there are any suspicious activities.

AML challenges with transaction monitoring

Monitoring and screening financial transactions is a crucial aspect of AML compliance. This time-consuming process can lead to compliance gaps due to time or workforce limitations. This is why adapting to efficient and new processes becomes imperative.

Reporting requirements

Anti-money laundering reporting involves filing Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs) in case of any serious suspicion or a doubtful money transaction. SARs have a filing duration of 30 days, while CTRs have a filing duration of 15. The reporting is extensive and includes all relevant documents related to the client, their historical records, financial transactions, and involvements of any third party (if any). This is an extensive process for which financial institutions must have a robust system and framework for timely reporting management to avoid gaps.

Sanctions screening

Sanctions screening checks include checking whether individuals, organizations, and countries are listed in the global sanctions lists or high-risk entities. Any transaction with high-risk entities can lead to legal penalties and heavy losses that can come with permanent reputational damage. This is a significant part of AML compliance. It requires a smart approach to ensure a risky transaction is reported and no time is wasted due to false alarms.

AML training and awareness

Training employees and compliance staff with the changing money laundering methods is imperative to the success of any compliance department and financial institution. This is an important part of ensuring effectiveness across systems and departments. Organizations need to understand the needs of employees and provide them with suitable support that aligns with their roles and responsibilities in AML compliance.

These are the key challenges in AML compliance that can affect the turnaround and effectiveness of processes, hamper data quality, and create compliance gaps in the system. This is where HyperVerge offers an array of solutions powered by SaaS, Technology, Analytics & BI, Machine Learning, and AI to make AML compliances easy.

AML compliance made easy

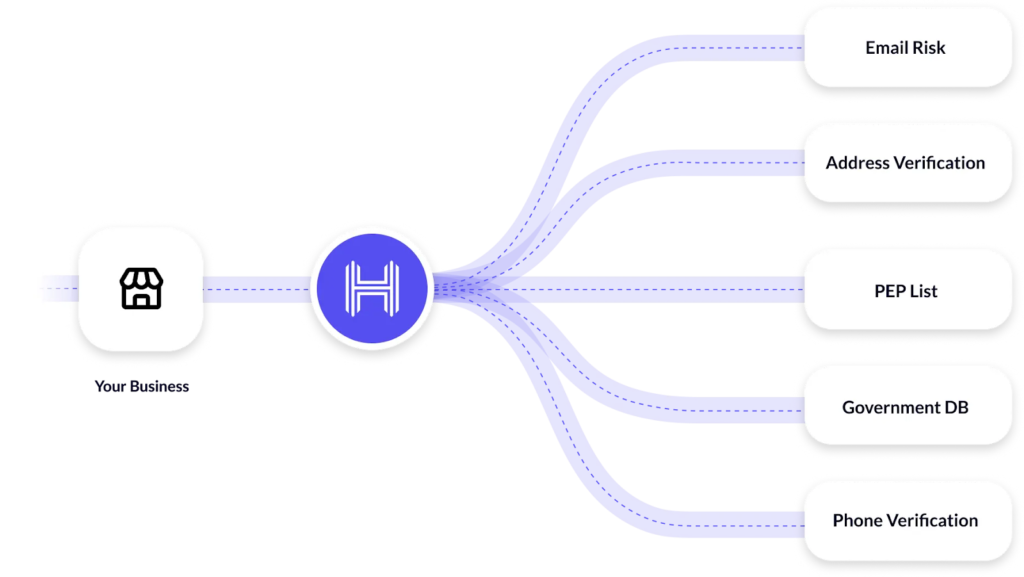

It is necessary to leverage technology to enhance screening processes, strengthen verification processes, and overall increase the efficiency of the compliance departments. This is where HyperVerge provides easy tools for AML compliance that offer real-time screening and monitoring of data that gives you a complete view of customer risk identification, empowering you to make informed decisions and meet AML legal compliance requirements.Book a demo

We offer seamless KYC and AML integrations through APIs that help you with custom filtering, identifying relevant names, 24/7 real-time sanction screening process, PEP & adverse media updates every 7 mins, AI detection, constant monitoring, and complete access to the dashboard for easy understanding.

We can help you overcome the challenges of the constantly evolving money laundering methods and complexities that can be combated using the latest technology, cutting-edge tools, AI, and time-efficient tools to stay ahead.

Staying ahead by leveraging technology

AML compliance is critical for maintaining safety and growth in any nation. It helps to prevent terrorist financing, financial fraud, drug trafficking, human trafficking, and tax evasion through economic systems.

As the world is adapting to new technology and tools with agility, it is crucial for financial institutions also to gain a competitive edge in compliance and risk management by embracing technology. It is not only a need but also a smart move to establish more effective processes. This is where HyperVerge AML solutions help simplify your AML processes and protect your business with higher safety, world-class technology, and AI tools that can empower you to make informed decisions and meet AML legal compliance requirements. HyperVerge AML solutions provide a complete view of customer risk identification, empowering you to make informed decisions and meet AML legal compliance requirements. Sign up today!