May 29, 2023

May 29, 2023

Breaking Down the New RBI Amendments to the KYC Master Direction

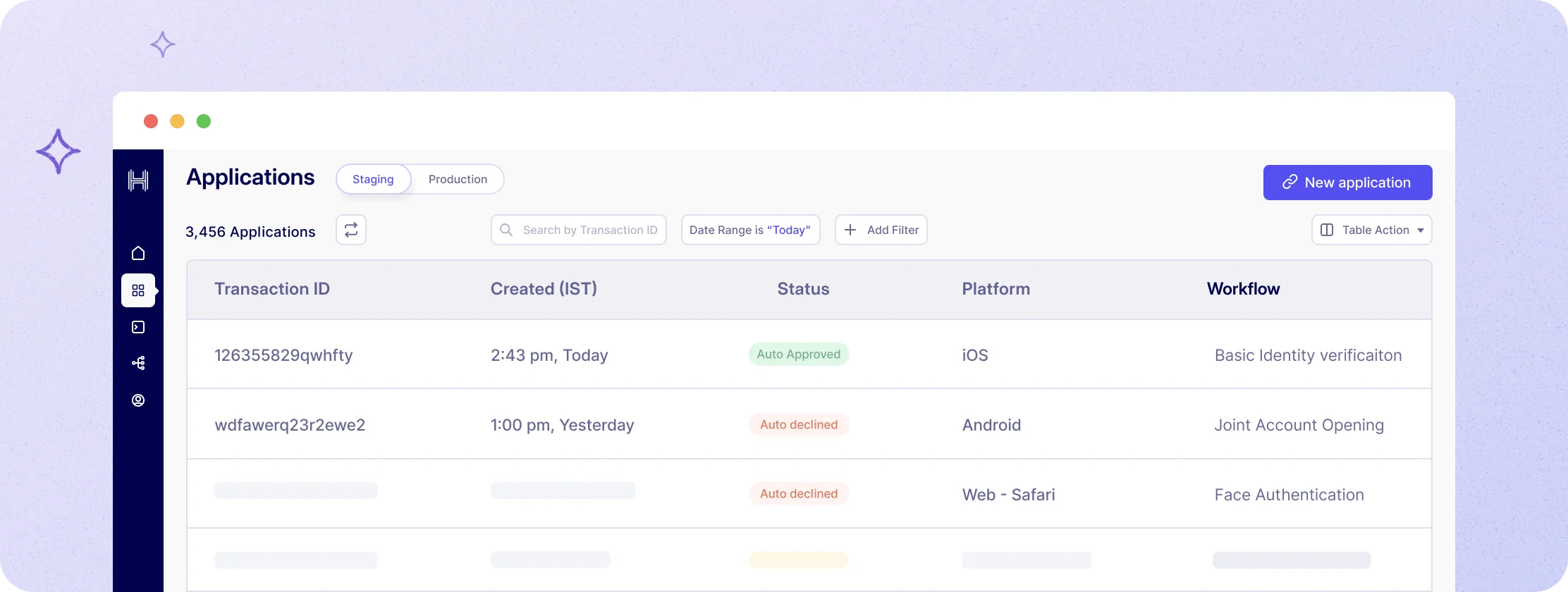

Compliance is no longer a mere cost but a critical aspect of business operations. Organizations must adapt to...