What is the Office of Foreign Assets Control (OFAC)?

Office of Foreign Assets Control (OFAC) is part of the Department of Treasury and oversees and enforces economic sanctions based on United States foreign policy

Office of Foreign Assets Control (OFAC) is part of the Department of Treasury and oversees and enforces economic sanctions based on United States foreign policy. These sanctions typically target individuals, entities, and countries involved in activities such as terrorism, the development of weapons of mass destruction (WMDs), narcotics trafficking, or other illicit activities and threats to the national security of the U.S.

How Does OFAC Work?

OFAC sanctions target countries, individuals, and entities involved in activities contrary to U.S. interests, such as terrorism, narcotics trafficking, or supporting problematic regimes. These sanctions can affect specific targeted countries and individuals and companies associated with those targeted countries.

Transparency is maintained through publicly available lists like the Consolidated Sanctions List and the Specifically Designated Nationals (SDN) List. Entities and individuals not named on these lists can face OFAC discipline through secondary sanctions.

In May 2019, OFAC issued a Framework for OFAC Compliance Commitments for effective sanctions compliance programs. This guidance helps companies navigate the complex sanctions environment and prevent violations.

What is an OFAC Check?

An OFAC check is a specific type of background check for financial transactions, ensuring compliance with U.S. regulations. It confirms whether individuals or companies are permitted to conduct business in the United States according to OFAC rules.

This helps ensure that you’re not dealing with anyone who is banned from doing business in the U.S. due to reasons like being involved in terrorism, drug trafficking, or other illegal activities. It’s essential for adhering to U.S. laws and avoiding risky transactions with entities posing economic sanctions or national security threats.

To Whom Do the OFAC Checks Apply?

OFAC regulations apply to all United States individuals and businesses, including financial institutions like banks and their subsidiaries, with foreign assets both within and outside the U.S. These entities must stick to sanctions programs, taking a risk-based approach in their economic and trade sanctions implementation.

Non-compliance can lead to severe penalties, including fines of up to US$10 million and imprisonment for up to 30 years, especially for those engaging in business with individuals or entities failing an OFAC check.

What is the OFAC-sanctioned Country List?

The OFAC sanctions list includes several countries subject to ongoing updates, hence its accuracy may vary. As of the latest information, some of the countries on this list include:

- Belarus

- Burma

- Cuba

- Afghanistan

- Democratic Republic of Congo

- Iran

- Iraq

- Ivory Coast (Côte D’Ivoire)

- Liberia

- North Korea

- Sudan

- Syria

- Russia

- The Balkans region

- Zimbabwe

Furthermore, the SDN and Blocked Persons Lists feature individuals and companies affiliated with sanctioned countries, along with terrorists and international terrorists and narcotics traffickers themselves, designated as posing global threats but not tied to specific nations.

Impact of OFAC Sanctions

OFAC sanctions help secure national security goals and reduce crimes by preventing illicit crimes and disrupting funding to criminal entities. By using economic and trade sanctions, freezing assets and restricting financial transactions, these sanctions make it harder for terrorist organizations, criminal networks, and rogue authorities to operate.

Additionally, they promote compliance with international norms and regulations, encouraging commitment to legal and ethical standards. Collaborative efforts with allied nations and international organizations further strengthen global cooperation in addressing security threats.

How to Maintain OFAC Compliance

Let us outline the essential strategies and practices necessary for maintaining OFAC (Office of Foreign Assets Control) compliance, ensuring businesses adhere to regulations concerning economic sanctions and international trade. It explores key considerations and best practices to mitigate the risks associated with non-compliance.

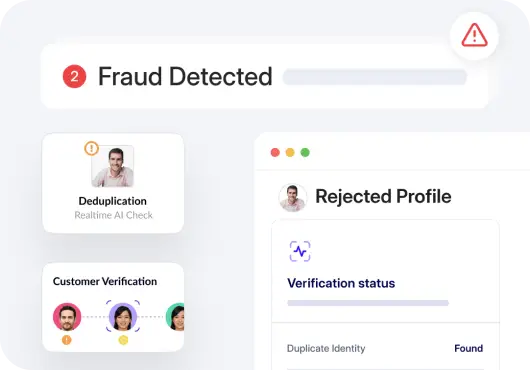

Customer Verification

To maintain Office of Foreign Assets Control (OFAC) compliance, businesses should conduct thorough customer verification (KYC) processes to ensure they are not dealing with individuals or entities on OFAC’s sanctions lists. It includes collecting basic information about customers such as name, date of birth, and driver’s license number.

The data collected in the Customer Identification Program (CIP) is important for running a check against OFAC’s lists.

Risk Assessment

Performing regular risk assessments is essential to identify potential exposure to the OFAC sanctions list targeted foreign countries. This involves evaluating customers, the nature of the business, its activities, geographic locations (country), and customer base to assess the risk of engaging with sanctioned entities foreign countries.

Transaction Screening

Businesses should implement robust transaction screening procedures to check all transactions against OFAC’s sanctions lists and politically exposed person (PEP) lists in real time. This helps prevent unintentional dealings with sanctioned individuals or entities.

Recordkeeping and Reporting

Maintaining detailed records of all transactions and compliance activities is crucial for demonstrating adherence to OFAC regulations. Additionally, businesses must promptly report any suspicious activities or potential violations to the appropriate authorities.

Ongoing Monitoring

Continuous transaction monitoring and customer activities is necessary to promptly identify and address any potential OFAC compliance issues. Regular updates to compliance policies and procedures ensure ongoing adherence to regulatory requirements.

Stay Compliant with OFAC

To stay compliant with Office of Foreign Assets Control (OFAC) requirements and AML compliance regulations, follow these key steps:

- Customer Due Diligence: Conduct comprehensive customer due diligence to verify identities and screen against sanctions lists and AML databases.

- Risk-Based Approach: Implement a risk-based approach to identify and assess potential risks other threats associated with customers, foreign policy and national security, transactions foreign assets, trade sanctions based foreign funds control and business activities.

- Transaction Monitoring: Implement robust transaction monitoring systems to detect and report suspicious activities, ensuring timely compliance with reporting requirements.

- Recordkeeping and Reporting: Maintain detailed records of customer information, activities related transactions, activities related and compliance activities to facilitate audits and regulatory suspicious activity reporting.

Advanced AML solutions enable businesses to stay compliant with OFAC rules. They enable efficient customer verification, risk assessment, real-time transaction screening, recordkeeping, reporting, and ongoing monitoring. Read more in our comprehensive guide to AML compliance.