Key Terms for Bank Account Verification in India

With rising digital payments, financial fraud risks are also on an uphill climb. Understanding key terms in bank account verification isn’t just for bankers—it’s for anyone who uses online transactions.

Secure and efficient account verification is the backbone of trust in banking. Whether it’s opening an account, making high-value transfers, or setting up auto-debits, every financial transaction relies on robust verification mechanisms to prevent fraud and ensure compliance with regulatory norms.

From KYC (Know Your Customer) to CKYC (Central KYC), NPCI (National Payments Corporation of India), and penny drop verification, these terms define the processes that safeguard your money. Knowing what they mean—and how they work—can help individuals and businesses navigate banking with confidence.

In this guide, we break down key terms in bank account verification, helping you stay informed and secure.

Essential Terms in Bank Account Verification

Understanding key terms in bank account verification is crucial. It leads the way to secure and seamless financial transactions. These terms form the foundation of India’s banking system. They ensure compliance, efficiency, and fraud prevention. Let’s break down the essential concepts:

Account Number

An account number is a unique identifier assigned to each bank account. It’s a critical component in transaction processing. It distinguishes one account from another, ensuring that funds are correctly credited or debited.

The accuracy of an account number is crucial for secure transactions. A single error can lead to misdirected funds, delays, or even financial fraud. Ensuring the correct account number before initiating any transaction is a fundamental step in maintaining banking security.

IFSC Code

The Indian Financial System Code (IFSC) is an alphanumeric code that uniquely identifies bank branches in India. It is primarily used in electronic payment systems such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service).

This code is essential for directing funds to the correct branch. Thus, minimizing errors in digital banking. Without an IFSC code, online transactions would be inefficient and prone to misrouting. This would, in turn, affect the speed and reliability of financial transfers.

MICR Code

The Magnetic Ink Character Recognition (MICR) code is a unique nine-digit number printed on cheques using magnetic ink. It helps banking systems process cheques quickly and accurately by enabling automated scanning.

MICR technology significantly speeds up cheque clearance. Thereby reducing the chances of human error and fraud. By enhancing the efficiency of the clearing process, MICR codes ensure that cheque-based transactions are processed securely. They also prevent unnecessary delays.

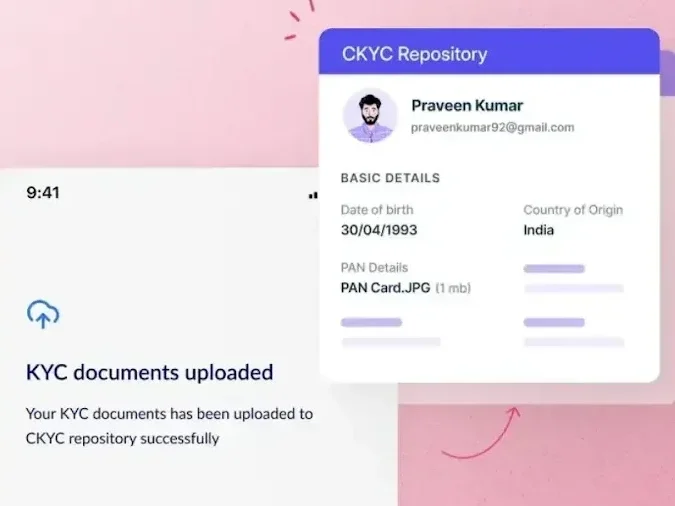

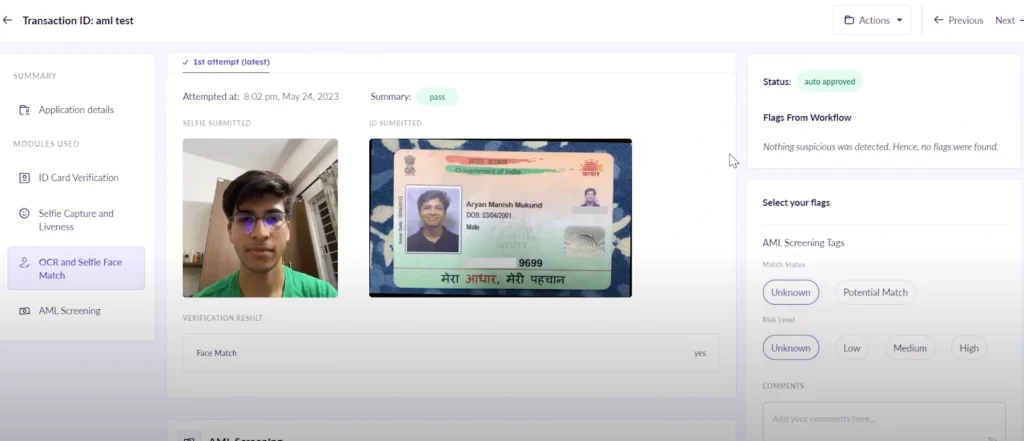

KYC (Know Your Customer)

KYC is a mandatory process in which banks verify the identity of their clients before opening an account or conducting significant transactions. Customers must provide identity and address proofs. These may include Aadhaar, PAN, or passport, to comply with regulatory norms.

KYC is a crucial tool in preventing fraud, identity theft, and financial crimes like money laundering. By ensuring that all account holders are legitimate, KYC helps maintain the integrity of the banking system while fostering trust between financial institutions and their customers.

AML (Anti-Money Laundering)

AML refers to a set of regulations and procedures designed to prevent criminals from disguising illegally obtained money as legitimate income. Banks and financial institutions implement AML measures to track and report suspicious transactions.

These regulations ensure that financial transactions remain transparent and legally compliant. By preventing money laundering activities, AML frameworks protect the economy from financial crime, terrorism financing, and tax evasion. This reinforces a safer banking environment.

Two-factor authentication (2FA)

2FA is a security process that requires users to verify their identity using two different methods before accessing their accounts. Typically, this involves a combination of something the user knows (like a password) and something they receive (like a one-time password or OTP).

2FA adds an extra layer of security to online banking. It protects users from unauthorized access and cyber threats. As digital transactions become more common, 2FA has become an essential tool in preventing phishing attacks and financial fraud.

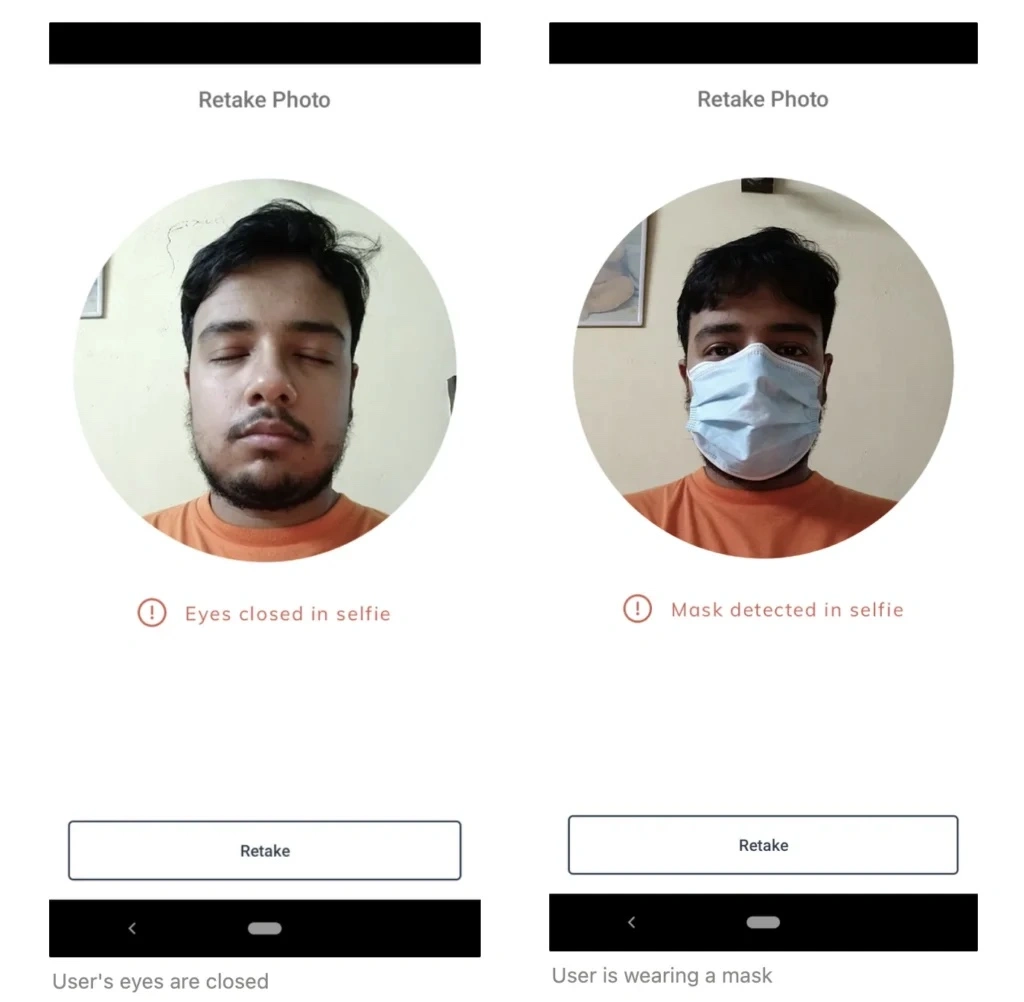

Liveness Detection

Liveness detection is a biometric security feature. It ensures that the biometric sample being scanned is from a real, live person rather than a spoofed or fraudulent source. The sample may entail a fingerprint or facial recognition.

This technology helps prevent biometric fraud, such as the use of photos, videos, or deepfakes to bypass security checks. By ensuring the authenticity of biometric verification, liveness detection strengthens identity verification processes. This makes digital banking more secure.

Biometric Verification

Biometric verification uses an individual’s unique biological traits to confirm identity. These can include fingerprints, facial recognition, or iris scans. This method is increasingly used in banking. It enables account access, transactions, and customer authentication.

The use of biometrics enhances both security and convenience. It eliminates the need for passwords while ensuring that only authorized individuals can access financial services. As biometric verification continues to evolve, it is becoming a preferred authentication method in modern banking.

API (Application Programming Interface)

API is a set of protocols that allows different software systems to communicate and exchange data. APIs enable real-time verification, secure payments, and integration with third-party financial services.

They play a crucial role in digital banking by facilitating smooth and automated account verification. They help banks connect with fintech companies, improve user experience, and enhance the efficiency of financial transactions.

Real-Time Verification

Real-time verification is the process of instantly validating account details during transactions. This technology ensures that banking credentials—such as account numbers and IFSC codes—are accurate before completing a transaction.

By reducing errors and preventing fraud, it improves the speed and reliability of digital banking. It enhances trust in online transactions. Thus, making financial operations smoother for individuals and businesses alike.

Each of these terms plays a vital role in ensuring that India’s banking ecosystem remains secure, efficient, and compliant with regulatory standards. Understanding them empowers individuals and businesses to navigate digital finance with greater confidence.

Verify bank accounts seamlessly

with HyperVerge’s AI-powered verification solutions. Schedule a DemoImportance of Understanding These Terms

Whether you’re an individual user, a business owner, or a financial institution, understanding these terms is key. It ensures seamless transactions, regulatory compliance, and enhanced security. Here’s why this knowledge matters:

Enhancing Security Measures

Financial fraud and cyber threats are growing concerns in the digital banking space. Knowing verification terms helps individuals and businesses implement stronger security measures. These protocols protect against unauthorized access, identity theft, and fraudulent transactions. By staying informed about modern security mechanisms, users can actively participate in safeguarding their financial data.

Ensuring Regulatory Compliance

India’s financial regulations are designed to prevent financial crimes and ensure a transparent banking environment. Concepts like KYC and AML are legal requirements that banks and financial institutions must follow. Understanding these terms ensures compliance with RBI (Reserve Bank of India) guidelines. Thus helping businesses and individuals avoid legal complications, account freezes, or penalties. Staying compliant not only protects financial entities from regulatory action but also strengthens the overall integrity of the banking system.

Improving Customer Trust

Trust is the foundation of any financial transaction. When banks and businesses use clear, well-defined verification processes, customers feel more secure in sharing their sensitive information. Knowing how account numbers, IFSC codes, and real-time verification work fosters transparency. It reduces concerns about fraud or mishandled transactions. A secure and efficient verification system builds long-term customer relationships. Thus, enhancing user satisfaction and loyalty.

By understanding these essential terms, individuals and businesses can better navigate India’s banking landscape. Thereby resulting in safe, compliant, and hassle-free financial transactions.

Takeaways

A strong understanding of key bank account verification terms is essential for secure and seamless financial transactions in India. Terms like account numbers, IFSC codes, and MICR codes ensure accurate fund transfers. Meanwhile, security measures such as two-factor authentication and biometric verification help prevent fraud. Compliance with KYC and AML regulations is crucial for preventing financial crimes and adhering to RBI guidelines.

Additionally, advancements like real-time verification and APIs improve efficiency and transparency in banking operations. Staying informed about these concepts empowers individuals and businesses to make safer transactions, protect sensitive information, and confidently navigate India’s financial landscape.

FAQs

1. What is the significance of the IFSC code in bank transactions?

The IFSC code is an essential identifier for bank branches in India. It enables seamless electronic transactions through NEFT, RTGS, and IMPS. It ensures that funds are routed correctly, reducing errors and enhancing transaction speed.

2. How does two-factor authentication enhance security?

2FA adds an extra layer of security by requiring users to verify their identity using two different methods. This can include a password and an OTP. 2FA significantly reduces the risk of unauthorized access and cyber fraud.

3. Why is KYC mandatory for bank account holders in India?

KYC is a regulatory requirement that helps banks verify the identity of customers. It prevents financial crimes like money laundering and fraud. It ensures that only legitimate users access banking services, contributing to a secure and transparent financial system.