What is the Driving License (DL) Verification Process?

Verifying driver’s license information is a crucial part of identity verification. Industries use this process to validate the identity of users. Finance, insurance, e-commerce and various other industries do it to comply with regulations. Digital transformation is on the rise. Thus leveraging technology for accurate and efficient identity checks has become a priority. This blog explores the driving license verification process. It highlights the role of OCR technology and verification APIs.

Why is driving license verification important?

Understanding the significance of driving license verification is essential, particularly for organizations that rely on it to maintain security and integrity

Importance for financial institutions

For banks and financial institutions, verifying a customer’s identity is vital. DL verification is often part of the KYC (Know Your Customer) process. Thereby allowing banks to ensure that their clients are legitimate. This helps avoid onboarding individuals with false identities. It reduces the risk of fraud and improves customer trust.

Preventing fraud and identity theft

Driving licenses contain vital personal information. By verifying them, businesses can prevent identity theft. Scams like identity theft are gaining popularity in the insurance and e-commerce sectors. Fraudulent claims, fake accounts, and identity theft can all be minimized with a robust verification process. Thus saving companies from financial losses and legal issues.

Regulatory compliance and legal requirements

In many countries, it is mandatory for businesses to verify customer identity as part of regulatory compliance. Failing to do so can result in fines and penalties. This is why DL verification is an essential step. Especially for businesses to meet legal requirements and maintain trust with regulators.

How does driving license OCR work?

Optical Character Recognition (OCR) technology allows computers to read text from images or scans. Here’s how driving license OCR works:

- Capturing an Image: The system captures a clear image of the license.

- Pre-processing to Enhance Clarity: The image is processed to enhance its quality.

- Detecting Text Regions and Segmenting Characters: The text regions on the license are identified, and characters are segmented.

- Recognizing Characters Using Visual Features or Machine Learning: The characters are then recognized through machine learning or visual feature techniques.

- Post-processing to Improve Accuracy: Any errors in recognition are corrected in the post-processing step.

- Extracting Recognized Text into Digital Format: The text is extracted into a digital format for further use.

The extracted driver’s license information usually includes the license holder’s name and license number. It also mentions the date of birth and other relevant details.

Overview of Optical Character Recognition (OCR) technology

OCR technology is key to extracting data from physical documents. This technology helps businesses automate their DL verification processes. Thereby improving speed and accuracy while reducing human error.

Steps in the OCR process

The OCR process follows a series of steps:

- Scanning

- Pre-processing

- Text detection

- Character recognition

- Extraction into a usable format.

Each step ensures that the extracted information is as accurate as possible.

Accuracy and limitations of OCR

OCR technology has become quite advanced, but it is not foolproof. Blurry images, poor lighting, or complicated fonts can reduce the accuracy of text recognition. Yet, machine learning models continually improve these systems. This makes them more reliable over time.

How does DL verification API work?

A DL Verification API automates the extraction and verification of data from a driving license. This technology uses AI to detect fraud and synthetic IDs. By taking a picture of a license, the DL verification API extracts details like the license number and key verification markers. This enables businesses to verify identities quickly and easily. It provides a smooth digital onboarding experience.

Integration with existing systems

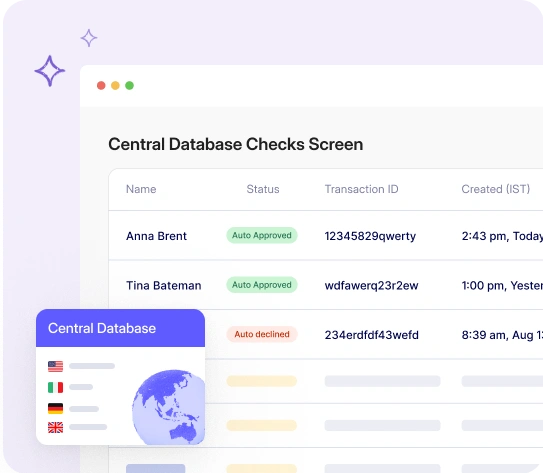

The DL verification API integrates seamlessly with existing web and app-based platforms. By incorporating it into a digital onboarding flow, businesses can automate the verification of driver’s licenses using AI-powered OCR technology. The API checks license data against government databases. They are frequently updated to ensure accuracy.

Real-time data processing

Driving License Verification APIs process data in real-time. It allows businesses to verify identity instantly. This reduces the time spent on manual verification and improves the user experience.

Ensuring data privacy and security

Data privacy is critical in any identity verification. Verification APIs are designed to follow data privacy regulations. This ensures that sensitive information is handled securely and is not misused.

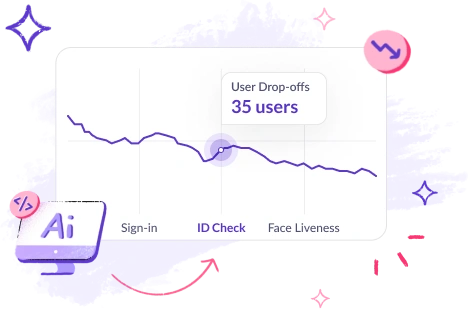

Challenges with existing solutions

The traditional onboarding process can be tedious. Its many input fields can lead to high user drop-off rates. Complex workflows, several verification attempts, and manual processes further increase the turnaround time (TAT). These factors can cause frustration and delays, affecting both users and businesses.

Common limitations of current APIs

Some verification APIs face issues with data quality and accuracy. Users may also be resistant to providing their personal data. This can create trust issues. Furthermore, some APIs lack real-time data processing, which increases TAT.

HyperVerge’s driving license verification API

HyperVerge’s Driving License Verification API is designed to overcome these challenges, providing businesses with a streamlined verification procedure. Here are some key features:

Key features of HyperVerge API

Leverage the key features of the HyperVerge API to optimize your verification process and ensure compliance effortlessly:

- Central database checks. The DL verification API cross-references license data with central databases recognized by the government, ensuring authenticity.

- Simple onboarding journeys. The API requires minimal input from users, reducing friction and improving the user experience.

- Smart auto-filling. The API fetches data from local databases and auto-populates it for users.

- Reduced Manual Hours: The entire DL verification process API is automated, which reduces TAT significantly.

Use cases and applications

Here are several real-world scenarios where HyperVerge can be effectively applied:

- Insurance: Insurers can verify the status of a driver’s license before providing coverage. This can assess risk and avoid claims from unlicensed drivers.

- Transportation: Companies can verify drivers’ licenses before assigning duties. Thus ensuring compliance with commercial vehicle laws.

- Human resources: HR departments can verify a candidate’s license status. This can help prevent liabilities.

- Shared economies: Platforms for renting cars or booking stays can use license verification to screen identities efficiently.

- Age verification: License verification is useful for ensuring users meet age requirements for services.

- Fraud prevention: Built-in forgery detection helps prevent fraud and ensures accurate identity verification.

- Insurance claims verification: The driving license verification API checks the status of licenses (suspended, blocked, valid). This ensures the legitimacy of claims.

- Digital KYC: The API can be integrated with KYC processes to ensure regulatory compliance.

- Delivery executive onboarding: Verifying driving licenses ensures companies hire authorized drivers.

- Live biometric verification. The driving license verification API can match a person’s face to their ID using AI, adding an extra layer of security.

Driving license verification is essential for preventing fraud and ensuring regulatory compliance. Technologies like OCR and verification APIs are key in streamlining this process. Thus making it faster and more efficient.

Ready to streamline your onboarding process? Book a demo with HyperVerge and get a demo to our quick and secure identity verification solutions.

FAQs

1. What is the API for driving license verification?

An API that automates the extraction and verification of data from a driving license using OCR and AI.

2. What is an API for identity verification?

An API automates the process of verifying a user’s identity. It uses various documents and databases.

3. What is API verification?

The process of verifying that data retrieved by an API is accurate and valid.

4. What is PAN verification API?

An API that verifies the authenticity of a Permanent Account Number (PAN) in India.