What is Bank Statement Analysis? A Complete Guide for 2025

A single bank statement can determine loan approvals, business credibility, and financial stability—here’s why it matters.

Every financial decision, big or small, starts with understanding financial health. Whether it’s an individual applying for a loan, a business assessing a potential partner, or a lender evaluating risk, bank statement analysis plays a crucial role. It provides a clear picture of income, expenses, cash flow patterns, and financial habits. This helps decision-makers make informed choices.

For lenders, analyzing bank statements is key. It helps them give loans to financially stable individuals and businesses. Companies use this analysis to evaluate vendor reliability and customer creditworthiness. Even individuals can benefit by gaining insights into their financial standing. They can detect potential risks and improve money management.

AI-powered financial data intelligence is making the process faster and more accurate. Moreover, it’s also enhancing its efficiency. But what exactly does this analysis entail, and how does it work? Let’s break it down.

What is bank statement analysis?

Bank statement analysis involves reviewing bank statements to evaluate financial stability, spending habits, and risk factors. It provides a detailed insight into income sources, expenses, and cash flow trends. It points out any anomalies in bank statements that could impact creditworthiness. This process helps financial institutions (FIs), individuals and businesses in myriad ways. It allows informed lending and investment decisions—minimizing that financial risks.

Who uses bank statement analysis?

Various industries rely on bank statement analysis for different purposes:

- Lenders and financial institutions: Banks and NBFCs analyze a bank statement to assess loan applicants’ creditworthiness. Before approving credit, they check for a stable income and responsible spending habits.

- Fintech companies: Digital lending platforms and payment service providers use AI-driven HyperInsights to automate credit assessments, detect fraud, and enhance financial decision-making.

- Businesses: Companies check the bank statements of vendors, customers, and partners. They do so to verify financial stability before entering contracts or extending credit.

- Auditors and regulators: Compliance teams and auditors analyze bank statements to detect discrepancies and ensure transparency. They identify suspicious transactions that may indicate fraud or financial mismanagement.

Why is bank statement analysis important?

Bank statement analysis is essential for:

- Risk assessment: Lenders determine if an applicant has the financial stability to repay a loan. Their transaction patterns and cash flow inform this decision.

- Fraud detection: Identifying unusual transactions is paramount. It flags money laundering and suspicious financial activities that may indicate fraudulent behavior.

- Income validation: Financial data intelligence verifies if an applicant’s declared income matches actual bank deposits. This ensures accurate financial disclosure.

- Financial planning: Individuals and businesses can analyze past transactions to improve budgeting and spending habits.

- Loan defaults prevention: Lenders can identify risky borrowers by assessing financial trends and irregularities. This, in turn, reduces non-performing loans.

How Does Bank Statement Analysis Work?

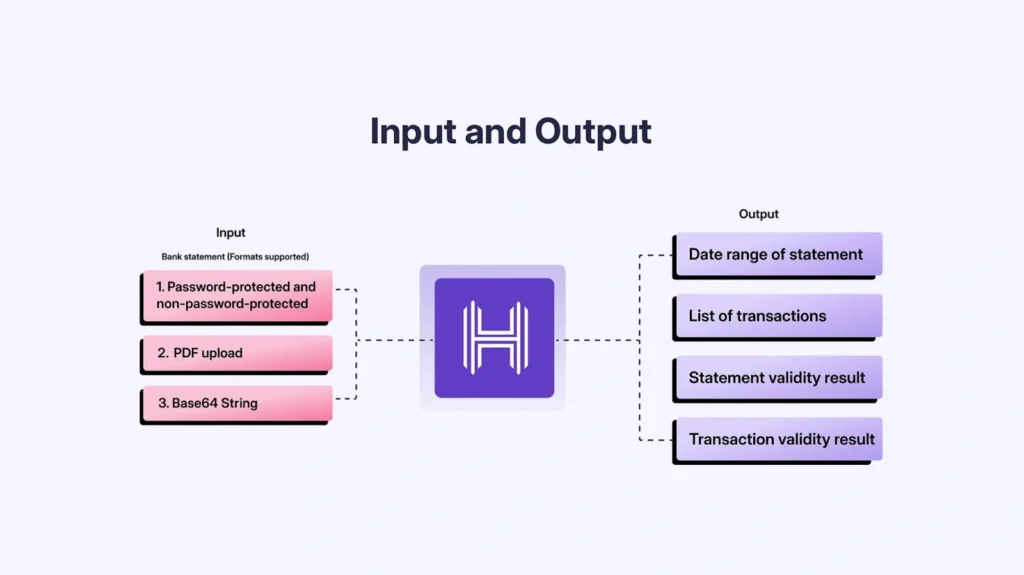

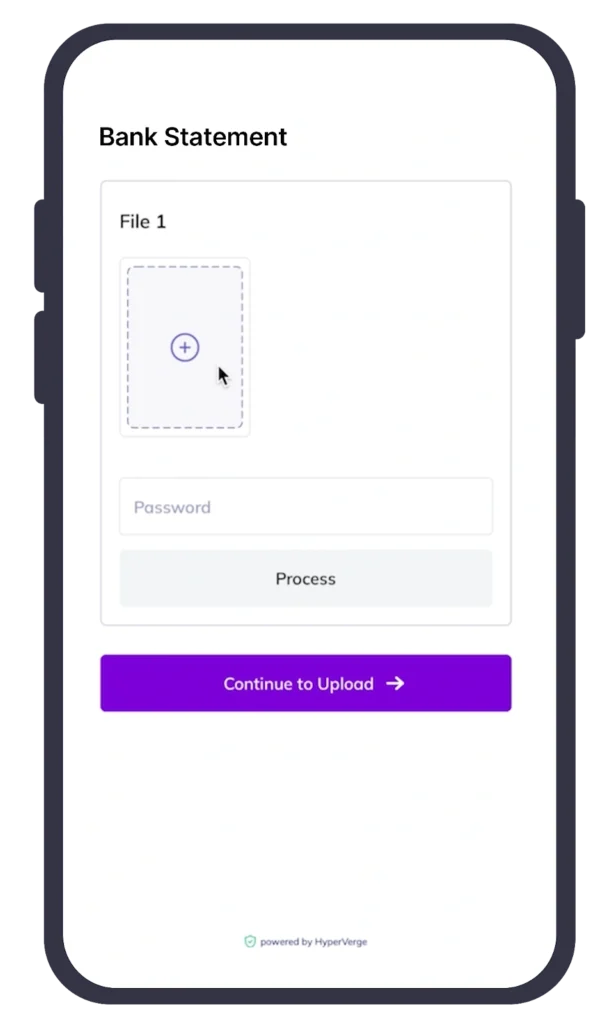

Bank statements can be analyzed either manually or through automated solutions. Manual analysis is time-consuming, prone to errors, and requires significant effort to identify patterns. Financial Data Fetch—the process of retrieving and structuring financial data from bank statements—is a crucial step in this analysis. On the other hand, automated tools can extract and categorize data instantly from PDFs, scanned documents, and digital statements, making the process more efficient and reliable.

Bank statement analysis follows a structured approach which includes:

Data extraction

Financial data fetch is the process of retrieving and structuring financial data from a bank statement. Statements can be analyzed either manually or through automated solutions. Manual analysis is time-consuming and prone to errors. It requires significant effort to identify patterns. On the other hand, AI-powered tools can extract and categorize data instantly. Be it PDFs, scanned documents or digital bank statements. This makes the process more efficient and reliable.

Identifying key indicators

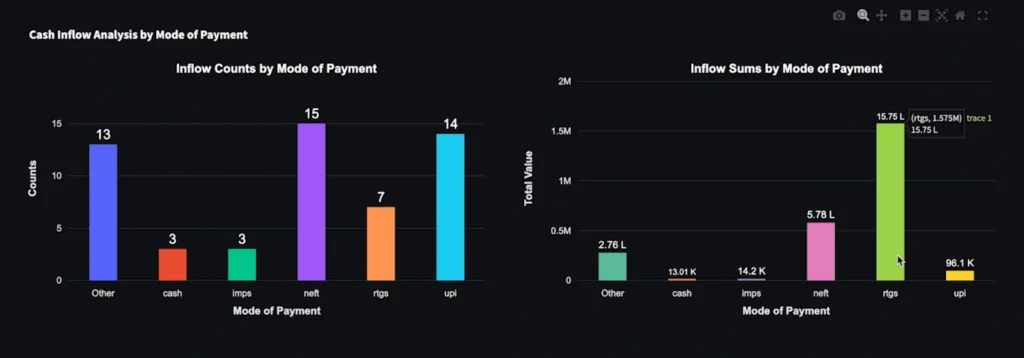

Key bank statement aspects evaluated include income patterns, recurring expenses, cash flow consistency, and liabilities. These indicators help lenders and businesses assess financial stability and repayment capability. Thus, reducing the risk of defaults.

Detecting anomalies

AI-powered HyperInsights can detect irregularities such as:

- High cash withdrawals indicating potential liquidity concerns or undisclosed income sources.

- Frequent overdrafts suggesting financial distress and an inability to manage finances effectively.

- Inconsistent deposits, which might point to unreported income, cash-based transactions, or financial instability.

- Unusual spending behavior, such as sudden spikes in luxury purchases. This could signal potential financial mismanagement.

Creditworthiness assessment

Based on the extracted data, an applicant’s creditworthiness is evaluated. There are various measuring factors like debt-to-income ratio, spending habits, and financial commitments. The final analysis helps FIs make accurate lending decisions. This, in turn, ensures that financially responsible people and businesses are granted loans.

Key Elements Evaluated in a Bank Statement

Before diving into the benefits, it’s essential to understand how these insights contribute to financial decision-making.

Income Patterns

A stable and recurring salary deposit or business revenue stream is a positive indicator of financial health. Lenders look for:

- Salaried individuals: Monthly salary credits, bonus payments, and other consistent income sources.

- Business owners: Regular revenue inflows, invoicing patterns, and profit margins that demonstrate financial viability.

Expense Categories

Expenses are categorized into:

- Fixed expenses like rent, loan EMIs, utility bills and insurance payments. Fixed expenses also entail other essential monthly obligations.

- Variable expenses like entertainment, dining, shopping and travel. This also includes discretionary spending that may fluctuate over time.

- Irregular expenses like large one-time purchases or medical emergencies. Investments that could impact cash flow stability also fall under this category.

Cash Flow Stability

Stable cash flow indicates good financial planning. Erratic transactions might signal financial instability or mismanagement. Lenders prefer applicants with a predictable income and expense cycle. This ensures timely loan repayments.

Loan Repayments & Liabilities

A borrower’s existing financial obligations impact their creditworthiness. These entail EMIs, overdraft utilization, and credit card payments. High liabilities with irregular repayments can be a red flag for lenders.

Red Flags for Lenders

Here are some red flags that can hinder your financial well-being and standing:

- Bounced cheques indicating insufficient funds or financial distress.

- Unusual transactions such as large, unexplained cash deposits or withdrawals. These may indicate suspicious activity.

- Frequent overdraft usage signaling financial mismanagement and dependency on borrowed funds.

- Sudden spikes in spending could mean impulsive financial behavior or underlying financial issues.

Benefits of Bank Statement Analysis

Bank statement analysis provides valuable insights that enhance financial decision-making. It also mitigates risks and improves economic stability. Below are some key advantages:

Faster Loan Approvals

By evaluating transaction histories, lenders can quickly determine an applicant’s financial health. As a result, this leads to faster and more efficient loan approvals. This speeds up the lending process and ensures that deserving borrowers receive financial support without unnecessary delays.

Fraud Detection and Risk Mitigation

Bank statement analysis helps detect irregularities and reduce financial risks. Such as, undisclosed loans, fraudulent transactions, and sudden unexplained deposits or withdrawals. It is critical in identifying money laundering activities and preventing financial crimes.

Improved Budgeting and Financial Planning

Individuals and businesses can analyze bank statements to manage expenses effectively. They can allocate funds efficiently, and enhance financial planning. Understanding spending patterns enables better savings strategies and financial goal setting.

Strengthened Business Relationships

Companies use bank statement analysis to assess the financial stability of vendors, clients, and partners before engaging in business transactions. This reduces risks associated with unpaid dues, bad debts, and unreliable business partnerships.

Enhanced Credit Assessments

FIs gain deeper insights into an applicant’s financial behavior. This means better credit decisions and reduced likelihood of loan defaults. Accurate credit assessments contribute to a healthier lending ecosystem. They minimize bad debts and defaults.

Future of Bank Statement Analysis in India

As financial transactions continue to evolve in the digital landscape, the need for efficient and accurate bank statement analysis is more critical than ever. Businesses, lenders, and fintech companies are increasingly turning to advanced technologies. FIs are utilizing AI tools to streamline financial assessments and mitigate risks.

Rise of AI and Machine Learning in Financial Risk Assessment

With AI and Machine Learning (ML), a bank statement analysis allows lenders and businesses to make data-driven decisions with higher accuracy. These technologies enable real-time insights, predictive analytics, and advanced fraud detection capabilities.

Increasing Adoption by Fintech and NBFCs

Non-banking financial companies (NBFCs) and fintech firms are increasingly leveraging AI-driven analysis. AI is instrumental in streamlining loan underwriting and customer verification. Automated analysis provides better insights, reduces manual efforts, and improves operational efficiency.

Regulatory Considerations

Compliance with Reserve Bank of India (RBI) regulations and data privacy laws is essential for FIs. Especially when using automated analysis tools. Secure handling of sensitive financial data is a top priority. It guarantees consumer protection and regulatory compliance.

Final Thoughts: Why Automating This Process is the Way Forward

Manual bank statement analysis is time-consuming and prone to errors. AI-powered financial data intelligence offers a fast, accurate, and secure way to analyze financial data. Thus making it the future of financial risk assessment. Businesses and lenders adopting automated solutions will gain a competitive edge in decision-making and risk management.

Automate Your Bank Statement Analysis Today – Try Our AI-Powered HyperInsights.

FAQs

1. What is bank statement analysis?

Bank statement analysis refers to the process of reviewing and interpreting financial transactions within a bank statement. It’s done to assess financial health, detect fraud, and evaluate creditworthiness.

2. How do banks analyze a bank statement for loans?

Banks examine income patterns, expense behavior, liabilities, and cash flow stability. This helps them determine an applicant’s financial stability before approving loans.

3. Can bank statement analysis detect fraud?

Yes, AI-driven analysis can identify fraudulent transactions and money laundering activities. They can also flag inconsistencies that point to potential fraud.

4. Is automated bank statement analysis accurate?

Automated analysis powered by AI and ML ensures high accuracy. They eliminate human errors and detect financial anomalies in real-time.