As online threats are increasing day by day, ensuring strong identity verification measures becomes a top priority for businesses.

A report by the Federal Trade Commission highlights fraud losses in the U.S. hit $10 billion, with identity theft and investment scams driving a large portion of these losses in 2023. This underscores the urgent need to protect your business and customers.

To address such challenges, selecting a reliable identity verification provider becomes more important.

This guide saves you time and effort by providing a complete list of the top identity verification providers. Along with the list, the blog also provides information on how to select the right provider for your business.

How we analyzed and selected the best identity verification software providers

Our team carried out an extensive process where we performed thorough market research and detailed analysis to shortlist the best providers. Here is how we evaluated each provider.

- We evaluated 45+ providers who are experts at providing digital identity verification.

- Our team compared each provider’s reviews and ratings on popular platforms like G2, Capterra, and TrustRadius.

- We then shortlisted the provider based on features & functionalities, pricing structure, scalability, data security measures, deployment options, and customer support.

Such an evaluation helped us create a list of identity verification software providers who specialize in streamlining the customer onboarding process.

A complete overview of the 10 best identity verification providers

Here is a table with an overview of the top providers specializing in delivering top-notch identity verification solutions.

| Top Providers | Core Capabilities | Free Trial Availability | Targeted Industries |

| Rapid authentication in under 3 seconds with a 95% auto-approval rate | A 30-day free trial is available with a sandbox environment | • Financial services • Education • Gaming • Remittance • Crypto • Marketplaces • Logistics and eCommerce | |

| Global identity verification powered by machine learning insights | A 7-day free trial is available | • Financial services • eCommerce • Payments | |

| Real-time automated identity verification in 4 steps | No free trial is available | • Financial services • Insurance • Legal • Gambling • Cryptocurrency • Telecommunications | |

| Instant remote identity verification in minutes | A free trial is available | • Public sector • Financial services • Automotive • Travel • eCommerce • Healthcare | |

| Rapid biometric verification in under 10 seconds | No free trial is available | • Financial services • Remittance • Gaming • Transport • eCommerce • Healthcare • Telecommunication | |

| Global user verification with 90%+ pass rates | A 14-day free trial is available | • Fintech • Gaming • Trading • Crypto • Transportation • Marketplaces | |

| AI-enhanced verification with expert human review | A free trial is available | • Fintech • Crypto • Blockchain • Online gambling • eCommerce • Gaming • Transportation | |

| Automated fraud detection with a 90% reduction in registrations | A 30-day free trial is available | • Financial services • Gaming • Retail • Payment fraud • Fintech | |

| Quick and accurate KYC checks for 220+ regions | A 14-day free trial is available | • Telecoms • FinTechs • Financial services • eCommerce • Crowdfunding | |

| AI-driven verification of 5,000+ ID types | No free trial is available | • Financial services • Gaming • Sharing economy • Healthcare • Travel • Mobility |

An in-depth explanation of each identity verification provider

1. HyperVerge

About HyperVerge

HyperVerge ONE is a reliable digital identity verification and KYC provider that simplifies and accelerates the identity verification process. This AI-powered solution ensures smooth onboarding across 195+ countries. With a strong system trained on different facial variations and ID formats, HyperVerge carries a track record of verifying 750+ million identities.

This identity verification platform achieves a 95% auto-approval rate and reduces verification drop-offs by 50%, improving efficiency and user experience. The software’s advanced functionalities are beyond identity verification. HyperVerge integrates real-time AML screening and monitoring to provide a complete view of customer risk identification.

By using advanced AI technology, HyperVerge allows businesses to automate KYC processes, reduces manual verification hours, and protects them from fraud. The platform’s global coverage and compliance across several industry verticals make HyperVerge the best choice for enterprises looking to improve security and maintain regulatory compliance.

Key features of HyperVerge

- Biometric authentication: Offers AI-driven facial recognition that verifies users within 3 seconds to ensure high precision and speed. By combining document verification with selfie matching, the software strongly defends against identity fraud and deep fakes.

- Optical character recognition: Extracts and verifies information from identity documents. This feature improves the speed and accuracy of the verification process by automatically reading and validating customer IDs.

- Database verification: Verifies the authenticity of documents by cross-refering with central databases recognized by the local governments. This includes checks like SSN, AAMVA, BVN, and NSDL.

- Fraud prevention: Integrates with global databases, PEP lists, watchlists, and adverse media to screen users. This helps identify and mitigate risks to protect businesses from fraudulent activities.

HyperVerge pricing

HyperVerge provides flexible pricing opinions for all types of businesses. Check out all the pricing models in detail.

| Start plan | Grow plan | Enterprise plan |

| Suitable for Startups | Suitable for Mid-size companies | Suitable for Enterprise-level organizations |

| The Start plan offers a free trial and easy integration within 4 hours. It also offers several tools to view and manage verification for one month. | The Grow plan offers everything covered in the Start plan. Also, it includes an end-to-end ID verification suite, access to AML checks, central database checks, & customized business workflows. | The Enterprise plan offers all the features and offerings from the Grow plan, along with custom pricing and collaborative tools. |

What people say about HyperVerge

- Users appreciate the software for offering modules like age verification, address verification, and document verification.

- Certain users praise customizable workflows, no-code workflow builder, and deepfake detection.

- The excellent customer support and reduction in KYC drop-offs make users choose HyperVerge ONE over alternatives.

- Businesses appreciate the enhanced experience with easy deployment.

- Users find the software effective at authenticating current customers while blocking fraudsters.

Client video testimonial

HyperVerge serves clients globally including AngleOne, L&T Finance, PDAX, Ahamove, and XestMoney. Recently, HyperVerge helped Oona Insurance reduce manual verification time from 3-5 days to less than 1 day which increased application completion rates by 70%.

The integration of HyperVerge’s OCR technology reduces application processing time from 20 minutes to under 5 minutes. This is how HyperVerge helped Oona in delivering exceptional digital transformation solutions.

2. Ekata

About Ekata

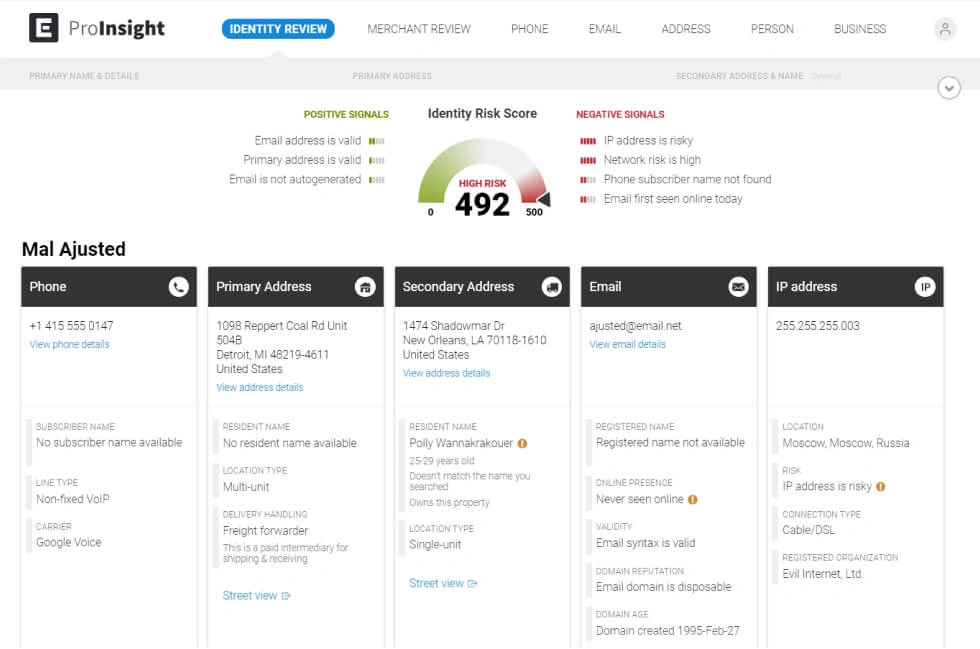

Ekata is an identity verification solution of Mastercard that provides businesses with smarter identity insights while preventing fraud. The platform uses machine learning technology to offer smooth and secure customer onboarding and transactions, protecting businesses against fraud, scams, and abuse.

With analytics from the first customer touchpoint, Mastercard identity helps optimize manual review processes, increase approval rates, and combat transaction fraud. The software also improves customer acquisition and retention by preventing fake accounts.

Ekata pricing

Contact Ekata for current pricing.

Key features of Ekata

- Global identity verification: Verifies customer identities globally to ensure businesses confidently onboard new customers and fulfill KYC requirements.

- Fraud prevention: Prevents fraud by analyzing behavioral, personal, and device data with global fraud insights. This strategically declines suspicious online transactions while minimizing the friction for legitimate customers.

- Optimized manual review: Speeds up the approval of valid customers by providing accurate insights to reduce customer abandonment rates and increase review agent productivity.

Pros of Ekata

✓ Businesses gain valuable insights from detailed account attributes this software provides, which enhances fraud mitigation.

✓ Users find it efficient to detect fraudulent activity by highlighting negative attributes linked to customer details.

✓ The risk indicators and verifiable information help businesses in identifying and addressing fraud patterns and red flags.

Cons of Ekata

✕ Users find redundant information like duplicate network signals which clutters the results and reduces clarity.

✕ The platform experiences inconsistencies with risk scores, often requiring both primary and secondary factors for accurate assessment.

3. Ondato

About Ondato

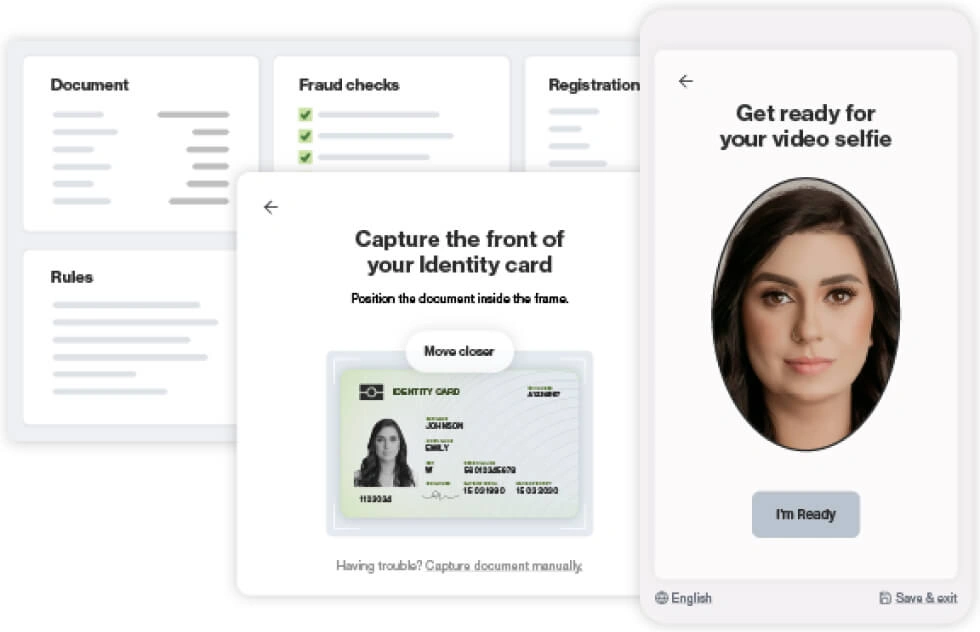

Ondato is one of the popular identity verification software solutions known for streamlining the onboarding process. The platform offers real-time automated identity verification to enable businesses to prevent fraud with unmatched efficiency.

Ondato ensures compliance with KYC, AML, and GDPR using advanced AI-driven technologies. By combining biometric security with strong document and spoofing checks, Ondato specializes in delivering a secure and user-friendly experience.

Ondato pricing

Ondato offers pricing plans that start from $0.99 per verification with a monthly commitment. Also, the software offers custom pricing options for enterprises.

Key features of Ondato

- Automate identity verification: Captures and verifies identity documents and user selfies in real-time using AI technology. This process checks against multiple ID registries to prevent fraud.

- ID spoofing checks: Ensures the authenticity of the documents using advanced filters and crossreference against ID registries, preventing the use of fake IDs.

- Biometric security: Uses biometric comparisons to verify users’ faces. This helps detect deepfakes and masks to ensure secure identity verification.

Pros of Ondato

✓ Users find the support team to be responsive. Their team addresses issues promptly and considers feedback for future product enhancements.

✓ Users admire how Ondato’s KYC ID checks help stop fraudsters from bypassing the system.

✓ Businesses appreciate Ondato’s user-friendly interface, customizability, and rapid development of new features.

Cons of Ondato

✕ At times, the system misclassifies documentation, which affects the overall accuracy of verification.

✕ Integration with external APIs and back-office systems is a bit difficult.

4. ID.me

About ID.me

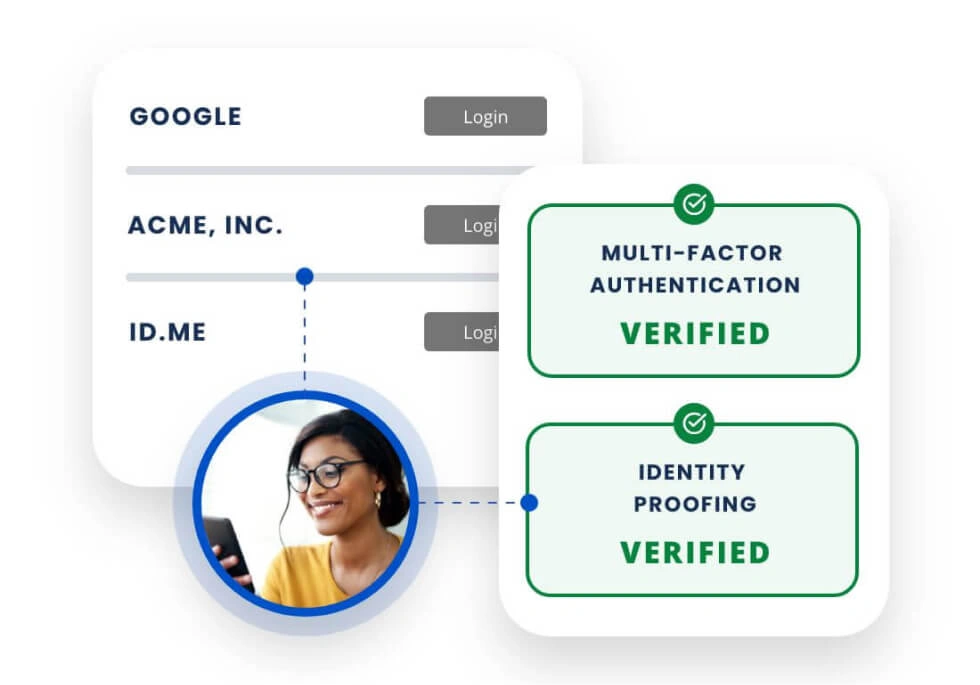

ID.me is a reliable identity verification provider offering a remote verification process using physical ID scans, mobile network data, and fraud checks. The software allows users to manage identities and access government services like IRS accounts and unemployment benefits. Combining physical ID checks with advanced fraud detection technologies, ID.me uses a multi-faceted approach to ensure accurate validation of users’ credentials. Such an approach leads to enhancing positive customer experience and reduces the risk of identity theft.

ID.me pricing

Contact ID.me for current pricing.

Key features of ID.me

- Multi-factor authentication: Supports multiple MFA options like SMS, phone calls, security keys, and their authenticator app to protect user accounts from unauthorized access.

- NIST compliance: Adheres to the NIST 800-63-3 standards for identity proofing and authentication. This helps meet federal and state-level requirements for secure digital interactions.

- Interoperable login: Provides access to any organization without the requirement of re-verification to streamline the login process and reduce friction in accessing services.

Pros of ID.me

✓ Some users praise the support from exploration to integration and maintenance. The assigned managers are quick at responding to the queries.

✓ The identity proofing and verification process is fast and straightforward.

✓ Integrating the ID.me platform into existing infrastructure is way easier.

Cons of ID.me

✕ Businesses find the reporting and dashboard capabilities limited, lacking basic data export functionality.

✕ The entire documentation from upgrading to a full integration is confusing for users.

5. Onfido

About Onfido

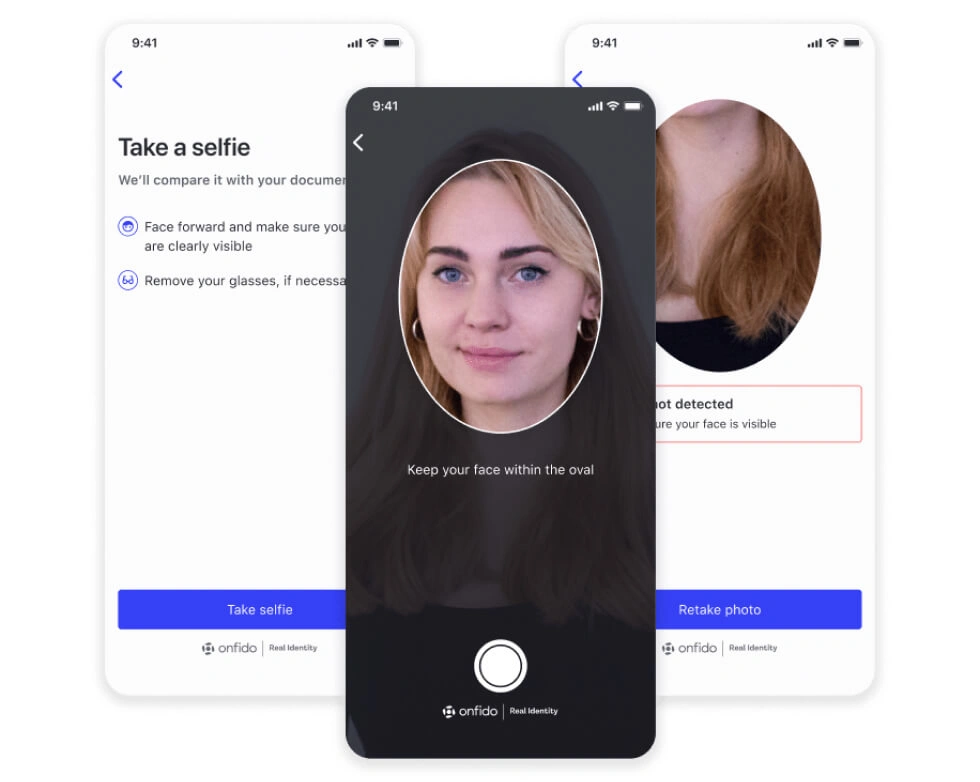

Onfido offers top-notch identity verification software solutions that streamline and secure the onboarding process. This end-to-end solution integrates multiple verification methods like biometric and document checks to ensure compliance and mitigate fraud. Onfido allows businesses to customize verification workflows depending on specific risk profiles and geographical requirements. Smart Capture SDKs complement this flexibility by facilitating smooth and rapid identity verification with real-time glare and blur detection and multi-frame capture.

Onfido pricing

Contact Onfido for current pricing.

Key features of Onfido

- Global document verification: Supports verification of 2,500 different documents globally. Such wide coverage allows businesses to verify identities from diverse countries and territories.

- Biometric verification: Processes 95% of biometric verification in under 10 seconds using advanced AI technology. This ensures rapid and accurate identification of the users while preventing fraud.

- Customizable onboarding workflows: Helps businesses create tailored verification journey that aligns with their risk tolerance and regional compliance requirements, making it easy to manage diverse business verification needs.

Pros of Onfido

✓ Users like how Onfido detects fraudulent documents with its advanced algorithms.

✓ Some businesses find the live demos and ongoing customer support to be helpful, with well-prepared integration documentation.

✓ The wide range of accepted documents and collaboration with the customer success manager enhances the overall process.

Cons of Onfido

✕ Users encounter issues like the software failing to provide coverage for the Arabic language and the high price.

✕ The reporting dashboard lacks the required level of granularity.

6. Sumsub

About Sumsub

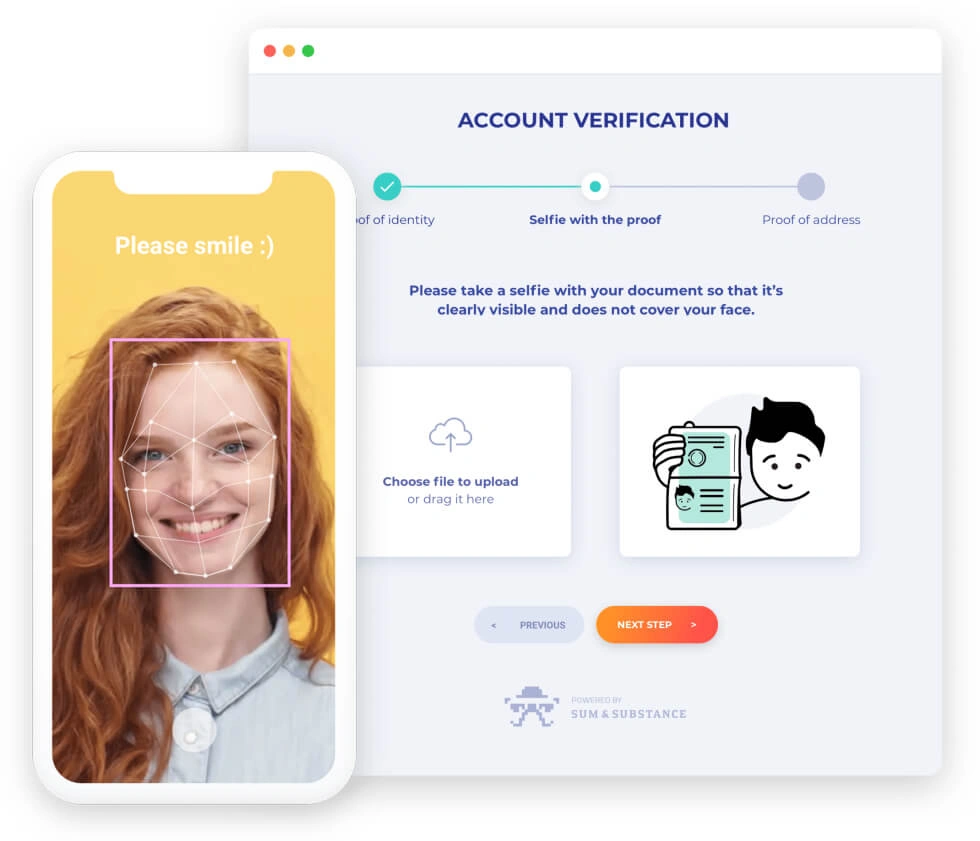

Sumsub is a secure and scalable identity verification platform that assists in onboarding users within 30 seconds. The platform ensures top pass rates and strict compliance with regulatory standards by offering customizable KYC/AML workflows.

It allows businesses to configure unique verification flows without coding to ensure rapid and secure user onboarding. The platform excels at identifying fraudulent activities and document inconsistencies by using advanced machine learning algorithms.

Sumsub pricing

Sumsub provides different pricing plans that start at $1.35 per verification with a monthly commitment. The provider also offers custom pricing for enterprise-level organizations.

Key features of Sumsub

- AI-driven fraud detection: Employs advanced AI algorithms to detect document templates, behavioral red flags, and fraud networks. This ensures that 100% of the fraud attempts are blocked.

- Global verification coverage: Supports verification processes in 220 countries and territories. The software uses an optimal verification method for each case to ensure fast and reliable identity verification, regardless of the user’s location.

- Non-document verification: Increases pass rates by 35% with non-doc verification that allows verification using just an ID number or a tap on a bank or government app.

Pros of Sumsub

✓ Several businesses appreciate the fast and accurate document verification solution that Sumsub provides.

✓ The flexibility and customization options with data analytics capabilities make it a better choice for users.

✓ Users like the support that their team provides for the integration of Sumsub into existing systems.

Cons of Sumsub

✕ Business faces problems like a high false positive rate for address documents which is around 10%.

✕ Users do not like the rejection of KYC applicants by the compliance team for reasons that seem unreasonable.

7. iDenfy

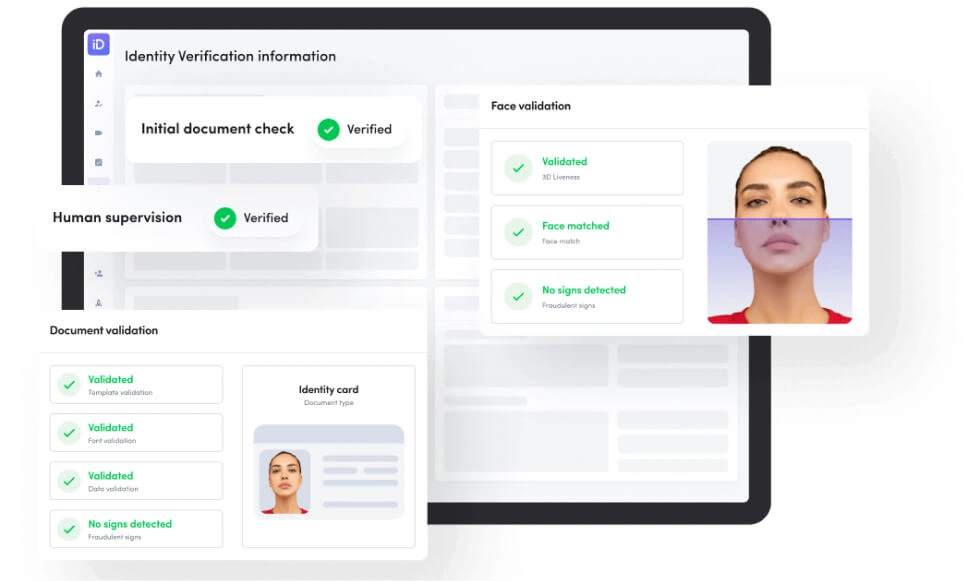

About iDenfy

iDenfy is one of the reliable identity verification providers specializing in optimizing business operations and ensuring top-notch security. Using advanced biometric technologies and a global document database, the platform supports 3,000 ID documents, allowing for precise and efficient document analysis. iDenfy easily integrates with diverse applications from Gmail to Shopify to ensure compatibility across platforms. The platform also enhances security and reduces costs by charging only for approved verification.

iDenfy pricing

Contact iDenfy for current pricing.

Key features of iDenfy

- Advanced biometric verification: Employs facial recognition and 3D liveness detection technologies to ensure the authenticity of identities. This prevents the use of photos, masks, or other fraudulent methods.

- Human review oversight: Reviews automated verification within 3 minutes with iDenfy’s team of experts to ensure potential errors or fraud attempts do not arise.

- Customizable verification flow: Offers a dynamic and adjustable verification process, including steps like utility bills checks, or bank statements to meet client requirements and compliance needs.

Pros of iDenfy

✓ The straightforward and professional customer verification process with easy API integration is remarkable for users.

✓ Business appraise the quick and efficient validation of ID documents.

✓ Most of the users find the technical and customer support services are responsive.

Cons of iDenfy

✕ Annual contracts that require upfront payments are challenging for businesses.

✕ Businesses find the AML feature documentation to be unclear.

8. SEON

About SEON

SEON is a fraud prevention software that provides passive identity verification solutions. The platform develops a detailed digital profile of each user through an advanced analysis of their email, phone, and IP data gathered during onboarding. This ensures rapid identification of fraudulent activities and reduces the need for extensive KYC procedures. The software provides a smooth customer onboarding experience by integrating real-time behavioral data. SEON’s advanced fraud detection capabilities help reduce the manual workload and accelerate the review process.

SEON pricing

Contact SEON for current pricing.

Key features of SEON

- Behavioral analysis: Integrates real-time data to validate user authenticity by assessing the behavioral patterns and online presence. This approach helps in improving the speed and accuracy of fraud detection.

- Customizable fraud detection rules: Allows businesses to set up custom rules and scoring systems based on their unique risk profiles and operational requirements. This enhances and assists in reducing the false positives.

- Automated AML screening: Streamlines anti-money laundering efforts with automated checks with global watchlists. This ensures compliance and timely detection of suspicious activities.

Pros of SEON

✓ The software is ideal for users as it provides easy creation of fraud detection rules tailored to their requirements.

✓ Users like how it offers detailed analysis of financial activities with a user-friendly interface.

✓ Businesses find SEON’s fraud-combating engine extremely powerful.

Cons of SEON

✕ Several businesses experience integration issues that lead to data losses.

✕ The customization requires direct support from SEON, which is challenging for users as it causes delays.

9. ComplyCube

About ComplyCube

ComplyCube is one of the best online identity verification and KYC providers. ComplyCube’s platform integrates advanced technology like AI to verify customers in seconds by analyzing ID documents, selfies, and data from trusted sources.

ComplyCube supports businesses in adhering to AML regulations, preventing fraud, and ensuring customer due diligence. The platform supports several document types and uses advanced biometric liveness detection to detect and prevent fraud.

ComplyCube pricing

ComplyCube offers pricing plans that start at $249/month for the Basic plan. The provider also offers custom pricing for enterprise solutions tailored to specific business needs.

Key features of ComplyCube

- Biometric liveness detection: Validates customer’s identity through high-resolution selfies, to protect against spoofing attempts with masks or photos.

- Real-time AML monitoring: Monitors customer profiles for potential money laundering and fraudulent activities to ensure compliance with regulatory standards.

- Advanced document capture: Uses guided document capture to ensure high-quality image capture for KYC processes. This enhances accessibility and accuracy in identity verification.

Pros of ComplyCube

✓ Users appreciate the entire experience as straightforward from signing up to integrating the SDKs.

✓ The customer support is helpful for users to navigate complex compliance challenges.

✓ ComaplyCube supports all language scripts including Latin, Chinese, and Arabic which enhances its usability across diverse markets.

Cons of ComplyCube

✕ Users face issues with the local regulator blacklist not integrated into the software’s database.

✕ Businesses experience in requesting company documents through a link.

10. Jumio

About Jumio

Jumio is a trusted identity verification platform using AI and machine learning to provide fraud prevention solutions. The platform excels at providing accurate identity verification and risk management through advanced analytics and superior user experiences. Using past and present behavioral data, Jumio provides predictive insights into potential fraud risks. This enhances proactive measures and reduces the chances of fraudulent activities.

Jumio pricing

Contact Jumio for current pricing.

Key features of Jumio

- Real-time identity verification: Verifies identities quickly with a combination of biometric analysis and ID document checks. This feature ensures that individuals are genuine and not using fraudulent or stolen identities.

- Risk scoring: Employs customizable risk scoring to assess and prioritize user interactions based on real-time data and historical fraud patterns.

- AML screening: Automates the screening process against global watchlists including sanctions and politically exposed persons (PEPs). This helps businesses comply with anti-money laundering regulations.

Pros of Jumio

✓ Some users appreciate how Jumio passes or fails verifications while still having an option for human review.

✓ Businesses benefit from detailed status updates for unvalidated identities.

✓ Users find efficient uploads and accurate ID detail extraction, even with slight blurriness.

Cons of Jumio

✕ Users sometimes experience false positives or different results for the same ID type.

✕ Businesses face issues with the accuracy of face-matching features.

How to choose the right identity verification provider for your business

Here is the entire process of choosing the right identity verification software provider for your business.

Step 1: Define your identity verification requirements

Outlining your identity verification needs ensures you select a solution tailored to your specific business processes, regulatory requirements, and customer expectations. A well-defined set of requirements simplifies the selection process and improves the effectiveness of the chosen solutions. Here is what you need to consider during this first step.

- Define whether you need solutions for KYC, anti-money laundering, or other compliance requirements.

- Specify the necessary features like biometric authentication, ID verification, and real-time monitoring.

- Assess your business’s verification volume and future growth to ensure the provider scales with your needs.

- Ensure the solution meets industry-specific regulatory requirements like GDPR and CCPA.

Not defining your requirements results in collaborating with a provider whose services do not fully address your needs.

Step 2: Shortlist and research identity verification providers

With all the requirements in hand, compile a list of potential identity verification producers. Performing in-depth research on these providers helps identify those that best match your criteria. This step narrows down your options and ensures you choose a reliable provider.

- Identify providers who specialize in offering features and compliance measures that you require.

- Compare offerings, pricing models, and any additional costs for integration or upgrades.

- Look for reviews and ratings on reliable platforms like G2 or Capterra.

- Consider the provider’s experience in a specific industry and track record with similar businesses.

These are the factors to consider while researching and shortlisting providers. If you fail to consider these then you may select one with insufficient features and poor customer service.

Step 3: Assess the performance and security of the software

An important step in the selection process is to ensure that the software performs well and adheres to high-security standards. Evaluate how the software manages real-world scenarios.

- Review the software’s speed, accuracy, and reliability during verification processes.

- Examine encryption measures, data protection practices, and compliance with security standards like ISO 27001.

- Check how easily the software integrates with the existing workflows and systems.

Ignoring performance and security considerations leads to data breaches, compliance failures, and operational disruptions.

Step 4: Conduct trials, get feedback, and make a decision

Testing the software by conducting trials and gathering user feedback offers invaluable insights. This phase helps validate the software’s effectiveness and ensure it aligns with operational requirements before committing.

- Request a trial or demo version of the software to test the functionalities and suitability.

- Collect input from team members who use the system to understand the software’s performance and usability.

- Use the feedback and trial results to choose the provider that best fits your criteria.

With such an easy and simplified process you get to choose a provider that fulfills your business identity verification requirements.

Pick the best identity verification software solution

Identity verification solution is essential for streamlining the customer onboarding process and ensuring strong security & compliance. The ideal solution improves efficiency in verifying identities and also mitigates risks related to fraud and regulatory breaches. Choose the right provider that aligns with your specific requirements, integrates easily, and adheres to relevant industry standards.

HyperVerge ONE platform provides a complete solution for identity verification. The platform offers an all-in-one approach to customer onboarding and fraud prevention. Using advanced technologies like AI-powered biometric authentication and fraud detection, HyperVerge ensures a secure verification process. Schedule your free trial today.

Frequently asked questions

1. Who needs an identity verification solution?

Here are the industries that need an identity verification solution:

- Financial institutions: To ensure compliance with regulations and prevent fraud.

- eCommerce platforms: To combat fraud and protect from chargebacks.

- Healthcare providers: To protect patient data and comply with regulations.

- Government agencies: To secure access to services and maintain voter registration integrity.

- Employers: To confirm the identities of new employees and meet security requirements.

2. What are the features to look for in identity verification software?

Here are the features to look for in identity verification software:

- ID verification: Authenticates various documents like passports and driving licenses.

- Biometric verification: Uses facial recognition, fingerprint, or iris scanning for identity confirmation.

- Liveness detection: Ensures the verifier is present and not using a static image.

- API integration: Offers API support for easy integration with existing systems and applications.

- Fraud prevention: Integrates advanced algorithms and machine learning to detect and prevent fraudulent activities.

3. What are the benefits of an online identity verification solution?

Here are the benefits of online identity verification solutions:

- Minimizes the risk of fraud and identity theft by verifying users through advanced technologies.

- Allows users to complete the verification process from any location and at any time.

- Delivers immediate results that accelerate the verification process and improve operational efficiency.

- Reduces operational expenses by automating the verification process.