“While we don’t have a model for the post-Corona world, at least we have a path to the answer for that”

Introduction

Kissht (Hindi for EMI) was founded to bridge the gap between Indians not serviced by traditional lenders and affordable credit. Reaching out to these millions in the middle, curating products for them, and working with them to navigate the current crisis are some of the topics that Karan Mehta, CTO, Kissht, discussed with us on a warm Saturday morning (23rd May) in the 3rd chapter of HyperInsights.

Anatomy of an AI-driven Lending Company (link)

The Context

Consumer lending apps in India constantly strive to strike a balance between delivering a personalised experience for millions and operating a sustainable lending business. Leading into the conversation, the audience wanted to know how Kissht maintains this balance. Karan offered the view that AI can act as a lever in achieving this, and what Kissht does differently from everyone else in this context.

HyperInsights

- Building AI powered alternative credit scoring and fraud prevention engines were the first pieces that Kissht built.

- Karan and his team soon expanded the role of AI into delivering a better customer experience by:

(a) Building an automated onboarding solution which is AI driven (this included HyperVerge Fintech Stack APIs).

(b) Contextualising customer conversations with timed messages, voice bots and other tools that grant more control over the quality of interaction. - Karan remarked on how millions of customers had been overlooked by traditional lenders and could be serviced by Kissht because of:

(a) The ability to make a decision (lend/not lend) without relying on bureau data.

(b) A diversification of the supply of credit: on-book and on partner’s book.

(c) Building a customer experience* that encourages repeat behaviour – first loan takes 60 seconds, repeat loans take 20 seconds.

* Kissht’s app is rated 4.4 on the Google Play store with over 200K votes.

How to build an AI-driven lending company (link)

The Context

After an insightful overview of how Kissht leverages AI, Karan spoke about how a lender new to AI could approach it.

HyperInsights

- Start with building a credit engine first and then a fraud engine. A good credit engine will reduce the load on other parts of your stack while fraud detection will filter bad actors before they enter your portfolio.

- Prioritise using AI to make customer experiences seamless starting with the onboarding process.

- AI can help decide how and when to escalate collections and make the lives of collection agents easier.

Collections: Before and After COVID-19 (link)

The Context

“If you don’t do collections, you won’t survive as a company.” In mature markets like the US, entire companies focussed on collections have been operating for years now*. Closer home Kissht built one of India’s first technology driven collections stacks. A stack so extensive that more than a third of Kissht focusses on running it.

HyperInsights

- While other companies were using excel sheets and printouts, Karan built a bespoke collection stack from scratch (with AI built in).

- The solution conveys insights about which customers need to be visited in-person and when.

- Kissht offers alternative options to restructure EMIs, “snooze” repayments in the event of defaults to expand customer’s options to repay from being a binary decision. (These were in place before the first RBI moratorium of March 2020.)

- Every interaction on the Kissht app generates a few data points. The collection stack runs on an analytics engine that collates these.

- Lastly, communication is integral, by fine-tuning the tonality of collection calls/chats/emails and personalising the language used, Kissht has incrementally added to their cash-in-bank.

A fintech CTO’s worst nightmares (link)

The Context

What are the things that keep Karan awake at night? We imagined quite a few. He is, after all, the CTO of a lending company catering to millions of customers. Karan shared with us two of his biggest demons:

HyperInsights

- Security: Kissht handles sensitive data of millions of customers. The possibility of losing this to hackers is something that constantly drives Kissht to update security practices.

- Fraud: Staying ahead of fraudsters and filtering them early through “tenterhooks” and other means is one of Karan’s primary focus as a CTO.

Questions and recurrent theme

Karan devoted a substantial time for questions from the audience, some of the most interesting questions and recurrent themes from the conversation are given below:

Questions

- On leveraging SMS, data, telco data, and other sources to build an alternative credit scoring engine (link)

- On collections during COVID-19 (link)

- On managing delinquency in the context of RBI regulations (link)

- On personalisation and human-ness of AI-enabled customer interactions (link)

- On reconfiguring risk models and filtering wilful defaulters (link)

- On the use of Digital SI: The pros of usability and cons of enforceability (link)

Recurrent theme

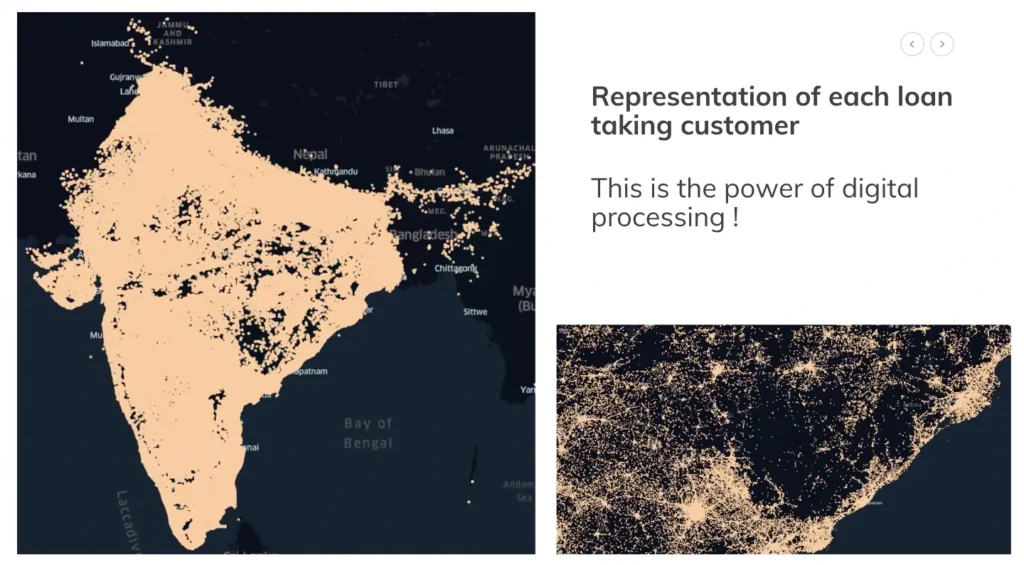

A fascinating theme that all of our guests were eager to share is the spread of their customer base across the country. It’s easy to forget that most of India’s consumer apps are built for people in the city, in a post COVID-19 world, that is set to change dramatically.

And on that note, we stop here and urge you to watch the entire discussion! Don’t forget to check out HyperInsights S1E2 | Early Salary | Akshay Mehrotra too for a more strategic business based approach to lending in the time of COVID-19.

US

US

IN

IN