Groww app has quickly become a leading choice for investors; more so among young and tech-savvy users. With more than 20 million + registered users, it offers a seamless and paperless investment experience in mutual funds and equities.

However, to fully enable the app’s features and safely manage your investments, it is crucial to complete the Know Your Customer (KYC) process. In this detailed guide, we’ll walk you through steps on how to update KYC in Groww app–online and offline.

Importance of activating KYC

KYC verification is a mandatory requirement when using the Groww app. By completing the Groww KYC process, you’re not only fulfilling a regulatory compliance requirement but also safeguarding your investments.

KYC verification is not just about adhering to regulations. By verifying your identity, KYC minimizes any chance of unauthorized access and fraudulent activities. With cyber threats looming large and issues of money laundering, such precautions are essential to the safety of your financial interests.

Moreover, without Groww KYC, access to certain assets like mutual funds, or equities may remain restricted, which can limit your investment potential. So, if you have downloaded the Groww app and are ready to kick-start your investment journey, you will need to complete the Groww KYC formalities. You can opt for the online or offline mode.

First, let us understand KYC verification for mutual funds.

KYC for mutual funds

The Securities and Exchange Board of India (SEBI) mandates that all mutual fund investors complete KYC–a process that involves identifying investors through several authorized documents viz. Aadhaar cards, driving licenses, voter identity cards, passports, etc.

Currently, KYC is categorized into three types: ‘Validated,’ ‘Registered,’ and ‘On Hold.’

Here’s what it means–

- Validated: An ‘Validated’ investor status, achieved through Aadhaar verification, can invest in any mutual fund without restrictions and get access to all the mutual fund houses.

- Registered: Investors who completed their KYC through documents like driving licenses or voter IDs are restricted from investing. They can only purchase or sell units in the existing mutual funds but cannot invest in other mutual funds.

- On Hold: Investors with this status face restrictions on both investing and redeeming mutual funds.

Latest SEBI updates on KYC verification for mutual funds

Recent updates from SEBI have introduced additional flexibility in KYC verification. For instance, the ‘On Hold’ status due to issues like non-linkage of Aadhaar and PAN will now be transitioned to ‘Registered’. The ‘On Hold’ category investors now will not only be able to purchase and sell, but also redeem mutual fund units from their existing investments.

Furthermore, you can choose between email or phone verification for online KYC. Both are not mandatory.

Non-resident Indians (NRIs) are also granted broader access: they can now invest in any fund house, even without an Aadhaar card, provided they offer alternative documentation such as a passport or OCI card. Plus, NRIs are exempted from PAN-Aadhaar linking (by updating their status on the Income Tax portal). Hindu Undivided Families (HUFs) can continue their investments without KYC validation affecting their existing orders or SIPs.

Online KYC

If you are looking to avoid the hassles of offline KYC such as physical document submission or in-person verification, you can complete your KYC online through the Groww app.

Below is the Groww KYC step-by-step guide–

Online KYC with Groww

Once you have downloaded the Groww app and registered with your email, the steps next are as follows

- Enter and verify your mobile number.

- Now, enter the details of your PAN card along with the name as it is on the card.

- Enter personal information in the form: date of birth, gender, and nominee details. Also, provide details to questions such as the mother’s/father’s names and marital status.

- Next, connect your bank account by entering the IFSC code and bank account number.

- You will be asked to share a clear image of yourself, after which you will have to record a small video for identification. Also, capture clear images of your PAN card and Aadhaar card for address verification.

- Then, review and check the details, then tap ‘I agree’ to the terms and conditions to complete the process.

- Lastly, you need to upload an e-signature.

Once done, your Groww KYC process will be complete, and you can start investing immediately.

Are you tired of fraud threats and lengthy verification processes?

Sign up today and experience quick, reliable, and user-friendly verification tailored to your needs. Schedule a DemoDocuments required for KYC

Groww KYC documents required in case of individual investors are as follows–

Proof of Identity (PoI):

- Aadhaar card

- Voter’s ID

- Driving license

- Passport

- PAN card

- Government-issued ID cards

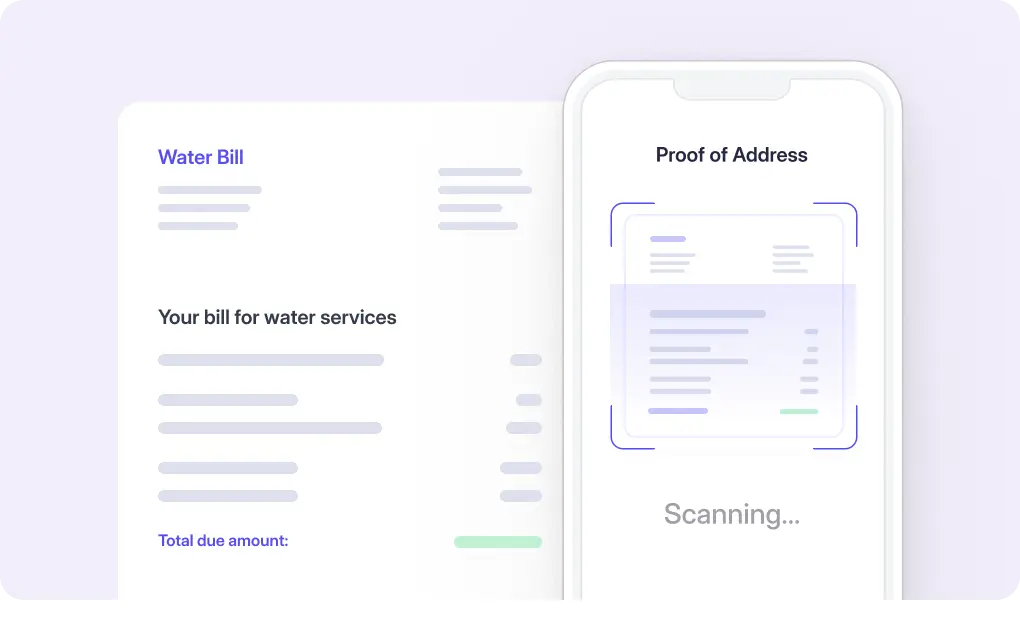

Proof of Address (PoA):

- Aadhaar card

- Voter’s ID

- Driving license

- Passport

- Registered lease agreement

- Utility bills less than 3 months old

How to complete Aadhaar e-KYC

Aadhaar eKYC makes verification of identity easier through its Aadhaar database. It involves the use of biometric and demographic information held by the Unique Identification Authority of India. Given that UIDAI has already verified this information, the process is faster and reduces the need for extensive documentation.

There are two methods by which Aadhaar eKYC can completed:

Biometric Authentication

- Provide your Aadhaar card to the service provider who will then record your Aadhaar number.

- Next, a biometric scanner will be used to capture a fingerprint or retinal scan of your fingerprint.

- This biometric data is then sent to UIDAI to be matched against their database.

- Once the values match, and your identity gets confirmed, the service provider gets access to your Demographic information — DOB, address, photograph, etc.

OTP Authentication

- Present your Aadhaar card to the service provider.

- UIDAI will send an OTP to your registered mobile number.

- Feed the OTP into the device provided by the service provider.

- On verification, UIDAI will share the information with the service provider, thereby completing the eKYC.

Note: If investors opt for eKYC based on OTP, they can invest only up to Rs. 50,000 per fund house per year. To read more about document verification, click here.

Conclusion

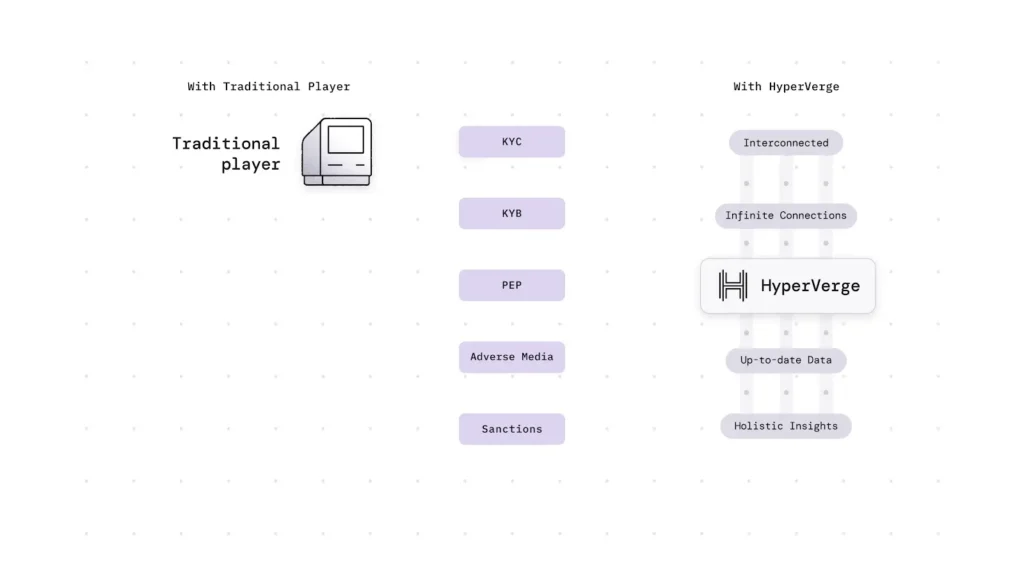

Secure customer onboarding is the backbone of a robust financial ecosystem. KYC plays a crucial role here, by verifying customer identities, preventing fraud, and ensuring regulatory compliance. However, traditional KYC methods are cumbersome, error-prone, and inefficient.

Solution? Enter HyperVerge, the leader in KYC automation. Powered by intelligent validation and seamless integrations, HyperVerge’s solutions unlock unparalleled features and customer satisfaction.

With HyperVerge, you can

- Automate data entry and batch file generation, eliminating manual errors.

- Receive real-time notifications and complete process orchestration for seamless compliance.

- Ensure intelligent validation, and fraud detection to help safeguard against identity theft.

- Make the API integration smooth for a seamless onboarding experience.

HyperVerge KYC is the solution you’ve been looking for. Our advanced platform automates the entire workflow, saving you both time and money.

Schedule a chat today to unlock seamless compliance.

FAQs

1. Is Groww KYC mandatory?

Yes, the KYC verification is mandated by government bodies for investing in equities and mutual funds. The KYC ensures that there is less likelihood of your identity being stolen.

2. How do I update my KYC on Groww?

To update your KYC in the Groww app, enter your mobile number, DOB, bank account details, Aadhaar and PAN details, and finally, an e-signature. You can also follow the step-by-step guide in this blog to update your Groww KYC.

3. Why is my KYC rejected in the Groww app?

Groww KYC failure reasons could be many—incorrect personal information, missing or invalid documents, or problems with verification. To avoid rejection, you will have to check the feedback and upload the correct information/document again.

4. How much time does KYC verification take in Groww?

Groww KYC verification time may vary from 1-3 working days. It depends on the method you are applying for, online or offline, and how promptly the required documents are submitted.