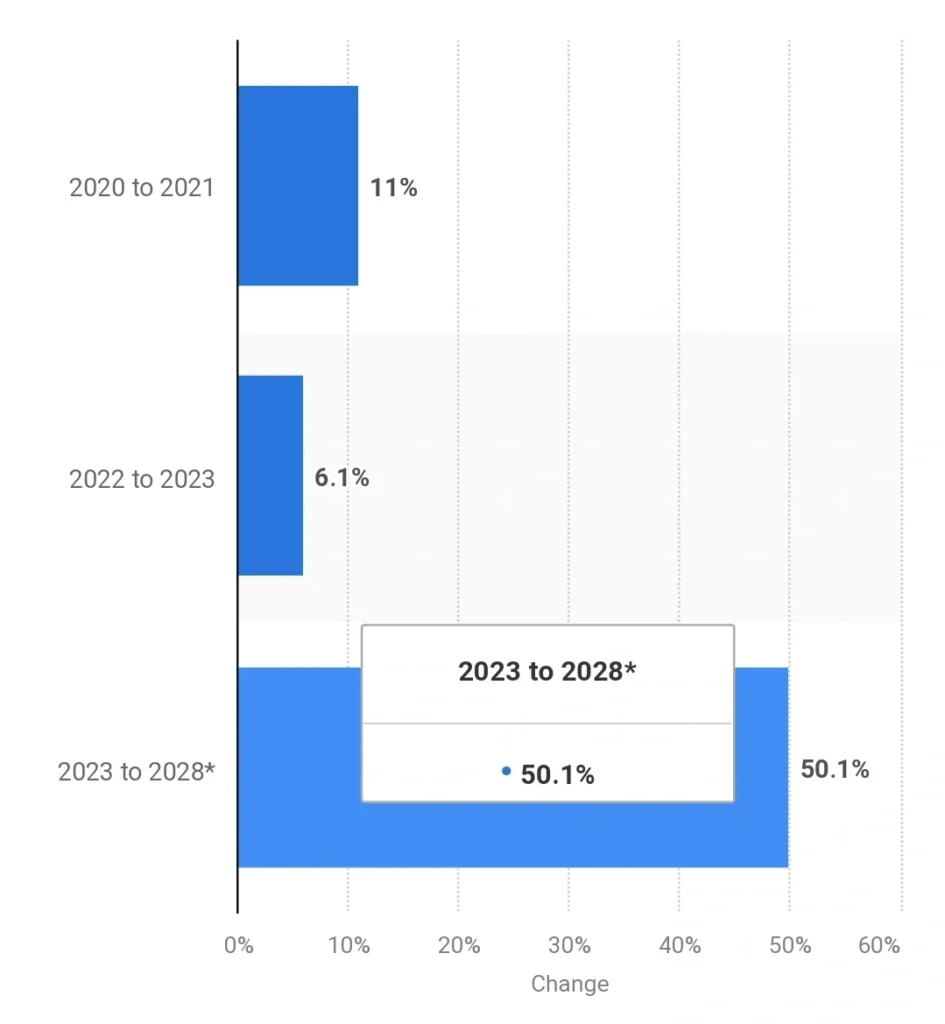

India’s private wealth management services sector is booming. High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) have increased significantly over the past decade. The HNW population is expected to grow at 10-12%, while UHNWIs are projected to grow by 50% between 2023-2028.

The new age investors mainly consist of millennials and Gen Z. They have different expectations than older generations when it comes to financial advisory services. Having grown in digital and tech-savvy environments, they seek personalized solutions that are fast, accessible, and convenient.

Digital transformation in wealth management firms helps wealth managers cater to the expectations of an emerging fraction of clients. It involves integrating advanced technologies to enhance financial advisory services.

Wealth managers who embrace digital tools can enhance efficiency and better serve their clients’ needs. This transition also presents opportunities for innovation and improved client engagement.

On the other hand, firms that fail to automate will struggle with diminished client satisfaction and might lose them to agile competitors. Besides, regulatory compliance and rising operational costs are other major challenges in a row.

Therefore, understanding the role of technology in transforming wealth management is important. This article aims to educate you about what technologies are shaping the future of financial services and how you can leverage them to increase client satisfaction, efficiency, and revenue.

Key drivers of digital transformation in wealth management

Several key drivers propel digital transformation in wealth management. They are redefining how firms engage with clients and manage operations.

Changing client preferences and expectations for seamless, technology-enabled services

Today’s clients demand seamless, technology-driven experiences. A survey revealed that 36% of wealth management firms prioritize enhancing customer experience through digital solutions.

This is because clients expect real-time access to their portfolios and personalized services. For instance, HNWIs (High Net Worth Individuals) increasingly prefer seamless digital engagement, which allows them to manage their wealth conveniently from anywhere. Firms that adopt user-friendly mobile apps and online platforms can offer better service and gain a competitive edge.

The role of technology in automating onboarding, enhancing KYC processes, and boosting operational efficiency

Technology plays a crucial role in automating onboarding and Know Your Customer (KYC) processes. Automation reduces the time spent on administrative tasks. This allows wealth managers to focus on strategic advisory roles.

Firms are leveraging AI and big data analytics to streamline these processes, enabling quicker client onboarding and compliance with regulatory standards. For example, robo-advisors have emerged as effective tools for providing automated financial planning services with minimal human intervention. This helps businesses save employee bandwidth for other high-value tasks.

Impact of regulatory requirements in India promoting transparency and accountability

Recent Indian regulatory frameworks like the Digital Personal Data Protection (DPDP) Act are driving transparency and accountability in wealth management. This act mandates strict data protection measures and responsible handling of client information.

As firms adapt to these regulations, they must invest in secure digital infrastructures while also enhancing their compliance capabilities. These changes not only protect clients but also build trust in the wealth management ecosystem.

Shift toward hyper-personalization and real-time insights

Clients seek tailored investment solutions that align with their unique needs and goals. Wealth managers are utilizing advanced analytics to provide real-time insights into market trends and investment opportunities.

This level of personalization allows firms to cater to individual preferences effectively. A notable example includes the rise of ESG (Environmental, Social, and Governance) investing. Here, the clients aim to make a positive impact on the environment while generating financial returns for themselves. Hence, they may prefer to invest in green energy and sustainability-focused startups.

Generational wealth transfer and the rise of millennial investors

According to recent data, millennials are expected to inherit $68 trillion by 2030, underscoring the importance of adapting to their preferences. The generational wealth transfer is creating a new wave of millennial investors who prioritize digital solutions.

As millennials inherit wealth or accumulate it through entrepreneurship, they demand innovative investment products and services that fit their lifestyles. This demographic shift is prompting traditional wealth managers to rethink their strategies and embrace digital platforms to attract younger clients.

As these drivers continue to shape the wealth management sector, firms must stay agile and responsive to evolving client needs and technological advancements.

Technological innovations transforming wealth management

Below are the technological innovations that are revolutionizing wealth management by making financial services more tailored, accessible, and scalable.

Artificial intelligence (AI) and data analytics

AI and data analytics are at the forefront of this transformation. Wealth managers leverage AI to streamline client verification processes, significantly reducing onboarding time.

AI can analyze vast amounts of data to assess client risk profiles and automate KYC (Know Your Customer) compliance. Predictive analytics further empowers portfolio management by forecasting market trends based on historical data and real-time market conditions.

Robo-advisors

Robo-advisors are democratizing wealth management for retail investors, providing low-cost investment solutions that were once accessible only to high-net-worth individuals. These platforms use algorithms to create personalized portfolios based on individual risk tolerance and investment goals.

Blockchain and cryptocurrency

Blockchain technology ensures transparency and security in transactions, which is increasingly vital in the digital age. By providing a decentralized ledger of transactions, blockchain reduces the risk of fraud and enhances trust between clients and wealth managers.

Additionally, the rise of cryptocurrencies has prompted wealth managers to incorporate these assets into their portfolios, catering to clients interested in diversifying their investments.

Cloud computing

A study found that nearly 50% of wealth management firms are already utilizing cloud technology extensively. Cloud computing streamlines operations and enables scalability for wealth management firms.

Moving to cloud-based platforms improves collaboration, reduces IT costs, and eases data accessibility. This shift allows wealth managers to become agile and offer services in line with changing market demands.

Cybersecurity

As digital transformation accelerates, cybersecurity becomes paramount in protecting sensitive financial data. Wealth management firms must invest in robust security measures to safeguard client information from cyber threats. Implementing advanced encryption methods and continuous monitoring systems helps mitigate risks associated with data breaches, ensuring client trust remains intact.

Impact on client experience

Integration of technology into wealth management impacts client experience at multiple levels. It optimizes the client experience throughout their interaction with businesses.

Let’s understand this impact in detail.

Enhancing convenience through mobile-first platforms

Mobile-first platforms have revolutionized client convenience by allowing investors to access their portfolios anytime, anywhere. With dedicated mobile applications, clients can monitor their investments, execute trades, and receive real-time updates on market conditions directly from their smartphones.

Accessible solutions empower clients to make informed decisions quickly. This fosters a sense of control over their financial futures. For instance, stock trading and investing platforms like Robinhood have gained popularity. They offer user-friendly mobile interfaces that cater specifically to the needs of tech-savvy investors.

Offering multichannel support for seamless engagement

In today’s fast-paced world, clients expect multichannel support that allows them to engage with wealth managers through various platforms—be it phone, email, chat, or social media. This omnichannel approach ensures that clients can communicate in the manner they prefer, enhancing their overall experience.

For example, firms that integrate chatbots into their customer service strategy can provide instant responses to common inquiries. For complex issues, they can escalate queries to human support. This flexibility improves client satisfaction along with strengthening relationships between clients and advisors.

Improving service delivery with hyper-personalized tools

Hyper-personalization is transforming service delivery in wealth management by tailoring offerings to individual client needs and preferences. Advanced analytics and AI enable firms to analyze client behavior and investment patterns, allowing advisors to provide customized recommendations.

For instance, a wealth management firm can use data insights to suggest specific investment products aligned with a client’s values, risk appetite, or desired returns bracket. This level of personalization fosters loyalty as clients feel understood and valued.

Enhance user experience through real-time verifications and seamless onboarding

Real-time verifications and streamlined onboarding processes significantly enhance the user experience in wealth management. With technologies like biometric authentication and e-signatures, firms can simplify the onboarding process. They can enable clients to set up accounts quickly and securely.

For example, digital platforms like Acorns have implemented straightforward onboarding procedures that require minimal documentation, making it easier for new investors to start their financial journeys. This efficiency reduces friction and encourages more individuals to engage with wealth management services.

Building trust through transparency, powered by AI-driven insights

Trust is fundamental in wealth management, and technology plays a crucial role in fostering it through transparency. AI-driven insights provide clients with clear visibility into their investment performance and associated risks.

Using detailed reports and analytics on portfolio performance, firms can demystify the investment process for clients. AI-powered personalized performance dashboards allow clients to see exactly how their investments are doing in real-time. This empowers clients to make informed decisions about their financial strategies.

Benefits of digital transformation for wealth managers

From enhanced operational efficiency to convenient client engagement, digitally powered wealth management offers multiple benefits. Here are the prominent ones:

- Improved operational efficiency and cost reduction

Digital tools allow wealth managers to automate routine tasks such as client onboarding and compliance checks. Technologies like robotic process automation (RPA) can handle data entry and validation. It reduces human error and frees up staff to focus on strategic activities. This efficiency cuts operational costs and accelerates service delivery.

- Enhanced client acquisition and retention through tailored services

With advanced data analytics, wealth managers can deliver personalized services that cater to individual client needs. Firms can analyze client behavior and preferences. These insights help them create customized investment strategies and proactive communication plans.

This tailored approach helps firms stand out and attract new clients. It also fosters loyalty among existing ones,

- Broader access to underserved segments, including Tier 2 and Tier 3 cities in India

Digital platforms enable wealth management firms to reach clients in Tier 2 and Tier 3 cities, where traditional services may be limited. By offering online advisory services and mobile apps, firms can provide financial guidance to a wider audience.

This democratization of wealth management helps tap into previously underserved markets. Wealth managers can expand the client base and promote financial inclusion across diverse demographics.

Challenges in implementing

Transforming wealth management with technology also presents some challenges. Wealth managers must navigate them successfully and adapt to thrive in a digitally transformed environment. Here are the major ones:

- Resistance to change and the learning curve for adopting new tools

One of the primary obstacles is the inherent resistance to change among employees. Many wealth management professionals are accustomed to traditional methods and may be skeptical about new technologies. A survey finds that 68% of wealth managers find learning about and keeping up with new technology to be their top challenge.

Overcoming this resistance requires a cultural shift within organizations. Training and continuous support are essential to help staff overcome this learning curve and embrace the benefits of digital transformation.

- Balancing high implementation costs with ROI for smaller firms

For smaller wealth management firms, the high costs associated with implementing digital solutions can be challenging. These firms often struggle to justify the investment against potential returns within confined budgets.

Smaller firms need to prioritize specific areas for digital investment. These areas could be client onboarding or compliance automation. This will help them achieve tangible benefits without overwhelming their financial resources.

- Ensuring compliance with Indian and global financial regulations using automated tools

In India, regulations such as the Digital Personal Data Protection (DPDP) Act impose strict requirements on data handling and client privacy. Firms must ensure that their automated systems comply with both local and global regulations, which can be complex and resource-intensive.

Implementing RegTech solutions can help streamline compliance processes. Firms must invest time and resources into understanding these regulations and coordinate them with their digital frameworks.

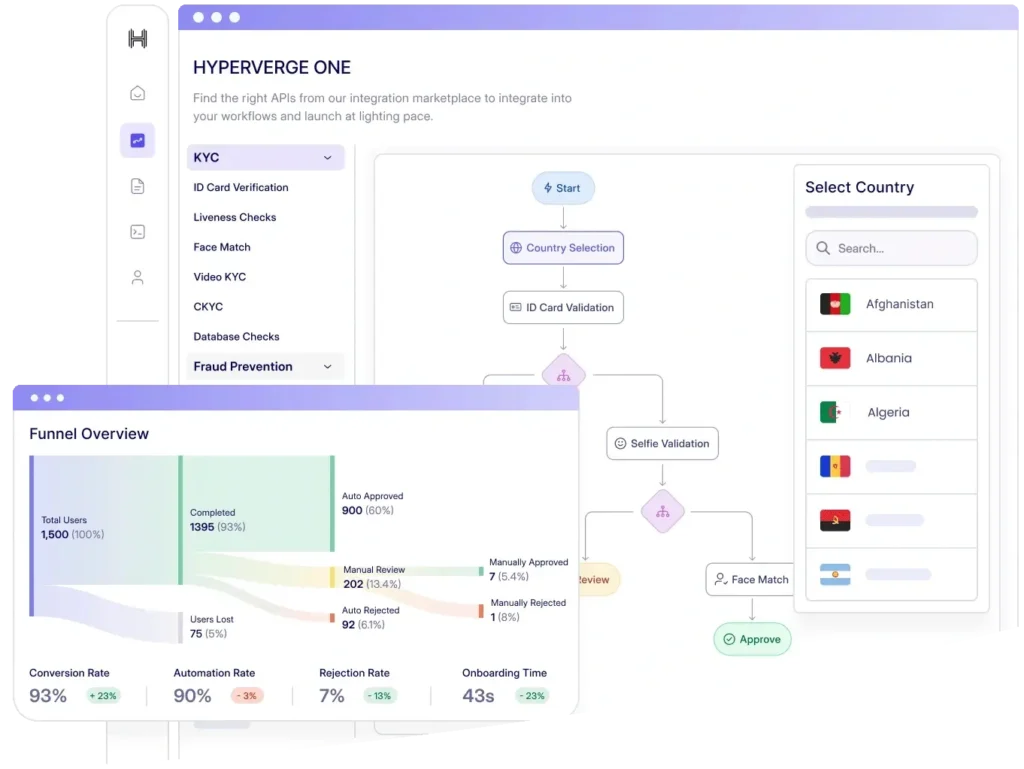

Here’s how Hyperverge helped IndMoney, a wealth management platform, overcome challenges through a unified KYC interface. After IndMoney went live with Hyperverge’s digital KYC solutions, the platform onboarded customers with 99.5% accuracy, improved speed, and frictionless customer experience.

Future trends in digital wealth management

Generative AI and conversational AI are set to revolutionize advisory services by providing personalized, real-time assistance to clients. These technologies can analyze vast amounts of data. Managers can leverage tailored investment recommendations and insights to strengthen client-advisor relationships.

For instance, conversational AI can facilitate interactive dialogues with clients, helping them navigate complex financial decisions throughout their investment journey. As these tools become more sophisticated, they will enable wealth managers to deliver hyper-personalized experiences at scale. Eventually, firms can improve client satisfaction and retention.

Further, seamless end-to-end digital onboarding journeys are the key to improved conversion rates and customer experience. Robust tools like HyperVerge One software enable wealth managers to create seamless onboarding processes that guide clients from initial engagement through account setup and investment management.

With AI-powered investor onboarding solutions, firms can reduce friction points that often lead to drop-offs during onboarding. Access dashboard analytics to analyze exactly where users are dropping out of the process, discover reasons for reviews, and get tools to re-engage customers. These functionalities further boost your conversions without sacrificing the speed and accuracy of the KYC process.

Onboard investors with faster turnaround time and more accuracy while minimizing friction and risks. Switch to smarter wealth management solutions with Hyperverge’s SEBI-compliant end-to-end onboarding solutions today.

FAQs

1. How is technology changing wealth management?

Technology transforms wealth management with personalized client services, holistic planning, and improved accessibility. Innovations like AI and data analytics streamline processes. At the same time, mobile platforms enable real-time engagement. Additionally, digital solutions broaden access to underserved markets, including clients in Tier 2 and Tier 3 cities in India, fostering financial inclusion.

2. Why is digital onboarding critical for wealth management in India?

Digital onboarding is critical for wealth management in India as it streamlines the client acquisition process. This further helps firms to engage new clients quickly and efficiently. Remote account setup and verification during digital onboarding reduces the time and resources needed for traditional methods. This approach enhances client experience, fosters trust, and expands access to financial services, particularly in underserved regions.

3. How can AI improve wealth management services?

AI can improve wealth management services by automating routine tasks. Firma can access insights for personalized investment recommendations and analyze large datasets. It enables predictive analytics to forecast trends, improves client engagement through chatbots, and streamlines compliance processes. AI-assisted wealth management makes financial advisory services more efficient.

4. How do robo-advisors work, and are they reliable?

Robo-advisors use algorithms to assess clients’ financial situations and investment goals. They typically offer low fees and require minimal human intervention. For better service, firms should use a hybrid approach of assigning robo-advisors and human advisors according to the client’s needs.