Chargeback fraud is a growing problem for businesses of all sizes. According to the Chargeback Report, there will be over 238 million chargebacks globally in 2023.

Chargebacks can happen for many reasons, such as billing errors, customer claims, business errors, or customer dissatisfaction. Sometimes, customers use chargebacks to avoid returning items and getting a refund for legitimate purchases, while fraudsters take legitimate chargebacks and use them to steal from businesses.

Both cases can seriously harm a business’s financial health and reputation. Understanding what fraudulent chargebacks are, how they work, and which businesses are most at risk is the first step in dealing with them.

What is chargeback fraud?

Chargeback fraud happens when a customer intentionally demands an illegitimate chargeback amount to get a refund while keeping the product or service. Customers with chargeback fees might falsely claim that they never received the product streaming service, that it was defective, or that they did not make the transaction.

There are various forms of chargeback fraud, such as:

- Criminal fraud: This happens when a fraudster steals a customer’s payment information, makes unauthorized or fraudulent purchases elsewhere, and the customer files a chargeback to recover the money. This type of fraudulent chargeback is difficult to prevent due to tactics like phishing scams or malware.

- Friendly fraud: Friendly fraud occurs when a cardholder denies a legitimate purchase, falsely claiming they didn’t authorize it or that the goods/services were not as described. This can happen if the cardholder forgets about the charge or does not initially recognize it on their credit card statement, assuming it is fraudulent. Customers may sometimes receive the products but still file a chargeback, falsely claiming they did not receive it.

- Merchant error: Merchant fraud can sometimes arise from a genuine mistake or mistakes where a merchant misrepresents a product/service, fails to deliver as promised, or engages in misleading practices, whether intentional or not.

Merchants must prevent such issues. They can safeguard themselves by ensuring clear, accurate product descriptions, timely order fulfillment, providing evidence, and delivering excellent customer service to resolve any customer disputes more effectively. Effective chargeback management can help businesses dispute fraudulent chargebacks and recover lost revenue.

How chargeback fraud works

Chargeback fraud can affect any business that accepts credit card payments, regardless of size or industry. Here is a step-by-step process of how the chargeback process works:

Step 1: Initial customer dispute

- The cardholder raises a dispute for the transaction with the credit card provider.

- Multiple chargebacks can be filed for different transactions.

Step 2: Provisional refund

- A conditional refund is issued to the cardholder.

- The transaction amount is moved back from the acquirer to the issuer and debited from the merchant’s account.

Step 3: Examining the reason code

- The issuing bank assigns a reason code and transmits chargeback information to the acquirer, who forwards it to the merchant.

Step 4: The option to re-present

- The merchant can accept the chargeback or contest it by providing proper documentation to the acquirer.

Step 5: Compile your documents

- The merchant must gather and submit evidence, such as a refutation letter and legitimate transaction records, to support their case.

Step 6: Submit the refutation package

- The merchant submits the refutation package to the acquirer, who reviews it and sends it to the issuer.

Step 7: Bank review and decision

- The issuing bank reviews the case and decides whether to favor the merchant or the cardholder or initiate a second chargeback.

Step 8: Arbitration

- If unresolved, the case goes to arbitration, and the card network makes a final decision. This can incur significant fees.

Common tactics used by fraudsters

To perform chargeback fraud, many fraudsters use some of the common techniques, such as:

- Fraudsters say they never received the merchandise or services to get a refund.

- Fraudsters claim the product was not as described or was defective to get a chargeback.

- Fraudsters trick customers into providing payment information through fake websites or emails and then use it to make unauthorized purchases and file chargebacks.

- Some merchants misrepresent products or services, fail to deliver them, or use deceptive practices.

- Fraudsters request refunds for purchases made with stolen credit cards and then file chargebacks.

- Fraudsters create fake identities using real and fake information to open credit card accounts, make purchases, and file fraudulent chargebacks.

The impact of chargeback fraud on businesses

Here are some common damages faced by businesses as a result of payment fraud:

Financial losses

Merchants stand to suffer greatly from chargeback fraud. When a fraudulent chargeback takes place, merchants lose not only the earnings from that initial transaction but also have to deal with additional costs imposed by their financial institution or any related penalties imposed on them.

Moreover, merchants need to present evidence in contrast to chargebacks. Businesses have to spend money and time on this process. If the rate of chargebacks increases over time, the business will incur increased fees and possibly no longer have any way of processing payments or cards with that credit card company.

Operational costs

Chargeback abuse and fraud also affects merchants operationally. Upon a chargeback initiation, merchants must investigate the full dispute process, gather evidence to commit chargeback fraud, track chargeback data, and respond within a set timeframe. This process is time-consuming and may necessitate diverting resources to fight chargebacks from other business operations. High chargeback rates may cause merchants to take higher fees, adopt more financial fraud prevention measures, or undergo strengthened scrutiny from their payment processors.

Reputational damage

Merchants who lose in a chargeback may be ruined in reputation. When a consumer files a full chargeback based on an order that he made fraudulently, he often penalizes the seller with poor online feedback. This behavior discredits a merchant’s name and will eventually massively limit the number of his customers. Additionally, merchants who are unable to effectively prevent chargeback fraud are easily viewed as dishonest or even dishonorable, which makes it hard for them to attract new customers.

Potential loss of payment processing privileges

Businesses with a high chargeback ratio may face punishing action from processors and credit card issuers. What’s more, high chargeback rate ratios can result in greater merchant account processing costs, and businessmen may lose their credit card payments.

Warning signs of chargeback fraud

Here are simple warning signs to look for:

Suspicious purchasing patterns

Look for orders that are unusually large, frequent orders within a short period, or orders with rushed shipping methods regardless of cost.

Mismatched billing and shipping information

Be alert of significant differences between the billing and shipping addresses, especially with international shipments or frequent changes in shipping addresses.

High-risk products or services

Be cautious with products or services that are commonly targeted for chargeback fraud, such as electronics, luxury items, or digital goods. Implement additional verification measures for these transactions to reduce the risk of chargeback fraud.

Preventing chargeback fraud

Protecting against chargeback abuse requires businesses to take proactive measures. Here are steps businesses can take to prevent and combat chargeback fraud:

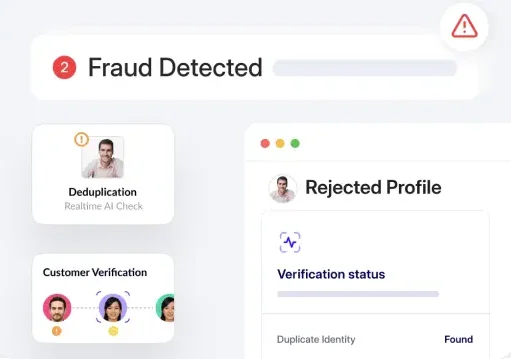

Implementing robust identity verification processes

Robust fraud prevention and identity verification tools, like HyperVerge, use advanced machine-learning algorithms to verify identities and detect fraudulent transactions preemptively, thereby preventing chargebacks.

Utilizing clear merchant descriptors

Chargeback fraud occurs because customers find it easier to initiate fraud or a chargeback process rather than navigate a business’s return or exchange policy. By making clear and consumer-friendly return and refund policies, businesses can prevent fraud and make customers understand handling procedures for returning or getting cash back on their items.

Maintaining detailed transaction records

Accurate chargeback records management not only benefits businesses by helping them to get back money that has been lost and recover lost revenue due to both fraud and legitimate claims. It can help in disputing all reasons for chargeback. This proactive approach helps businesses protect their finances and maintain healthy merchant relationships.

Offering excellent customer service

When customer service is good, the chances of disputes and chargebacks caused by dissatisfaction with a product or service reduce. With the finest support for customers as well as very professional accessibility, customers are free to ask any questions and get things sorted out quickly. This top-notch customer service helps businesses to resolve concerns on the spot, thereby mitigating customers’ chances of appealing for a chargeback.

Leveraging fraud detection tools and AML screening solutions

To prevent illegal chargeback fraud, tools for fraud detection and AML screening solutions are necessary. They analyze the behavior of both customers’ data and stolen transactions to identify suspicious activities, authenticate customer personalities, and check whether there were any anomalous payments. By automating risk assessments of chargeback fraud consequences and regulatory compliance, the technology helps protect businesses from chargebacks themselves and ensures their financial stability to some extent.

Takeaways

Chargeback fraud presents significant challenges for businesses, affecting their finances and reputation. It’s necessary to address this issue to maintain financial stability and customer trust. Identity verification and Anti-Money Laundering (AML) solutions are essential in combating chargeback fraud by analyzing transaction data and verifying customer identities.

HyperVerge offers advanced solutions for chargeback fraud prevention. Our fight chargeback fraud detection software and AML screening solutions use advanced technology to analyze transaction patterns, verify identities, and monitor suspicious activities in real-time.

By integrating HyperVerge’s solutions, businesses and credit card providers can improve their fraud prevention measures and further protect customers against financial losses from chargeback fraud.

Explore how HyperVerge’s fraud prevention solutions streaming services can protect consumers and your business from chargeback fraud. Learn more at HyperVerge Fraud Prevention Solutions.