Over 94% of fraudulent application documents show altered bank balances and transactions. With such a high risk of fraud, verifying bank statements is crucial. Manual checks are slow and prone to errors. This is where automation in bank statement analysis helps. It detects fraud faster and with greater accuracy.

Businesses need reliable insights to assess risk and prevent fraud. Automated checks strengthen onboarding and build trust.

In this article, we’ll explore what is bank statement analysis automation. We will also look at how automated statement analysis in onboarding can assist you.

What is Automated Bank Statement Analysis?

Automated bank statement analysis uses AI and machine learning to process and verify financial data. It scans bank statements, detects inconsistencies, and extracts key insights. This technology helps businesses assess financial health and detect fraud.

The key objectives of automated analysis are:

- Efficiency: It processes large volumes of data quickly to reduce the time spent.

- Accuracy: AI eliminates human errors to ensure reliable financial insights.

- Scalability: It can handle growing data needs without extra effort or resources.

How It Differs from Manual Bank Statement Analysis

Manual analysis requires employees to check bank statements and verify transactions. This process is slow, prone to errors, and labor-intensive.

Automated analysis, on the other hand, uses AI to flag suspicious activity and provide insights instantly. Here are the limitations of manual bank statement analysis that automated analysis overcomes:

- Time-consuming: Reviewing multiple bank statements manually takes hours or even days.

- Error-prone: Human mistakes can lead to missed fraud or incorrect assessments.

- Limited scalability: As data increases, manual checks become overwhelming.

- Inconsistent results: Different employees may interpret data differently, reducing reliability.

Which bank statement analysis software works best for financial institutions handling multiple accounts?

For financial institutions that need to analyze multiple bank accounts per customer—across lenders, co-borrowers, guarantors, and historical periods—the most effective bank statement analysis software is one that can reliably normalize heterogeneous statement formats, reconcile cross-account cash flows, and produce audit-ready outputs at scale.

Platforms like HyperVerge are designed specifically for high-volume, multi-account analysis in regulated environments. They support parallel ingestion of statements from different banks, identify inter-account transfers, de-duplicate transactions, and generate structured outputs suitable for underwriting, risk, and compliance workflows.

In contrast, tools built primarily for SMB accounting or consumer finance often struggle with multi-account reconciliation, inconsistent formats, and explainability requirements expected by banks and NBFCs.

Why Automated Bank Statement Analysis is Essential

The importance of bank statement analysis automation is undeniable for lenders, businesses, and individuals. Here is how automated account aggregator impacts each of them:

Financial Institutions and Lenders

- Faster credit assessment: Instantly verifies income and financial stability.

- Higher accuracy: Reduces human errors and ensures reliable evaluations.

- Better risk management: Provides deep insights into an applicant’s financial health.

- Fraud prevention: Detects inconsistencies and fake transactions quickly.

Businesses

- Streamlined cash flow analysis: Automates tracking of revenue and expenses.

- Error-free accounting: Eliminates manual data entry mistakes.

- Real-time insights: Helps in budgeting and financial planning.

- Risk detection: Identifies potential financial issues before they escalate.

Individuals

- Simplified finance management: Categorizes expenses and tracks spending automatically.

- Faster loan approvals: Enables seamless and secure financial data sharing.

- Less paperwork: Eliminates the need for manual document submission.

- Improved financial awareness: Provides clear insights into personal cash flow.

Why most bank statement tools fail with multiple accounts

Multi-account analysis introduces challenges that single-account tools are not designed to handle. These include inconsistent statement formats across banks, duplicated transactions caused by self-transfers, mismatched timelines, and attribution errors between primary and secondary accounts.

For financial institutions, these errors can distort income assessment, understate liabilities, or trigger incorrect risk flags—making robust multi-account logic essential rather than optional.

How Automated Bank Statement Analysis Works

Now we know why is automated bank statement analysis crucial, let us look at its process and the technology behind it.

Step-by-Step Process

The process of conducting automated bank statement analysis follows these steps:

- Data Extraction: The system collects raw financial data from bank statements. This process, known as financial data fetch, ensures accurate data retrieval.

- Categorization: AI identifies income, expenses, and recurring transactions, organizing data for easy analysis.

- Analysis: The system generates reports and insights. This includes spending patterns and risk assessments using advanced tools like HyperInsights.

Technology Powering Automated Bank Statement Analysis

The automated bank statement analysis software is based on the following technology:

- AI, OCR, and Machine Learning: AI automates data processing, OCR extracts text from scanned statements, and machine learning improves accuracy over time.

- APIs for Connectivity: APIs enable seamless integration with financial platforms. This allows businesses to access and analyze financial data in real time.

Benefits of Automated Bank Statement Analysis

There are several automated bank statement analysis benefits that lenders can profit from. These include:

Improved Accuracy and Reduced Errors

Automation removes human errors in data extraction and categorization. AI-driven analysis ensures precise financial insights, reducing the risk of discrepancies. This leads to more reliable assessments for businesses and financial institutions.

Faster Turnaround Time

Automated systems process bank statements instantly, speeding up approvals and risk evaluations. Businesses and lenders can make quicker decisions without delays. This efficiency helps improve customer experience and operational productivity.

Enhanced Fraud Detection

AI detects transaction anomalies, such as altered balances or unusual spending patterns. Automated systems flag suspicious activities in real-time, reducing fraud risks. This strengthens financial security and ensures compliance.

Cost-Effectiveness

Automation lowers operational costs by reducing the need for manual reviews. It also minimizes fraud-related losses and compliance expenses. Businesses can scale operations efficiently without increasing costs.

Key Features to Look for in Automated Bank Statement Analysis Tools

When looking for an automated bank statement analyser, here are the features you must consider:

Real-Time Data Processing

The tool should process bank statements instantly, providing quick insights. Faster data processing helps businesses make timely financial decisions.

Comprehensive Data Coverage

It should support various bank formats and transaction types. A good tool can analyze multiple account types and financial documents.

Security and Compliance

Strong security measures ensure data privacy and compliance with regulations. Encryption and secure access controls protect sensitive financial information.

Automated Expense Categorization

The tool should automatically classify transactions into categories like rent, salary, and utilities. This simplifies financial analysis and budgeting.

Comprehensive Income and Transaction Analysis

It should accurately track income sources and transaction patterns. Businesses can assess financial health and verify income details efficiently.

Transaction Monitoring and Red Flag Alerts

The system should detect unusual transactions and raise alerts. This helps prevent fraud and ensures financial transparency.

Comparison of bank statement analysis tools for multi-account use cases

Evaluation criteria include account consolidation, reconciliation logic, scalability, auditability, and downstream decisioning readiness.

| Platform | Multi-Account Support | Cross-Account Transfer Detection | Output Format | Designed for Regulated BFSI |

|---|---|---|---|---|

| HyperVerge Bank Statement Analysis | Native (10–50+ accounts per customer) | Yes (linked account logic) | JSON, CSV, API | Yes |

| Ocrolus | Limited (account-wise, not holistic) | Partial | PDF, CSV | Partial |

| Perfios | Moderate | Partial | Excel, API | Yes |

| Karza Technologies | Moderate | Limited | Reports | Yes |

| Yodlee | Consumer-centric | No | API | No (bank ops) |

Use Cases of Automated Bank Statement Analysis in India

There are different use cases of automated bank statement analysis to prevent fraud and make analysis easier. These include:

Securities, Brokerages, and AMCs

Automated bank statement review helps validate income for F&O trading. SEBI mandates this verification to ensure compliance and financial stability.

Lending (Banks and NBFCs)

BNPL: Assesses income for users without a credit history.

Credit Cards: Determines credit limits based on income validation.

Loans: Helps decide loan amounts and interest rates by verifying income.

Small and Medium Enterprises (SMEs)

SMEs use automated analysis to manage cash flow efficiently. It simplifies financial operations, improving business stability.

Personal Finance Management Apps

Individuals can track spending, savings, and financial trends. Automated insights help users make better financial decisions.

Insurance

For term insurance, income validation determines the maximum coverage amount. IRDAI mandates a limit of up to 25 times the annual income.

Challenges and Solutions in Automated Bank Statement Analysis

Here are some of the most common challenges and how you can get past them.

Common Challenges

- Incomplete or inconsistent data: Missing or incorrect details can affect analysis.

- Technical integration issues: Connecting with multiple banking systems can be complex.

- Limited fraud checks: Basic systems may not detect all fraudulent activities.

- Manual review: Some processes still need human verification, causing delays.

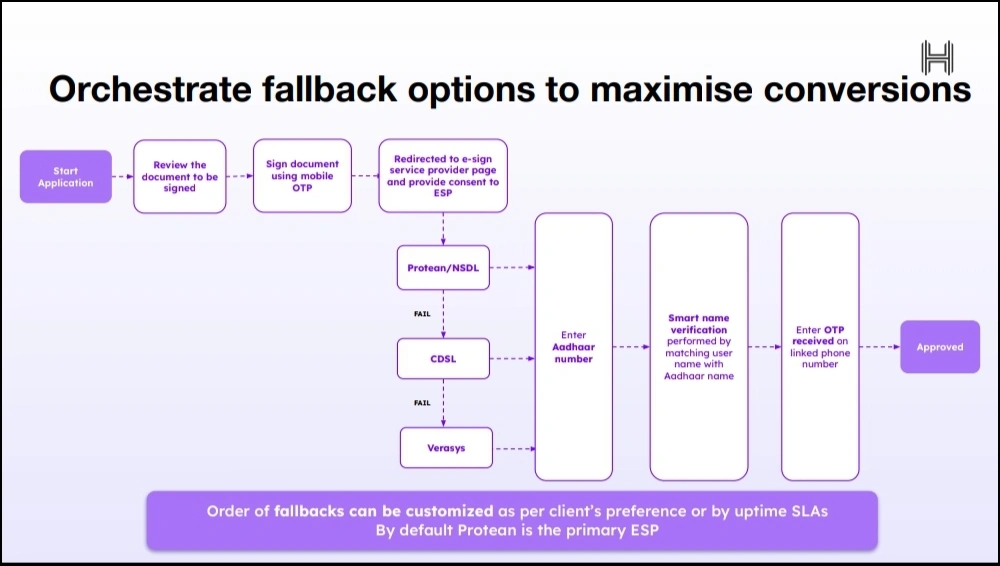

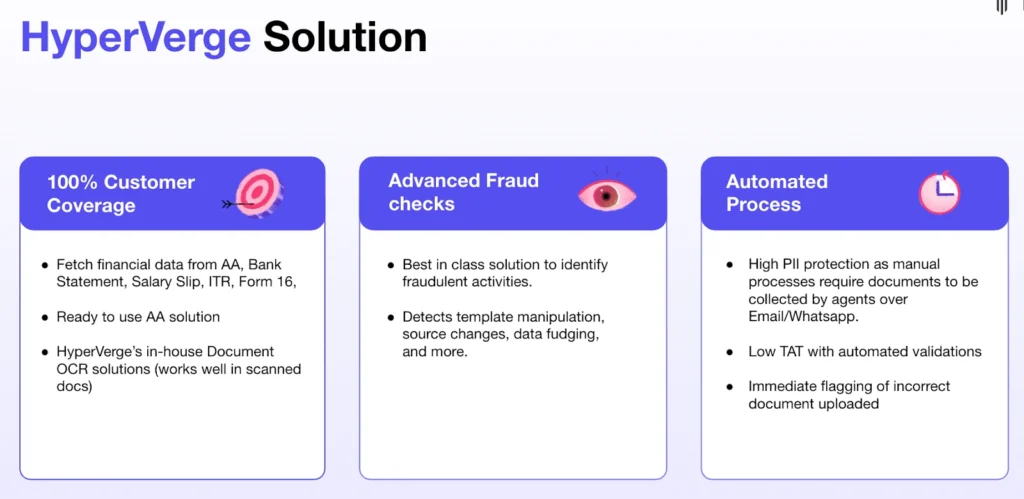

- Limited coverage:

- Low user conversion: Relying on one data source misses many customers.

- AAs have high drop-offs: Bank downtimes and incomplete responses reduce accuracy.

How Modern Tools Address These Issues

- Advanced machine learning algorithms improve data accuracy.

- Seamless integration connects with multiple financial systems.

- Data fetch from multiple sources ensures complete analysis.

- AI-powered OCR solutions extract data with high precision.

- Advanced fraud checks detect anomalies in transactions.

- Automated processes enhance security and efficiency:

- High PII protection avoids manual document handling.

- Low TAT speeds up validations.

- Immediate flagging catches incorrect document uploads instantly.

Final thoughts

Automated bank statement analysis is transforming the financial ecosystem. It enhances accuracy, speeds up decision-making, and improves fraud detection. Lenders use it for better credit assessments and individuals manage personal finances more effectively.

HyperVerge’s Bank Statement Analysis (BSA) tool offers advanced AI-powered features, seamless integration, and real-time fraud detection. It ensures high accuracy, secure data processing, and compliance with financial regulations.

To enhance onboarding with bank statement analysis, explore HyperVerge Bank Statement Analysis now.