In a striking incident recently, FinCEN fined an AML executive at a US credit union a whopping $100,000 for not flagging $1 billion in high-risk transactions!

Financial institutions have to be more vigilant than ever to ensure that their platform or services are not used for money laundering.

This blog seeks to demystify the subtleties of the AML transaction monitoring process and how it fits into the overall AML compliance workflow. Moreover, it aims to provide practical insights specifically crafted for organizations maneuvering through the landscape of AML compliance.

Defining Transaction Monitoring

Transaction monitoring systems, with both proactive and reactive measures, act as a critical defense against financial crime. They conduct real-time analyses of transactions, scrutinizing each for potential anomalies that signal suspicious activities. By promptly flagging risks, these systems help financial institutions stay ahead in the ongoing battle against a range of financial crimes.

Compliance with regulations is just the tip of the iceberg; effective transaction monitoring substantially empowers businesses to proactively identify and prevent illicit activities in the swiftly evolving digital financial environment. Think of it as the ever-vigilant guard standing outside the gates of economic enterprises, diligently conducting transaction screening for signs of illicit interest.

What Makes it Important?

- AML Compliance: Organizations that circulate money, such as banks, fintech firms, and fee processors, must comply with AML regulations. Here, transaction monitoring software effectively works toward detecting and investigating suspicious activities to ensure compliance.

- Financial Crime Prevention: It helps prevent terrorist financing, money laundering, and other financial crimes by monitoring anomalies, thereby safeguarding the integrity of the financial system.

- Government Scrutiny: Governments worldwide are tightening the noose of AML practices. Failure to comply results in hefty fines and reputational damage. Effective transaction monitoring is, therefore, non-negotiable.

Critical Role of Transaction Monitoring Across Industries

Financial crimes directly affect organizations, leading to reputational damage and regulatory scrutiny. Inadvertent involvement in money laundering, human and drug trafficking, terrorist financing, and fraudulent transactions not only threatens financial system integrity but also undermines trust built with customers and partners. Here, the transaction monitoring process (with real-time analytics capabilities) acts as a proactive shield, helping companies with regulatory compliance, preventing financial crimes, and preserving stakeholder trust.

Let’s delve into its paramount importance for various industries in ensuring unwavering compliance, total risk scoring, risk-based approach, effective hazard mitigation, and protection of the entire financial ecosystem.

Financial Institutions

Banks, credit unions, and other financial institutions function as the critical pillars of the economic landscape and carry out the management of financial transactions. In this regard, AML transaction monitoring functions as their unwavering compass, guiding them through the labyrinth of financial intricacies.

- AML Compliance — At its core, transaction monitoring ensures strict compliance with anti-money laundering principles for financial institutions. By carefully screening every monetary interaction, it acts as a bulwark against money laundering, fraud, and the spectrum of various economic crimes.

- Risk Identification — Transaction monitoring aids financial institutions in effectively reading transaction patterns to identify anomalies and excessive risk, thereby enabling efficient risk management. It goes beyond compliance and provides proactive insights, contributing to a robust threat management approach.

- Money Service Businesses — Money transmitters, remittance firms, and currency exchanges operate within substantial transaction volumes, requiring a shield against suspicious activities. Transaction monitoring steps in as their formidable defender, equipped to detect and thwart potential threats swiftly.

- Swift Detection — Financial organizations operate in an environment where speed is of the essence. Here, transaction monitoring acts rapidly with a direct response to detect and address illegal activity. It is the first line of defense against money laundering and other financial crimes, representing a proactive technique to control the danger.

Additionally, crypto businesses also need to comply to AML compliance requirements to prevent illicit funds from being laundered.

Stages Involved in the Transaction Monitoring Process

The following stages collectively create a robust transaction monitoring platform, crucial for preventing and fighting financial crime, such as money laundering:

1. Data Collection: The Foundation

- Purpose: Gather relevant customer data on financial transactions.

- Sources:

- Internal Data: Transaction records, customer profiles, bank accounts information.

- External Data: Sanctions lists, watchlists, news feeds, and other third-party data.

- Challenges: Ensuring data accuracy, completeness, and timeliness.

2. Risk Assessment

- Purpose: Evaluate risks associated with each customer’s account or transaction.

- Factors Considered:

- Customer type (individual, business, high-risk industry).

- Transaction amount, frequency, and patterns.

- Geographical locations involved.

- Risk Level Categories: Low, medium, or high-risk customers.

3. Rule Setting: Crafting the Guidelines

- Purpose: Define rules and scenarios for detecting suspicious behavior.

- Types of Rules:

- Threshold Rules: Trigger alerts when transaction amounts exceed predefined thresholds.

- Behavioral Rules: Detect unusual patterns or deviations from expected behavior.

- Watchlist Rules: Match transactions against sanctions lists or internal watchlists.

- Fine-tuning: Regularly review and adjust rules to minimize false positives and false negatives.

4. Transaction Analysis: Unmasking Anomalies

- Purpose: Investigate flagged transactions.

- Alert Generation:

- The automated system generates alerts based on rule matches.

- Analysts review alerts for potential suspicious activity in case of money laundering and other illicit activities.

- Investigation Process:

- Initial Review: Assess the alert’s relevance and context.

- Data Enrichment: Gather additional information (e.g., customer history, related parties).

- Risks Assessment: Determine the severity of the alert.

- Decision: Escalate for further investigation or close as non-suspicious.

5. Case Management: Coordinating Responses

- Purpose: Manage and track investigations.

- Workflow:

- Assign cases to analysts.

- Document findings, actions taken, and outcomes.

- Collaborate with other departments (legal, compliance, law enforcement).

6. Reporting and Record Keeping: Documenting the Journey

- Purpose: Fulfill regulatory requirements and demonstrate compliance.

- SARs (Suspicious Activity Reports):

- File SARs with authorities to monitor suspicious transactions.

- Include details of the investigation and rationale for suspicion.

- Record Retention:

- Maintain records of alerts, investigations, and decisions.

- Retain customer records for the specified regulatory period.

Best Practices for an Effective Transaction Monitoring Process

Let’s delve into the best practices that ensure robust, just compliance regulations, enhanced due diligence, and efficient transaction monitoring systems, safeguarding the financial ecosystem.

1. Robust Framework

Regulatory Imperative: The ever-changing regulatory environment requires unwavering vigilance. Transaction monitoring systems must be agile and adapt quickly to evolving standards.

Incorporation of Advanced AML Tools: To create a robust framework, financial institutions should include a state-of-the-art AML system capable of accurate testing and real-time monitoring. These tools act as frontline protection, detection, and prevention of illegal activities.

Real-Time Tracking: The ability to recognize and address suspicious activity as it occurs is critical to maintaining the integrity of a money transfer.

2. Risk Awareness

Purpose: Being aware of the hazard is not only a regulatory requirement; it is equally crucial to maintain the monetary health of financial institutions.

Competent Teams: Building a competent, well-trained team is paramount. Team members should be able to exercise sound judgment in monitoring customer transactions. This includes spotting unusual patterns, erratic behaviors, and potential illicit activities.

Staying Informed: The financial landscape is constantly evolving, and so are the methods adopted by financial offenders. Staying informed of growing threats ensures that the compliance teams are equipped to navigate these troubled waters effectively.

3. Integrated AML Process

Collaboration Across Departments: AML transaction monitoring cannot operate in isolation. To be truly effective, collaboration across various departments is essential.

Compliance and Support: Ensuring alignment with anti-money laundering regulations is vital. Collaboration with the compliance and support department ensures that the transaction monitoring system is in sync with regulatory requirements.

Audit and Risk: Validation of controls and assessing their effectiveness fall under the purview of the audit and risk department. Collaborating with the department helps reinforce an AML transaction monitoring process with anti-money laundering controls.

These best practices emphasize the dynamic nature of AML transaction monitoring. Ultimately, it’s about building a resilient and proactive defense mechanism against money laundering and other crimes.

Transaction Monitoring Made Seamless

Understanding the importance of AML transaction monitoring, the industries it affects, and best practices for implementing effective monitoring is essential for businesses in today’s hyper-connected financial environment.

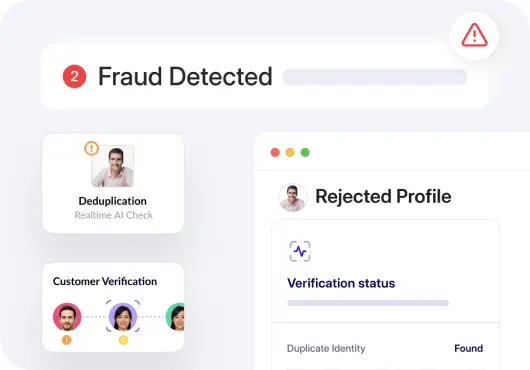

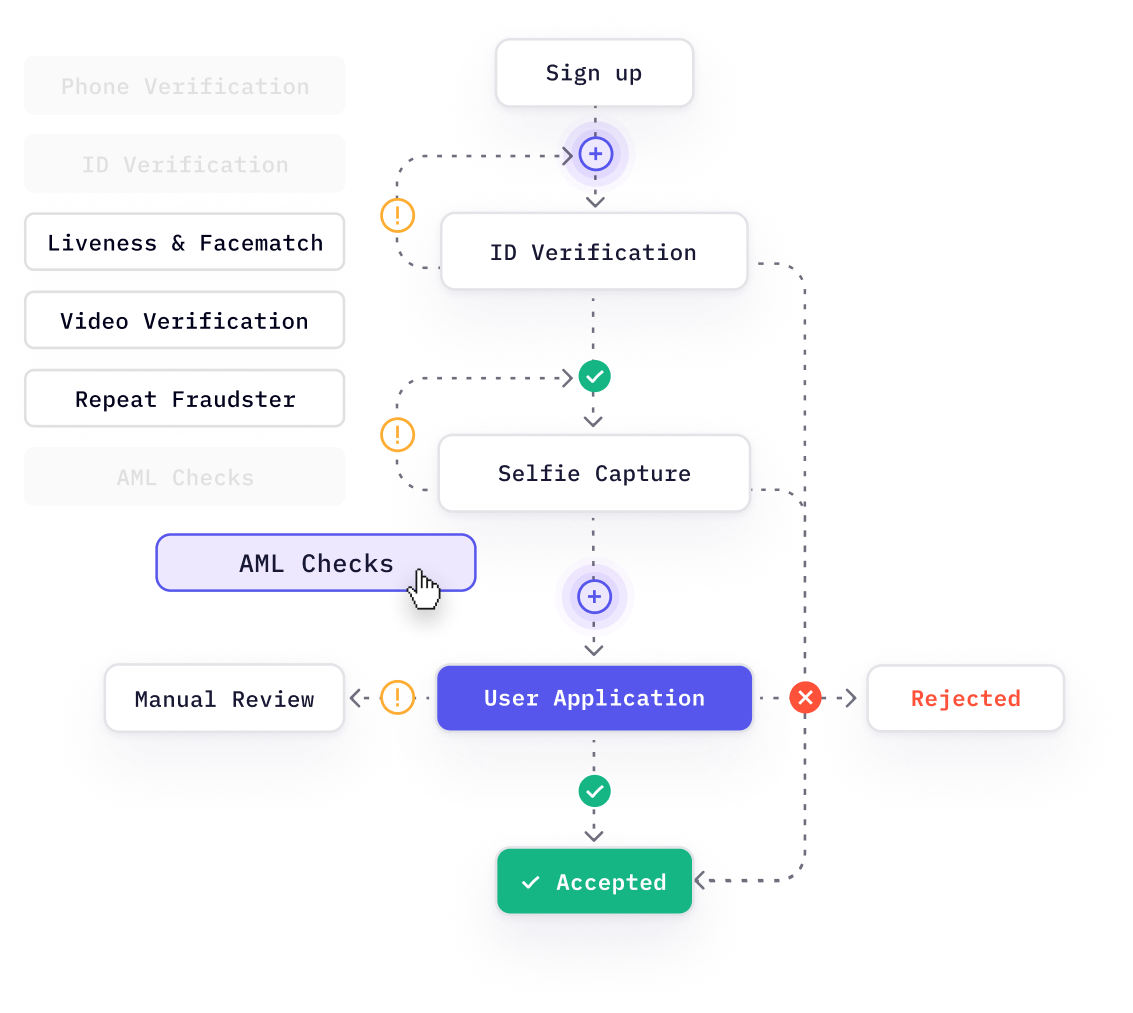

HyperVerge’s end-to-end approach to KYC and AML compliance includes transaction monitoring, sanctions screening, risk assessment, ongoing monitoring, customer due diligence measures, and more.

To fortify your defenses and ensure seamless AML compliance, explore HyperVerge’s cutting-edge solutions. Sign up now and get a customized demo.

FAQs

1. Why is transaction monitoring important for financial institutions?

Transaction monitoring is crucial for financial institutions to detect and prevent criminal activities such as money laundering, fraud, and terrorist financing. By continuously monitoring transactions, financial institutions can identify suspicious patterns or behaviors, mitigate risks, and ensure compliance with regulatory requirements. Failure to effectively monitor transactions can expose institutions to significant legal, financial, and reputational risks.

2. How does advanced analytics and machine learning enhance transaction monitoring?

Advanced analytics and machine learning play a vital role in enhancing transaction monitoring capabilities for financial institutions. These technologies enable institutions to analyze large volumes of transactional data in real-time, identify complex patterns indicative of potential risks or fraudulent activities, and adapt to evolving threats. By leveraging sophisticated algorithms, financial institutions can improve the accuracy of risk detection, reduce false positives, and streamline the process of identifying suspicious transactions, ultimately strengthening their overall risk management framework.

3. What is the significance of risk appetite in transaction monitoring?

Risk appetite refers to the level of risk that a financial institution is willing to accept in pursuit of its objectives. In the context of transaction monitoring, establishing a clear risk appetite is essential for defining the boundaries within which the institution operates and making informed decisions about which transactions warrant further investigation. A well-defined risk appetite framework provides guidance for evaluating the effectiveness of transaction monitoring processes and adjusting them as necessary to maintain an appropriate risk posture.