Money laundering affects many businesses and industries, like real estate or financial institutions. In the US, criminals launder an estimated $300 billion every year. Anti-money laundering (AML) investigations analyze suspicious activities to detect and prevent illicit activities.

They are usually linked to money laundering and other financial crimes. These investigations involve meticulous tracking of the flow of funds. They use these to uncover any suspicious transactions or identify potential criminal schemes.

The importance of AML investigations is undeniable. They play a vital role in maintaining the integrity of a financial institution. Besides, they protect institutions from criminal exploitation. By conducting thorough investigations, institutions can also follow regulatory requirements.

Importance of AML investigations

Anti-money laundering (AML) investigations are very important in the financial world. They help find and stop financial crimes. Strong AML controls help banks and other institutions avoid money laundering. This can help stop serious crimes like drug trafficking, corruption, and terrorism. Besides regulations, it also helps protect these institutions from problems with their reputation.

On a larger scale, AML investigations help keep our country safe and society healthy. They stop criminals from stealing money. Moreover, they help uncover crimes like human trafficking and fraud. AML investigations help protect the financial system and the economy from misuse.

Who needs AML investigations?

AML investigations are not limited to traditional banks. Various industries must install these practices, including:

- Financial institutions: Banks and credit unions must track transactions to prevent money laundering.

- Fintech companies: Technology-based financial services must ensure compliance with AML regulations.

- Gaming and gambling platforms: Casinos and online gambling sites need robust AML programs to detect money laundering.

- Real estate firms: Real estate transactions can be a front for money laundering. Thus, firms must conduct thorough investigations.

- Insurance companies: Insurers need to assess risks associated with money laundering in their operations.

- Legal and accounting firms: These firms must track transactions to prevent exploitation of their services.

- Regulatory bodies: Organizations that regulate financial institutions also need AML investigations to ensure compliance.

The AML investigation process

The first step to creating an AML investigation is defining a structured process. This will shape the investigation of any suspicious activities related to money laundering.

Step 1: Define your AML investigation process

Every AML investigation process needs a clearly defined workflow. Begin by outlining the steps your business will take when investigating money laundering and other suspicious activities.

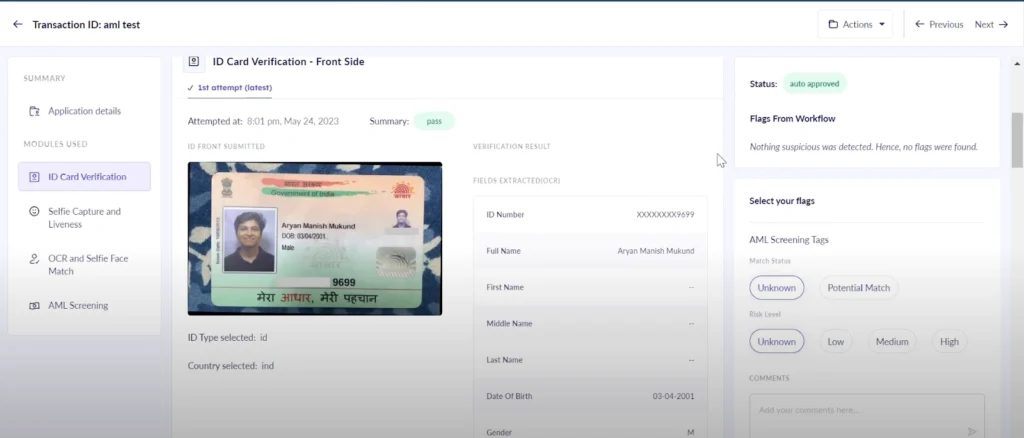

This involves determining the data sources, documents, and records to review. Defining the start and end of each investigation ensures consistency and thoroughness.

Step 2: Identify and investigate suspicious activity

An AML investigation process often begins with identifying red flags. These can be suspicious activities that warrant further scrutiny. Common triggers include:

- Large or frequent cash transactions: High cash transactions that are unusual may point to money laundering.

- Rapid and unexplained transfers: Quick transfers without a clear purpose can raise suspicion. They can also lead to further investigation.

- Complex or layered transactions: Financial transactions that are too complicated may be attempts to disguise illicit funds.

- Deposits followed by withdrawals: If a deposit follows a quick withdrawal—especially without logic—it’s worth investigating. Usually, it triggers AML investigations further.

- Refusal to provide documentation: If a customer is unwilling to present documentation, it may signal suspicious behavior or potential money laundering.

- Inconsistent transactions: A transaction analysis should be conducted if transactions don’t align with a customer’s profile.

- High-risk countries or individuals: Transactions involving individuals or entities from high-risk industries can hint at potential money laundering.

- Alerts from monitoring systems: Internal systems that flag unusual patterns can trigger an investigation for money laundering.

Step 3: Collect and analyze evidence

Upon the identification of suspicious activity, investigators must collect and analyze evidence. This data analysis could involve scrutinizing financial statements, account activities, and customer interactions.

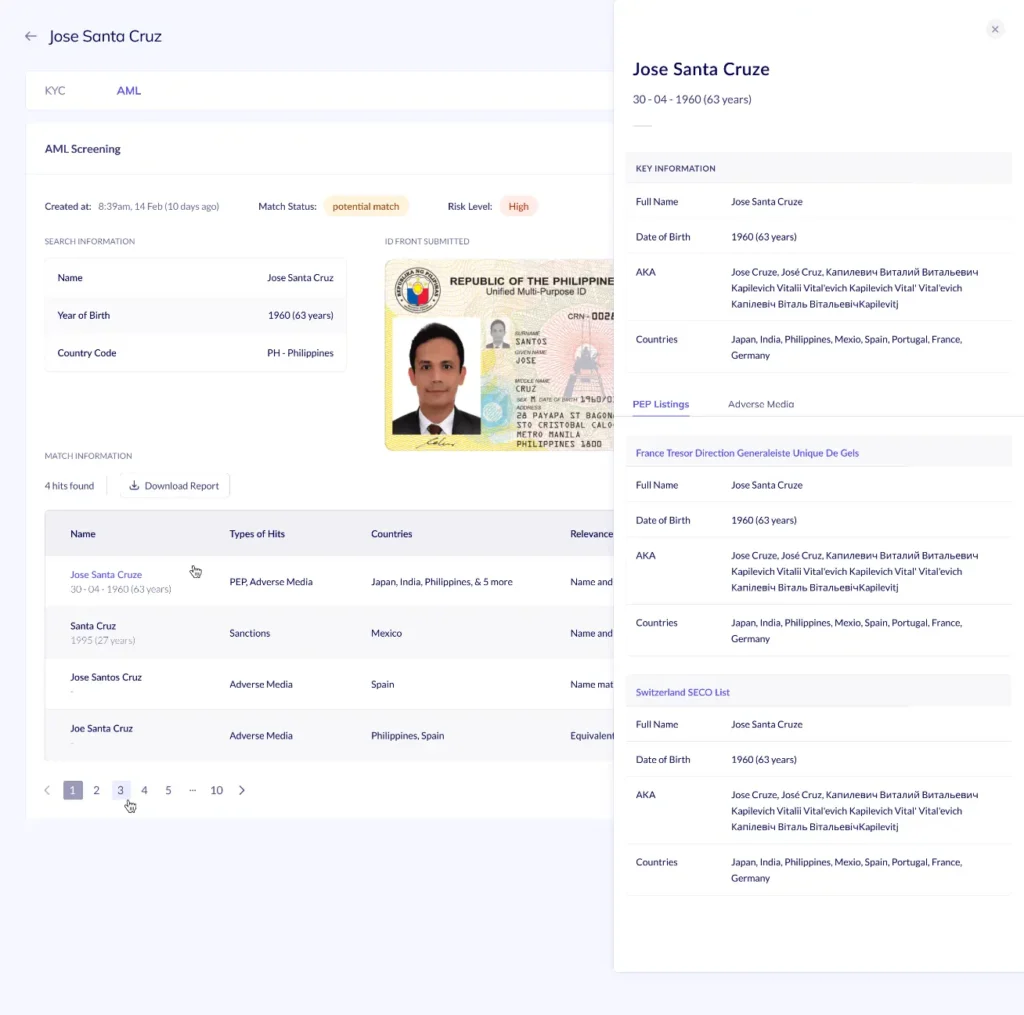

Customer Due Diligence (CDD) is a common practice. It needs businesses to gather customer information. This verifies their identity and assesses the risk they pose. High-risk customers may need Enhanced Due Diligence (EDD). For instance, Politically Exposed Persons (PEPs), warrant deeper investigation.

Some alerts may turn out to be false positives. Yet, others may need further examination to uncover the full picture.

Step 4: Report findings and take action

Investigators must file a Suspicious Activity Report (SAR) with the appropriate regulatory authorities. Actions taken may include:

- Freezing accounts: Upon confirming money laundering, authorities may need to freeze the accounts.

- Cooperating with law enforcement: Financial institutions should work with authorities to address suspicious activities.

- Implementing compliance measures: Adding extra steps can enhance compliance and prevent future incidents.

Step 5: Document the investigation

Proper documentation is essential in anti-money laundering investigations. From identifying suspicious activity and data analysis to filing an SAR—recording every step is vital.

Not only does this aid future investigations but also ensures regulatory compliance. Financial institutions often need to keep records of AML investigations for many years.

Even after a complete investigation, monitoring ongoing customer behavior is essential. This is key to preventing further financial crimes.

Impact of poor AML investigations

Businesses should address their AML investigation challenges. Otherwise, it can cause serious harm to both their operations and the economy. Here are some major problems that can arise:

- Large regulatory fines: Weak AML programs can result in hefty fines from regulators. For example, Deutsche Bank incurred a fine of $124 million in 2022 for having poor AML controls. These fines take away money that could help business growth and operations.

- Reputational damage and financial losses: Ineffective AML programs can harm your organization’s reputation and make customers lose trust. If banks keep failing in their AML efforts, people may think they support financial crime. This can make customers cautious and lead to a loss of business. A survey showed that the stock prices of major banks dropped by 20.7% in the six months after an AML scandal.

- Broader impact on the financial system: Weak AML controls can threaten the financial system’s stability and integrity. They allow money laundering from corruption, tax evasion, and organized crime. The UN estimates that money laundering makes up 2-5% of the world’s GDP every year.

To address these issues, it’s essential to explore the importance of AML investigation technology.

The importance of using AML investigation technology

AML investigation technology plays a vital role. It enhances the efficiency, accuracy, and scalability of investigations.

How AI is changing AML investigations

Artificial Intelligence (AI) has emerged as a game-changer in AML investigations. AI algorithms can analyze vast amounts of transactional data in real-time. Thus enabling businesses to detect suspicious activities much faster. They’re also more accurate than manual processes.

Here are some of the ways AI is transforming AML investigations:

- Transaction monitoring: AI can analyze vast amounts of transactional data in real time. This enables quick identification of suspicious transactions that need further investigation.

- Risk assessment: AI can identify high-risk customers and transactions. Thus allowing AML professionals to focus their resources on the most critical areas.

- CDD: AI can automate the CDD process by verifying customer identities. It can screen against sanction lists, and identify potential fraud risks.

- Suspicious activity reporting (SAR): AI can detect unusual transaction patterns and behaviors. Especially if they are indicative of money laundering activities.

- Enhanced screening: AI can improve the accuracy of screening activities by identifying potential false positives. It can reduce the number of manual reviews required.

- Predictive analytics: AI can use predictive analytics to forecast potential money laundering activities. Historical data and behavioral patterns shape these predictions.

Benefits of AML investigation technology

The involvement of technology in AML investigation offers a variety of advantages:

- Improved efficiency: Advanced technology can streamline the investigation process, allowing teams to work faster.

- Enhanced accuracy: Automated systems can reduce human error in detecting suspicious activities.

- Reduced costs: By automating routine tasks, businesses can divide resources with more efficiency.

- Real-time monitoring: Advanced technologies allow for continuous surveillance of transactions. Thus enabling quick identification of suspicious activities.

- Scalability: As businesses grow, technology can help scale AML efforts. This can be done without significant increases in staffing.

- Centralized data management: Technology provides a unified platform for storing and managing data. This makes it easier to access and analyze information.

- Risk-based approach: Automation enables organizations to focus resources on the highest-risk areas.

- Regulatory compliance: Technology solutions ensure consistent compliance with all AML requirements

How AML investigation technology can comply with regulations

Compliance is one of the biggest challenges businesses face. This is due to strict AML regulations. Investigative teams face several common challenges during investigations. One major challenge is the constantly changing and complicated nature of AML laws.

Companies also struggle with false positives. These occur when poor KYC and monitoring processes create many unnecessary alerts. Moreover, the large number of investigations can be too much to handle, as teams must sort through a lot of data and many reports.

Integrating AML investigation technology ensures that your business meets regulatory requirements with ease. For example:

- Automated transaction monitoring: Systems can automatically flag and report suspicious transactions. This ensures that no activity goes unnoticed.

- Efficient SAR filing: AML software can simplify the process of filing SARs. Thus ensuring that reports are accurate and filed on time.

- Customer identity verification: Technology ensures vetting customers against sanctions lists and other high-risk databases.

There’s a large volume of data and documents associated with each case. Hence, you need case management software that is user-friendly and flexible to act as your system of record.

Key Takeaways

Conducting effective AML investigations is vital. Not only for protecting your business but also for maintaining financial integrity. A structured investigation process enhances your organization’s ability to prevent money laundering. A successful AML investigation can identify suspicious activities, collect evidence, and leverage technology to its benefit.

Remember that the landscape of financial crime is ever-evolving. Staying informed about the latest trends and technologies in Anti Money Laundering is essential. For more information on AML solutions and how to enhance your investigations, check out our services.

FAQs

1. How do I investigate an AML case?

Investigating an AML case involves identifying suspicious activities. It entails collecting evidence, analyzing the data, and filing a SAR if needed.

2. What checks are required for AML?

AML checks typically include:

- Customer due diligence

- Transaction monitoring

- Verifying customer identities against sanctions lists.

3. What are the red flags in AML?

Red flags include large cash transactions, rapid transfers, and refusal to provide documentation.

4. What is the most important thing for an AML investigator to know?

An Anti Money Laundering investigator must understand the various indicators of suspicious activity. They must be familiar with regulatory requirements to ensure compliance.