In 2026, regulators are no longer asking whether institutions have AML policies on paper. They are asking whether those controls work in practice across onboarding, periodic KYC updates, transaction monitoring, reporting, and governance oversight.

Globally, enforcement is increasingly data-driven. In India, supervisory penalties have scaled across hundreds of regulated entities in a single year. Virtual asset providers are facing direct monetary penalties. Intermediary frameworks are becoming standardized, reducing ambiguity in enforcement outcomes.

The pattern is clear: weak KYC hygiene, ineffective monitoring, governance lapses, and reporting failures now translate into predictable monetary penalties.

This section reviews the most significant AML/KYC fines shaping 2026 enforcement expectations — globally and in India and what they reveal about regulator priorities.

Biggest AML fines in 2026

TD Bank – $3.09 Billion (U.S.)

Fine: $3.09 billion (2024 action shaping 2026 enforcement posture)

Nature of failure: Long-standing transaction monitoring and AML control gaps.

Large traditional financial institutions are not insulated from enforcement risk. Regulators increasingly examine monitoring effectiveness, not just policy presence.

2026 lesson: Control breakdowns over time are viewed as governance failures, not operational mistakes.

RBI Enforcement Scale Snapshot (FY 2024–25)

Total penalties imposed: ₹54.78 crore

Entities penalized: 353 regulated entities

Rather than a single mega-fine, India’s enforcement pattern shows broad supervisory scaling. RBI penalties typically relate to non-compliance with KYC Directions, periodic updation failures, risk assessment gaps, and governance deficiencies identified during inspections.

Why this matters for 2026:

- Enforcement is high-volume.

- Even mid-sized compliance failures attract monetary penalties.

- Inspection findings are translating into measurable supervisory outcomes.

FIU-IND Penalty on Bybit (VDASP)

Penalty: ₹9.27 crore (Order dated January 31, 2025)

Regulator: Financial Intelligence Unit – India

Nature of failure: PMLA-related non-compliance obligations applicable to reporting entities.

This action marked a strong signal that AML enforcement now squarely applies to virtual digital asset service providers operating in India.

2026 lesson: Registration, reporting, and monitoring obligations for VDASPs are enforceable — not advisory.

Emerging trends and regulatory focus areas for AML:

- There is increased scrutiny of cryptocurrency transactions. Regulators target exchanges and wallets for compliance with anti-money laundering.

- Focus on beneficial ownership transparency. Authorities demand clarity on the ultimate owners of assets from financial institutions.

- Enhanced due diligence for high-risk customers is a fundamental focus area now. Banks must verify sources of funds more rigorously.

- There are stricter regulations on politically exposed persons. Financial institutions need to monitor PEP transactions closely.

- There is a greater emphasis on technology adoption. It is more important now than ever to use AI and machine learning for suspicious activity detection.

- There is a higher level of collaboration between international regulators regarding anti-money laundering.

The impact of AML fines

Anti-money laundering fines are more than just penalties imposed. They have wide-ranging effects on companies. These regulatory fines drain resources, disrupt operations, and damage reputations. It is crucial to understand the different impacts so businesses can realize compliance’s importance and take necessary steps. Here is a breakdown of the most evident consequences of AML fines.

Financial implications

AML fines have severe financial consequences for companies.

- Direct fines drain millions of dollars from company resources.

- Legal costs escalate as firms hire top lawyers to manage investigations.

- Reputational damage leads to lost business opportunities and severed partnerships.

- Stock prices drop sharply, causing major woes for the company as investor confidence plummets.

Operational disruptions and compliance overhaul

AML regulatory fines lead to major changes in the organization.

- Daily operations are disrupted as resources are used to address compliance issues.

- Companies need to revamp their compliance programs. This costs a lot and takes up valuable time.

- Frequent internal audits and external reviews interrupt normal business activities.

- Training employees on new compliance measures can slow down business processes. This affects productivity.

Loss of customer trust and market share

Trust is crucial for businesses. AML fines damage this trust significantly.

- Customers lose confidence in the company’s ability to protect their interests. This leads them to leave.

- Competitors take advantage of the situation. They attract unhappy customers.

- Market share drops as the company struggles to restore its damaged reputation.

- Long-term relationships with clients suffer. This results in fewer business opportunities and loss of revenue.

2026 Regulatory focus

India’s AML/KYC enforcement signal in 2026 is clear: regulators are moving from “policy presence” to control effectiveness. The pattern is higher supervisory scrutiny, more measurable hygiene expectations (especially around KYC upkeep), and sharper accountability for reporting and registration obligations in higher-risk segments like VDASPs.

1) Enforcement is scaling through supervision, not just landmark cases

RBI’s penalty volume indicates that enforcement is increasingly broad-based and supervisory-led (across many regulated entities), rather than limited to a few headline actions. In FY 2024–25, RBI imposed ₹54.78 crore in penalties across 353 regulated entities, signaling that audit findings and recurring control gaps are now routinely translating into monetary penalties.

What this implies for 2026: even “mid-sized” control failures (periodic updation backlogs, weak monitoring governance, inconsistent KYC documentation) can lead to penalties because the enforcement engine is operating at scale.

2) “KYC hygiene” is being pushed as a system-level priority

RBI’s Financial Literacy Week 2026 theme explicitly centered on KYC (“KYC – Your First Step Towards Secure Banking”), which is a public signal of where regulator education and compliance emphasis is pointing.

What this implies for 2026: regulators want institutions to treat KYC as an ongoing control (not a one-time onboarding step), and they expect measurable upkeep across the customer lifecycle.

3) Periodic updation and customer data upkeep are becoming the easiest enforcement lever

RBI’s KYC direction communications include operational allowances tied to periodic updation timelines (including references up to June 30, 2026 for certain low-risk cases). This indicates that the regulator is monitoring periodic updation execution closely enough to specify time-bound operational treatments.

What this implies for 2026: periodic updation is likely to remain a high-frequency inspection focus because it is easy to test (sampling and exception rates), and it correlates strongly with downstream monitoring effectiveness.

4) FIU-IND posture is hardening for VDASPs (registration + compliance execution)

FIU-IND enforcement against VDASPs has moved from guidance to penalties—e.g., Bybit was penalized ₹9.27 crore (order dated Jan 31, 2025), reflecting stricter expectations on compliance with PMLA obligations for virtual digital asset service providers.

In parallel, FIU-IND has issued updated VDASP-facing compliance communication/circular material (2025), reinforcing registration/compliance expectations.

What this implies for 2026: AML enforcement is increasingly extending into digital-native channels where customer onboarding, travel rule/recordkeeping, and monitoring maturity vary widely—creating a high-risk enforcement surface.

5) Market intermediaries are seeing standardized penalty frameworks (more predictable enforcement)

SEBI has publicly communicated efforts toward standardisation/rationalisation of penalties levied on stock brokers by stock exchanges (Oct 2025).

What this implies for 2026: enforcement becomes more consistent and repeatable—i.e., once the framework is standardized, firms can’t rely on “interpretation gaps” and should expect similar lapses to attract similar outcomes across exchanges/intermediaries.

So what’s the 2026 pattern, in one line?

High-volume supervisory enforcement + KYC lifecycle hygiene + stricter reporting entity accountability (especially VDASPs) + more standardized penalties for intermediaries.

What to do

- Treat periodic updation as a KPI-led program (coverage %, backlog aging, exception reasons, closure SLA).

- Build evidence-grade auditability: retrievable KYC artifacts, decision logs for EDD, alert closure rationale, and governance sign-offs (so you can prove control effectiveness during inspections).

- For VDASPs: document registration status, reporting workflows, monitoring rules, and escalation paths with the same rigor as banks/NBFCs.

Meeting AML compliance requirements

Regulatory landscape and evolving AML/CFT standards

Financial regulations are ever-changing. Institutions need to stay updated with changes about anti-money laundering from key regulatory bodies. These include the following:

- The Financial Action Task Force – FATF sets international standards

- Office of Foreign Assets Control – OFAC oversees economic and trade sanctions

- Financial Crimes Enforcement Network – FinCEN focuses on domestic AML efforts

Best practices for AML compliance programs

The best AML compliance programs around the world share some common elements. Financial institutions should make certain that the AML solutions they deploy adhere to these best practices.

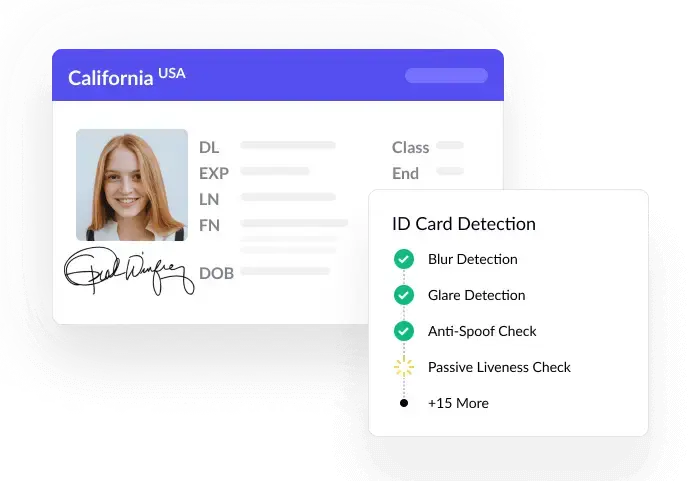

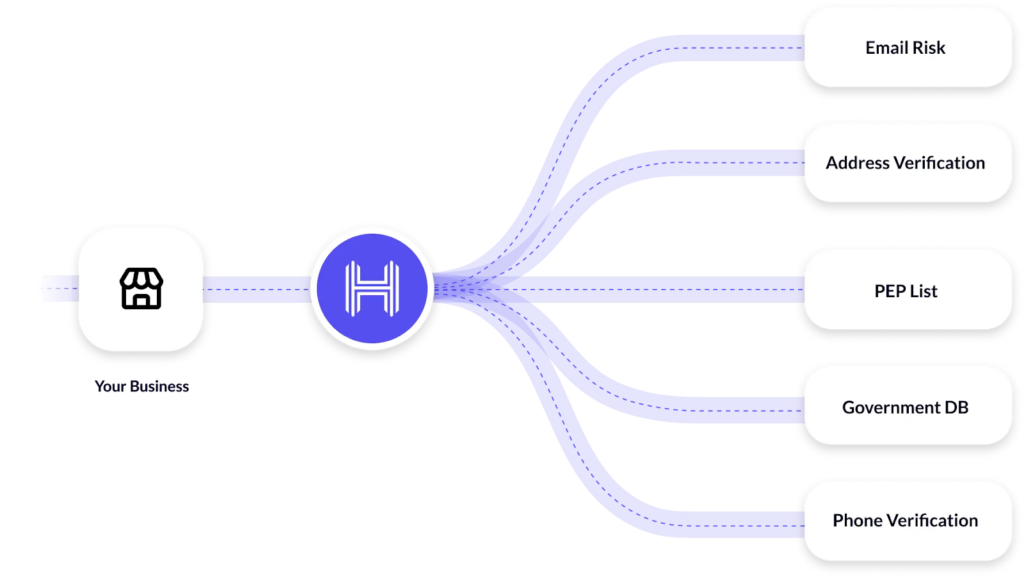

- The first is well-implemented KYC compliance and CDD processes. They are used to verify identities and assess risk.

- Then comes regular risk assessments.

- Not to forget ongoing employee training. These keep staff informed about the latest AML requirements and red flags.

- After everything is set up, continuous transaction monitoring is paramount, which helps in spotting and reporting suspicious activities on time.

- Finally, detailed record-keeping. This is important to make sure there are relevant audit trails and support investigations.

The role of technology in streamlining compliance efforts

Technology transforms AML compliance. The use of artificial intelligence and machine learning is a game-changer.

The first benefit is that large volumes of risk assessment and monitoring can be done quickly.

Plus, the technology of real-time monitoring catches criminals red-handed. This also allows authorities to catch those indulging in financial crimes quickly.

They can detect unusual patterns and predict potential risks.

How to avoid AML fines

No business wants to be fined. But wanting alone is not enough. You need to take firm steps to ensure anti-money laundering compliance. Here are some vital things to stay compliant and avoid regulatory fines.

Comprehensive AML policies and procedures

AML policies are a set of rules and guidelines to prevent money laundering. They are mainly written documents that outline steps to detect and prevent illegal money activities. Employees follow these guidelines to ensure criminals do not misuse the company for money laundering. For any organization, these are the foundation of all good anti-money laundering programs.

- Involve senior management in creating and reviewing AML policies for firm commitment and supervision.

- Use practical examples and real-life scenarios to make policies easy to understand.

- Align your AML policies with the overall business plan for consistency.

- Customize policies to address the specific risks and nature of your business.

- Make policies easy to find and understand for all employees.

- Also, tailor your guidelines and framework to your business’s specific risks and operations.

- Update them regularly to reflect anti-money laundering regulations.

- Conduct periodic reviews to make sure the effectiveness is valid with changing times.

Risk-based approach

Such AML measures focus on higher-risk areas for money laundering. To implement such a system, organizations need to identify risks first. Then, they allocate resources where the risk is higher.

- Focus on detailed risk assessments. This helps find the most vulnerable areas at risk of money laundering threats.

- Use data analysis to find risk patterns. Look for trends in customer type, geography, transaction types, and business.

- Regularly update your risk assessments. Make sure to add new information and changes from time to time.

- Allocate resources wisely for anti-money laundering. Pay more attention to higher-risk areas. Also, implement continuous monitoring.

Customer due diligence (CDD)

CDD is the mandatory process all financial institutions must follow to check and verify customer information. This is the first step in understanding the end-user. In addition, customer due diligence allows businesses to be aware of money laundering risks from the beginning.

- Verify customer identities. Use reliable documents like passports, driver’s licenses, or other government-issued IDs.

- Check customer information against sanction lists. Also, check politically exposed persons (PEP) lists and other databases.

- Assess the risk level of each customer. Look at their profile, transaction history, and where they are from.

- Regularly review and update customer information. This keeps it accurate.

- Do extra checks for high-risk customers. Gather more information and watch their transactions closely.

- Record and securely store all customer data. Keep verification documents handy for audits or investigations.

Transaction monitoring

It is critical to keep an eye on customer transactions for suspicious activity. Transaction monitoring systems help businesses respond quickly to potential money laundering attempts.

- Customize your transaction monitoring system. Make it fit your business’s needs and risks.

- Use machine learning and AI. This helps find unusual activities.

- Have a dedicated team. They review and investigate alerts from the monitoring system.

- Regularly update your monitoring settings. Stay ahead of new threats. Also, regularly check your monitoring system. Make sure it works well and is accurate.

Employee training and awareness

Educated employees are more likely to recognize and report suspicious activities.

- Provide AML training to employees from time to time.

- Employees should know about the various compliance rules and regulatory fines that apply to the business.

- Update training content regularly to include new laws, risks, financial penalties, and case studies.

- Create a culture of compliance. Encourage ethical behavior throughout the organization.

Whistleblower protection

A strong whistleblower protection program is essential. It makes employees feel safe. They can report suspicious activities without fear of punishment.

- Provide anonymous reporting channels to protect whistleblower identities.

- Ensure all reported issues are taken seriously and addressed quickly.

- Regularly share the outcomes of whistleblower reports. This shows the program works.

- Protect whistleblowers from retaliation. This encourages a culture of openness and trust.

- Promote the whistleblower program throughout the organization. Make sure everyone knows how and why to use it.

AML Fines Are a Governance Test, Not Just a Compliance Cost

Globally, record-setting penalties against banks and crypto exchanges show that regulators will act decisively when monitoring systems, sanctions controls, or governance oversight fail to keep pace with business growth. In India, enforcement has scaled across hundreds of regulated entities, FIU-IND has moved firmly against non-compliant digital asset providers, and intermediary penalty frameworks are becoming standardized and predictable.

The message is consistent across jurisdictions: AML enforcement is becoming data-driven, lifecycle-focused, and audit-evidence based.

For financial institutions, NBFCs, fintechs, brokers, and VDASPs, the risk is not just the monetary penalty. It is:

- Supervisory scrutiny and follow-on inspections

- Operational disruption during remediation

- Reputational damage and partner hesitation

- Increased capital, reporting, or governance requirements

The institutions that will avoid AML fines in 2026 are those that can demonstrate:

- Measurable KYC lifecycle hygiene

- Risk-based monitoring calibrated to customer behavior

- Structured escalation and STR governance

- Documented board oversight and accountability

- Audit-ready evidence across onboarding, screening, and transaction monitoring

In 2026, the real question is not whether fines are increasing. It is whether your AML program can withstand inspection and prove that it works.

For more detailed insights and to explore how HyperVerge can assist you in maintaining AML compliance, visit HyperVerge AML Solutions and sign up now.