Accepted modes of KYC

Digital KYC

Central KYC

Aadhaar – authentication

OVD with Pan/Form 60

Aadhaar – Online authentication

Video-based verification

Implementing a single mode of KYC will not help Onboard every customers!

Insurance companies need to seamlessly integrate multiple KYC methods to manage needs of all our customers.

How do you seamlessly integrate multiple KYC methods to ensure low-friction onboarding of all your customers?

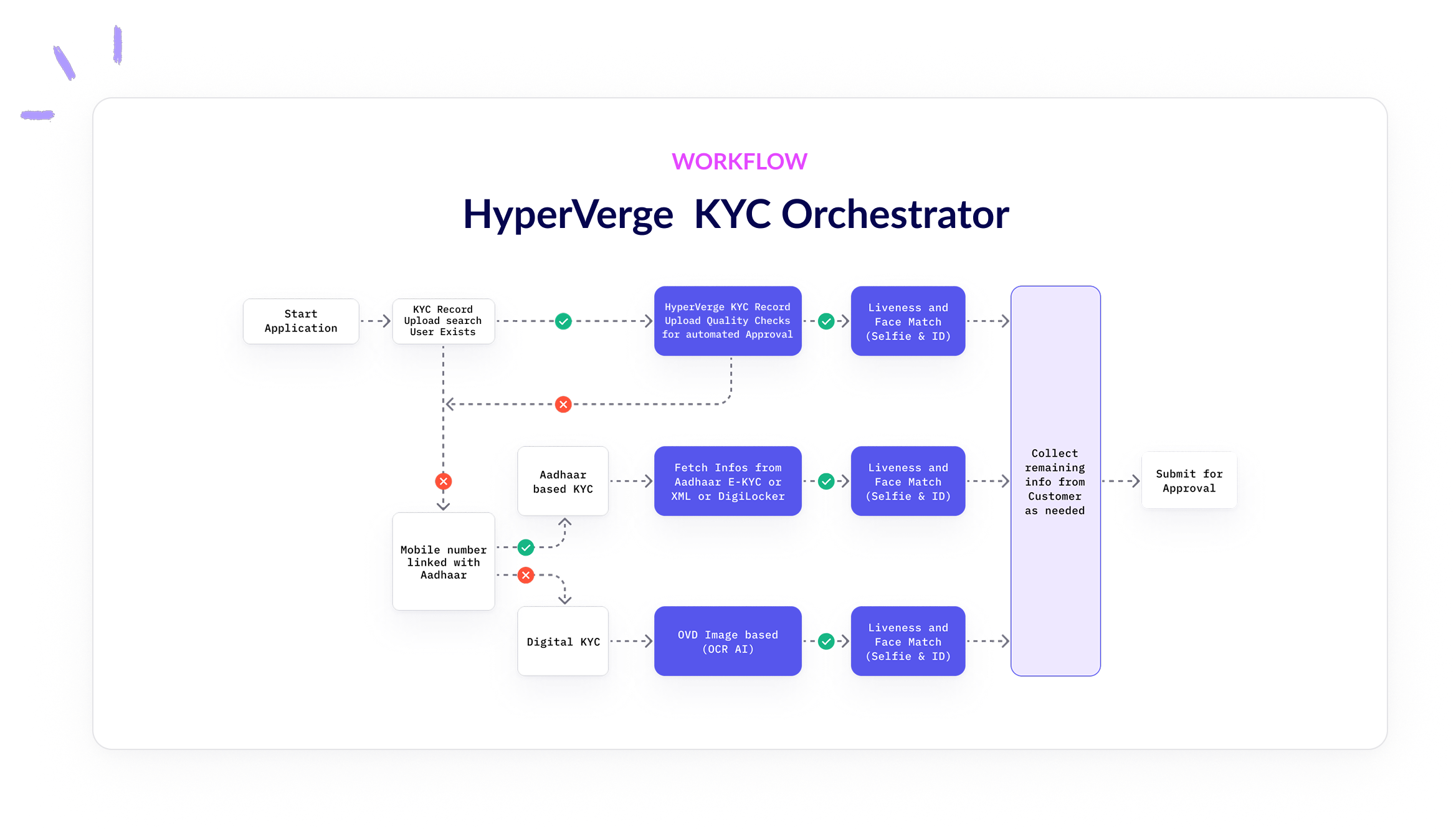

Based on factors like phone number & linkage, CKYC record’s existence, etc certain modes of KYC will fail. The HyperVerge Identity Platform has an end-to-end KYC orchestrator which can support any KYC workflow.

HyperVerge KYC Orchestrator

How do we manage a seamless KYC experience across all partners and acquisition channels?

Launch new customer journeys much faster, without writing code or requiring app releases.

Automate your PIVC

process & reduce

friction

Cut down on manual review efforts & resources spent using our AI to expedite your PIVC process!

Instant Onboarding

Onboard customers in <30 seconds even at scale

Reduce Fraud

Reduce fraud by 95% through automation.

Cost Efficient

Decrease backend verification expenses by 80%

Always stay compliant

with AML Regulations

Our end-to-end onboarding stack is a comprehensive product suite that contains global AML checks to prevent any fraud.

Global Sanctions & Watchlists

Global & country-specific sanctions imposed by different organisations

Politically Exposed Persons

~100% Politically Exposed Persons Profile with Global Coverage

Adverse Media Check

Adverse Media for people associated with ML/fraudulent activities

Mistakes to avoid while selecting/orchestrating KYC methods

- If someone is using Aadhaar XML (even though we don’t recommend using it), it is necessary to do some health check to ensure whether the UIDAI website is live or down

- In the KYC Record upload workflow, make sure to extract & validate KYC details, not just ‘search & download’. If only search & download is done, bad/empty records can be downloaded.

- Not all Aadhaar numbers are linked with mobile numbers, so before taking a user through a journey, it would be helpful to check whether their mobile number is linked to their Aadhaar.

(Digilocker has an API call that can check whether the mobile number and Aadhaar number are linked only using the mobile number as input)

What are the 80-20s to get right when implementing aKYC process/ solution?

- Try to use a workflow orchestrator instead of building everything yourself

- Use passive liveness as a best practice. It has a high conversion rate, requires very little instructions and works well on all devices and bandwidth conditions