Suspicious Transaction Report (STR): A Guide for US Businesses

A Suspicious Transaction Report, or STR, is a report filed with regulatory authorities to bring notice to suspicious transactions. In many countries, STR is a regulatory requirement. This includes the United States.

So if you are a business with any transactions or presence in the US, you will need to understand what STR is, and how to file it.

In the United States, Financial Crimes Enforcement Network (FinCEN) requires businesses to monitor customer transactions and report any suspicious transactions that may indicate money laundering, terrorist financing, or any other criminal activity. The specific report for this purpose is known as the Suspicious Activity Report (SAR).

Identifying suspicious transactions

Before you can learn to file STRs, you first need to understand how to identify suspicious transactions.

Monitoring customer transactions is mandatory for financial institutions, but it is equally important for other businesses. When monitoring, you can identify some of the red flags that can lead you to suspicious transactions, such as:

- Unusual transactions

- Large cash deposits or withdrawals

- High-risk jurisdictions

- Frequent Transfers Between Accounts

- Complex Transaction Structures

- Transactions with known criminals

- Unusual Source of Funds

These can be some of the indicators of suspicious transactions and can form a basis for an STR. To stay on top of suspicious transactions, it is best to adopt a risk-based approach and conduct customer due diligence.

How to file a Suspicious Transaction Report (STR) in the US

Now that you know how to identify suspicious transactions, let us take a look at how to file a suspicious transaction report in the US.

Steps to File an STR

1. Identifying Suspicious Activity

- Monitor Transactions: Train staff to recognize unusual patterns or behaviors.

- Criteria for Suspicion: Look for transactions that are inconsistent with customer profiles or involve large cash amounts.

2. Gathering Evidence

- Documentation: Collect relevant information, including transaction details and customer identification.

- Internal Review: Assess the legitimacy of the transaction and gather additional evidence if needed.

3. Reporting to FinCEN

- Complete the STR Form: Provide detailed information about the suspicious activity.

- Submission Deadline: File within 30 days of identifying suspicious activity, with a possible extension of up to 60 days.

Methods of filing STRs

Filing an STR is a straightforward process, but there are different methods of doing it.

Electronic Submission

The most preferred method for filing an STR is the FinCEN’s e-filing system. It is a secure online platform used by financial institutions to submit Suspicious Activity Reports (SARs) and other required reports to the Financial Crimes Enforcement Network (FinCEN).

Here’s a general outline of the steps involved in filing an STR via FinCEN’s e-filing system:

- Registration: Financial institutions must first register with FinCEN to obtain a registration number. This process involves providing information about the institution, its authorized representatives, and its contact information.

- Login: Once registered, authorized representatives can log in to the e-filing system using their unique credentials.

- Select Report Type: Choose the appropriate report type, in this case, a Suspicious Activity Report (SAR).

- Provide Report Details: Enter the required information about the suspicious transaction, including:

- Customer information

- Transaction details

- Description of the suspicious activity

- Supporting documentation (if applicable)

- Review and Submit: Carefully review the completed report for accuracy and completeness. Once satisfied, submit the report to FinCEN.

Alternative Methods

In addition to FinCEN’s e-filing system, there are a few alternative methods for filing STRs:

- Paper Filing: Some financial institutions may still be required to file STRs on paper forms. However, e-filing is generally preferred for its efficiency and security.

- Third-Party Vendors: Some third-party vendors offer software solutions that can help financial institutions automate the STR filing process and integrate with their existing systems.

The paper filing method, while traditional, is somewhat outdated and can result in delays. However, if you use a strong third-party vendor with clearances, your STR filing process can be automated and fastened without hassle.

Suspicious Transaction Report requirements in the US

Suspicious Transaction Reports (STRs) are primarily governed by two primary pieces of legislation in the United States: The Bank Secrecy Act of 1970 (BSA), and Anti-Money Laundering (AML) Regulations.

The BSA specifically mandates that financial institutions file STRs with the Financial Crimes Enforcement Network (FinCEN) when they detect suspicious activity that may be related to money laundering or other illegal activities.

Whereas, AML regulations require financial institutions to establish systems for monitoring customer accounts and transactions to identify suspicious activity.

Here, businesses need to remember a few key details:

- Joint Enforcement: Both the BSA and AML regulations are enforced by various federal agencies, including the Department of the Treasury, the Securities and Exchange Commission (SEC), and the Federal Deposit Insurance Corporation (FDIC).

- Penalties: Failure to comply with STR reporting requirements can result in severe penalties, including fines, imprisonment, and the revocation of a financial institution’s license.

- Industry Guidance: In addition to federal regulations, financial institutions are also subject to industry guidance and best practices issued by organizations such as the Financial Industry Regulatory Authority (FINRA) and the American Bankers Association (ABA).

Suspicious Transaction Report Template and Resources

FinCEN provides STR templates that financial institutions can use to file their reports. These templates are designed to help ensure that the required information is included in the reports and to streamline the filing process.

You can find the STR templates on FinCEN’s website.

The Suspicious Transaction Reporting Process for Financial Crime

Once a Suspicious Activity Report (STR) is submitted to the Financial Crimes Enforcement Network (FinCEN), it undergoes a multi-step process to identify potential patterns of criminal activity and to inform investigations.

Here’s a simplified overview of the process:

- Data Entry and Analysis:

- Data Entry: FinCEN staff enters the STR data into their systems.

- Data Analysis: The data is analyzed using advanced analytics tools to identify potential patterns, trends, and connections between STRs.

- Initial Assessment:

- Review: The STR is reviewed by analysts to determine its significance and whether it warrants further investigation.

- Categorization: STRs are categorized based on the type of suspicious activity reported.

- Information Sharing:

- Internal Sharing: Relevant information from the STR may be shared internally within FinCEN or with other government agencies.

- External Sharing: In some cases, STRs may be shared with law enforcement agencies, foreign governments, or other financial institutions.

- Investigation Coordination:

- Case Development: If an STR is deemed significant, FinCEN may coordinate with law enforcement agencies to develop a case.

- Information Sharing: FinCEN may provide additional information or intelligence to support investigations.

- Case Closure or Referral:

- Closure: If an investigation does not lead to a successful prosecution, the case may be closed.

- Referral: If there is sufficient evidence, the case may be referred to the Department of Justice or other appropriate authorities for prosecution.

Suspicious Activity Report (SAR) vs. Suspicious Transaction Report (STR)

STR and SAR are often used interchangeably, but they can have slightly different meanings depending on the context and jurisdiction.

STR (Suspicious Transaction Report) is the more general term used to describe any report filed by a financial institution to a regulatory authority about a transaction that is suspected of being related to money laundering or other illegal activities.

SAR (Suspicious Activity Report) is a specific type of STR that is used in the United States. It is a report filed with the Financial Crimes Enforcement Network (FinCEN) by financial institutions to report suspicious activity that may be indicative of money laundering, terrorist financing, or other criminal activity.

In many cases, the terms STR and SAR are used interchangeably, particularly outside of the United States. However, it is important to understand the specific requirements and definitions that apply in your jurisdiction.

Takeaways

It is important to remember that suspicious transaction reporting is a legal requirement and if neglected, can incur hefty penalties from various regulatory bodies. In some cases, it may also lead to criminal charges.

Keeping that in mind, filing STRs timely is crucial. But the volume of transactions can make this a difficult feat. This is especially true for large financial organizations, where overseeing all transactions manually is impossible.

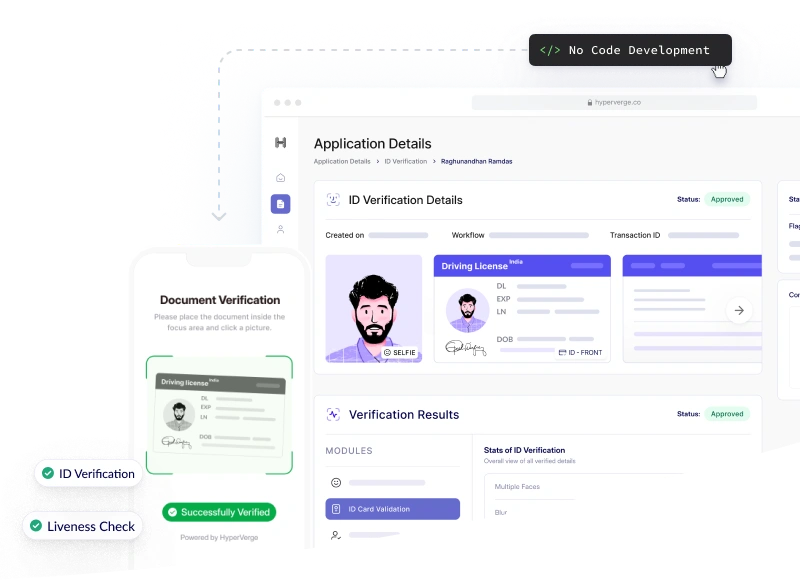

Therefore, it is important to invest in a solution that simplifies your STR and SAR filing by continuously monitoring transactions for suspicious activity and automating the filing process. Make sure to choose a compliant solution such as HyperVerge’s AML suite, for your regulatory concerns.

FAQs

1. What transactions are considered suspicious?

Suspicious transactions often involve activities that deviate significantly from a customer’s normal financial behavior or that appear to be related to illegal activities.

2. When must a suspicious transaction be reported?

Financial institutions are generally required to file a Suspicious Activity Report (SAR) with the Financial Crimes Enforcement Network (FinCEN) promptly after identifying a suspicious transaction. This typically means within a few days of discovering the activity.

3. How should you report a suspicious transaction?

Financial institutions should report suspicious transactions through their designated compliance officer or using the appropriate electronic filing system, such as FinCEN’s e-filing system. The specific reporting process may vary depending on the jurisdiction and the financial institution’s internal procedures.

4. What is the difference between a STR and a SAR?

While the terms STR (Suspicious Transaction Report) and SAR are often used interchangeably, there may be slight differences in their definitions depending on the jurisdiction. In the United States, a SAR is a specific type of STR that is filed with FinCEN.