What Is Securities Compliance?

How confident are you about the safety of your investments in the stock market? In a world rife with financial fraud, how can you protect your hard-earned money? Securities compliance is the answer. It shields your investments from risks, ensuring a transparent and accountable trading environment.

Securities compliance refers to a set of laws and guidelines that oversee the issuing, trading, and reporting of securities such as stocks and bonds. These rules ensure transparency and add an important layer of accountability.

Curious about what is securities compliance? Let’s explore its components and how it safeguards your financial interests.

What is securities compliance?

Securities compliance involves laws and regulations governing the issuing, trading, and reporting of financial instruments like stocks and bonds. Its primary goal is to ensure transparency and fairness in financial markets.

By following these regulations, companies, and individuals help maintain a trustworthy financial system.

Different bodies regulate these compliance requirements, these include:

- Securities and Exchange Commission (SEC): The SEC is the primary regulatory body in the US, enforcing federal securities laws to protect investors. Companies going public must file detailed financial reports with the SEC to eliminate risk-based approaches and aid informed investment decisions.

- Financial Industry Regulatory Authority (FINRA): This organization oversees broker-broker-dealers and their employees and conducts regular audits and investigations to ensure fair treatment of investors.

- National Futures Association (NFA): The NFA regulates the forex and futures markets, ensuring firms and professionals operate securely and ethically.

Importance of securities compliance

Securities compliance benefits firms, professionals, and investors by:

- Protecting investors: Compliance laws ensure that investors receive accurate and honest information, empowering them to make informed decisions and minimize the risk of loss.

- Maintaining market integrity: By enforcing uniform rules, compliance fosters trust and fairness in financial markets.

- Avoiding legal penalties: Companies failing to follow regulations can face serious consequences–legal penalties, fines, sanctions, or even the suspension of business operations. Compliance helps organizations avoid these risks.

- Reducing the risk of fraud: Strong compliance measures deter fraudulent activities and enhance market transparency.

Don’t forget to check out our guide on global watchlist screening and financial crime compliance & how to prevent crimes.

Key components of securities compliance

Securities compliance relies on several critical components that enhance investment safety:

The U.S. securities laws mandate that companies provide accurate information to investors. The SEC plays a vital role in enforcing these laws, ensuring transparency and fraud prevention.

- Identity verification

Identity verification is essential in the securities industry. Know Your Customer (KYC) confirms client identities, preventing fraud. Additionally, Anti-Money Laundering (AML) requirements combat illegal activities, safeguarding the financial system.

- Reporting obligations

Companies must meet specific reporting obligations such as filing Form D for private offerings and Form 10-K for annual financial statements. Timely and accurate submissions are crucial to avoid fines and to maintain market transparency.

You may like: Ultimate Beneficial Ownership (UBO) Identification: Compliance Rules To Know

Strategies for achieving securities compliance

To achieve securities compliance, companies must put in place a comprehensive strategy. Key steps include—

- Building a compliance program: This is the first step towards achieving securities compliance. This program outlines the rules and procedures a company must follow. It helps ensure that everyone understands their responsibilities.

- Risk-based approach: This process identifies potential risks related to compliance. This helps minimize the likelihood of serious regulatory issues.

- Internal controls: Implementing internal controls can help prevent fraud and errors and ensure that operations are in line with state rules and regulations.

- Compliance training: Regular compliance training is essential for all employees and investment advisors as it helps them understand the laws and regulations they must follow. It also reinforces the importance of ethical behavior in the workplace.

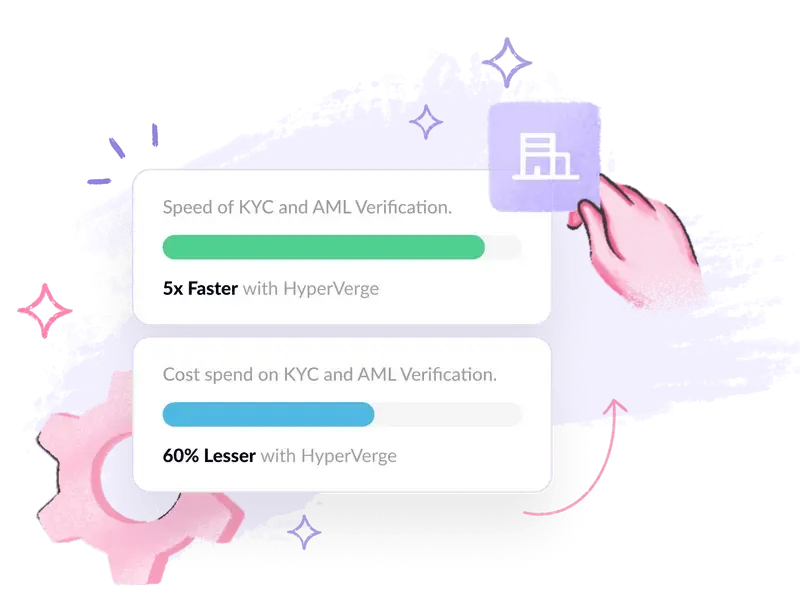

- Importance of technology: Technology can play a vital role in achieving compliance by streamlining processes and making monitoring easier.

- Transaction monitoring systems: Transaction monitoring systems are important for ongoing compliance. They track transactions in real time to identify unusual patterns. This proactive approach helps companies catch potential compliance issues early.

Conclusion

How do you ensure your investments remain secure in today’s volatile markets? Securities compliance holds the key. By adhering to its principles, businesses and individuals can foster trust, maintain market integrity, and mitigate risks effectively.

It’s not just about meeting legal obligations; it’s about creating a resilient and transparent financial ecosystem.

With HyperVerge AML solutions, you can elevate your compliance strategies to the next level. Experience seamless real-time AML compliance screening and monitoring, fully integrated with your KYC and due diligence processes.

Schedule a demo with HyperVerge today and empower your organization with smarter, safer compliance tools!

FAQs

1. What is securities compliance?

Securities compliance refers to the set of laws and regulations governing financial transactions, including the buying, selling, and reporting of instruments like stocks and bonds. It aims to protect investors and ensure fair market practices.

2. What are the basics of securities regulation?

Securities regulation includes rules companies must follow when issuing or trading securities. These rules emphasize transparency, accurate reporting, and fair treatment of investors. The Securities and Exchange Commission (SEC) oversees these regulations in the U.S.

3. What are the different types of securities?

There are several types of securities, such as bonds, stocks, mutual funds, and options. Securities compliance safeguards the investments in all these financial securities.

4. Who must follow SEC regulations?

Companies that issue securities to the public must follow SEC regulations. This includes publicly traded companies, investment firms, and brokers. Even private companies must follow certain rules if they sell securities to investors.