When it comes to bank account verification, Penny Drop is the OG of digital banking. If you aren’t aware, penny drop verification actually drops a penny in your account to make sure that the account belongs to you.

In the early days of UPI, Penny Drop was used to verify linked bank accounts before the system allowed direct name-matching APIs.

This verification method has become a backbone for secure, seamless payouts in India’s fast-growing fintech ecosystem, where fraud risks and transaction failures can cost businesses crores. It’s quick, cost-effective, and essential for compliance in digital financial operations.

In this article, we will explore how penny drop verification works, as well as its advantages, disadvantages, and applications.

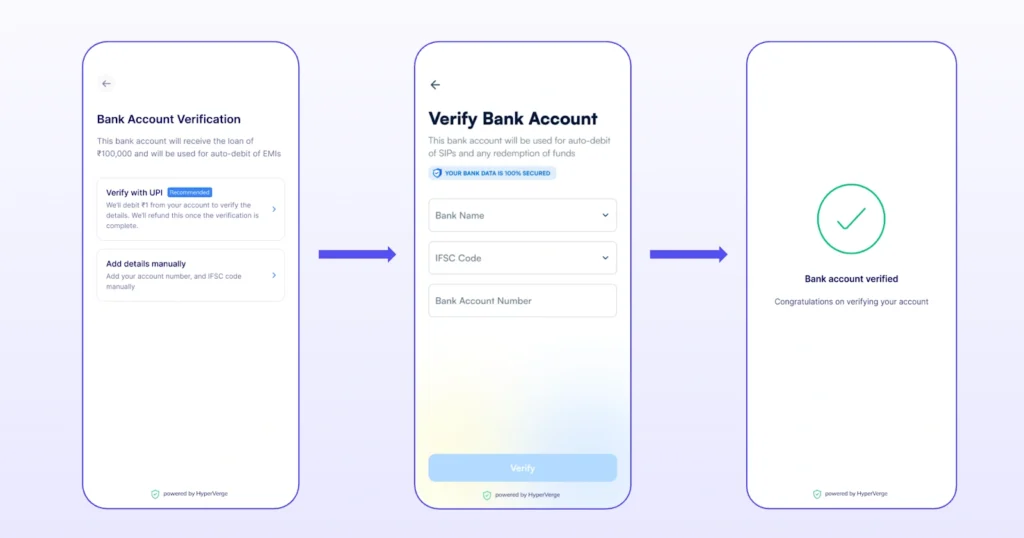

How Does Penny Drop Verification Work?

Penny drop verification is a real-time process that validates a bank account’s authenticity by depositing a small amount, usually ₹1, into the account.

Here’s how it works:

Step 1. Collecting Bank Account Details

The first step in verifying a bank account is collecting the necessary details from the user, vendor, or beneficiary. These typically include:

- Account Number: A unique identifier for the user’s bank account.

- IFSC Code: A code that identifies the specific bank branch associated with the account.

Step 2: Initiating a Micro-Deposit

Once the account details are collected, the system initiates a small test transaction, typically a ₹1 micro-deposit, to the provided bank account. This step serves multiple purposes:

- Checks if the beneficiary bank account exists.

- Tests if the banking information has been entered correctly.

- Initiates a request to fetch the account holder’s name from the bank.

If the financial transaction fails, it could indicate that the account is inactive, incorrect, or blocked. This proactive check helps prevent errors in future high-value transactions and ensures that payment systems remain efficient and error-free.

Step 3: Retrieving the Registered Account Holder’s Name

After the micro-deposit is sent, the bank processes the transaction and responds with the name registered to the account. This is a key step in the bank account verification method because it links the provided account details with the official bank records.

Step 4: Matching the Name With KYC/PAN Details

The platform or verification system then compares the name returned by the bank with the name provided by the user in their KYC or PAN documentation. This name-matching step is essential to ensure that:

- There is no mismatch between the user’s identity and the bank records.

- The bank account belongs to the intended recipient.

Step 5: Sharing the Verification Status

Once the comparison is complete:

- If the names match, the account is marked as verified, and future payments can proceed with confidence.

- If the names do not match, the system flags the account for review, helping to prevent fraud or payment errors.

This step prevents fraud and ensures payments reach the right person. It helps businesses and financial institutions avoid costly errors.

Role of APIs in Automating the Process

APIs make the penny drop verification method fast and efficient by connecting businesses to banks for instant bank account verification.

Bank account verification APIs help banks, fintech firms, and businesses verify accounts at scale. When a user enters bank details, the API triggers a ₹1 deposit. It then fetches the account holder’s name automatically. This removes manual work and reduces errors. It also speeds up the verification process.

Benefits of Penny Drop Verification

With the rise in digital transactions, security has never been more critical. Between April 2024 and January 2025 alone, India recorded over 2.4 million cases of digital financial fraud, amounting to a staggering ₹4,245 crore in losses.

In this landscape, penny drop verification plays a vital role in preventing fraudulent payouts. It improves security, accuracy, and compliance. Here are its key benefits:

1. Ensures Account Validity and Ownership

Penny drop verification checks if a bank account is real and active. A small deposit confirms that the account exists. It also verifies the registered account holder’s name.

2. Reduces Transaction Failures and Payment Fraud

Incorrect bank details can cause failed payments, which can lead to delays and extra costs. Fraudsters may provide fake account details to steal money. Over 13.4 lakh cases were reported in 2023–24, with losses crossing ₹1,087 crore. Many scams involve fake UPI IDs or account details. Fraudsters also trick users through phishing and social engineering.

Penny drop verification helps stop this. It confirms if the bank account really belongs to the user. This reduces fraud, cuts failed transactions, and saves businesses time and money.

3. Increases Customer Trust and Experience

Failed payments frustrate customers and vendors and can damage relationships. Penny drop verification ensures smooth transactions by confirming account details before payments are made.

A seamless payment experience builds customer confidence, strengthens business relationships, and improves satisfaction.

4. Ensures Compliance With Regulatory Requirements

As per RBI’s KYC Master Directions, the Prevention of Money Laundering Act (PMLA), and NPCI guidelines for UPI, financial institutions must strictly verify customers’ bank accounts to prevent fraud and ensure compliance. Penny drop verification helps meet these rules by confirming account ownership.

Applications of Penny Drop Verification in Various Sectors

Penny drop bank account verification is used across industries. Let us take a look at its usage in different sectors:

- Banking and Financial Services

Banks rely on penny drop verification to confirm customer accounts. It plays a crucial role in KYC compliance and fraud prevention.

- Loan providers use this method to check bank details before disbursing funds. This ensures that money reaches the correct borrower, minimises errors, and prevents fraudulent transactions.

- Insurance companies verify account ownership before claim settlements to reduce fraud and avoid payment mistakes. This step is crucial as fraudulent claims account for nearly 15% of all insurance claims in India, amounting to around ₹900 crores annually, according to the Times of India. By confirming account details in advance, insurers ensure smoother claim processing and timely payouts, enhancing both efficiency and customer trust.

- Payment gateways use penny drop verification to validate merchant accounts. This prevents failed transactions and enhances security. Secure transactions help maintain customer trust.

- E-commerce Platforms

E-commerce businesses process thousands of transactions every day, making accuracy and reliability critical. Penny drop verification serves as a key safeguard to maintain seamless payment flows and build trust with sellers and customers alike.

- Marketplaces like Amazon and Flipkart implement such verification processes to authenticate vendor bank details, ensuring a smooth and secure payment cycle.

- Refunds and cashback processes become more reliable. For example, Myntra uses automated bank verification to ensure customers receive refunds promptly, significantly improving the user experience. By eliminating errors and unnecessary delays, businesses boost customer satisfaction and encourage repeat purchases, directly contributing to brand loyalty.

- Payroll and Employee Reimbursements

Companies must ensure that salaries and reimbursements go to the right employees. Penny drop verification helps confirm bank details before payments are made.

- Bank account validation ensures salaries and reimbursements are credited to the correct employee.

- Payment failure reduction minimises delays due to incorrect or inactive bank accounts.

- Automation in payroll systems streamlines verification for HR and finance teams, saving time.

- Improved employee experience from timely and accurate salary and expense disbursals.

- Insurance Claim Settlements

Insurance companies must verify bank details before claim payouts. Penny drop verification ensures accuracy and prevents wrongful payments.

- Beneficiary verification confirms account ownership before claim payouts, reducing fraud risk.

- Faster disbursal by eliminating delays caused by incorrect bank details.

- Bulk verification support enables insurers to validate multiple policyholder accounts quickly during peak claim periods.

- Regulatory compliance is supported by maintaining accurate payout records tied to verified bank accounts.

These applications highlight different types of bank account verification to ensure secure and seamless financial operations across sectors.

Limitations and Considerations

While penny drop verification is useful for confirming bank account ownership, it comes with essential limitations that businesses must factor in, especially when operating at scale.

- Not a standalone fraud prevention method: Penny drop only validates whether an account exists and who owns it. It does not detect fraudulent intent or synthetic identities. A scammer can still use a real account under a fake onboarding profile. This makes it insufficient as a complete fraud prevention solution, especially in high-risk industries like lending or gig economy platforms.

- Fraudsters have gotten smarter: While effective, penny drop verification is a slightly dated method, and fraudsters have come up with sophisticated ways to get around it. For example, penny drop fraud is a common scam wherein fraudsters send in several verification requests and get INR 1 deposited in their account thousands of times.

- Needs continuous monitoring and layered checks: For high-volume platforms, relying only on one-time verification isn’t enough. Real-time risk monitoring, behavioural analytics, and liveness detection must be layered on top to prevent evolving fraud vectors and account misuse.

- User friction and high drop-offs: The need to manually enter the bank account number and IFSC code creates friction. Users may drop off due to input errors or lack of awareness, especially in tier 2/3 cities. This hurts conversion during onboarding and vendor registration.

While penny drop verification is helpful, it has its challenges. A more advanced approach, like reverse penny drop, ensures better accuracy, security, and convenience.

Why Is Reverse Penny Drop A Better Choice?

Given the limitations of penny drop verification, reverse penny drop is a better option in terms of security and convenience.

Reverse penny drop enhances the traditional verification process by reducing friction and improving accuracy. It also strengthens fraud checks, making customer onboarding faster and more secure.

In the standard penny drop method, users must manually enter sensitive details like account number and IFSC code. This introduces errors, document verification delays, and higher drop-offs, especially among first-time users or those with limited digital literacy.

Reverse penny drop API solves this by pulling basic bank account data from a verified source (like an Aadhaar-linked account or through UPI validation) before initiating the verification. The ₹1 transaction is then used to confirm that the account is active and matches the user’s name.

This flow reduces manual entry, eliminates mismatches, and delivers a smoother onboarding experience. It also enhances security by ensuring the bank account is genuinely linked to the user, not just any valid account.

For fintechs, lenders, and gig platforms dealing with large volumes of payouts, Reverse Penny Drop offers faster verification with fewer errors.

Build Trust Through Smarter Verification

The penny drop verification process helps businesses prevent fraud, ensure compliance, and process payments smoothly. Many financial institutions use it to confirm account ownership before transactions.

In India’s growing digital economy, secure bank account verification is more important than ever. As online transactions increase, fraud risks also rise. The future of verification lies in automation and advanced AI-driven solutions. Reverse penny drop and AI-powered verification will reduce errors and improve efficiency.

HyperVerge is a leading AI company specialising in financial verification solutions. Its bank account validation system ensures quick and accurate account validation. HyperVerge Bank Account Verification uses AI and automation to minimise manual errors and fraud risks. Businesses can verify accounts in real-time, improving user experience and security.

Want to improve your bank account verification process? Book a demo today!

FAQs

1. What is the purpose of penny drop verification?

Penny drop verification is used to verify a bank account’s ownership. A small amount (usually ₹1) is sent to the account. This confirms that the account is active and belongs to the right person.

2. What is penny drop verification of a bank account?

Penny drop verification is a process where a financial institution deposits a small amount into a bank account. The system retrieves the account holder’s name from the bank records. This helps confirm identity and prevent fraud.

3. Is penny drop safe?

Yes, penny drop verification is safe. It only checks account details without storing sensitive information. Financial institutions use secure systems to process these transactions.

4. Can penny drop verification fail?

Yes, it can fail. Incorrect account numbers, closed accounts, or bank server issues can cause failures. Insufficient funds or technical errors may also disrupt the process.