The Bank Secrecy Act was implemented in the year 1970. It was developed by the Financial Crimes Enforcement Network (FinCEN). BSA is also known as the Currency and Foreign Transactions Reporting Act.

Bank Secrecy Act is an important federal law that states financial institutions’ recordkeeping and reporting requirements to prevent financial criminal activities.

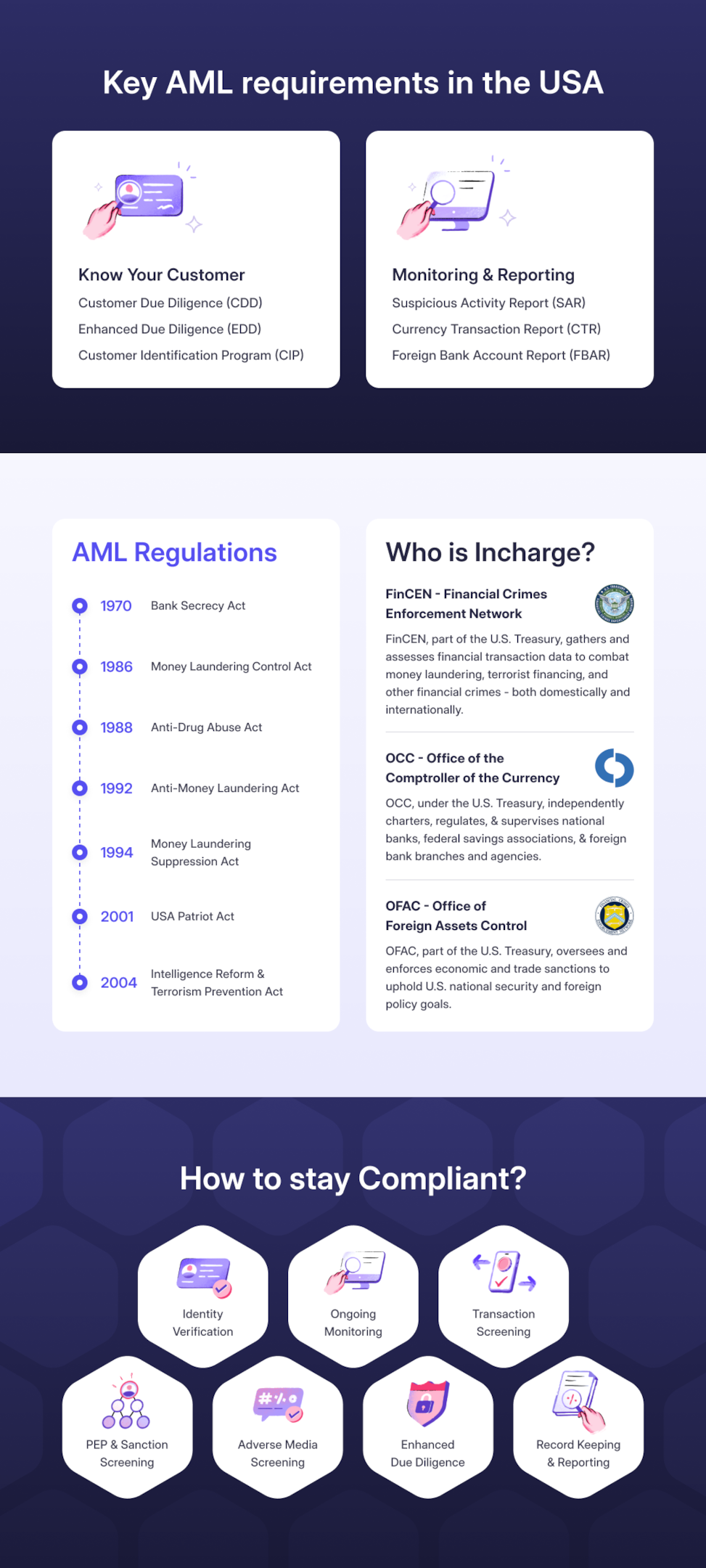

The requirements include customer identity verification, developing internal controls, updating policies, continuous monitoring, and submitting suspicious activity reports. The Bank Secrecy Act has undergone numerous revisions over the years in response to the shifting financial environment and developing tactics used by criminals. Now, the BSA works together with the USA Patriot Act to fight illegal cash transactions and suspicious activities. All the financial institutions in the USA must comply with the BSA requirements. Not adhering to the requirements causes them to risk customer safety, for which they can face legal consequences.

BSA plays a crucial role in the US financial system. The functions and responsibilities of the BSA which makes it important are

Adhering to the BSA not only protects the financial system against criminal activities but also spares financial institutions from severe penalties. Financial penalties for breaking the BSA can be severe and can amount to tens of thousands, hundreds of millions, or even billions of dollars. For more serious violations, they can be sentenced to prison for up to 20 years.

The primary purpose of this act is to help the government to ensure that no institutions, companies, or individuals are involved in fraudulent activities.

As mandated by the BSA, financial institutions must establish proper protocols for maintaining records and make sure that correct information and data are gathered. Any individual, partnership, trust, corporation, or business must fill out Form 8300 if they receive a payment exceeding $10,000 cash from a single buyer. This can be from single or multiple transactions. The form must be filled out within 15 days of the transaction. Any financial transaction within US borders, territories, or possessions must follow this process. Banks, federal savings associations, and other institutions undergo periodic inspections by the Office of the Comptroller of the Currency (OCC) to ensure that they comply with the BSA. The BSA statute maintains a list of exceptions that are exempt from this rule. Examples of exempted parties are government departments and agencies listed on major North American exchanges.

Here’s how businesses can comply with the Bank Secrecy Act:

With the introduction of the Fincen or Financial Crimes Enforcement KYC compliance and customer due diligence have become a part of the BSA. As a result, every financial institution must verify the identity of its clients and customers. This involves collecting basic customer details, such as name, address, date of birth, and social security number from a verified government ID proof. Along with personal details verification, it is necessary to create risk profiles for customers. Enhanced due diligence is performed for high-risk customers who can be identified by verifying against sanction lists, adverse media lists, and watchlists.

Read more

Every financial institution must integrate stringent AML or anti-money laundering policies into its system. This is a mandatory requirement as per Section 352 of the USA Patriot Act. Here are the different components of AML compliance:

According to the BSA, financial institutions must report any transaction suspected of money laundering, tax evasion, or criminal activity. If found to be potentially risky, the transaction must be reported to relevant authorities.

Some mandatory reports all businesses need to maintain include:

Read more: What is transaction monitoring?

Businesses must possess a comprehensive understanding of the AML monitoring and reporting framework and identity verification services that are suitable for their particular firm and function well with their present systems and procedures. And that’s where AML solutions like HyperVerge come into the picture!

HyperVerge’s end-to-end solutions help businesses verify customer identities accurately using proprietary AI technology. This superfast technology involves several AI checks, enables seamless onboarding, and guarantees the best customer experience.

Businesses can easily integrate HyperVerge’s identity verification and AML solutions into their apps or websites and abide by the BSA requirements without any hassle.

Want to know more about how HyperVerge can help? Book a free demo now!