The number of bank accounts in India reached a staggering figure of 2.5 billion in 2024. However, this remarkable growth has also given birth to a significant challenge: digital fraud in the banking sector surged by 27% in the first half of the financial year 2024-25.

Manual verification of such a sheer volume of bank accounts is practically impossible. That’s why an automatic account verification process is the need of the hour for banks and other financial institutions. HyperVerge is one company that stands at the forefront of this technological revolution, offering innovative solutions that address these critical challenges.

But is HyperVerge the right solution for your business, or should you be open to more options?

In this blog, we help you find the answer to the above question by diving deep into HyperVerge’s capabilities and exploring four other top-tier bank account verification platforms that are worth checking out.

Why consider several providers for bank account verification?

When evaluating bank account verification solutions, organizations must look beyond surface-level features and dive deep into critical aspects. Here are the six points you must consider when picking the best bank account verification solution:

Flexibility & Adaptability

API integration is the backbone of modern verification systems. Consider a scenario where a fintech startup needs to verify bank accounts during loan applications. A robust API allows seamless integration with existing loan management systems, reducing manual intervention and cutting down verification time from hours to mere seconds. This means your internal teams can focus on core business activities while the verification process runs smoothly in the background.

Pricing & Scalability

Pricing models can be complex, ranging from per-verification charges to volume-based discounts. The right platform should grow with your business, offering flexible pricing that doesn’t become a financial burden as your verification volumes increase. A solution that charges the same rate for 100 and 10,000 verifications demonstrates true scalability.

Ease of Use

User-friendly platforms dramatically reduce onboarding time for your technical teams. Intuitive interfaces and clear documentation mean your developers can implement the verification solution quickly, minimizing training time and reducing potential integration errors.

AI Capabilities

Take HyperVerge’s AI-powered solution as an example. Their advanced machine learning algorithms can detect subtle fraud patterns in real time, flagging suspicious activities that might slip through traditional verification methods. For instance, their system can identify potential identity mismatches or detect synthetic identities within milliseconds.

Geographical Availability

Comprehensive coverage across Indian banks and financial institutions is crucial. Your verification solution should support a wide range of banks, ensuring you can verify accounts across different regions and banking networks without multiple integrations.

Data Security & Fraud Prevention

Compliance with RBI guidelines isn’t optional—it’s mandatory. Non-compliance can result in hefty penalties, potentially running into crores of rupees. A robust verification platform must ensure end-to-end encryption, secure data handling, and strict adherence to regulatory frameworks.

How We Evaluated the Top 5 Providers

We evaluated the platforms based on three points:

Feature comparison: An overview of what each tool is capable of and the best features available to support bank account verification

Pricing and cost analysis: This is to help you gauge if the tool fits into your budget

Reviews and ratings: We also analyzed popular software comparison websites like G2 and Capterra to highlight the best reviews about these products. Reviews will help you understand the real-world user sentiments

Overview of the Top 5 Bank Account Verification Providers in India

Here’s a table to give you an overview of the top 5 bank account verification providers in India:

| Tool | Free Trial | Standout Features |

| HyperVerge | 30 days | – AI-powered identity verification in under 3 seconds – Biometric authentication & passive liveness checks – Global coverage: supports 195+ countries and 150+ languages |

| Setu | No | – Penny drop verification for instant account ownership – Consent-based data access for regulatory compliance – Open API standards for easy integration |

| Digio | No | – OCR-based data extraction from Aadhaar/PAN – Video KYC for remote onboarding – Business KYC for entity verification |

| Cashfree | Free credits are available for limited trial, but period is not mentioned | – Bulk verification for up to 10,000 accounts – Beneficiary name match scoring – Unified dashboard for real-time verification |

| Digitap | No | Free credits are available for a limited trial, but period is not mentioned |

Top 5 Bank Account Verification Providers

Here’s a look at five leading platforms, including HyperVerge, that make the account verification process seamless and efficient.

1. HyperVerge

Basic Info

HyperVerge is an AI-powered platform designed for real-time bank account verification in compliance with RBI guidelines.

Best For

It’s best for banks, NBFCs, FinTechs, and large enterprises.

Key Features that make it a great fit for the above sectors:

Instant Account Validation: HyperVerge verifies bank details by cross-checking them with official banking records, ensuring accuracy and reducing transaction errors. A bank or an NBFC can use HyperVerge to instantly validate the account details of new customers during onboarding, preventing fraudulent account setups.

Fraud Prevention: The platform identifies discrepancies in user-provided information to prevent unauthorized transactions and minimize identity theft risks. For example, HyperVerge checks duplicate faces across applications to stop repeat fraudsters. This is useful for a loan provider to prevent loan application fraud.

Bulk Verification: HyperVerge’s platform enables businesses to verify large volumes of bank accounts or identities in one go, significantly streamlining onboarding and compliance processes. This bulk verification capability is particularly beneficial for organizations handling high transaction volumes or mass customer acquisitions

Regulatory Compliance: HyperVerge is designed to meet stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, making it highly suitable for regulated sectors like banking, NBFCs, insurance, and fintech. The solution incorporates features such as ongoing due diligence, sanction list screening, PEP (Politically Exposed Persons) checks, and adverse media monitoring to ensure comprehensive compliance

HyperVerge Pricing

HyperVerge offers flexible pricing based on volume and usage:

Start: Best-suited for startups as it provides a free 1-month trial in a sandbox environment

Grow: This is best for mid-size companies looking for an end-to-end verification suite

Enterprise: This is for enterprise-level companies interested in having customized pricing and a dedicated customer support team

What Do HyperVerge Users Say?

2. Setu

Basic Info

Setu simplifies account verification with its API-first approach, leveraging a unique “penny drop” method to verify accounts.

Best For

Fintech startups, lenders, and payment platforms.

Key Features that make it a great fit for the above sectors:

Penny Drop Verification: Setu helps companies like payment gateways to instantly verify account ownership by depositing ₹1 into the customer’s bank account. This simple step confirms the account holder’s name, account number, and IFSC code. This approach is widely adopted before processing payouts to reduce the risk of incorrect transfers.

API Management: Integrating Setu into your systems is easy. You get straightforward tools that let you plug account verification right into your workflow, monitor how things are running, and scale up as your business grows.

Consent-Based Data Access: With Setu, you are always in control of the user data. Setu makes sure you get the information you need only after your customer gives the approval, which helps you stay compliant and build trust. For instance, if you’re in a lending business, you can securely pull in a borrower’s bank details only after they’ve agreed.

Open API Standards: Setu’s APIs follow industry standards, which makes it convenient for your tech team to get things up and running. No major changes to your existing setup.

Setu Pricing

Setu charges Rs. 3 per successful verification for up to 1000 verifications a month. You can also contact their sales team to get bulk pricing.

What do Setu users say:

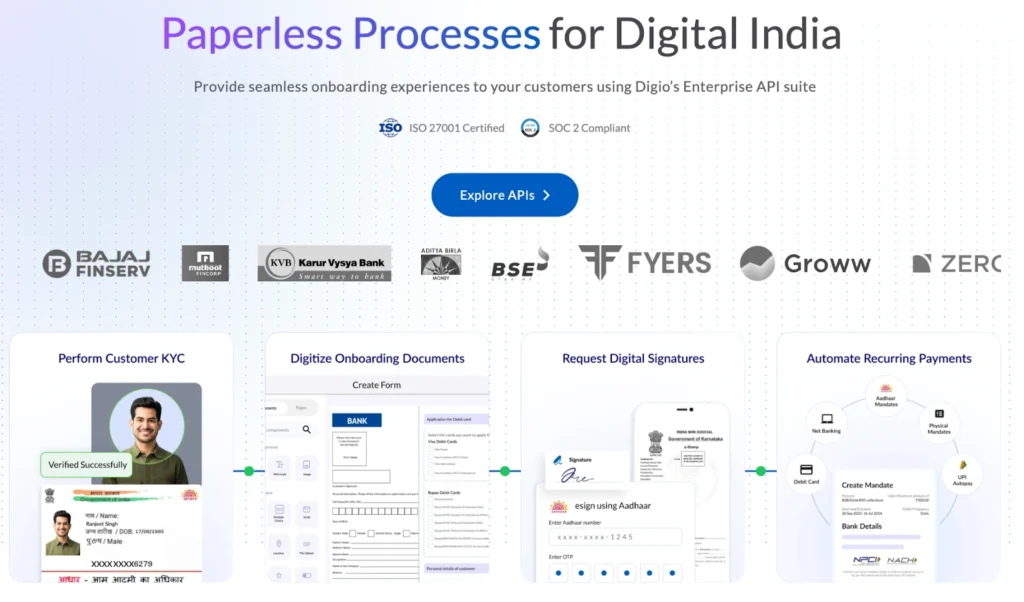

3. Digio

Basic Info

Digio is designed to make digital onboarding and account verification easy, secure, and fully compliant with India’s evolving KYC regulations. It’s a great solution for businesses planning to acquire new customers rapidly without compromising compliance and security.

Best For

Regulated businesses need strong KYC compliance.

Key Features that make it a great fit for the above sectors

Identity Establishment with OCR: Digio uses advanced OCR (Optical Character Recognition) to automatically pull data from identity documents like Aadhaar or PAN cards. This saves time and makes onboarding smoother. For example, an online investment platform can use Digio’s OCR to instantly extract and verify details from uploaded PAN cards, making sign-ups a breeze.

Video KYC: Digio’s Video KYC lets you verify identities in real time over a secure video call. This is especially useful for lending platforms that need to onboard borrowers without in-person meetings while staying fully aligned with RBI, SEBI, and IRDAI regulations.

Business KYC (KYB): Digio also makes it easy to verify GSTINs, PANs, and other business credentials. Its comprehensive business verification ensures you’re working with legitimate business partners by screening for risks like defaults or non-compliance with tax regulations.

Digilocker Integration: With Digio, you can access certified, government-issued documents directly from Digilocker, making customer verification even more seamless. This integration supports a wide range of IDs, from PAN and Aadhaar to voter IDs and driving licenses, all with a single authentication step

Digio Pricing:

Digio offers custom pricing, meaning the price is decided based on your requirements

What Do Digio Users Say

4. Cashfree

Cashfree is built for businesses that need fast, reliable account verification and payout, especially those dealing with high transaction volumes. The platform is also designed to reduce the risk of failed or misdirected payments, so you can focus on growing your business without worrying about payment errors.

Best For

Businesses handling high transaction volumes

Key Features that make it a great fit for the above sectors

Bulk Verification: Cashfree lets you validate up to 10,000 bank accounts in a single go, either through their advanced APIs or by uploading a simple Excel file. This is suitable for large organizations verifying employee bank details in bulk to ensure salary disbursements happen smoothly and accurately

Beneficiary Verification with Name Match: Before you send out any payments, Cashfree matches the beneficiary’s name you provide with the name on bank records. This reduces the risk of fraud and failed transfers. For example, payment gateways use this feature to make sure the account name matches the details before processing a transaction. The system even gives you a name match score, so you know exactly how confident you can be in the match.

Unified Verification Dashboard: In Cashfree’s dashboard, you can easily check account holder names, account numbers, IFSC codes, phone numbers, UPI IDs, PAN, Aadhaar, and even GSTIN details in real time.

Flexible Integration: Cashfree offers official libraries for different programming languages, making it easy for your tech team to plug account verification into your existing systems. Plus, you can integrate directly with your ERP or internal tools for seamless bulk operations.

Cashfree Pricing:

Cashfree’s pricing starts at 1.95% for completed transactions. An annual maintenance contract also applies.

What Do Cashfree Users Say

5. Digitap

Digitap brings AI-driven intelligence to financial identity verification and fraud prevention, helping you stay a step ahead of risk while keeping onboarding smooth for genuine customers.

Best For

NBFCs, lending platforms, and financial institutions

Key Features that make it a great fit for the above sectors

Advanced Algorithms for Fraud Screening: Digitap automatically cross-checks customer information against global watchlists and extensive databases. This makes it easy to spot high-risk or fraudulent accounts and keep your system safe from potential cyberattacks. For example, you can use Digitap to screen new customers during onboarding and catch potential risks early.

Biometric Checks & Facial Recognition: With Digitap, you can add an extra layer of security to your onboarding and transaction processes through biometric authentication and facial recognition. This feature is highly useful for lending institutions to verify borrowers’ identities before approving loans, cutting down on identity theft and fraud.

Automated Monitoring Tools: Digitap’s automated monitoring tools keep an eye on customer activity over time, flagging suspicious behavior. This ongoing vigilance helps you catch evolving threats and maintain compliance without manual intervention.

Digitap Pricing

Digitap’s pricing is not listed on the website. You might have to contact their sales team to learn more about the pricing

What Do Digitap Users Say

Automate and Secure Your Bank Account Verification Process

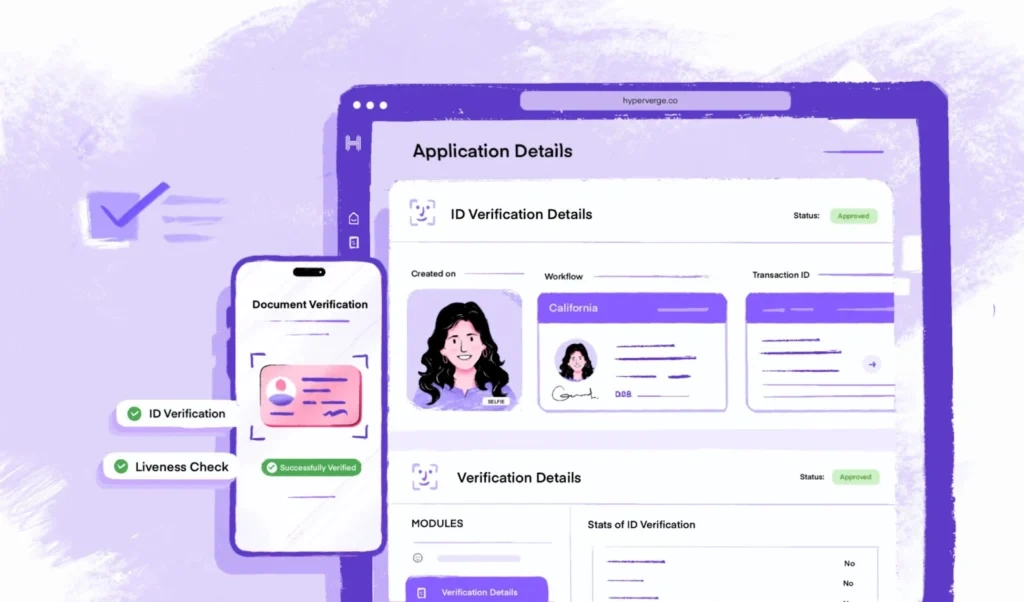

If you’re ready to take your bank account verification process to the next level, HyperVerge One offers a solution that brings speed, security, and flexibility together seamlessly. Imagine being able to verify accounts in real time, thanks to the built-in powerful AI. You also don’t have to rely on developers to create your own verification journey. HyperVerge’s no-code workflow builder helps you to customize workflows — whether you’re onboarding customers, vendors, or employees — with an easy drag-and-drop interface.

HyperVerge’s secure API fits right into your existing systems without disrupting your operations. Plus, with built-in downtime protection, you never have to worry about interruptions, even if one verification method is down. And for those cases that need a closer look, the application review portal gives your team an extra layer of control and insight.

Ready to see how effortless and reliable bank account verification can be? Explore HyperVerge One today.

FAQs

1. What are the key benefits of using a verification provider?

Using a verification provider streamlines your onboarding process, reduces manual errors, and significantly cuts down the risk of fraud. You get access to automated, real-time checks that confirm the legitimacy of user or business accounts, helping you comply with regulatory requirements like KYC and AML.

2. Which are the top bank account verification providers in India for 2025?

For 2025, the leading bank account verification providers in India include HyperVerge, Setu, Digio, Cashfree, and Digitap. These platforms are trusted by fintechs and financial institutions for their reliability, compliance, and innovative verification methods such as penny drop, reverse penny drop, video KYC, and AI-powered fraud detection

3. How does HyperVerge compare with Setu, Digio, Cashfree, Digitap, and Surepass?

HyperVerge stands out with its AI-powered real-time verification, offering multiple methods like penny drop, reverse penny drop, and even pennyless verification for flexibility. Unlike some providers, HyperVerge features a no-code workflow builder, robust downtime protection with automated fallback, and an analytics dashboard to identify drop-off reasons.

4. Is HyperVerge’s bank account verification API compliant with RBI regulations?

Yes, HyperVerge’s bank account verification API is fully compliant with the latest RBI regulations. The platform incorporates features like end-to-end encryption, secure data storage within India, AML screening against RBI-mandated sanction lists, and robust audit trails.