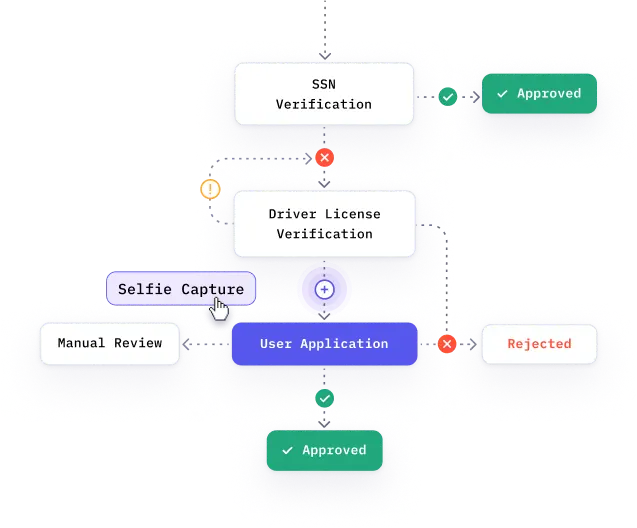

Customize and build your own workflow

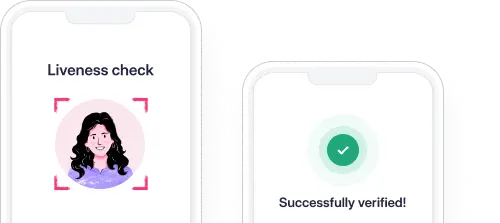

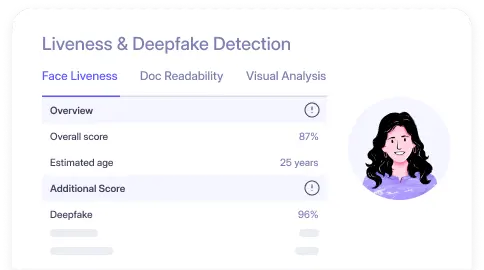

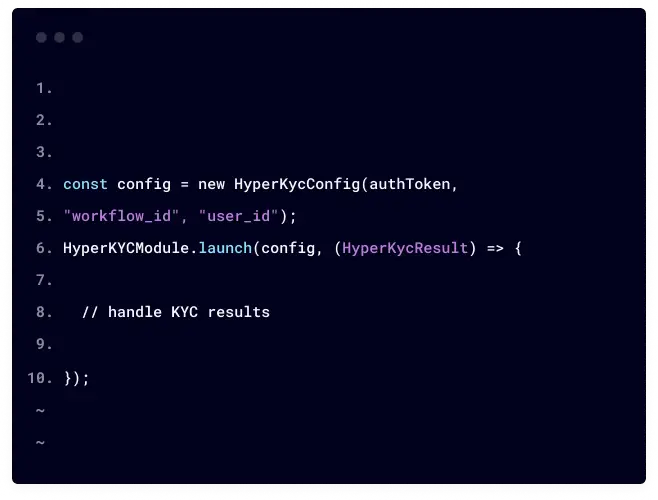

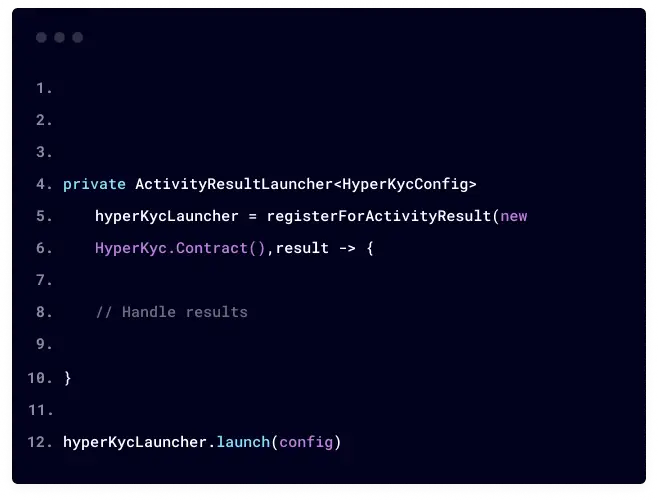

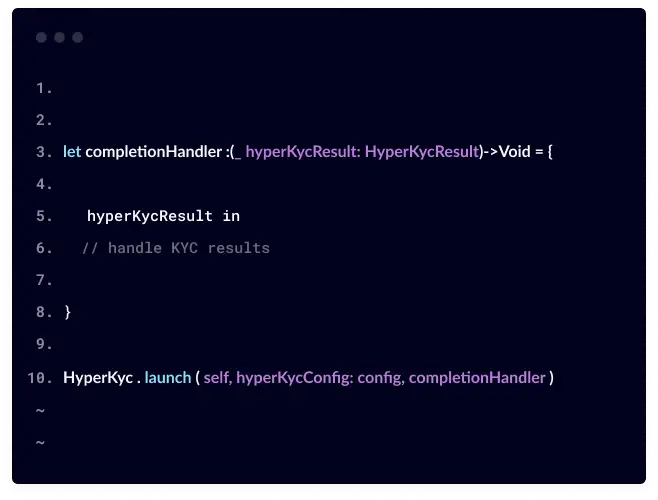

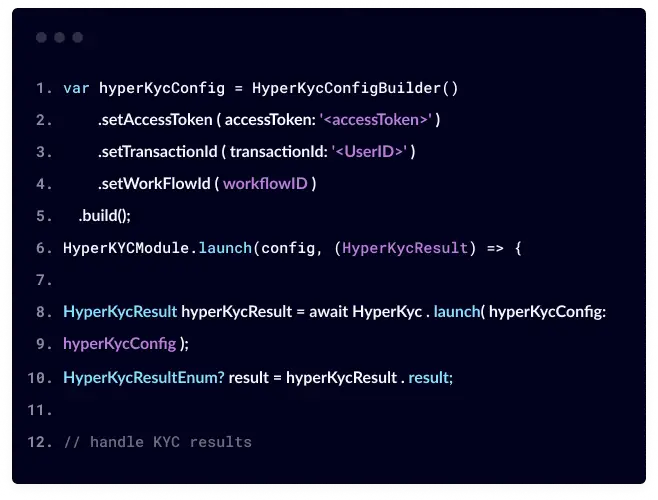

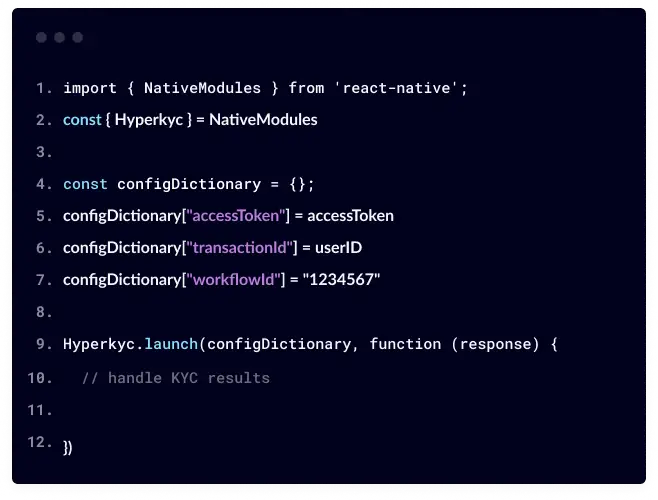

Strengthen security measures using a multi-layered approach of combining document verification with selfie matching.Easily configure and modify workflows, ensuring seamless integration into your existing systems.